-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

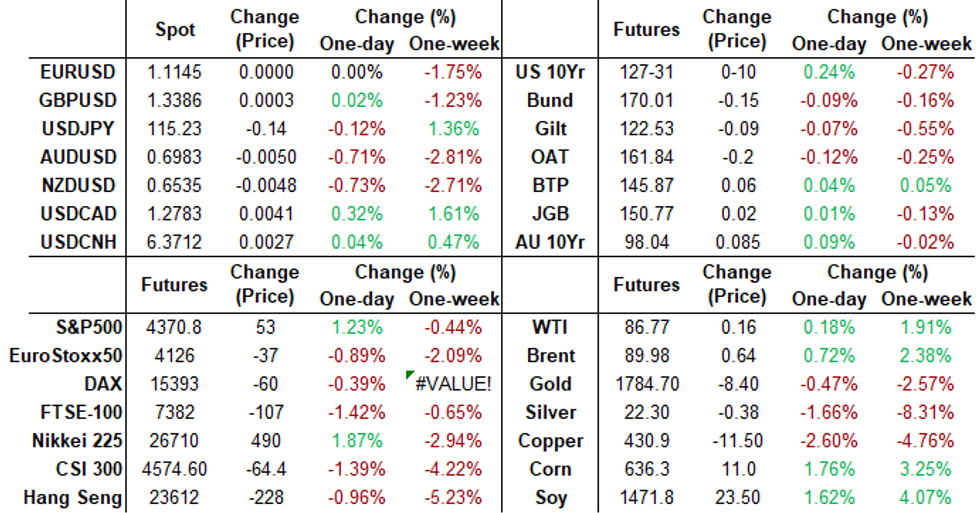

Free AccessMNI ASIA MARKETS ANALYSIS: Aggressive Hike Est's Cool Somewhat

Market Roundup, Aggressive Hike Estimates Cools Slightly

Both FI and equity markets finished higher Friday as expectations of more aggressive rate hikes for the year cooled somewhat after MN Fed Pres Kashkari (dove, non-voter) spoke.- First out of Blackout, Kashkari said while a "March hike is likely" .. the Fed "could pause after spring."

- In a second appearance on Yahoo finance, Kashkari said there is some value in adjusting rates in the near future; conceivable FOMC could move in the spring and then pause.

- Kashkari doesn't want to use terms like "gradual" or "deliberate" for the path ahead, as "too much is outside our control", and the Fed needs more information before deciding what they'll do a few months from now.

- Tsys see-sawed higher across the board, 30YY -.0196 to 2.0733%, 2s10s yield curve gained .628 to 90.695, and 7s10s remains above inversion at 2.659.

- Equities finished near highs, SPX eminis +105.5 at 4423.25.

- Short end: Eurodollar lead quarterly EDH2 remains under pressure (-0.035 at 99.455) after latest 3M LIBOR set' surged +0.01757 to 0.31657% (+0.05886/wk) -- new highest level since May 2020.

- Debate over size and speed of liftoff: some dealers, Nomura for example, expect a 50bp hike in March, while Wells Fargo sees 25bp hike in May adding to four quarterly hikes (+125bp/yr).

- Policy uncertainty/inflection point remains Green Dec'24 (97.910) inverted vs. most of the Blues (EDH5-EDU5) -- steady vs. Blue Dec'25.

- The 2-Yr yield is down 2.6bps at 1.1623%, 5-Yr is down 4.6bps at 1.6127%, 10-Yr is down 3bps at 1.7695%, and 30-Yr is down 2bps at 2.0733%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00071 at 0.07814% (+0.00343/wk)

- 1 Month +0.00129 to 0.10629% (-0.00142/wk)

- 3 Month +0.01757 to 0.31657% (+0.05886/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01572 to 0.53443% (+0.09000/wk)

- 1 Year +0.02629 to 0.94786% (+0.14929/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $80B

- Daily Overnight Bank Funding Rate: 0.07% volume: $274B

- Secured Overnight Financing Rate (SOFR): 0.04%, $913B

- Broad General Collateral Rate (BGCR): 0.05%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $333B

- (rate, volume levels reflect prior session)

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

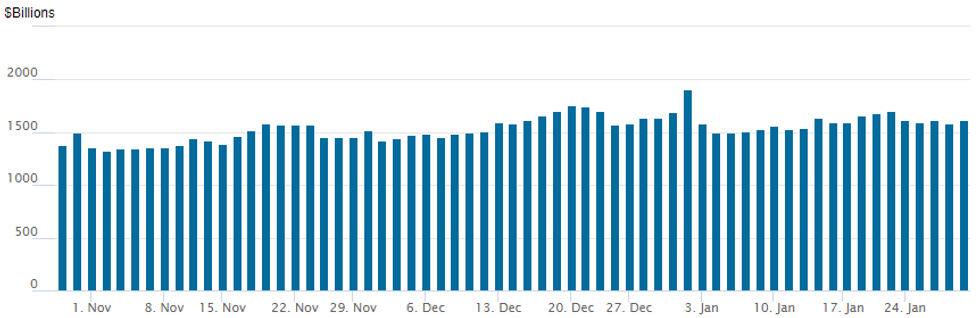

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounced to week high Friday: $1,615.021B w/81 counterparties vs. $1,583.895B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -4,000 May 99.00/99.18 put spds 8.0 over 99.56 calls

- +10,000 May 99.18/99.25/99.31 call flys, 0.5

- 5,000 Dec 98.50/98.62 put spds, carry-over from O/N, >20k total

- Overnight trade

- +8,500 Jun 99.12/99.25/99.37 call flys, 1.5 vs. 99.10/0.05%

- -8,000 short Jun 98.75/99.00 call spds, 2.5 vs. 98.14/0.08%

- +8,000 short Jun 97.81/98.00 put spds 1.5 over 98.56 calls

- 7,000 short Jun 98.75/99.00 call spds

- 7,500 May 99.06/99.18 2x1 put spds

- 5,000 Sep 99.50/99.75 1x2 call spds

- 5,000 Sep 98.93/99.12/99.25/99.37 put condors

- 2,500 Blue Mar/Blue Jun 97.62/97.87 put spd strip

- +8,000 TYH 129.25 calls, 8 vs. 127-19.5/0.15%

- 20,000 TYJ 128.5 calls, 37

- Block, -10,000 FVH 119 puts, 22 adds to O/N sale

- Overnight trade

- 9,000 TYH 126 puts

- -7,000 TYH 126.5 puts

- Block, -10,000 FVH 119 puts, 25.5

EGBs-GILTS CASH CLOSE: UK Short-End Shows Pre-BoE Jitters

Bund and Gilt yields retraced their intraday highs to close fairly flat by the close, with some modest bear steepening in both curves.

- Ahead of next week's BoE meeting (a 25bp hike is nearly fully priced), UK short-end yields hit fresh 11-year highs (2Y > 1.00%) before pulling back.

- Eurozone GDP data was mixed (German miss stood out). Attention also turns to the ECB meeting next week.

- BTP spreads continued to compress amid yet another day of impasse in the presidential elections. Italian political sources told MNI Draghi's chances are improving ahead of a weekend showdown vote. Elsewhere, periphery EGB spreads were mixed; Spain underperformed.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.4bps at -0.607%, 5-Yr is up 1.4bps at -0.305%, 10-Yr is up 1.4bps at -0.045%, and 30-Yr is up 1.1bps at 0.239%.

- UK: The 2-Yr yield is up 0.7bps at 0.968%, 5-Yr is up 0.5bps at 1.07%, 10-Yr is up 1.6bps at 1.244%, and 30-Yr is up 1.9bps at 1.37%.

- Italian BTP spread down 1.7bps at 132.8bps / Spanish up 1.5bps at 74.3bps

EGB Options: Put Buying Dominates

Friday's rates/bond options flow included:

- RXH2 169/168/167p fly sold at 13 in 1.5k

- RXH2 167.5/166ps 1x2, sold at 7.5 in 2.5k

- DUH2 112/111.90p strip, bought for 10.5 in 2.5k

- ERZ2 100.25/99.87/99.62p fly, 1x3x2, bought for 4 in 5k

FOREX: AUDUSD Breaches Key Support As Antipodean FX Extends Weakness

- Both the Australian and New Zealand dollars were the clear standouts on Friday, extending on the prior sessions significant sell-off.

- Despite the dollar index trading close to unchanged amid volatile two-way price action in equity benchmarks, AUD and NZD retreated a further 0.6%, bringing losses comfortably over 2% since Wednesday.

- AUDUSD’s clear break of 0.7069 reinforced bearish conditions and cleared the way for an extension towards the key support at 0.6993/91, the Dec 3 and Nov 2, 2020 lows. The support was broken during the European session and market participants will pay attention to the potential for a weekly close below the technical point. Moving average conditions remain in a bear mode, highlighting current sentiment.

- The dollar index caps off a stellar week, likely to register gains of around 1.65% and sitting at 18-month highs.

- Worth noting China will be out all of next week, however, Chinese PMI’s to be released Sunday before Monday’s data focus in the form of the MNI Chicago Business Barometer™.

- The week ahead will be highlighted by central bank policy decisions from the RBA, BOE and the ECB.

FX: Expiries for Jan31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100(E1.3bln), $1.1370-90(E715mln)

- USD/JPY: Y114.00($850mln), Y114.95-05($1.1bln), Y117.00($1.2bln)

- AUD/USD: $0.7300-15(A$587mln)

- USD/CAD: C$1.2550-60($931mln)

EQUITIES: Markets on Course for Lower Weekly Close Despite Friday Rally

- Following an acutely volatile beginning to the week, the S&P 500 looked to confirm a fourth consecutive week of losses, with the busy earnings calendar, heightened geopolitical risk and a hawkish Federal Reserve meeting conspiring against prices. Despite a solid session on Friday, with tech names (and notably the NASDAQ) rallying, markets were unable to climb above last Friday's close, leaving indices lower for fourth consecutive week.

- Friday's recovery was led by the likes of Apple, Visa and Mastercard, who all rallied 5% on more on a solid set of earnings, helping the tech sector to the top of the S&P 500.

- Energy names were the laggard despite still-buoyant crude prices as Chevron's earnings missed forecast - with profits and revenues failing to keep up with oil price rally.

- Earnings season continues in the coming week, with a further 28% of the S&P500 due to report, including megacap names Meta (Facebook), Amazon and Alphabet. Full schedule as well as EPS and Revenue expectations here: https://roar-assets-auto.rbl.ms/documents/13665/MN...

COMMODITIES: Oil Up For Sixth Week, Gold Slides On Hawkish Fed

- Crude oil prices are up 0.3-0.9% today and currently ending the week up 2.0-2.6% for the sixth consecutive weekly gain.

- Russia-Ukraine geopolitical developments have been mixed today, with Ukraine President Zelensky criticizing the media for making the situation appear worse but later headlines including Russia boosting military readiness with blood supplies.

- WTI is +0.3% at $86.9 having cleared first resistance of $88.54 before retracing, in a similar pattern to yesterday. Support is seen at $85.01 (Jan 26 low).

- Brent is +0.9% at $90.15, having earlier cleared two resistance levels and opening $93.89 (2.236 proj of the Dec 2-9-20 price swing) before retracing. Support is seen at $87.79.

- Gold meanwhile has fallen for the third day running, -0.7% at $1784.8 for a -2.75% drop on the week on Fed hawkishness. It twice tested second support at $1782.8 (Jan 7 low), a clear break of which could open the key support of $1753.7 (Dec 15 low).

Data Calendar for Monday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/01/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 31/01/2022 | 0800/0900 | *** |  | ES | HICP (p) |

| 31/01/2022 | 0900/1000 | *** |  | IT | GDP (p) |

| 31/01/2022 | 1000/1100 | *** |  | EU | GDP preliminary flash est. |

| 31/01/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 31/01/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 31/01/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 31/01/2022 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 31/01/2022 | 1630/1130 |  | US | San Francisco Fed's Mary Daly | |

| 31/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/01/2022 | 1740/1240 |  | US | Kansas City Fed's Esther George | |

| 01/02/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.