-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 2s10s Curve Appr 30Bp Steeper/Wk

US TSYS: 2s10s Yield Curve Appr 30Bp Steeper on Wk

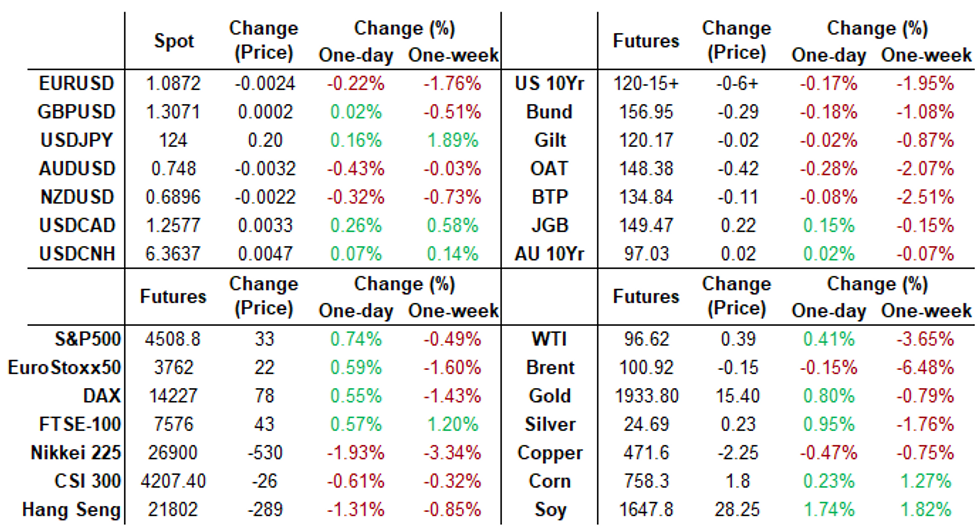

Tsys holding mixed levels after the bell, curves steeper with long end underperforming -- 10s-30s holding narrow range/near lows since noon.

- Nothing really new from StL Fed Bullard comments on economy/monetary policy this morning, save perhaps that current policy is "about 300bp too low", and stresses importance of taking recession red flag yield curve inversions seriously.

- Currently, 2s10s nearly 30bp off Sunday evening inverted low of -9.531 at +19.708 while 3s, 5s and 7s remain inverted or near inversion vs. 10s (+0.208, -4.370, -7.347 respectively).

- At 120-16 (-6) June 10Y futures remain above key support of 120-04+ (Low Dec 12/13 2018, cont); if yields continue to rise -- next key psychological support of 120-00.

- Limited data, no scheduled Fed speakers or Treasury supply:

- Apr-8 1000 Wholesale Trade Sales MoM (2.1%, 2.1%)

- Apr-8 1000 Wholesale Inventories MoM (4.0%, 0.8%)

- The 2-Yr yield is down 0.8bps at 2.4636%, 5-Yr is up 1.9bps at 2.7008%, 10-Yr is up 6bps at 2.6578%, and 30-Yr is up 5.9bps at 2.6847%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00686 at 0.32114% (-0.00615/wk)

- 1 Month +0.03671 to 0.48814% (+0.05057/wk)

- 3 Month +0.00243 to 0.98886% (+0.02686/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00086 to 1.50257% (+0.01343/wk)

- 1 Year -0.02857 to 2.21486% (+0.04329/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $77B

- Daily Overnight Bank Funding Rate: 0.32% volume: $254B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $905B

- Broad General Collateral Rate (BGCR): 0.30%, $332B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $322B

- (rate, volume levels reflect prior session)

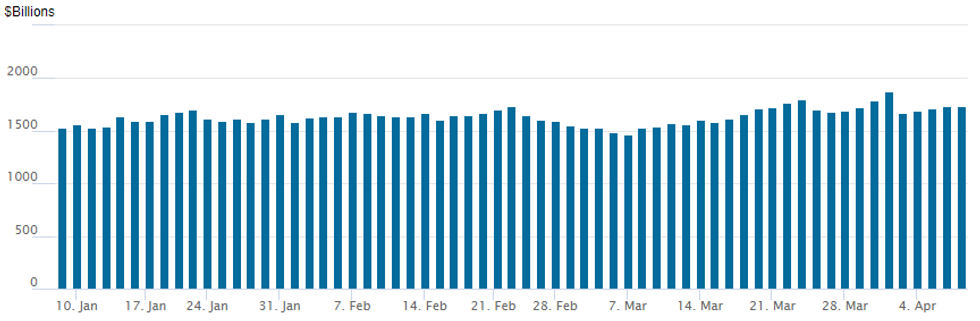

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches higher: 1,734.424B w/ 85 counterparties from prior session 1,731.472B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

US FI option trade continued to focus on downside puts Thursday as underlying rate futures traded mixed. Tsy yield curves continued to march off early week inverted lows, 2s and 5s outperforming weaker 10s-30s day after the March FOMC minute outlined factors for coming balance sheet drawdown (as early as May) and willingness to hike 50bp if needed to get inflation under control.- Overall volumes were rather muted, however, with a few exceptions. September Eurodollar options saw carry over interest after Block sale of -40,000 Sep 96.62/97.12/97.75/98.00 put condors crossed 8.5 on Wednesday.

- In the current session, 40,000 Sep 96.75/97.00 put spds were blocked at 2.75 after a scale seller of -15,000 Sep 97.00/97.50/98.00/98.50 iron condors from 23.0-22.5 ref 97.68. In Treasury options, paper bought over 25,000 wk3 TY 118.5 puts at 4.

- Block, 18,500 short Sep 97.62 puts 106.0

- Block, 40,000 Sep 96.75/97.00 put spds, 2.75

- Update: -15,000 Sep 97.00/97.50/98.00/98.50 iron condors, 23.0-22.5 ref 97.68

- -2,000 short Sep 96.62 straddles, 76.0-75.0

- 6,700 short Jul 97.62/97.87 call spds

- Overnight trade

- -8,000 Sep 97.06 puts, 8.5 ref: 97.675

- 5,400 Sep 97.00 97.50 put spds

- 2,000 USM2 138/140/142/144 put condors, 38

- over 25,000 wk3 TY 118.5 puts, 4

- 4,500 FVK 113.5 puts

- Overnight trade

- 5,000 TYK 120.75 calls, 58 ref 120-22.5

- +5,000 TYK 123/124 call spds, 5.0 ref 120-31.5

- +5,000 wk2 TY 120/120.75

EGBs-GILTS CASH CLOSE: Yield Ascent Continues

Bund and Gilt yields finished off session highs but continued their overall ascent Thursday.

- The accounts of the last ECB meeting were interpreted hawkishly, suggesting the GC may be more proactive than expected in tightening policy.

- Separate from the ECB-induced move for EGBs, 10Y Gilt yields underperformed hit another post-2016 high before pulling back slightly.

- A first poll to show Le Pen defeating Macron in the French election met with little market reaction.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.6bps at -0.014%, 5-Yr is up 3.7bps at 0.477%, 10-Yr is up 3.4bps at 0.681%, and 30-Yr is up 2.1bps at 0.811%.

- UK: The 2-Yr yield is up 0.8bps at 1.47%, 5-Yr is up 1.3bps at 1.517%, 10-Yr is up 2.7bps at 1.73%, and 30-Yr is up 4.5bps at 1.864%.

- Italian BTP spread unchanged at 165.3bps / Spanish down 0.7bps at 98.3bps

EGB Options: Mostly German Downside

Thursday's Europe rates / bond options flow included:

- RXM2 155.50/154.50/153.50p fly, bought for 7 in 1.25k

- RXM2 154/152ps, bought for 41 and 43 in 3.5k

- RXK2 159.50/161.50/163.50c fly, bought for 23 in 1k

- RXK2 161.00c, bought for 29 in 2k

- OEM2 127.5/127ps, bought for 14 in 5k

- OEK2 128/127 ps, sold at 34.5 in 2k

- OEK2 127.5/126.5ps sold at 21.5 in 2.5k

- OEK2 128.25/127.25/126.50p ladder vs 129.75/131.25 cs, bought the ladder for 1 in 6.2k

FOREX: Greenback Edges Higher As G10 FX Ranges Remain Contained

- The greenback has edged slightly higher (DXY +0.15%) on Thursday, however, G10 currency ranges were narrow and price action much more subdued amid a light data calendar.

- Following yesterday’s weakness, the likes of AUD, NZD and CAD extended their short-term downward bias and are bottom of the G10 pile on Thursday, all shedding between 0.35-0.50%.

- USDCAD has recovered from its recent lows and maintains a firmer tone. Tuesday’s price action, in Japanese candlestick terms, is a long-legged doji and a potential short-term reversal signal, suggesting potential for a correction near-term. The small continuation higher has narrowed the gap with the 50-day EMA that intersects at 1.2632 today.

- EURUSD traded either side of unchanged despite printing fresh lows for the week at 1.0865 during early European trade. $6.36 billion of option expiries between 1.0875/1.0936, including 2.13bn of 1.0900 strikes acted as a magnet for the pair.

- USDJPY remains towards the upper end of the days range, hovering just below 124.00. On the upside, clearance of 125.09, the Mar 28 high and bull trigger, is required to confirm a resumption of the primary uptrend.

- RBA Financial Stability Review features in a quiet APAC schedule. Friday’s highlight is March employment data for Canada.

FX: Expiries for Apr08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0825-50(E1.3bln), $1.0990-05(E3.3bln), $1.1045-50(E555mln)

- USD/JPY: Y119.75-95($1.3bln), Y124.00($730mln)

- USD/CAD: C$1.2500($859mln), C$1.2665-70($531mln), C$1.2750($616mln)

Late Equity Roundup: Session Highs After FI Close

No particular headline driver but equity indexes have ratcheted off session lows over the last couple hour, extending highs after the FI close.

- 1) Bank shares taking a beating as global sanctions against Russia for war in Ukraine -- may be weighing on large global systemically important banks (GSIBS) as many start writing off Russia. Yield curve collapses into inversion (recession flag despite modest overall bounce this week) playing havoc on holdings.

- 2) Upcoming earnings season arrives next week with prospect of unwelcome news due to point #1.

- S&P eminis currently trading +28.75 (0.64%) at 4505.25 as focus turned from earlier support to resistance of 4588.75 High Apr 5. Resumption of gains and an ability to remain above the 50-day EMA would be seen as a bullish development.

- Meanwhile, Dow Industrials currently trade +132.32 (0.38%) at 34633.97, Nasdaq +54.7 (0.4%) at 13944.43.

- SPX leading/lagging sectors: Health Care sector (+2.06%) lead by pharmaceutical names, Consumer Staples up second (+1.28%)

- Laggers: Real-estate sector underperformed late (-0.65) followed by Utilities (-0.40) and Communication (-0.37).

- Dow Industrials Leaders/Laggers: United Health (UNF) continued to outperform, +5.63 to 537.38, while Home Depot finally sees some buying after weeks of selling of mid-March highs of 340.49. Banks underperform but off lows: C (-1.92 at 217.08), GS (-1.65 at 314.61), AXP (-0.52 at 183.19).

- RES 4: 4730.50 High Jan 1

- RES 3: 4663.50 High Jan 18

- RES 2: 4633.44 76.4% retracement of the Jan 4 - Feb 24 downleg

- RES 1: 4588.75 High Apr 5

- PRICE: 4513.00 @ 1515ET Apr 7

- SUP 1: 4453.65/4444.50 50-day EMA / Low Apr 6

- SUP 2: 4425.96 38.2% retracement of the Feb 24 - Mar 29 rally

- SUP 3: 4400.00 Round number support

- SUP 4: 4363.85 50.0% retracement of the Feb 24 - Mar 29 rally

COMMODITIES: Oil Prices Softer As Supply Fears Still Weigh

- Oil prices continue to be weighed down by the previously announced release of IEA reserves along with further USD strength. Despite today's sell-off in long-end Tsy yields and the curve steepening, a hawkish Fed could conceivably be seen weighing on demand ahead.

- The Senate and House have passed the previously announced ban on Russian oil imports, with news that the House done so boosting prices before it was quickly reversed.

- Separately, the EU has backed an embargo on Russian coal.

- WTI is -0.8% at $95.46, with an earlier low of $93.81 comfortably through initial support at yesterday’s low of $95.73. Next support is eyed at the bear trigger of $92.20 (Mar 15 low).

- Brent is -1.0% at $100.1, also through support from the 50-day EMA and Apr 6 low between 100.54-59, next opening key support at $94.61 (Mar 16 low).

- Gold is +0.5% at $1934.4 as it edges nearer to resistance seen at $1966.1 (Mar 24 high) whilst support remains the bear trigger of $1890.2 (Mar 29 low).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/04/2022 | 0001/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 08/04/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 08/04/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 08/04/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 08/04/2022 | 1115/1315 |  | EU | ECB Panetta at IESE Business School Conference | |

| 08/04/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/04/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/04/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.