-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

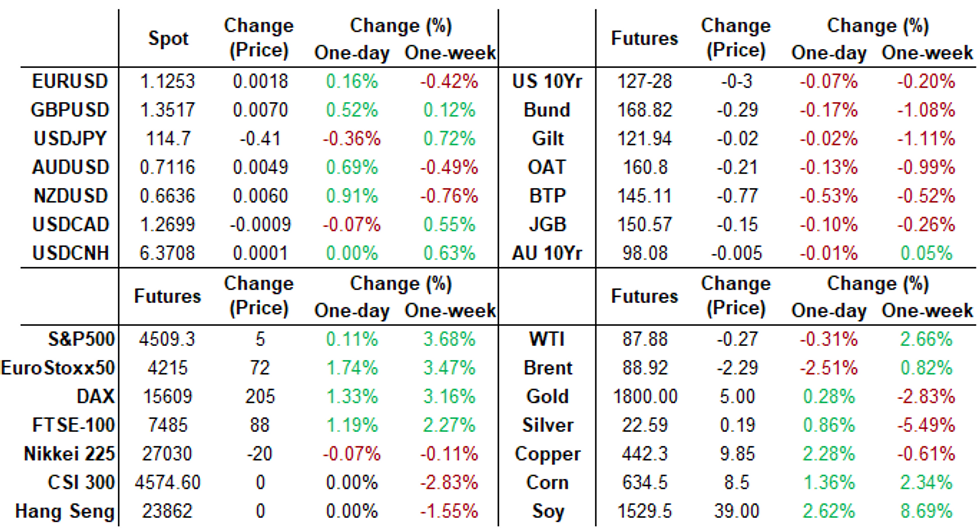

MNI ASIA MARKETS ANALYSIS: StL Fed Bullard Downplays 50Bp Hike

Eurodollar/Treasury Roundup, Risk-On Ahead Wed's ADP

Risk appetite gradually improved Late Tuesday, after StL Fed Bullard continued to downplay chances of a 50Bp hike in March.

- Stocks made decent gains after FI close, SPX eminis on highs and through 20D EMA at 4540.0 (+45.25) high. Top sectors leading Energy (+3.4%), Materials (1.65%) and Financials (+1.52%).

- Tsys finished weaker, after paring early session gains, yield curves rebounding from early flattening amid decent buying in short end including +15k TYH2 Block at 108-09.8. Trading desks reported foreign real$ buying in 3s, two-way in 5s from central banks and leveraged$, short end steepeners in 2s vs. 3s and 5s.

- Large flattener blocks in the long end eary in the session included 10s and 30s vs. 30Y ultra-bonds.

- Eurodollar and Treasury options saw decent unwinds in crowded March rate-hike trades as active spec accounts looked for better opportunities in longer expiries. Salient trades: paper sold over -80,000 short Mar 98.50/98.62 put spds at 8.5 vs. 98.42/0.12%; in Treasury options: -16,000 TYH 127/129 put over risk reversals, 1 vs. 128-00.5/0.49%.

- Data highlight for Wednesday: ADP private employment figures ahead the NY open, potential insight ahead Fri's Jan NFP (+150k est vs. +199k in Dec).

- The 2-Yr yield is down 1.4bps at 1.1651%, 5-Yr is up 1.3bps at 1.6226%, 10-Yr is up 2.2bps at 1.7982%, and 30-Yr is up 1.7bps at 2.1244%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00043 at 0.07743% (-0.00157/wk)

- 1 Month +0.00614 to 0.11300% (+0.00671/wk)

- 3 Month -0.00615 to 0.30271% (-0.01386/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.01443 to 0.52597% (-0.00486/wk)

- 1 Year -0.02772 to 0.93457% (-0.01329/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $78B

- Daily Overnight Bank Funding Rate: 0.07% volume: $256B

- Secured Overnight Financing Rate (SOFR): 0.05%, $1.019T

- Broad General Collateral Rate (BGCR): 0.05%, $357B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $343B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.551B submitted

- Next scheduled purchases:

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

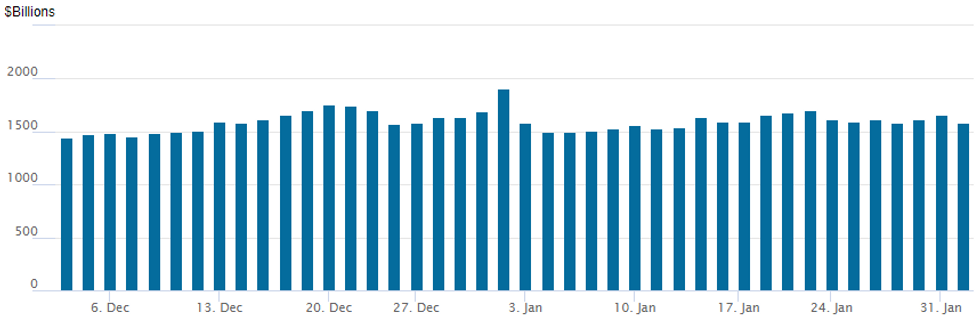

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,584.109B w/78 counterparties vs. $1,654.850B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- total -80,000 short Mar 98.50/98.62 put spds at 8.5 vs. 98.42/0.12%

- 5,000 short Mar 98.00/98.25/98.50 put flys

- 3,000 short Mar 98.37/98.50/98.62 put flys

- 7,500 Mar 99.31/99.43 put spds

- -2,500 Dec 98.25/99.00 strangles, 28.0

- -10,000 Apr 98.93.99.06 put spds, 4.0 ref: 99.095

- -1,000 Jun 99.12/99.25/99.37 call flys, 1.5

- Overnight trade

- +Green Jun 97.37/97.88 2x1 put spds, 6.5

- Block, -6,000 short Mar 98.25/98.50 put spds 8.0 over Blue Mar 97.62/97.87 put spds

- 5,000 TYH 128/128.5 call spds, 14

- 2,500 FVH 115.25 puts, .5

- -10,000 TYH 126.5 puts, 10

- -16,000 TYH 127/129 put over risk reversals, 1 vs. 128-00.5/0.49%

- Overnight trade

- +8,000 FVH 119.25 puts, 20.5

- +7,500 FVH2 119.75 calls, 12 vs. 119-10.5/0.33%

- +5,000 TYH 126.5/127 put spds, 5 vs. 128-06.5/0.08%

EGBs-GILTS CASH CLOSE: Yields Reverse Higher In The Afternoon

European yields rose Tuesday as equities held their ground and markets continued to reprice central bank outlooks in a more hawkish direction.

- That's of course ahead of the ECB and BoE decisions Thursday and marked a reversal in the afternoon, as morning yield drops dissipated.

- Stronger-than-expected US ISM prices paid data and job openings contributed to a negative tone.

- This time, the German short-end underperformed (vs UK weakness Monday).

- BTPs rallied briefly on a BTPei syndication announcement which was seen as reducing potential for a nominal mandate in February.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.8bps at -0.47%, 5-Yr is up 1.8bps at -0.202%, 10-Yr is up 2.6bps at 0.037%, and 30-Yr is up 3.8bps at 0.315%.

- UK: The 2-Yr yield is up 1.6bps at 1.061%, 5-Yr is up 0.3bps at 1.136%, 10-Yr is down 0.2bps at 1.3%, and 30-Yr is down 2.1bps at 1.427%.

EGB Options: Heavy Bobl Action

Tuesday's Europe rates/bond options flow included:

- DUH2 112.00/111.70 put spread sold at 12 in 5k

- DUH2 112.00/111.10 1x1.5 call spread bought for 1.25 in 4k

- OEH2 131.00 put bought for 7.5 in 3k and 8 in 4k

- OEH2 131.75/132.50 strangle sold at 46 in 1k

- OEJ2 132.75/132.00/131.25 put fly sold at 12.5 in 1k

- OEJ2 131.75/130.75 1x1.5 put spread bought for 15/15.5 in 6k

- OEH2 131.50/131.00 put spread bought for 8 in 8.35k vs RXH2 169/168 putspread sold at 38 in 1.67k

- RXH2 167.50/166.00 1x1.5 put spread sold at 13 in 2k

- RXH2 169.5 call vs RXJ2 166.5 call sold at 61 in 1.5k (sold April, bought Mar)

FOREX: Greenback Weakness Extends, NZD Squeezes Ahead Of Jobs Data

- The USD index sits marginally in the red on Tuesday, extending yesterday’s strong sell-off. A light calendar and broadly in-line US ISM Manufacturing PMI data did little to stoke any G10 currency volatility as markets await more major central bank meetings later in the week.

- Particular beneficiaries were once again AUD (+0.67%) and NZD (+0.93%), boosted by equity benchmarks consolidating at better levels, an advance for metals and higher commodity indices in general.

- AUDUSD failed to gather any downward momentum following the post-RBA downtick and continued to grind higher throughout both the European and US trading sessions. Furthermore, Friday’s false break of 0.6993/91, the Dec 3 2021 and Nov 2, 2020 lows has contributed to the squeeze/recovery with firm short-term resistance now in focus at 0.7130, the Jan 7 low.

- NZD’s outperformance comes ahead of quarterly employment data due overnight. Further gains may target the December lows of 0.6702, the most notable short term resistance point.

- The Pound also caught a bid, with cable rising 0.48% as well as the pressure on the cross which has been edging back towards the 0.8300 as we approach Thursday’s BoE meeting. The MPC looks set to raise Bank Rate by 25 basis points for a second meeting in a row taking it to the 0.5% threshold for it to begin reducing the size of its balance sheet, and to open the door to another hike in May.

- Yesterday’s daily close for EURUSD highlights a 3-day Japanese candle reversal known as a morning star. This suggested scope for a stronger short-term corrective which did play out throughout Tuesday. EURUSD came within 14 pips of the next firm resistance at 1.1293, the 20-day EMA, before settling around 1.1250.

- Overnight, RBA Governor Lowe is due to speak at the National Press Club, in Sydney with a Q&A expected. In Europe, HICP inflation data will be published before Thursday’s ECB meeting.

FX: Expiries for Feb02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200(E520mln), $1.1240(E589mln)

- USD/JPY: Y113.25($600mln), Y114.35-50($840mln), Y115.00($793mln), Y115.50($761mln), Y116.00($1.2bln)

- GBP/USD: $1.3545-50(Gbp504mln)

- AUD/USD: $0.7050(A$506mln), $0.7250(A$563mln)

- USD/CAD: C$1.2500($711mln)

EQUITIES: Stocks Drift on ISM-Flagged Price Pressures

- Wall Street equity markets opened broadly flat, but slipped into negative territory ahead of the close following the acute price pressures evident in the January ISM manufacturing survey. The prices-paid subcomponent came in well ahead of expectations (76.1 vs. Exp. 67.0), bolstering the Fed's tightening bias this year.

- The e-mini S&P oscillated either side of the 4500 handle, trading comfortably back above the 200-dma for the H2 contract at 4418.6.

- Pre-market earnings were well digested, with a solid update from UPS driving the industrials sector higher (UPS added as much as 14%), while a lurch higher in profits for ExxonMobil put the energy sector at the top of the pile. Laggards included utilities and real estate.

- After-market focus for corporates turns to reports from Alphabet, PayPal, Starbucks and General Motors, with Tuesday marking one of the busiest sessions of the week for the index. Full earnings schedule including EPS and revenue expectations found here: https://marketnews.com/mni-us-earnings-schedule-sp...

COMMODITIES: Volatile Day For Oil Ahead Of OPEC+

- Crude oil prices are currently down slightly on what has been a volatile day, ahead of OPEC+ expected to approve a March increase of 400kbpd tomorrow.

- OPEC’s technical committee found that the market will be oversupplied by 1.3mbpd in 2022 if OPEC+ fully unwind their production cuts as planned.

- However, members struggled to boost output in recent months, with production 832kbpd below target in Dec and with further difficulties into Jan.

- WTI is -0.1% at $88.05. It fleetingly cleared first resistance at $88.84 (Jan 28 high) before retracing, whilst support remains at $85.01 (Jan 26 low).

- Brent is -0.2% at $89.04 and has remained below initial resistance of $90.27 (Jan 28 high), with support at $87.79 (Jan 27 low).

- Gold continues to edge up slowly this week, up 0.2% at $1801.1. It remains comfortably between resistance of $1822.2 (Jan 27 high) and support of $1780.4 (Jan 28 low). Analysts in the London Bullion Market Association's 2022 survey saw prices largely stable, averaging $1801.9 through year.

Data Calendar for Wednesday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/02/2022 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 02/02/2022 | 1000/1100 | *** |  | IT | HICP (p) |

| 02/02/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 02/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/02/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 02/02/2022 | 1330/0830 | * |  | CA | Building Permits |

| 02/02/2022 | 1500/1000 | ** |  | US | housing vacancies |

| 02/02/2022 | 1500/1000 |  | CA | BOC Deputy Gravelle speaks on swaps panel | |

| 02/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 02/02/2022 | 2000/1500 |  | CA | BOC Gov Macklem testifies at parliamentary committee | |

| 03/02/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.