-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Late Risk-On Unwinds Ahead Thu CPI

US TSYS: Late Risk-On Unwinds, Focus On Thu CPI

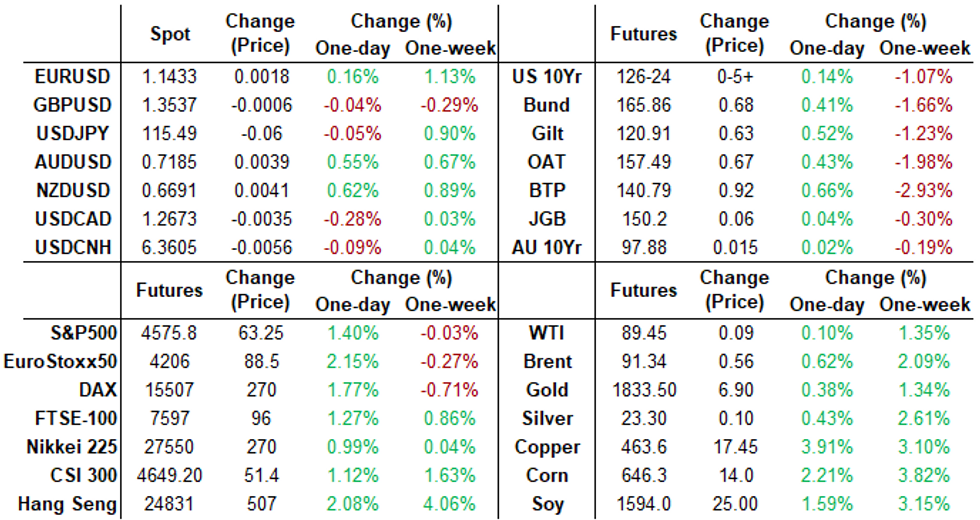

Late risk-on unwinds Wednesday as accounts scaled back tactical bets ahead Thursday's key inflation metric Jan CPI (MoM 0.6% rev, 0.4%; YoY 7.0%, 7.2%).

Yields quietly gained after the bell (10YY 1.9433% vs. 1.9071% in post-10Y auction trade) while stocks pared gains after marching to new late session high of 4580.0 after crossing 50-day EMA of 4563.47 earlier.

- Tsy futures extends session highs after strong $37B 10Y note auction (91282CDY4) trades through 2.3bp: 1.904% high yield vs. 1.927% WI; 2.68x bid-to-cover better than last month's 2.43x but still shy a 2.51x 5-month average.

- Indirect take-up surges to 77.56% vs. 65.53% last month (lowest since July '21); direct bidder take-up falls to 15.00% vs. 17.86%, while primary dealer take-up shrinks to record low of 7.44% vs. 16.61% prior.

- Waffles from Cleveland Fed President Loretta Mester, FI markets see-sawed around midday comments that Mester Wants Faster Hikes If Inflation Stays .. but sees No Compelling Case for 50BP Fed Hike.

- Mixed Eurodollar/Tsy option trade: Better upside Eurodollar call skew buying in first half a departure from better downside / rate-hike insurance buying via low delta puts (positions remain on books of course, with some rolling out to mid-late year put buying last few sessions). Meanwhile, Tsy options saw better put skew buying, ATM vol sales.

- After the bell, 2-Yr yield is up 0.5bps at 1.3461%, 5-Yr is down 1.8bps at 1.7985%, 10-Yr is down 3.6bps at 1.927%, and 30-Yr is down 2.6bps at 2.2313%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00071 at 0.07771% (+0.00071/wk)

- 1 Month -0.00300 to 0.12271% (+0.00742/wk)

- 3 Month +0.01114 to 0.37743% (+0.03843/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00529 to 0.63457% (+0.07914/wk)

- 1 Year +0.00200 to 1.09371% (+0.09471/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $263B

- Secured Overnight Financing Rate (SOFR): 0.05%, $896B

- Broad General Collateral Rate (BGCR): 0.05%, $346B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $335B

- (rate, volume levels reflect prior session)

- No buy-op Wednesday, resume Thursday:

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

- Next updated schedule will be released Friday, Feb 11 at 1500ET

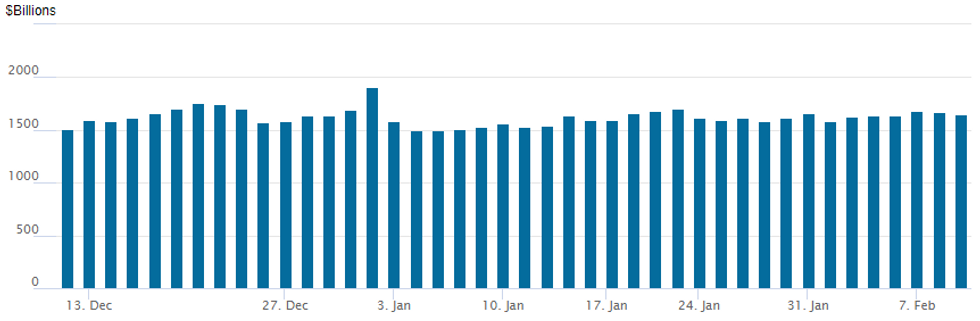

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,653.153B w/ 77 counterparties vs. $1,674.610B yesterday -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

SOFR Options:- +3,000 Dec SOFR 97.87/98.12/98.37 call flys, 3.5

- +5,000 Dec 98.00 puts, 19.0 vs. 98.335/0.35%

- -10,000 Dec 98.37 straddles, 63.0

- +15,000 Red Mar 99.25 calls, 5.5 vs. 98.165/0.10%

- +10,000 Jun 99.75/99.87 call spds, cab

- 5,000 Blue Feb 98.00 calls

- -5,000 short Jun 98.50 calls, 6.5

- +25,000 short Mar 97.87/short Jun 97.37 put diagonal spds, 3.0 net steepener/Jun bought over

- Overnight trade -- better upside skew buyers

- +6,850 Apr 99.00/99.06/99.12/99.25 call condors, 0.0/wings over

- 7,000 Feb 99.25/99.31 put spds

- +3,500 Jun 99.25/99.62 call spds, 4.75

- -4,000 Dec 98.00 puts, 18.0

- +5,000 Blue Feb 98.00/98.12 call spds, 0.5 vs. 97.85/0.10%

- 10,000 FVH 118/118.5 2x1 put spds, 2

- 2,500 TYH 126/127/128 iron flys, 45

- 4,000 USH 148/150 put spds, 7

- +10,000 wk2 TY 126.25/126.75 2x1 put spds, 5

- Overnight trade

- 7,800 TYH 127.5 puts, 53

- 7,300 FVH 119 calls, 5

- 1,500 FVJ 118.25/118.75 1x2 call spds

- 5,500 TYJ 124 puts, 11

- 9,000 TYH 124/125 put spds

- Blocks, +20,000 TYJ 126 puts, 40-44

- Block, +9,000 TYJ 123 puts, 5 vs. 126-26

- Block, 5,000 TYJ 126 puts, 40

EGBs-GILTS CASH CLOSE: Rally Consolidates

Gilts and Bunds rallied in the morning as ECB/BoE rate hike expectations were pared back slightly, before range range trading dominated for most of the session.

- Long-end EGBs underperformed with supply a key factor (Germany and Spain issuing 30Yrs). BTP spreads narrowed, in sympathy with a broader risk-on tone to the session.

- BOE's Pill didn't explicitly talk down market rate expectations but in laying out reasoning for not voting for a 50bp hike last week made it evident he doesn't see the need for what the market is currently pricing.

- Event focus still lies across the Atlantic, with a 10Y Treasury auction after the European close, and the crucial January CPI figures Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.1bps at -0.349%, 5-Yr is down 6.1bps at 0.02%, 10-Yr is down 5.3bps at 0.212%, and 30-Yr is down 2.8bps at 0.427%.

- UK: The 2-Yr yield is down 4.6bps at 1.283%, 5-Yr is down 5.2bps at 1.322%, 10-Yr is down 5.8bps at 1.431%, and 30-Yr is down 6.2bps at 1.531%.

- Italian BTP spread down 3.9bps at 154.3bps/ Greek up 1.8bps at 225.2bps

EGB Options: ECB Rate Plays Continue To Roll In

Wednesday's Europe rates / bond options flow included:

- RXK2 159 put bought for 52/52.5 in 15k

- DUH2 111.60 put sold at 7 in 6k

- OEJ2 131.75/130.75 1x2 put spread sold at -1 in 2k

- 0RM2 99.75/99.62/99.50/99.37p condor, sold at 2.75 in 2k

- 0RM2 99.25/99.12ps, sold at 3 in 6k (ref 99.46, -8 del)

- ERZ2 100.62c, bought for half in 10k

- ERZ2 100.00/100.125/100.25 call ladder bought for 0.25 in 3.6k

FOREX: AUD and NZD Outperform Amid Steady Recovery In Equities

- Firmer major equity benchmarks left Aussie and Kiwi top of the G10 FX leaderboard on Wednesday as broad dollar indices retraced yesterday’s small advance.

- Bolstered risk sentiment filtered through to risk/commodity tied currencies, however, price action/volatility remained subdued as market participants await US January consumer price data, scheduled for release on Thursday.

- For AUDUSD bulls a sustained break of key short-term resistance at 0.7179, the 50-day EMA would alter the bearish technical outlook.

- EURUSD had a brief pop to session highs of 1.1448 on Bloomberg reports that more ECB officials are said to distrust inflation forecasts, which emboldens a shift toward tighter policy this year, according to sources. The move fell just short of yesterday’s 1.1449 peak and any renewed optimism for the single currency was quickly sapped with EURUSD returning to the 1.1430 area.

- Ahead of tomorrow’s data, it is worth noting EURUSD’s recent consolidation appears to be a bull flag, reinforcing bullish conditions following last week's gains and clearance of the 20- and 50-day EMAs. The pair has also breached the top of its bear channel drawn from the Jun 1 high of last year, highlighting a more significant reversal. The focus is on 1.1558, a Fibonacci retracement. Initial support is seen at 1.1336.

- Emerging market currencies were favoured amid the supportive price action for equities, with emerging market currency indices rising around 0.5% and particularly strong performances from ZAR (+1.15%) and EURPLN seen 0.86% lower.

- On Thursday, potential comments from BOE Governor Bailey, speaking at an online event before US inflation data hits the wires 0830ET/1330GMT.

FX: Expiries for Feb10 NY Cut 1000ET (Source DTCC)

- EUR/USD: $1.1250-65(E560mln), $1.1280-00(E768mln), $1.1330-40(E1.3bln), $1.1410-30(E753mln), $1.1500(E1.7bln), $1.1600(E1.6bln)

- GBP/USD: $1.3500(Gbp564mln)

- AUD/USD: $0.7150-60(A$1.4bln), $0.7170-75(A$635mln), $0.7190-00(A$545mln)

- USD/CAD: C$1.2670-80($830mln), C$1.2810($1.2bln)

- USD/CNY: Cny6.3000($760mln)

EQUITIES: Tech & Growth Top Value as NASDAQ Nears Fed Highs

- Wall Street stock markets traded well Wednesday, extending late gains seen ahead of the Tuesday close as sentiment strengthened across Asia-Pac and European hours. Tech and growth names outperformed bluechips and value, putting the NASDAQ 100 on course to challenge the Feb highs at 15,196.

- Despite gains for the e-mini S&P, volumes remained below average for a second session, again signaling the willingness of traders to sit on the sidelines ahead of Thursday's CPI release.

- Real estate, materials and tech sectors drove gains in the S&P 500, with a re-flattening of the yield curve working in favour of housing names, while a fifth session of higher highs and higher lows for gold prices underpinned strength in mining names - most notably Freeport-McMoRan, which has now added near 25% off the January lows.

- Across the continent, notable strength was seen across Italy's FTSE-MIB and Spain's IBEX-35, as a relief rally in European government bonds worked in favour of Italian-German and Spanish-German yield spreads.

COMMODITIES: Oil Supported By Large Draw In US Inventories

- Crude oil prices have bounced after yesterday’s slide ahead of the possibility of a nuclear deal with Iran, boosted the largest draw on US crude inventories since September.

- WTI is +0.7% at $90.0, having fleetingly cleared initial support of $88.51 (Feb 8 low) before bouncing. A larger clearance would next open $86.34 (Jan 31 low) whilst resistance is $93.17 (Jan 4 high) as the outlook remains bullish.

- On a below average day for futures volumes, the most active strikes in the H2 contract have been $85/bbl puts followed by $90/bbl calls.

- Brent is +1.2% at $91.84, with support seen at $89.93 (Feb 8 low) and resistance at $94 (Feb 7 high) with the outlook remaining bullish.

- Gold is up another 0.4% today at $1833.49 ahead of tomorrow’s US CPI print. It edges nearer to the bull trigger of $1853.9 (Jan 25 high) and further from the bear trigger of $1780.4 (Jan 28 low).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/02/2022 | 0001/0001 | * |  | UK | RICS House Prices |

| 10/02/2022 | 0101/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 10/02/2022 | 0700/0800 | * |  | NO | CPI Norway |

| 10/02/2022 | 0830/0930 | ** |  | SE | Riksbank Interest Rate |

| 10/02/2022 | 1000/1100 |  | EU | European Commission Winter Economic Forecasts | |

| 10/02/2022 | 1200/1300 |  | EU | ECB de Guindos on Europe post-covid at LSE | |

| 10/02/2022 | 1315/1415 |  | EU | ECB Lane on supply chain disruptions panel discussion | |

| 10/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/02/2022 | 1330/0830 | *** |  | US | CPI |

| 10/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/02/2022 | 1700/1700 |  | UK | BOE Bailey speech at TheCityUK Dinner | |

| 10/02/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/02/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/02/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.