-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI ASIA MARKETS ANALYSIS: Russia/Ukraine Tensions Flare

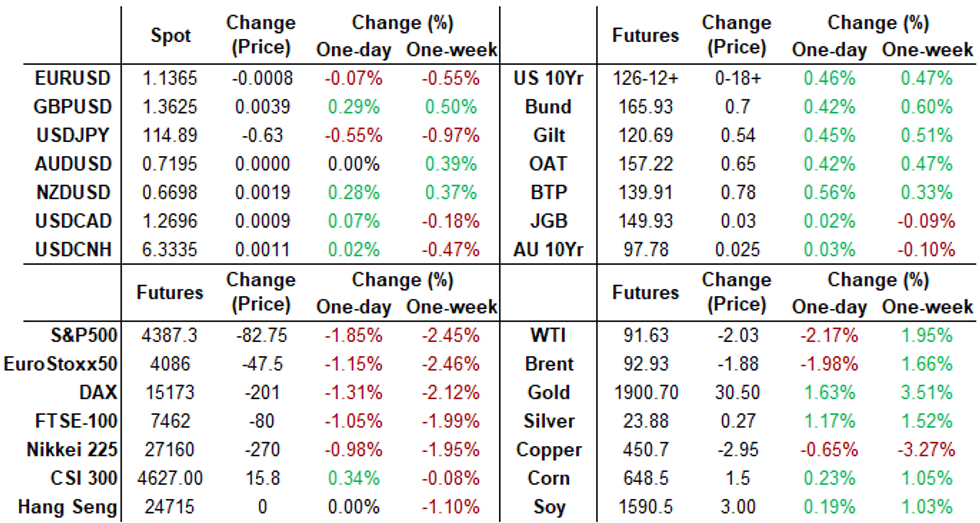

US TSYS: Russia/Ukraine Tension Heavy on Stocks, SPX Falls Over 2% Late

Ongoing Russia/Ukraine tension the main narrative driving risk-off tone Thursday (unconfirmed reports of renewed artillery firing in Eastern Ukraine making the rounds -- but note: Russia/Belarus were scheduled to perform live fire exercises today and Saturday).- Flood of headlines on day, gist: US/Allies disagree with reports of Russia troop withdrawals, wary of "false flag" operations.

- Gold surged +29.25 on safe haven buying, WTI crude weaker -1.87 at 91.79 on Iran nuclear deal hopes. US$ index DXY firmer +.122 to 95.823.

- For more prosaic reasons: Tsys extended early NY session highs after higher than forecasted weekly claims (+23k to 248k vs. 218k est).

- Long end Tsy futures pared gains briefly after poorly received $9B 30Y TIPS auction, tailing appr 6.5bp w/ 0.195% high-yield (-0.292% prior auction in Aug '21) vs. 0.130% WI; 2.17x bid-to-cover vs. last month's 2.34x.

- Indirect take-up receded to 69.9% vs. 74.9% last August; direct bidder take-up fell to 9.9% vs. 12.4%, primary dealer take-up climbed to 20.2% vs.12.7%.

- Implied vol held firm, sellers wary of taking on additional risk on headline prone markets. Steady drip of upside call and call spd trade, long put positions holding stead. Call volume climbing: over 400k calls traded between Mar-Jun expiries Wednesday, OI +149k.

- After the bell, 2-Yr yield is down 4.4bps at 1.4765%, 5-Yr is down 7.2bps at 1.8466%, 10-Yr is down 6.8bps at 1.9702%, and 30-Yr is down 3.5bps at 2.3109%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00258 at 0.07629% (-0.00214/wk)

- 1 Month +0.02500 to 0.16171% (-0.02943/wk)

- 3 Month -0.00714 to 0.48100% (-0.02543/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.01357 to 0.77357% (-0.06686/wk)

- 1 Year -0.04100 to 1.28886% (-0.10343/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $241B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $960B

- Broad General Collateral Rate (BGCR): 0.05%, $341B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $335B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Tsy 10Y-22.5Y, appr $1.601B accepted vs. $5.640B submission

- Next scheduled purchases:

- Tue 02/22 1010-1030ET: TIPS 1Y-7.5Y, appr $1.025B vs. $2.025B prior

- Thu 02/24 1010-1030ET: Tsy 0Y-22.5Y, appr $6.225B steady

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

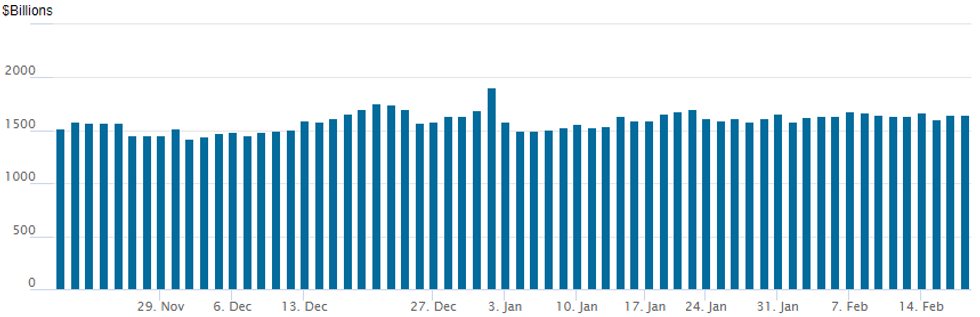

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches to $1,647.202B w/ 79 counterparties vs. $1,644.134B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

SOFR Options:- 1,500 SFRZ2 98.18/98.31 put spds vs. 98.62/98.75 call spds, 0.0

- 1,850 Apr 98.37/98.56/98.75 put flys vs. Jun 98.25/98.50/98.75 put flys

- +5,000 Sep 99.50 calls, 2.0

- Block, 10,000 Jun 98.62/98.81 put spds, 7.0

- +5,000 short Jun 97.25/97.43/97.56/97.68 broken put condors, 0.5

- +8,000 Dec 98.50/98.75/98.87 call trees, 0.5-0.0

- -5,000 short Jun 98.00 calls, 15.5 vs. 97.865/0.36%

- +10,000 short Apr 97.50/97.62 put spds, 3.5 vs. 97.83/0.08%

- +5,000 Sep 99.50 calls, 2.0 vs. 98.50/0.05%

- +6,000 short Apr 97.00/97.31/91.62 put flys, 4.5

- Overnight trade

- +5,000 short Apr 97.00/97.31/97.62 put flys, 4.5 ref. 97.775

- +21,000 May 99.00 calls, 8.0 vs. 98.83/030%

- Block, +8,000 Dec 97.75/98.00 put spds, 8.0

- Block, +5,000 May 98.62/98.81 put spds, 7.0

- 4,000 FVH 116.75 puts, 0.5 ref 117-28.25

- Block, 2,100 TUH 107.25/107.5 call spds, 4

- 1,750 USH 152 puts, 26

- 2,000 FVJ 117.5/119 2x1 put spds, 24

- -4,000 FVJ 118.25 calls, 17.5

- +5,000 TYH 124.5 puts, 54

- -10,000 FVJ 117.75 calls, 27.5 -- ongoing sell interest (see O/N Block, Wed trade below)

- +15,000 TYH 127 calls, 1-2

- +5,000 TYM 127/129 1x2 call spds, 13 -- ongoing

- Overnight trade

- Block, -10,000 FVH 118.25 calls, 16.5 (after heavy selling appr -25k each FVJ 117.25 and 117.75 calls on Wed)

EGBs-GILTS CASH CLOSE: Re-Escalation Drives Yields Lower

European FI rallied strongly Thursday as apparent Ukraine-Russia re-escalation dominated headlines and benefited safe haven assets.

- Bund and Gilt yield drops accelerated in the afternoon after Russia expelled a US diplomat and Pres Biden warned of an imminent Russian invasion of Ukraine.

- Curves bull steepened as near-term central bank hikes were priced out.

- ECB's Lane said in a wide-ranging MNI Webcast that the recent upward shift in inflation expectations will not make a major difference to monetary policy.

- Periphery EGBs managed to keep pace; 10Y BTP spreads fell as much as 5bp.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 6.5bps at -0.429%, 5-Yr is down 6.1bps at -0.019%, 10-Yr is down 4.7bps at 0.229%, and 30-Yr is down 3.3bps at 0.502%.

- UK: The 2-Yr yield is down 7.7bps at 1.33%, 5-Yr is down 6.8bps at 1.35%, 10-Yr is down 6.5bps at 1.459%, and 30-Yr is down 4.7bps at 1.541%.

- Italian BTP spread down 3.4bps at 160bps / Spanish down 1.2bps at 98.4bps

EGB Options: Heavy Headlines, But Light Flow

Thursday's Europe rates / bond options flow included:

- RXJ2 162/160.5/159p fly, bought for 21 in 1k

- OEJ2 132.25c, bought for 22 in 19k

FOREX: Yen, Swiss In Favour On Renewed Equity Weakness

- Currency markets were very much out of the spotlight on Thursday with the majority of the day’s volatility centred around equity and bond markets.

- However, the renewed risk-off sentiment did bolster haven-tied FX with the Japanese Yen and Swiss Franc up 0.45% and 0.3% respectively against the greenback. USDJPY fell to the worst levels in two weeks back below 115.00.

- Overall, the dollar index is likely to snap a two-day losing streak, however, gains for the greenback remain marginal and the index remains around 0.3% softer on the week. Worth noting the dollar continuing its weakening trend against gold, which has risen another 1.6% today, narrowing the gap with the June 2021 highs.

- Despite the lower equity and oil prices, AUD and CAD hold in well, broadly unchanged for the session and perhaps the more notable outperformer is GBP, rising 0.3%.

- EURGBP continues to edge back toward the significant support area around and just below the 0.83 handle, a multi-year range base since 2016 and 0.8282/77, the Feb’20 and Dec’19 lows. The cross is also below both the 20- and 50-day EMAs and resides just above the short-term support at 0.8331, a Fibonacci retracement.

- Naturally in emerging markets, RUB was the worst performer, retreating 1.35%. Despite today’s reversal higher in USDRUB, the pair remains well below the 77.62 highs seen late last week.

- Later today, expect comments from Fed’s Mester - due to speak about the economic and monetary policy outlook at an online event hosted by New York University. Q&A expected.

- Tomorrow’s data calendar will be headlined by retail sales from the UK and Canada before US existing home sales. There are also more scheduled Fed speakers throughout the latter half of Friday’s US session.

FX: Expiries for Feb18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1275-80(E959mln), $1.1325-40(E1.6bln), $1.1345-55(E2.1bln), $1.1375-90(E3.6bln), $1.1450-60(E775mln)

- USD/JPY: Y113.95-05($1.7bln), Y114.20-40($1.5bln), Y114.45-60($2.2bln), Y115.00($635mln), Y115.45-50($1.1bln), Y117.00($1.9bln)

- EUR/GBP: Gbp0.8350(E1.3bln)

- EUR/JPY: Y132.00(E510mln)

- AUD/USD: $0.7045-55(A$705mln)

- AUD/NZD: N$1.0755(A$2.0bln)

- USD/CAD: C$1.2595-00($572mln), C$1.2615-35($1.5bln), C$1.2700($1.2bln), C$1.2740-60($1.2bln), C$1.2795-00($1.1bln)

- USD/CNY: Cny6.3500-20($1.1bln)

EQUITIES: Stocks Slip as Ukraine Crisis Remains on Brink

- Equities across the European session traded shakily, but broadly mixed in early trade. This soon gave way into the NY crossover, however, with equities sliding as Russia-West tensions escalated despite the supposed demobilization of Russian military assets on Ukraine's borders. Russia expelled the deputy US ambassador from Moscow in what was framed as a tit-for-tat move, suggesting that diplomatic relations may have to get worse before they get better. Focus shifts to a potential face-to-face meeting held between foreign ministers Lavrov and Blinken in an attempt at finding a resolution.

- As such, headline stocks were all seen lower from the opening bell, with the tech and growth-led NASDAQ again leading losses to drop close to 2%. Unsurprisingly, tech and communication services names were at the bottom of the sector breakdown, with just consumer staples higher - as a solid earnings update from Walmart buoyed sentiment.

- Thursday's downside in the e-mini S&P keeps the outlook negative for now, with downside impetus strengthened by the failure of the contract to hold above the 50-day EMA - at 4549.15. This average represents a firm resistance and a clear break would suggest scope for a stronger rally towards 4671.75 initially, Jan 18 high. Recent bearish candle patterns have exposed 4212.75 the key downside target.

COMMODITIES: Oil Slides But Gold Prospers

- Crude oil prices are down -2.2% as progress in Iranian nuclear talks and the prospect of additional supply offset heightened Russia-Ukraine conflict fears.

- Prices spiked overnight on Donbas shelling headlines setting up for swings for the most of the day on various mixed messages in response.

- WTI is -2.2% at $91.6, with dips seen as corrective for now whilst it sits above the key short-term support of $88.41 (Feb 9 low). Resistance is $95.82 (Feb 14 high).

- Brent is -2.2% at $92.76, with underlying bullish sentiment as it sits above key short-term support at $89.93 (Feb 8 low). Resistance is seen at $96.78 (Feb 14 high).

- Gold meanwhile is on for another strong day, up 1.7% at $1900.62 thanks to its safe haven and inflation hedging properties. It earlier cleared resistance at $1881.6, opening 2021 highs with next resistance at $1903.1 (Jun 11, 2021 high) and then the medium-term upside target at $1916.6 (Jun 1, 2021 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/02/2022 | 0700/0800 | *** |  | SE | Inflation report |

| 18/02/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 18/02/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 18/02/2022 | 0900/1000 | ** |  | EU | EZ Current Acc |

| 18/02/2022 | 1000/1100 | ** |  | EU | construction production |

| 18/02/2022 | 1300/1400 |  | EU | ECB Elderson speech on industry climate risks | |

| 18/02/2022 | - |  | EU | ECB Lagarde at G20 CB Governors Meeting | |

| 18/02/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 18/02/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 18/02/2022 | 1500/1000 | * |  | US | Services Revenues |

| 18/02/2022 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

| 18/02/2022 | 1515/1015 |  | US | Chicago Fed's Charles Evans | |

| 18/02/2022 | 1515/1015 |  | US | Fed Governor Christopher Waller | |

| 18/02/2022 | 1600/1100 |  | US | New York Fed's John Williams | |

| 18/02/2022 | 1830/1930 |  | EU | ECB Panetta on CB digital currencies | |

| 18/02/2022 | 1830/1330 |  | US | Fed Governor Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.