-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Equities Stage Second Half Rally

US TSYS: Stocks Stage Late Rebound From Steep First Half Losses

Overall volumes rather muted Monday, traders pre-occupied ahead midweek CPI and Friday's Jan Eurodollar option expiration. Surprise: Stocks higher late.

- Stock indexes managed late session rebound, Nasdaq topping 4681.0 late vs. 4575.0 low -- no obvious headline driver but higher Tsy yld headwinds eased around midday, trading desks reporting several large program buys near lows.

- Medium term focus on finding value in downside puts targeting first rate hike at the March 15/16 FOMC policy annc.

- Note -- various dealers bringing there liftoff expectation forward to March as well: GS, JPM, MS and NatWest for starters as well as more details over Balance Sheet normalization.

- Markets eager for details of timing on Quantitative Tightening as well. NatWest strategists say the June 14/15 FOMC a close call between second rate hike vs. QT, but not both. "This decision should be highly data dependent. We lean to the Fed announcing a second interest rate hike at the June Meeting, but we envision strong risk to an early start of QT."

- Tuesday -- Fed Chairman Powell nomination hearing with Senate committee on Banking, Housing and Urban Affairs Tuesday at 1000ET.

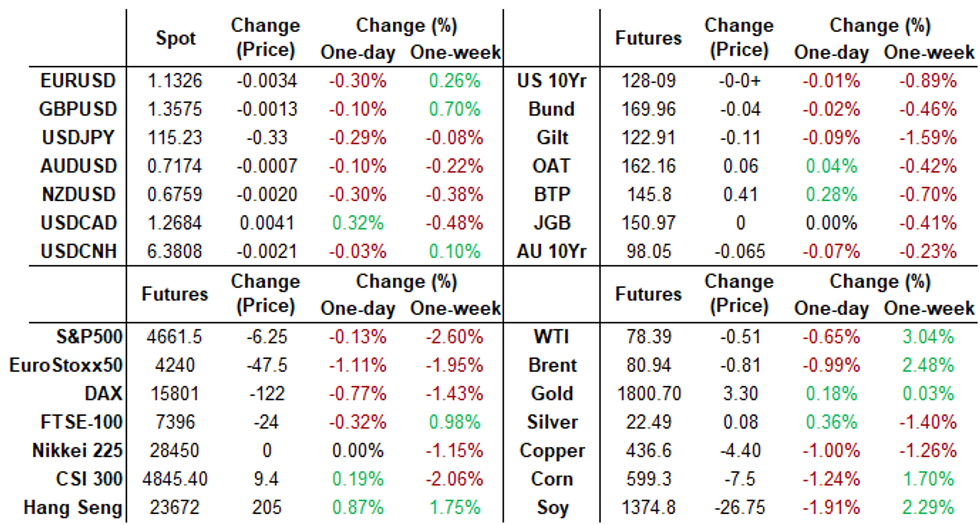

- The 2-Yr yield is up 4bps at 0.9024%, 5-Yr is up 3bps at 1.5285%, 10-Yr is up 0.7bps at 1.7692%, and 30-Yr is down 1.3bps at 2.1028%.

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N +0.00472 at 0.07743% (+0.00833 total last wk)

- 1 Month -0.00129 to 0.10400% (+0.00190 total last wk)

- 3 Month +0.00215 to 0.23829% (+0.02701 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00657 to 0.38300% (+0.03768 total last wk)

- 1 Year +0.01515 to 0.67686% (+0.07858 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $258B

- Secured Overnight Financing Rate (SOFR): 0.05%, $929B

- Broad General Collateral Rate (BGCR): 0.05%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $330B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $2.401B accepted vs. $7.108B submission

- Next scheduled purchases:

- Tue 01/11 1010-1030ET: Tsy 4.5Y-7Y, appr $4.525B

- Tue 01/11 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B

- Wed 01/12 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $6.325B

- Thu 01/13 1500ET: Updated NY Fed Operational Purchase Schedule

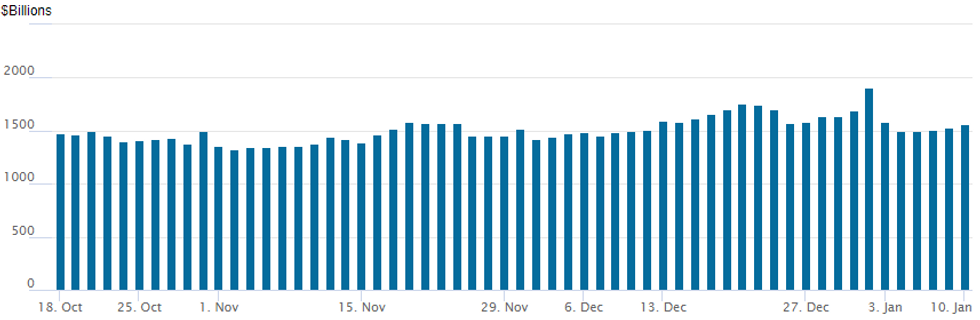

FED Reverse Repo Operation

NY Fed reverse repo usage climbs to $1,560.421B (76 counterparties) vs. $1,530.096B on Friday.

All-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:

+10,000 Dec 97.75/98.25 put spds, 4.0

+5,000 short Apr 98.00/98.12 put spds, 3.0

-4,000 Red Dec 97.12/97.62/98.12/98.62 put condors, 16.5

-5,000 Sep 99.00/99.50 risk reversals, 2x calls, 6.0 net/put over

-5,000 Blue Sep 97.50/97.75 put spds, 8

+5,000 Mar 99.50/99.56 put spds, 1.5 vs. 99.59/0.25%

+10,000 May 98.87/99.00/99.12 put flys, 0.75

Block +5,000 short Feb 98.43/98.62/98.75 put trees, 2.5

Block, +5,000 short Feb 98.50/98.62/98.75 put trees, 2.5

Treasury Options:

Update, +5,000 TYH 126/127/128/128.5 put condors, 3

1,500 TYH 127/128.5 3x2 put spds, 61

+3,500 TYH 126.5/127.5 put spds, 18

+/-10k TYH 127 puts, 28

-9,500 TYH 127/128/129 1x put flys, 1-00-1-02

FOREX: USD and JPY Bolstered By Equities Rout, Notable CHF Weakness

- FX markets were active on Monday despite the lack of significant data/event risk, however, G10 currencies largely played second fiddle to the large selloff seen across US equity indices.

- Despite the relatively contained price changes, both the US dollar and the Japanese Yen were beneficiaries as investors sought a flight to quality throughout the US session where e-mini S&P futures sunk roughly 2.3% from their intra-day highs at their worst point.

- The USD index gained 0.5% at its best levels, erasing the negative greenback sentiment in the aftermath of the US employment data on Friday. In general, the index continues to trade blows either side of the 96.00 level, a similar theme witnessed through much of December.

- USDJPY was understandably heavy and once breaking back below the old highs of 115.52, the Yen squeeze extended. Cross/JPY bore the brunt of the negative tone for risk with both CADJPY and NZDJPY losing over 0.6%.

- The most notable divergence was probably witnessed in the Swiss Franc, with USDCHF remaining very well supported throughout the entirety of the session. After a quiet Q4 last year, total sight deposits are pointing north again, potentially suggesting the SNB are uncomfortable with the pace of the recent CHF acceleration. Additionally, USDCHF breaking back above multiple recent highs around 0.9250 could be considered a bullish development.

- Aussie retail sales overnight before a very light European data calendar. Focus will be on potential comments from Fed’s Powell and other Fed speakers before the major data point of US inflation on Wednesday.

FX: Expiries for Jan11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1275-80(E1.1bln), $1.1350(E501mln), $1.1390-10(E552mln)

- USD/JPY: Y114.00($1.1bln), Y116.00($600mln), Y116.50($1.2bln)

EQUITIES: Stocks Slide as Markets Price Tighter Fed Policy

- Equities resided uniformly lower on Monday, with Wall Street resuming the slide seen last week as markets continue to rotate away from growth-oriented and tech names. A higher, steeper yield curve triggered by the Friday payrolls release continues to exert influence over stock traders - who are positioning for higher inflation and tighter Fed policy. Friday's NFP added to the rationale for this trade, pointing to a tightening labor market via faster earnings and lower unemployment.

- The NASDAQ underperformed notably, with tech and growth sectors the names to watch. The likes of Tesla, Etsy, Amazon and Alphabet all traded sharply lower, and a midday recovery failed to tip headline indices back into the green.

- The slide in the e-mini S&P puts the index within range of the 100-dma support at 4559.9, a break through which would put prices through the bull trend channel posted off the early October lows.

- Moves come ahead of the unofficial beginning of Q1 earnings season, as JPMorgan, BlackRock, Wells Fargo and Citigroup all report on Friday.

COMMODITIES: Oil Hit By Risk Off Sentiment

- Crude oil prices have dipped -1.25-1.5% today with the decline picking up speed on the US open in a broader risk-off environment and then again more recently, with declines across the curve.

- WTI is -1.3% at $77.88. Support is seen at $75.25 (20-day EMA), $74.40 (50-day EMA) and then a key support of $74.27 (Jan 3 low). Resistance is $81.73 (Nov 10 high).

- Today’s most active strikes in the G2 (Feb’22) contract have been $75/bbl puts followed by $80/bbl calls.

- Brent is -1.5% at $80.52, with initial support at $79.51 (Jan 5 low) and resistance at $83.11 (Nov 10 high).

- Gold meanwhile is up +0.2% at $1801.1. Initial resistance is seen at $1811.6 (Jan 6 high) whilst attention is on the base of a bull channel drawn from the Aug 9 low that intersects at $1783.2.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/01/2022 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 11/01/2022 | 0130/1230 | ** |  | AU | Retail Trade |

| 11/01/2022 | 0130/1230 | ** |  | AU | Trade Balance |

| 11/01/2022 | 0800/0900 | * |  | ES | industrial orders |

| 11/01/2022 | 0900/1000 | * |  | IT | retail sales |

| 11/01/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 11/01/2022 | 1020/1120 |  | EU | ECB Lagarde at Bundesbank Ceremony | |

| 11/01/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 11/01/2022 | 1430/0930 |  | US | Kansas City Fed's Esther George | |

| 11/01/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 11/01/2022 | 1500/1000 |  | US | Fed Chair Powell's Senate nomination hearing | |

| 11/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 11/01/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.