-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:Stocks Surge, Russian Sanctions Grow

US TSYS: Late Friday Roundup: Geopol Risks Reassessed

Distinction between calm or exhausted markets was hard to tell Friday, the second day after Russia invasion of Ukraine. Treasuries traded modestly weaker on an inside range as equities enjoyed strong gains in late trade - both a continuation from late Thursday trade as markets reassessed geopol-risk of the Ukraine invasion as well as the costs of punitive sanctions on Russia.

- Amid myriad sanctions against Russian banks, wealthy individuals (including Pres Putin and foreign minister Lavrov) is the ongoing debate over whether Russian would be banned from the SWIFT banking system. After some initial pushback on the matter, Italian officials said there was no veto on the ban while Germany said the ban would be "manageable".

- Despite the bounce back to early Monday level (ESH2 at 4378.75, +94.75 late Fri) E-Mini S&P technical conditions are bearish however price remains above Thursday’s 4101.75 low and a corrective bounce extended Friday.

- Heavy session volumes in Tsy futures largely tied to final rolling from March to June futures that take lead on Monday. TYM2 traded 126-11 after the bell, -2.

- Lead Eurodollar quarterly EDH2 traded weaker even before latest 3M LIBOR set' gain of +0.01514 to 0.52300% -- new high last seen around early May 2020 after benchmark climbs +0.4343 total for the week. Chances of 50bp liftoff n March back around 50% with EDH2 at 99.325, -0.0575 after the bell.

- Later next week: Fed Chair Powell will be giving the semi-annual monetary policy report testimony to the House Financial Services Committee on Weds March 2 and the Senate Banking Committee on Thu March 3 - 1000ET/1500GMT in each case.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00029 at 0.07714% (+0.00157/wk)

- 1 Month +0.02200 to 0.23057% (+0.05986/wk)

- 3 Month +0.01514 to 0.52300% (+0.04343/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.02428 to 0.82871% (+0.04742/wk)

- 1 Year +0.04442 to 1.33071% (+0.04485/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $64B

- Daily Overnight Bank Funding Rate: 0.07% volume: $243B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $924B

- Broad General Collateral Rate (BGCR): 0.05%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $332B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Tsy 0Y-22.5Y, $6.201B accepted vs. $32.145B submission

- Next scheduled purchases

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

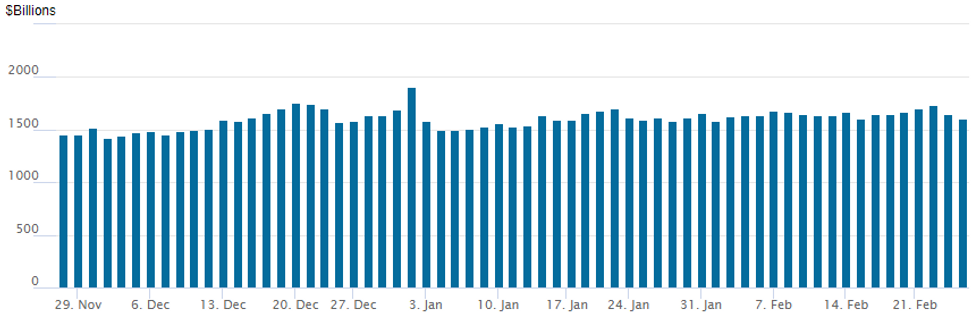

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,603.349B w/ 77 counterparties vs. $1,650.399B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

SOFR Options:- Blocks, total -10,500 SFRH3 98.12 straddle, 81.0-80.0

- +10,000 May 99.43/99.62 call spds, 0.5

- Block, 30,000 Jun 98.25/98.50 put spds, 3.75

- +15,000 short Mar97.62/short Sep 96.75 put spds, 7.0 micro-curve steepener

- -1,500 Red Mar'23 97.87 straddles, 86.0

- 1,000 short Mar 97.68/97.81 3x2 put spds

- Block, +10,000 Red Mar'23 97.00 puts, 21.5 vs. 97.83/0.22%

- +2,500 Dec 99.00 calls, 6.0

- Overnight trade

- 6,000 Blue Mar 97.50/97.75 3x2 put spds

- -10,000 FVJ 116.5/117 2x1 put spds, 4 ref 117-13.25 to -13.5

- 5,000 TYK 123 puts, 13 total volume over 21k/day from 13-16

- 4,000 FVJ 116.25/116.5/117.25 broken put trees

- Block, -20,000 FVJ 116.5/117.25 2x1 put spds, .5

- Overnight trade

- 8,000 TYK 121/122.5 put spds

- 4,000 TYK 123/124 put spds

- 2,000 TYJ 123.5/124/125 put flys

- +10,000 FVJ 118.75 calls, 6

- 3,000 FVJ 115.75 puts

EGB/Gilt - In the red going into the weekend

- EGBs and Bund fell this afternoon, after Equity rallied on report that Russia was ready to send a delegation for talks with Ukraine, but nothing as yet confirmed.

- Bund under performs, while Peripheral trade tighter today. As more Russia tension may slow the ECB's exit strategy.

- Greece is in the lead and tighter by 6.5bps.ECB Lagarde said that the ECB will analyze in March what to do in March.

- Some divergence between the UK and Germany, with Gilts holding onto gains, albeit still in the red at the time of typing.

- Gilt/Bund spread is 5.5bps tighter.

- Looking ahead BoE Pill speaks.

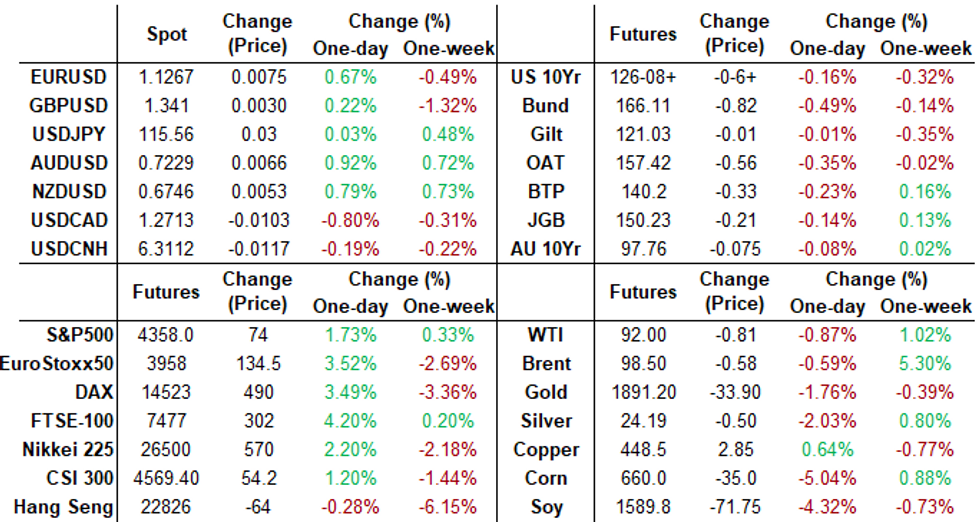

FOREX: Equity Markets Stabilisation Weighs On Greenback, Boosts Other Major FX

- Following the extension of Thursday’s late rebound on Wall Street, the greenback was on the backfoot approaching the close. Despite the dollar index making a fresh 19-month high this week amid the geopolitical circumstances, the DXY has slowly been edging away from these lofty levels as risk sentiment stabilises. The index remains around 0.7% higher for the week.

- Indeed, currency market sentiment is more favourable for Friday, helping the likes of AUD (+0.77%), NZD (+0.66) and CAD (+0.62%) towards the top of the G10 leaderboard.

- EURUSD also traded on a much more surer footing, edging further away from yesterday’s low print of 1.1106, rising back above 1.1250. Bearish technical developments this week defines a firm short-term resistance at 1.1280, the Feb 14 low.

- In similar vein, emerging market currencies bounced back with USDRUB seen 2.65% lower and in turn TRY, ZAR and MXN all posting near 1% gains on Friday.

- Outside of geopolitical risk, month-end flows had little impact on Friday, with most models pointing toward a USD-buying bias headed into Monday’s fix.

- Monday’s docket is kickstarted with Japanese and Aussie retail sales data before the US session is highlights by the MNI Chicago Business Barometer.

Equity Roundup, Back to Early Monday Levels

Stocks posting holding onto strong gains, SPX eminis all the way back to early Monday levels amid some intermittent sell programs/position squaring ahead the weekend. Inside session range for Tsys, trading moderately weaker w/ yield curves flatter in short end (30YY currently 2.3022, +.0240), Gold -14.8 at 1889.12, WTI crude -1.09 at 91.72.

- SPX Eminis currently trading +79.25 points (1.85%) at 4363; Dow Industrials 724.26 points (2.18%) at 33949.18; NASDAQ +138 points (1%) at 13611.88.

- SPX leading sectors:

- Materials +3.43%

- Financials +3.09%

- Utilities +3.07%

- Health Care +2.93%

- RES 4: 4671.75 High Jan 18

- RES 3: 4586.00 High Feb 2 and a key resistance

- RES 2: 4491.21 50-day EMA

- RES 1: 4415.92 20-day EMA

- PRICE: 4373.50 @ 20:27 GMT Feb 25

- SUP 1: 4101.75 Low Feb 24

- SUP 2: 4055.60 Low May 19 2021 (cont)

- SUP 3: 4029.25 Low May 13 2021 (cont)

- SUP 4: 3990.50 0.764 proj of the Jan 4 - 24 - Feb 2 price swing

E-Mini S&P technical conditions are bearish however price remains above Thursday’s 4101.75 low and a corrective bounce extended Friday. S/T momentum studies highlight bullish divergence between price and momentum suggesting scope for corrective cycle higher. Note that Thursday was a hammer candle formation - a reversal signal. The next resistance is 4415.92, the 20-day EMA. Thursday’s low of 4101.75 is the bear trigger.

COMMODITIES: Ending A Wild Week With Oil Stronger, Gold Softer

- Crude oil is ending the day down more than -1.0%, which sees WTI up +1% on the week (+22% year-to-date). Brent crude on the other hand is up +5.3% (26.5% year-to-date), driving the largest spread between the two since Apr-2020.

- The week has included some huge swings, including over 8% intraday gain Thursday after Russian invasion of Ukraine -- which was then fully reversed as it became clear the U.S. wasn’t going to sanction Russian oil and sanctions more generally less severe than they could have been.

- U.S. rig count continued to rise in response to high prices, up 5 to 650 this week and 11% higher year-to-date.

- WTI is -0.8% at $92.03, through first support of $94.95 (February 22 high) and briefly testing $90.64 (February 23 low) before retracing, resistance remains just north of $100.

- Brent is -0.6% at $98.51 and also cleared first support of $97.56 (February 24 low) before retracing.

- Gold has suffered for the second day running, down -0.7% at $1891.1, -0.3% lower on the week. Like oil, it surged through the initial invasion because seeing an intraday decline of almost 5% or $96.

- It was the largest intraday move since $115 in Nov’20 when gold ended -5% on the day as Pfizer announced effectiveness of its vaccine.

- It now sits above key short-term support of $1878.4 (February 24 low).

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/02/2022 | 0030/1130 |  | AU | Business Indicators | |

| 28/02/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 28/02/2022 | 0700/0800 | *** |  | SE | GDP |

| 28/02/2022 | 0700/0800 | ** |  | SE | Retail Sales |

| 28/02/2022 | 0700/0800 | ** |  | SE | Trade Data |

| 28/02/2022 | 0730/0830 | *** |  | CH | CPI |

| 28/02/2022 | 0800/0900 | *** |  | ES | HICP (p) |

| 28/02/2022 | 0800/0900 | *** |  | CH | GDP |

| 28/02/2022 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 28/02/2022 | 1130/1230 |  | EU | ECB Panetta speech at EUI monetary policy debate | |

| 28/02/2022 | 1330/0830 | ** |  | US | advance trade, advance business inventories |

| 28/02/2022 | 1330/0830 | * |  | CA | Current account |

| 28/02/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 28/02/2022 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 28/02/2022 | 1530/1030 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/02/2022 | 1550/1650 |  | EU | ECB Lagarde speech on Women in Econ & Finance | |

| 28/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 28/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.