-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBRIEF: ECB's Panetta-Time To Start Thinking Of NGEU Successor

MNI China Daily Summary: Wednesday, Aug 21

MNI ASIA MARKETS ANALYSIS: Rates Fade Hawkish Fed Refrain

US TSYS: Tsy Futures/Options Round-Up

Bonds leading steady march higher late Thu, highs for the wk outpacing Wed amid combination of short covering and new buying with futures back to early Jan 6 levels.

- Recent 30YY session low at 2.0499% after almost topping 2.10 earlier, 10YY 1.7076% low.

- Are markets fading hawkish Fed-speak? Perhaps that's what's contributing to the steady round of buying as more Fed officials see as many as four 25bp hikes this year.

- Then again, it could be straight-up risk-off as equities trade weaker (ESH2 -40.25 at 4676.0; Nasdaq below 100DMA at 14917.0 -271.) with IT (-1.85%), Consumer Discretionary (-1.25%) and Health Care (-1.04%) sectors underperforming.

- Eurodollar/Treasury option trade remains mixed, or less one-way than early week put buying with some accts unwinding downside insurance and buying calls. That said, 1StD put skews outpacing calls, implieds only mildly softer.

- Of note, January Eurodollar options expire Friday, February Treasury options expire next week Friday.

- Tsys gap lower but quickly recover after latest $22B 30Y Bond auction re-open (912810TB4) tailed again: 2.075% high yield vs. 2.072% WI; 2.35x bid-to-cover better than 2.22x last month (2.29x 5-month average)

- Indirect take-up climbs to 64.98% vs. 60.80% in Dec; direct bidder take-up recedes to 17.08% vs. 18.49% prior, while primary dealer take-up slips to 17.95% vs. 20.71%.

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N +0.00014 at 0.07743% (+0.00472/wk)

- 1 Month -0.00385 to 0.10629% (+0.00100/wk)

- 3 Month +0.00071 to 0.23914% (+0.00300/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01315 to 0.39686% (+0.02043/wk)

- 1 Year +0.01443 to 0.71357% (+0.05186/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $250B

- Secured Overnight Financing Rate (SOFR): 0.05%, $891B

- Broad General Collateral Rate (BGCR): 0.05%, $351B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $339B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4Y, $6.301B accepted vs. $17.129B submission

NY Fed updated purchase schedule: no new buys Friday through Monday's MLK Jr holiday, resume next week Tuesday, and again around the FOMC policy annc on Jan 26. NY Fed operations desk "plans to purchase approximately $40 billion over the monthly period from 1/14/22 to 2/11/22" vs. $60B prior as QE winds down.

- Tue 01/18 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B vs. $4.525B prior

- Thu 01/20 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Fri 01/21 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B vs. $9.325B prior

- Tue 01/25 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B vs. $1.525B prior

- Pause again around the FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

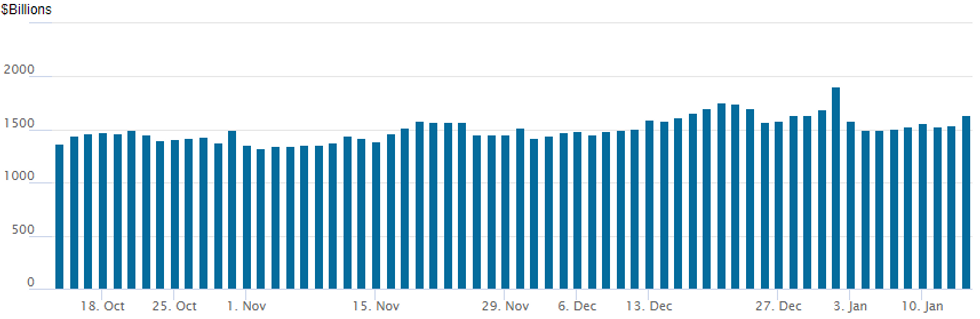

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage surged to $1,636.742B (79 counterparties) vs. $1,536.981B on Wednesday.

Remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +20,000 short Apr 97.87/98.12 3x2 put spds, 15-15.5 vs. 98.41-41.5/0.54%

- +10,000 Dec 98.00/98.18 put spds, 2.0 ref 98.78

- +10,000 short Mar 98.50/98.75 put spd 9.5 over 98.75/99.00 call spd vs. 98.58/0.48%

- +5,000 Dec 98.50/98.75/99.00 call flys, 5

- +5,000 Dec 99.75 calls, 1.5

- 6,000 Jun 99.12/99.25 put spds vs. 99.31/99.43 call spds

- +12,000 TYH 127.5 puts, 26 ref 128-13.5

- 2,500 TYG 128.5 straddles, 44

- 12,600 wk1 TY 129.5 calls

EGBs-GILTS CASH CLOSE: Rally Continues

A busy supply schedule did little to deter European bond gains Thursday, with Bunds bull flattening and the UK curve bull steepening for the second consecutive session.

- The German long-end once again set the tone for EGBs in general, resuming Wednesday's bullish price action.

- Few European macro drivers today (soft US PPI was marginally positive for core Global FI), but supply was eyed: Italy, Ireland, and Cyprus (the latter two syndications) sold bonds today.

- Periphery EGBs enjoyed a constructive session, with BTPs outperforming.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.2bps at -0.599%, 5-Yr is down 2.2bps at -0.399%, 10-Yr is down 3.1bps at -0.09%, and 30-Yr is down 4.7bps at 0.204%.

- UK: The 2-Yr yield is down 4.6bps at 0.761%, 5-Yr is down 4.2bps at 0.936%, 10-Yr is down 3.5bps at 1.105%, and 30-Yr is down 2.7bps at 1.216%.

- Italian BTP spread down 1.5bps at 130.7bps / Spanish down 0.9bps at 67.7bps

EGB Options: Large Euribor Midcurve Trades Feature

Thursday's Europe rates / bonds options flow included:

- RXH2 169/168/167p fly bought for 10.5 in 5.1k and 10 in 1k

- RXH2 172.00/171.00 ps, sold at 63.5 in 10.5k

- ERM2 100.37/100.25ps, bought for 1.5 in 5k (June 2022 hike play)

- 2RJ2 100/99.75ps, sold at 14.5 in 10k (unwind)

- 2RJ2 99.62/99.75/100 broken c fly, bought for -1.5 (receive) in 20k

- 2RM2 99.75/99.62ps vs 99.87/100cs, bought the ps for flat in ~15k (ref 99.775, -25 del)

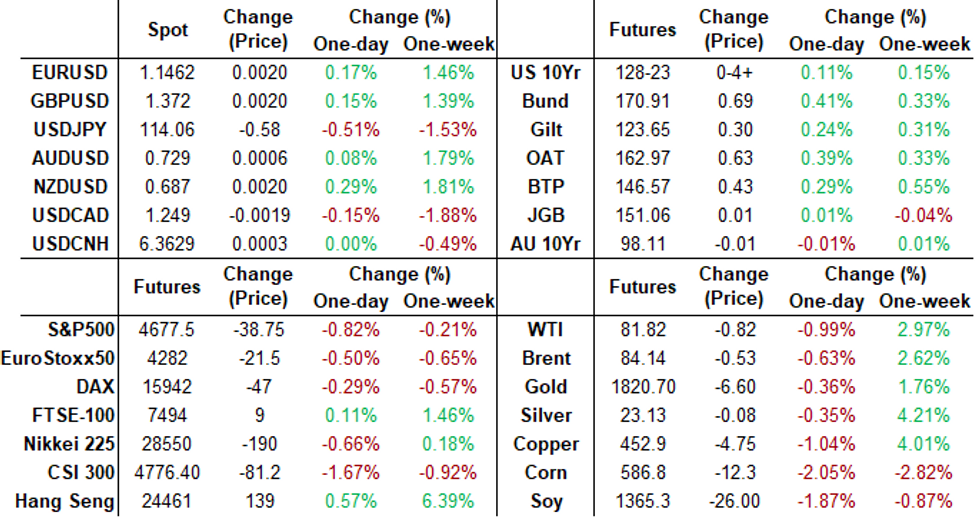

FOREX: US Dollar Consolidates At Two-Month Lows, JPY and CHF Firm

- The greenback is seen one tenth of a percent lower on Thursday, broadly consolidating the sizeable move seen during yesterday’s session. A turn lower in equity indices lent support to the likes of the Japanese Yen and the Swiss Franc.

- USDJPY (-0.47%) completed a full point move to the downside, following Wednesday’s break of 115.00, with the pair trading with a consistently offered tone through the NY session. The pair has now breached both the 20-day EMA and the 50-day EMA - at 114.22. This suggests scope for a deeper sell-off, potentially targeting 113.56, low Dec 21.

- Similarly, USDCHF fell 0.4% and briefly broke below some previous lows through the 0.91 handle.

- Elsewhere, ranges remained tighter compared to yesterday, however, EUR, AUD, GBP, NZD and CAD did all extend on their gains made yesterday.

- In emerging markets, Russia saying Ukraine talks hit a 'dead end' have diminished the chances of diplomatic resolutions and in turn have heavily weighed on the Ruble. USDRUB has risen close to 2% above the 76.00 mark. The break strengthens the bullish case and opens 78.0406, Apr 7 high.

- Chinese trade balance is scheduled overnight before monthly GDP/IP data will be released from the UK. December US retail sales and industrial production data will headline in the final US session of the week.

FX: Expiries for Jan14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1235-50(E1.2bln), $1.1280-00(E3.9bln), $1.1320(E503mln), $1.1365-75(E1.5bln), $1.1395-05(E1.4bln), $1.1415-25(E2.5bln), $1.1460-70(E1.2bln)

- USD/JPY: Y110.75-00($1.8bln), Y111.80-00($560mln), Y113.35-50($1.6bln), Y113.65-80($1.1bln), Y114.45-55($835mln), Y114.90-10($1.7bln), Y116.00($1.5bln)

- GBP/USD: $1.3385-10(Gbp1.0bln)

- EUR/GBP: Gbp0.8350(E682mln)

- AUD/USD: $0.7125-40(A$1.3bln)

- NZD/USD: $0.6845-50(N$536mln)

- USD/CAD: C$1.2485($1.3bln), C$1.2500-10($2.0bln), C$1.2520-30($1.7bln), C$1.2540-50($929mln)

- USD/CNY: Cny6.35($620mln), Cny6.3750($555mln)

EQUITIES

Key late session market levels:

- DJIA down 230.11 points (-0.63%) at 36055.49

- S&P E-Mini Future down 68.5 points (-1.45%) at 4646.75

- Nasdaq down 377.7 points (-2.5%) at 14809.79

European bourses closing levels:

- EuroStoxx 50 down 0.49 points (-0.01%) at 4315.9

- FTSE 100 up 12.13 points (0.16%) at 7563.85

- German DAX up 21.27 points (0.13%) at 16031.59

- French CAC 40 down 36.05 points (-0.5%) at 7201.14

COMMODITIES: Oil Dips After A Two Day Surge

- Crude oil prices are currently down -0.5 to -1% on a volatile day with risk off sentiment emerging. WTI remains up 8% ytd.

- WTI is -1% at $81.8, not troubling resistance levels for once after two strong days. Resistance is eyed at $83.10 (Jan 12 high) with key short-term support at $77.83 (Jan 10 low).

- The most active strikes in the Feb’22 contract today have been $80/bbl puts.

- Brent is -0.6% at $84.16, falling back from initial resistance at $85.21 (Jan 12 high) with initial firm support at $80.50 (Jan 10 low).

- Gold meanwhile gives back yesterday’s gains, -0.25% at $1821.1. Resistance remains at $1831.9 (Jan 3 high) with support at $1800.2 (Jan 11 low).

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/01/2022 | 0130/1230 | ** |  | AU | Lending Finance Details |

| 14/01/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 14/01/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 14/01/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 14/01/2022 | 0700/0700 | ** |  | UK | UK monthly GDP |

| 14/01/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 14/01/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 14/01/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/01/2022 | 0830/0930 | *** |  | SE | Inflation report |

| 14/01/2022 | 1000/1100 | * |  | EU | trade balance |

| 14/01/2022 | 1315/1415 |  | EU | ECB Lagarde speech at COSAC | |

| 14/01/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 14/01/2022 | 1330/0830 | ** |  | US | import/export price index |

| 14/01/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 14/01/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/01/2022 | 1500/1000 | * |  | US | business inventories |

| 14/01/2022 | 1500/1000 |  | US | Philadelphia Fed's Patrick Harker | |

| 14/01/2022 | 1600/1100 |  | US | New York Fed's John Williams | |

| 14/01/2022 | 1700/1200 |  | CA | BOC releases climate risk paper |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.