-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Curve Steeper Ahead of JOLTS

MNI US OPEN - Censure Motion Against France Gov't Due Today

MNI ASIA MARKETS ANALYSIS: March Minutes QT Metrics

US TSYS: Rapid QT Ahead

Heavy whipsaw action following March FOMC minutes, curves holding steeper even as bonds climbing off lows again well after the closing bell.- The Federal Reserve will begin rapidly shrinking its USD8.9T balance sheet starting as early as May as part of a broader tightening campaign that has officials considering one or more 50BP rate hikes this year, minutes from the central bank's March meeting showed.

- Very short end grappling with pricing in prospect of more aggressive policy if inflation persists (CPI +7.9% March YoY while the Fed's preferred PCE measure +6.4% in Feb YoY). "Many participants noted that one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified."

- Remains to be seen whether he can say anything new to make markets react but StL Fed Bullard will talk about US economy/mon-pol at U of Missouri event tomorrow at 0900ET, text and Q&A.

- Economic data on tap for Thursday at 0830ET:

- Initial Jobless Claims (202k, 200k), Continuing Claims (1.307M, 1.302M)

- Apr-7 1500 Consumer Credit ($6.838B, $18.100B) late in session at 1500ET

- The 2-Yr yield is down 2bps at 2.4939%, 5-Yr is up 0bps at 2.6956%, 10-Yr is up 5.3bps at 2.5994%, and 30-Yr is up 4.8bps at 2.6212%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00186 at 0.32800% (+0.00071/wk)

- 1 Month +0.00543 to 0.45143% (+0.01386/wk)

- 3 Month +0.01986 to 0.98643% (+0.02443/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.02685 to 1.50171% (+0.01257/wk)

- 1 Year +0.01557 to 2.24343% (+0.07186/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $79B

- Daily Overnight Bank Funding Rate: 0.32% volume: $263B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $929B

- Broad General Collateral Rate (BGCR): 0.30%, $336B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $323B

- (rate, volume levels reflect prior session)

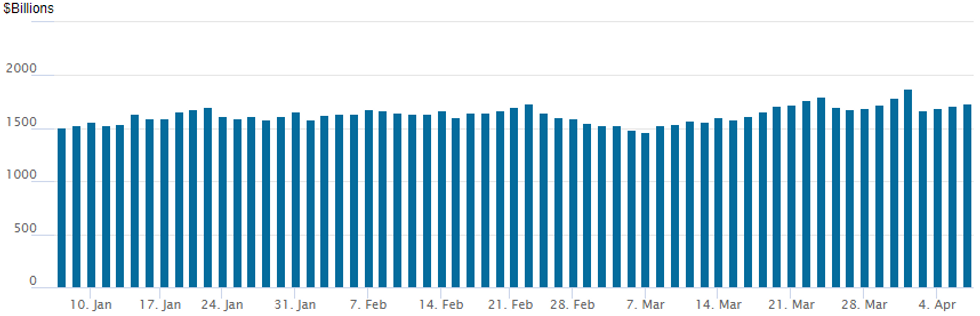

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,731.472B w/ 86 counterparties from prior session 1,710.834B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Put volume remained heavy Wednesday, pausing briefly in the post March FOMC minutes whipsaw trade as markets grapple with pricing in prospect of more aggressive policy if inflation persists (CPI +7.9% March YoY while the Fed's preferred PCE measure +6.4% in Feb YoY). 30YY currently 2.6412% +.0683.- Fed funds futures priced in appr 85% chance of 50bp hike in May while lead Jun quarterly Eurodollar futures now -0.050 at 98.34.

- Highlight trade, Block sale of -40,000 Sep 96.62/97.12/97.75/98.00 put condors crossed 8.5 -- likely a roll-down in strikes. Conditional bear curve steepeners noted: selling Aug 97.31/97.62 put spds vs. short Jun 95.93/96.37 put spds followed by sale of May 98.25/98.37 put spds 0.5 over Green Jun 96.50/96.62 put spds.

- Couple of notable SOFR option blocks included a buy of 5,000 short Apr SOFR 96.62/96.87 put spds w/ short Dec 96.00/96.50 put spds, 21.0 total db. Counter to the bear steepeners in Eurodollar options, another Block had 16,721 short Apr SOFR 96.87/short May 97.12 call spds trade 0.0 net, May said to be bought over

- Block, +5,000 short Apr SOFR 96.62/96.87 put spds w/ short Dec 96.00/96.50 put spds, 21.0 total db

- Total 16,721 short Apr SOFR 96.87/short May 97.12 call spds, 0.0 net, May said to be bought over

- Block, -40,000 Sep 96.62/97.12/97.75/98.00 put condors crossed 8.5

- 3,100 Aug 97.31/97.62 put spds vs. short Jun 95.93/96.37 put spds

- -2,500 May 98.25/98.37 put spds 0.5 over Green Jun 96.50/96.62 put spds, steepener

- +1,000 Dec 97.12 straddles, 88.0

- +4,000 Jul 97.25/97.6 2x1 put spds, 4.5 vs. 96.63 to .635

- Overnight trade

- Blocks +18,000 Green Jun 96.25/96.62 put spds, 10, 11k more on screen

- 6,000 Blue Jun 96.37/96.75 3x2 put spds, 10

- 10,000 wk3 TY 118.5/119/119.75 put flys

- +10,000 TYM 123 calls, 26

- +6,500 wk1 TY 121 calls, 2-3 ref 120-14 to -17 (wk1 midcurves expire today at 1500ET)

- Overnight trade

- 8,000 TYM 121.5/123 put spds

- Block +20,000 TYK 119.75 puts, 39

- 2,000 FVM 111.5/112.5/113.5 put flys

- Block, -21,000 FVK 113.75 puts, 61

- Block, -9,000 FVK 113.5 puts, 51.5

- Block, +30,000 FVM 112.5 puts, 45.5

EGBs-GILTS CASH CLOSE: Late Rally

Bunds and Gilts enjoyed a late rally Wednesday, with yields dropping after an earlier rise. Equities weakened sharply in the afternoon which eventually staunched FI losses.

- Curves closed mixed, though overall, UK and Germany steepened. ECB hike pricing again flirted with a 0.00% end-2022 rate, finishing just negative.

- Periphery yields were wider on the session but well off highs, with BTP spreads narrowing late alongside oil (as EU couldn't agree on Russia sanctions).

- Attention turns to Fed minutes after hours.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.7bps at -0.039%, 5-Yr is down 0.3bps at 0.44%, 10-Yr is up 3.3bps at 0.647%, and 30-Yr is up 6.2bps at 0.791%.

- UK: The 2-Yr yield is up 0.4bps at 1.463%, 5-Yr is up 2.6bps at 1.505%, 10-Yr is up 5bps at 1.704%, and 30-Yr is up 5.4bps at 1.82%.

- Italian BTP spread up 0.6bps at 165.4bps / Greek up 5.3bps at 210.6bps

EGB Options: Euribor Downside Buying As Rate Hike Expectations Mount

Wednesday's Europe rates / bond options flow included:

- OEK2 128.50/127.00ps, sold at 49 in 1.5k

- 0RM2 99.12/98.75 ps sold at 20.25 in 7k

- ERZ2 99.875/99.75/99.50/99.375p condor, bought for 3.25 in 2k

- ERZ2 99.50/99.125/99.00 broken put fly, bought for 7 in 2k

- ERZ2 100.00/100.125/100.25/100.50 broken' call condor, bought for 8.75 synth in 10k

- SFIK2 98.80/99.00 call spread bought for 1 in 30k on the day. Hearing that is covering back part of 98.70/98.80/98.90/99.00 condor to leave 98.70/98.90 call spread remaining.

- SFIK2 98.75/98.85 call spread bought for 1.5 in 3k

FOREX: USD Index Set To End Marginally Higher, AUD Reverses Course

- After a very brief blip lower following the release of the latest FOMC minutes, the greenback firmed with the Bloomberg Dollar Index rising to the best levels of the day and equities remaining under pressure.

- For EURUSD, an initial spike to 1.0928 encountered firm offers, prompting a retracement back below the 1.09 handle to trade within close proximity of the early European lows at 1.0875. However, a late bounce in equity indices saw the pair rise back to 1.0900, close to unchanged for Friday.

- As noted, this week’s weakness has reinforced a developing bearish technical threat. The break of 1.0945 signals scope for a deeper sell-off towards 1.0806, the Mar 7 low and a bear trigger.

- In similar vein, USDJPY fell to touch 123.50 before finding good support and now resides just shy of the 124 mark and day’s high at 124.05. Technically, a corrective cycle is still in play despite recent gains, with clearance of 125.09 needed to confirm a resumption of the primary uptrend.

- The overall weakness in equities weighed on Antipodean FX, with AUD the worst performer in G10 and set to snap a three-day winning streak. Additionally, EMFX has come under pressure, evident by the JPMorgan Emerging Market Currency index is seen 0.4% lower amid the dip in risk sentiment with popular longs such as MXN (-0.75%) and BRL (-1.20%) unwinding recent gains.

- AUD trade balance figures overnight before a fairly light data calendar on Thursday highlighted by German IP and Eurozone retail sales. However, the ECB Monetary Policy Meeting Accounts will be published at 1230BST/0730ET.

FX: Expiries for Apr07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.5bln), $1.0875(E828mln), $1.0900-15(E3.1bln), $1.0920-36(E3.1bln), $1.0965-70(E556mln), $1.1000-10(E2.2bln), $1.1025(E2.0bln), $1.1100-10(E1.1bln)

- GBP/USD: $1.3200-15(Gbp544mln)

- EUR/GBP: Gbp0.8375-90(E519mln)

- EUR/JPY: Y134.50(E677mln), Y136.00(E521mln)

- AUD/USD: $0.7575-85(A$624mln)

- USD/CAD: C$1.2500($635mln), C$1.2535-45($540mln), C$1.2575-90($1.3bln)

EQUITIES: Quick Post-Minutes Update, Climbing Off Lows

S&P eminis currently trading -41.75 (-0.92%) at 4478.5 -- after ESM2 trading down to 4447.25 -- through key support of 4452.75: 50-day EMA -- opening up next key support of 4320.25 (Low Mar 17).

- Meanwhile, Dow Industrials currently trade -165.22 points (-0.48%) at 34469.48, Nasdaq -278.4 points (-2%) at 13922.8.

- SPX leading/lagging sectors: Utilities sector still outperforming +1.66% lead by electricity, hybrid energy providers; Real Estate (+1.23%) and Consumer Staples (+1.05%) outpace Energy sector next up +0.51%.

- Laggers: Consumer Discretionary sector continues to underperform -- but off lows (-2.63%) followed by Information Technology (-2.16%).

- RES 4: 4800.00 High Apr 1 and the bull trigger

- RES 3: 4730.50 High Jan 1

- RES 2: 4663.50 High Jan 18

- RES 1: 4633.44 76.4% retracement of the Jan 4 - Feb 24 downleg

- PRICE: 4483.75 @ 1500ET Apr 6

- SUP 1: 4452.75 50-day EMA

- SUP 2: 4320.25 Low Mar 17

- SUP 3: 4129.50/4094.25 Low Mar 15 / Low Feb 24 and a bear trigger

- SUP 4: 4055.60 Low May 19 2021 (cont)

COMMODITIES: Oil Prices Slide On IEA Release

- Oil prices have slid after the IEA has said it will release 120 million barrels from reserves, with the US contributing half, unsurprisingly driving sizeable declines across the futures curve.

- The decline was further supported by the EU failing to approve new sanctions on Russia (generally, not oil) because of technical issues although MNI reported that EU officials see a ban on Russian gas as moving closer

- WTI is -4.7% at $97.2 having cleared first support of $97.78 (Apr 1 low), opening the bear trigger of $92.2 (Mar 15 low).

- Brent is -4.3% at $102.1, also just through support of $102.19 (Mar 29 low) having tested the 50-day EMA of $100.57 earlier which continues to be next support.

- Gold is +0.1% at $1925.4 as Treasuries twist steepen. Support remains the bear trigger of $1890.2 (Mar 29 low) whilst resistance is seen at $1966.1 (Mar 24 high).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/04/2022 | 0130/1130 | ** |  | AU | Trade Balance |

| 07/04/2022 | 0545/0745 | ** |  | CH | unemployment |

| 07/04/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/04/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 07/04/2022 | 0900/1100 | ** |  | EU | retail sales |

| 07/04/2022 | 1130/1330 |  | EU | ECB March meet Accts published | |

| 07/04/2022 | 1215/1315 |  | UK | BOE Pill Opening at BOE Sovereign Bond Market Conference | |

| 07/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 07/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 07/04/2022 | 1300/0900 |  | US | St. Louis Fed's James Bullard | |

| 07/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 07/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 07/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 07/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 07/04/2022 | 1800/1400 |  | US | Atlanta Fed's Raphael Bostic, Chicago Fed's Charles Evans | |

| 07/04/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 07/04/2022 | 2005/1605 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.