-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI ASIA MARKETS ANALYSIS: FOMC Delivers Hawkish Hold

Eurodlr/Tsy Futures/Options Roundup: Short End Hammered Post FOMC

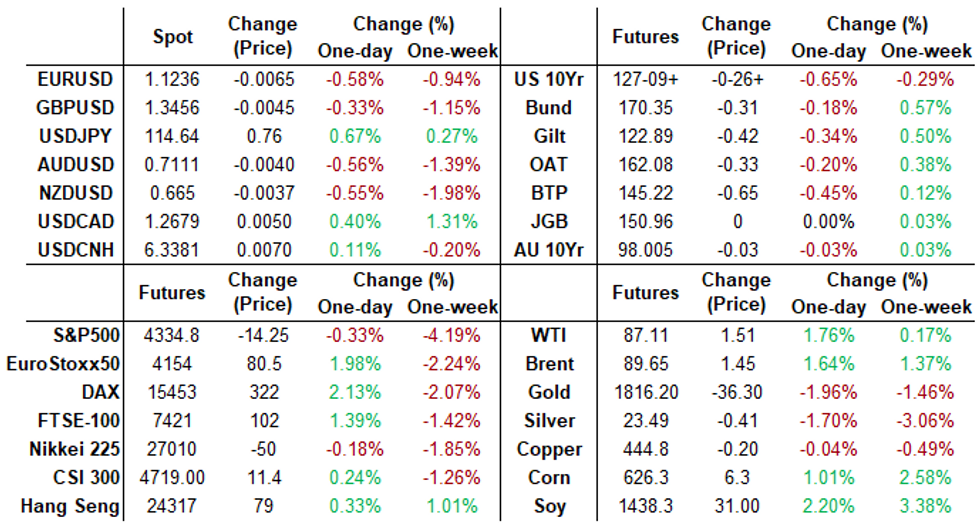

Markets reacted bearishly to the FOMC holding rates steady:- Short end yields surged on heavy volumes (2YY 1.1424%; 5YY 1.6713%) while equities gave up strong gains to trade weaker as Chairman Powell conceded liftoff will "soon be appropriate" as economic activity continues to expand at a robust pace and ""inflation remains well above our longer run goal of 2%."

- Stocks initially held gains until balance sheet run-off was discussed, lacking details over "sooner, faster" asset reductions appeared to trigger a sell-off.

- Short to intermediate rates sold off sharply as prospect for more than just 25bp rate hikes past March gained traction: lead quarterly Mar'22 Eurodollar futures slipped to 99.515 (-0.040) while June fell to 99.14 low (-0.090). Red pack (EDH3-EDZ3) traded -0.140-0.160 by the close -- Red March 2023 pricing in 125-150bp in hikes.

- Option trade saw some profit taking: over 20,000 TYH 127 puts sold from 30-26 (total session volume over 110k) after heavy buying over the last week; paper sold 10,000 Apr/Jun 98.93/99.06 put spd strip, 3.25, unwinding tactical play after paying 1.75 total to buy the double spd last wk.

- Otherwise, active accts continued to add to downside/rate hike positioning: for example paper +10,000 May 98.87/99.06/99.18 put flys, 2.75 adds to +50k Tue from 2.25-2.75.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00072 at 0.07814% (+0.00343/wk)

- 1 Month +0.00128 to 0.10914% (+0.00143/wk)

- 3 Month +0.01000 to 0.27757% (+0.01986/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01371 to 0.46400% (+0.01957/wk)

- 1 Year +0.01885 to 0.80871% (+0.01014/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $78B

- Daily Overnight Bank Funding Rate: 0.07% volume: $278B

- Secured Overnight Financing Rate (SOFR): 0.05%, $943B

- Broad General Collateral Rate (BGCR): 0.05%, $349B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $336B

- (rate, volume levels reflect prior session)

- Pause for FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

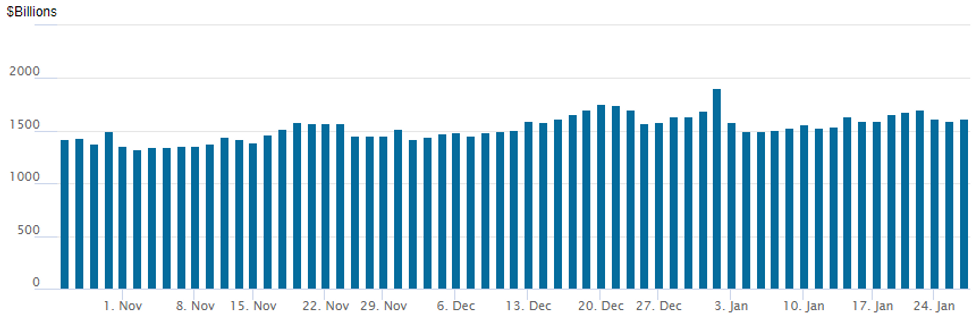

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $1,613.046B w/79 counterparties vs. $1,599.502B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +5,000 May 98.87/99.06/99.18 put flys, 2.75 adds to +50k Tue

- -10,000 Apr/Jun 98.93/99.06 put spd strip, 3.25 (unwind, paid 1.75 last wk)

- +10,000 Sep 98.75/98.87 put spds, 4.25 ref 98.985

- +10,000 short Jun 98.00 puts, 8.0 ref 98.385

- Overnight trade

- 5,000 Jun 99.25/99.37/99.50 call flys

- 5,000 Green Feb 97.87/98.00 1.5x1 put spds

- 2,500 Feb 99.37/99.50/99.62 put flys

- Block, +15,000 May 98.87/99.06/99.18 put flys, 2.5

- +4,000 Blue Mar 97.50/97.75 put spds, 3.5

- Block, +5,000 short Jun 97.50/97.75/98.00 put flys, 2.5

- -10,000 TYH 127 puts, 29-30

- -10,000 TYH 127/129 strangles, 37-38

- -4,000 TYH 133.5 calls, 1 total volume >14k

- Update, total -25,000 TYH 127/129.5 put over risk reversals, 5-6 vs. 128-05.5 to -04

- 6,500 TYM 125.5 puts, 39

- +5,000 TYH 129.5/130.5 call spds, 8

- Overnight trade

- 25,000 FVH 119/119.5 put spds, 13.5

- 8,000 FVH 120 calls, 14-14.5

- -4,000 FVH 119/120 put spds, 30.5 vs. 119-16/0.35%

- 3,000 FVH 118/118.5/119 put trees vs. FVH 120.5 calls

- 3,000 TYH 126.5 puts, 12

EGBs-GILTS CASH CLOSE: BTPs Weaker As Political Uncertainty Persists

BTP weakness was the standout in Wednesday's European trade, with the Italian curve bear steepening and spreads widening.

- The German and UK curves likewise bear steepened, with safe havens on retreat ahead of the Federal Reserve decision and as equities bounced.

- The 10Y BTP/Bund spread closed above 140bp for the first time since Sept 2020 as the Italian presidential voting impasse continued (MNI published a sourced exclusive on the election, including on Draghi's future)

- Finland's 20Y syndication saw lukewarm demand (books >E16bln on E3bln size).

- Attention after hours firmly on the Fed.

Closing levels:

- Germany: The 2-Yr yield is up 0.4bps at -0.645%, 5-Yr is up 0.6bps at -0.353%, 10-Yr is up 0.6bps at -0.074%, and 30-Yr is up 1.1bps at 0.246%.

- UK: The 2-Yr yield is up 2bps at 0.916%, 5-Yr is up 2.6bps at 1.022%, 10-Yr is up 3.4bps at 1.198%, and 30-Yr is up 4.8bps at 1.332%.

- Italy / German 10-Yr spread 3.3bps wider at 140.2bps

EGB Options: Variety Of Put Trades

Wednesday's Europe rates / bond options flow included:

- DUH2 112.00/90/80/70p condor, bought for 2 in 20k total

- RXH2 169/168 put spread traded 21/22 in 4k

- RXJ2 164/163 put spread bought for 14.5 in 3.3k

- 0EM2 98.00/97.75/97.50p fly, bought for 2.5 in 5k

- 0RU2 99.87/99.62/99.37p fly, bought for 3.25 in 11k

FOREX: Greenback Spikes As Chair Powell Fails To Rule Out Larger Hikes

- After some initial two-way price action following the release of the January FOMC decision/statement, broad dollar indices spiked as Chair Powell failed to rule out the potential for larger rate hikes going forward.

- The dollar index (DXY) has risen to the best levels in over a month, printing above 96.50 and hugging close to the highs approaching the close.

- The greenback strength was broad based with EUR, AUD, NZD, CAD, CHF and JPY all falling between 0.4-0.65%, reflecting the sharp adjustment higher in front-end US yields.

- Further weakness in global benchmarks may weigh on risk related currencies such as the Aussie. AUDUSD’s recent failure to remain above the 50-day EMA and the subsequent sharp sell-off strengthens the case for bears and signals potential for a deeper pullback.

- EURUSD makes fresh year-to-date lows, retreating below 1.1250 and narrowing the gap to the next technical point of note at 1.1222, the Dec 15 low. More significant support comes in at 1186/85 - Low Nov 24 / Low Jul 1, 2020 and the bear trigger.

- New Zealand CPI kicks off the APAC session overnight before markets await the Advance reading of US Q4 GDP. Durable goods orders, pending home sales and jobless claims also on the docket.

FX: Expiries for Jan27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100(E524mln), $1.1150(E687mln), $1.1200-05(E692mln), $1.1250(E552mln)

- USD/JPY: Y113.00($761mln), Y113.50-60($867mln), Y114.80-00($1.1bln)

- GBP/USD: $1.3285-03(Gbp576mln), $1.3548-70(Gbp795mln)

- EUR/JPY: Y127.00(E1.1bln)

- AUD/USD: $0.7220(A$640mln)

- USD/CAD: C$1.2560-65($927mln)

- USD/CNY: Cny6.3450($560mln), Cny6.3500($1.3bln)

EQUITIES: Stocks Reverse Early Gains as Markets Weigh Fed's First Move on Rates

- Wall Street traded lower into the Wednesday close, reversing initial strength as markets weighed Powell's inclusion of the option of a 50bps rate hike as part of the current tightening cycle. By acknowledging the stark difference between this economic expansion cycle and the last, markets were unsettled by the notion of a sharp beginning to rate rises, helping the e-mini S&P ease back below unchanged and drop around 150 points over the course of Powell's presser.

- Despite the tighter policy outlook, the NASDAQ managed to outperform its bluechip peers thanks to solid rallies across the likes of Corning, Microsoft and Broadcom post-earnings, while financials - most notably banks - benefited from a rally in short-end rates.

- Real estate, materials and industrials were the poorest performing sectors.

COMMODITIES: Oil Hangs On For Gains Despite Fed, Ukraine Ceasefire

- Crude oil prices have yet again been supported by mounting geopolitical fears.

- There has however been recent weakness after Russia’s Kozak said that Ukraine talks in Paris have agreed a ceasefire in Eastern Ukraine should be observed, with the headline hitting in Powell’s conference.

- WTI is +1.1% at $86.55, having broken two resistance levels in earlier of $87.1 (Jan 20 high and bull trigger) and $87.47. Next resistance was the psychological $90 whilst initial support is $81.90 (Jan 24 low).

- $80/bbl and $85/bbl puts have been the most active strikes in the H2 contract today.

- Brent is +1.1% at $89.16, having also broken two resistance levels earlier. Next resistance was viewed at $91.29 (2.00 proj of the Dec 2-9-20 price swing).

- Gold meanwhile is -1.7% at $1816.8, with the decline starting well prior to the Fed and then falling further as the FOMC indicated it will start hiking soon. Support is next seen at $1805.9 (Jan 18 low).

Data Calendar for Thursday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/01/2022 | 0030/1130 | ** |  | AU | Trade price indexes |

| 27/01/2022 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 27/01/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 27/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 27/01/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 27/01/2022 | 1330/0830 | *** |  | US | GDP (adv) |

| 27/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/01/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 27/01/2022 | 1500/1000 | ** |  | US | NAR pending home sales |

| 27/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 27/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.