-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: BoE Hike Upsets Calm Ahead Fri NFP

Eurodollar/Treasury Roundup, Hikes Already Priced In, Waiting on NFP

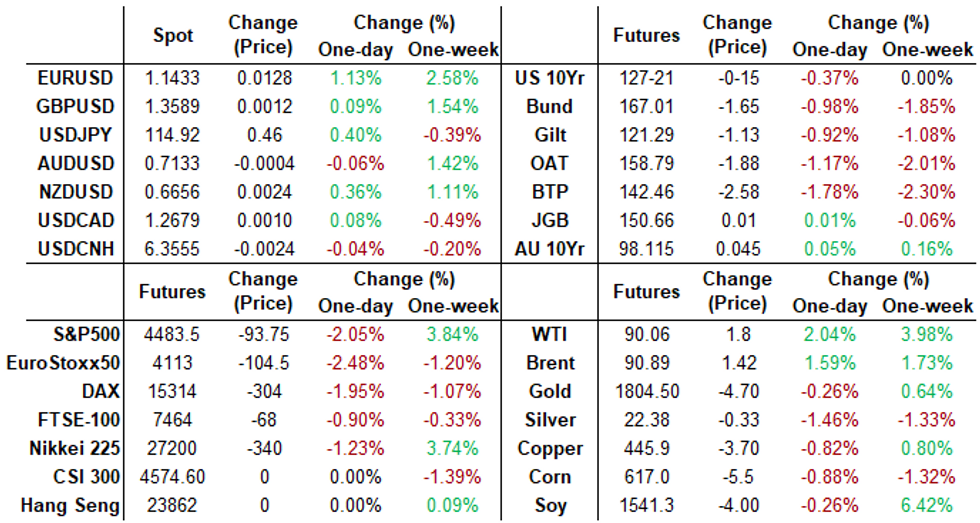

Rates finished session broadly lower, early sell-off triggered after after Bank of England raised bank rate by 25bp to .50% (4 out of nine Bank members called for 50bp hike).- Mkt initially shrugged on ECB leaving key deposit rate at -0.5%; subtle statement change omits "and in either direction" in shift to next step in addressing inflation.

- Early buying from prop accts playing the range evaporated after ECB Lagarde presser failed to calm hawks, chances of rate hike sooner than later on the rise.

- Little react to US weekly claims data this morning (238k vs. 245k est), Unit Labor Costs +.3% vs. 1.0% est.

- More focus on Fri's employment data for Jan (+150k est vs. +199k in Dec) -- little change to estimate after Wed's ADP private employ miss (-301k vs. +180k est).

- Tsy yields higher but off high: 30YY climbed to 2.1822% high (vs. 2.0886 opening low) finished 2.1473%; 10YY 1.8450% high finished 1.8217%.

- Eurodollar and Treasury option flow faded the sell-off, active trade in buying calls and call plays while unwinding or taking profits in put positions. Dec put condor Block sale appears to be bet on futures not adding any more than current 125bp in hikes by year end: +12,610 Dec 98.37/98.62/98.87/99.12 put condors, 6.0 vs. 98.445 at 1015:00ET.

- Note on equities: extending lows, tech shares heavy after Meta earnings/outlook miss. Eyes on Amazon annc after shares close (3.57 eps est).

- The 2-Yr yield is up 3.2bps at 1.1859%, 5-Yr is up 4.6bps at 1.654%, 10-Yr is up 4.3bps at 1.8181%, and 30-Yr is up 2.9bps at 2.137%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00029 at 0.07843% (-0.00257/wk)

- 1 Month +0.00315 to 0.11129% (+0.00500/wk)

- 3 Month +0.00443 to 0.31500% (-0.00157/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00557 to 0.52871% (-0.00572/wk)

- 1 Year +0.01415 to 0.94386% (-0.00400/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $274B

- Secured Overnight Financing Rate (SOFR): 0.05%, $927B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $328B

- (rate, volume levels reflect prior session)

- Tsys 10Y-22.5Y, $1.601B accepted vs. $4.193B submitted

- Next scheduled purchases:

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

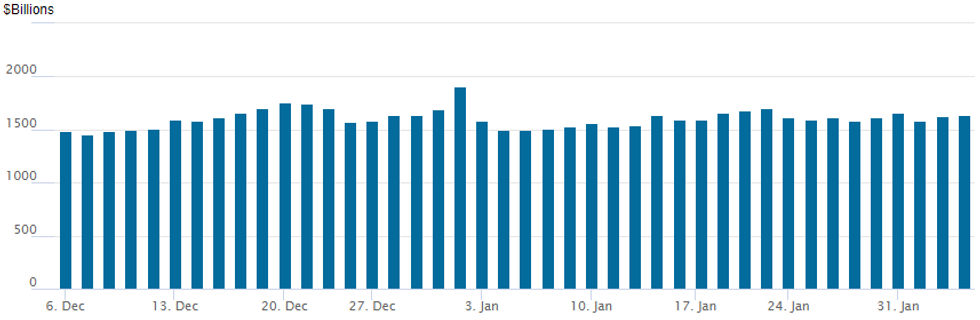

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,640.397B w/80 counterparties vs. $1,626.895B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 short Mar 98.75/99.00 call spds, 1.25 vs. 98.34/0.08%

- 2,000 Blue Feb 98.25 calls, 0.5

- Block, 21,000 Jun 99.25/99.37/99.50 call flys, 1.25

- Block, 12,610 Dec 98.37/98.62/98.87/99.12 put condors, 6.0 vs. 98.445 at 1015:00ET

- 10,250 Red Mar 99.25 puts, 96.0

- Overnight trade

- -8,000 Red Mar 99.75 puts, 134.5 vs. 98.415/0.98%

- -6,250 Sep 99.50 puts, 68.0 vs. 98.845/0.94%

- +4,000 Jun 99.25/99.37 call spds, 1.5

- 3,000 TYJ 122/124 3x2 put spds

- 1,600 TYJ 123/125 3x2 put spds

- -6,000 TYH 126.5/127.5 put spds, 20.0 vs. 127-19/0.30%

- 10,000 TYH 125.25 puts, 2

- Block, 12,000 TYH 125 puts, 2 vs. 127-17.5/0.04%

- 10,000 FVH 119.25 calls, 13 last

- 5,000 FVH 118.5/119 put spds, 3.5

- 3,000 USH 155 calls, 62

- 4,000 TYH 125.5/126.5 put spds 6

- 2,000 TYH 126/127.5 2x1 put spds

- -7,500 FVH 118.5/119 put spds, 11 adds to Block

- Block, -17,500 FVH 118.5/119 put spds, 11

- 10,000 Wk1 10Y 127 puts, 2

- 20,500 TYH 127 puts, 13-17, 17 last

- 30,000 TYH 126 puts, 4

- -20,000 TYJ 125 puts, 10 (open interest 42,115)

- -15,000 TYJ 124.5 puts, 7 (open interest 34,636)

- 2,000 TYH 128 calls vs. TYJ 130/131 call spds

- Late overnight trade:

- 14,000 TYJ 125.5 puts, 14

- 4,000 FVH 118.5 puts, 7

- +2,000 TYH 118/118.25/118.5 put flys, 1

EGBs-GILTS CASH CLOSE: Hawkish Turns

The BoE and ECB each surprised to the hawkish side with their decisions on "Super Thursday", leading to one of the biggest routs in European fixed income in recent years.

- The BoE hiked 25bp as expected, but that was almost an unexpected 50bp hike (favoured by 4 of 9 voters). Then Lagarde repeatedly refused to declare a 2022 ECB rate hike as "unlikely" and emphasised upside inflation concerns.

- Markets repriced accordingly. 40bp of ECB hikes are now seen (incl 10bp by Jul, 40bp by end-year); German 2Y yields rose by the most since Sept 2019, 10Y BTP since April 2020.

- UK FI "outperformed" but yields were also up double-digits.

- Little let-up Friday, with the US employment report set for release.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 12.9bps at -0.329%, 5-Yr is up 14bps at -0.04%, 10-Yr is up 10.5bps at 0.145%, and 30-Yr is up 4.4bps at 0.333%.

- UK: The 2-Yr yield is up 11.7bps at 1.146%, 5-Yr is up 11.4bps at 1.222%, 10-Yr is up 11.2bps at 1.369%, and 30-Yr is up 9.6bps at 1.457%.

- Italian BTP spread up 11bps at 150bps / Spanish up 5.3bps at 79.7bps

EGB Options: Lots Of Schatz, Before And After ECB

Thursday's Europe bond / rate options flow included:

- DUH2 111.50/40/30/20 put condor bought for 1.75 in 7.5k

- DUH2 111.60/50 put spread bought for 3.5 in 2.5k

- DUH2 111.50/40 put spread bought for 1.75 in 10k

- RXH2 169/167.5/165p fly, sold at 33 in 3k (closing)

- ERM3 99.875^, bought for 60 in 4k

- ERU2 100.25/100.125/100.00p fly, bought for 1 in 2k

FOREX: Euro Surges As Markets Digest More Hawkish ECB

- The single currency sprung to life on Thursday as markets interpreted the ECB’s press conference as a hawkish pivot, bringing forward bets that the ECB could tighten policy much sooner than previously anticipated.

- With risks to the inflation outlook, particularly in the near term, tilted to the upside compared to December’s meeting, ECB President Lagarde failed to rule out a rate hike this year which saw EURUSD spike to three-week highs, back above 1.14.

- Entering the press conference, EURUSD was a little softer around 1.1285. However, the weakness was short-lived and EURUSD rose quickly above the day’s high of 1.1308 and yesterday’s peak of 1.1330.

- The momentum continued with the pair blowing through noted resistance levels including the 50-day exponential moving average and the bear channel top drawn from the June 1, 2021 high. The rally narrows the gap with cluster resistance just ahead of the 1.1500 mark that may prove a short-term obstacle for short-term Euro bulls.

- EUR strength was broad based with EUR crosses all benefitting and especially EURJPY marching 1.56% higher, despite overall weakness in global equity indices.

- The other major central bank decision was a 25bp hike from the Bank of England. With 4 dissenting voters calling for a bolder 50bp hike, GBP immediately strengthened which prompted EURGBP to test multi-year support below 0.8300. With the strategy to tighten rapidly now in the hope of ensuring that the rate peak is lower, sterling gains were fairly short lived, retracing the moves ahead of the ECB.

- Amid the renewed optimism for the Euro, EURGBP had a very noteworthy 1.5% turnaround, likely to close the day back above 0.84.

- Dragged down by the impressive Euro rally, the dollar index extends on its recent downswing, with total losses for the index exceeding 2% on the week, retreating in every session. This comes ahead of January US non-farm payrolls data which headlines the Friday data schedule.

FX: Expiries for Feb04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200(E2.2bln), $1.1225-35(E514mln), $1.1300(E724mln), $1.1350(E656mln), $1.1400(E1.1bln)

- USD/JPY: Y113.80-00($1.3bln)

- GBP/USD: $1.3750(Gbp961mln)

- AUD/USD: $0.7100(A$701mln), $0.7195-00(A$549mln), $0.7300(A$1.1bln)

- USD/CAD: C$1.2500($1.6bln), C$1.2600-10($891mln), C$1.2695-10($1.5bln), C$1.2740($635mln), C$1.2940($2.5bln)

EQUITIES: Indices Slide, Meta's Loss Amongst Largest in Market History

- Equity markets edged lower Thursday, with tech a distinct underperformer following the notable slide in Meta (Facebook) shares. The company dropped over 25%, wiping out as much as $200bln in value - amounting to the one of the largest drops in $ terms in market history after-earnings.

- Meta's earnings outlined a myriad of problems facing the tech giant: dropping users to rival networks likeTikTok, a shrinking user base for the first time in company history, a tightening of Apple's privacy standards hurting Meta's ability to target advertising and sizeable investments in unprofitable virtual reality/metaverse products.

- This put the NASDAQ lower by over 2.5%, while the Dow Jones Industrial Average was more shielded, but still shed near 1% by the London close.

- Equities traded defensively following hawkish outturns from both the ECB and the Bank of England, with healthcare, consumer staples and utilities among the session's best performers, while tech and growth stocks made up the bottom of the pile.

- Earnings remain a market focus, with Amazon and Ford Motor due after the bell.

COMMODITIES: WTI Above $90/bbl For First Time Since 2014

- Crude oil prices are up strongly today on a combination of geopolitical risk and winter weather limiting some production in the US.

- Latest geopol developments include renewed US headlines from Russia potentially preparing a false flag operation to justify invading Ukraine. The US sanctions bill on Russia coming soon.

- WTI is up +2.1% at $90.09, having cleared $89.72 (Feb 2 high) and then the psychological $90. It next eyes $91.58, the 2.382 proj of the Dec 2-9-20 price swing.

- With the increases coming late in the day, most active strikes on the day have been $90/bbl calls followed by $95/bbl calls.

- Brent is +1.7% at $90.96, also through two resistance levels and next eyeing $93.24 (2.00 proj of the same price swing).

- Gold edges -0.1% lower at $1085.7, remaining comfortably between resistance of $1822.2 (Jan 27 high) and support of $1780.4 (Jan 28 low).

Data Calendar for Friday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/02/2022 | 0700/0800 | ** |  | DE | manufacturing orders |

| 04/02/2022 | 0745/0845 | * |  | FR | industrial production |

| 04/02/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 04/02/2022 | 0900/1000 |  | EU | ECB Survey of Professional Forecasters | |

| 04/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/02/2022 | 1000/1100 | ** |  | EU | retail sales |

| 04/02/2022 | 1215/1215 |  | UK | BOE Broadbent & Pill Monetary Policy Briefing | |

| 04/02/2022 | 1330/0830 | *** |  | US | Employment Report |

| 04/02/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 04/02/2022 | 1500/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.