-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Curves Extend Bear Steepening

US TSYS: 30YY Tops 2.8352%

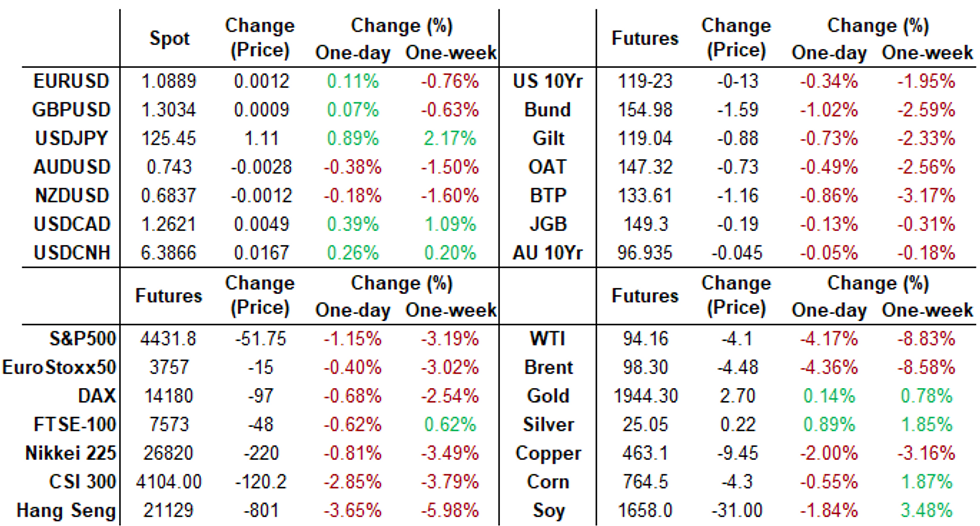

Tsy futures trade broadly weaker for the most part after Monday's close, curves bear steepening with 2s trading higher.

- Note, 2s10s currently +9.793 at 27.614 compares to inverted low of -9.561 a week ago Sunday as recession calls from dealers peaked. Trepidation over Tuesday's CPI data for March may be spurring some short end buying and rebound in curves off deeper inversion (recession flag).

- Re: chances of a recession in the U.S., GS strategists "found, when combining different segments of the yield curve a low probability of recession in the next 12 months is priced, but a 38% probability in 24 months".

- Highlight Block/cross: Massive 2Y vs. 5Y and 30Y ultra-bond steepener package at 1119:55ET

- +49,000 TUM2 105-19.25, buy through 105-18.38 post-time offer, $2M DV01

- -11,167 FVM2 113-01.75, sell-through 113-03.5 post-time bid, $540k DV01

- -3,006 WNM2 165-00, sell-through 165-09 post-time bid, 910k DV01

- Meanwhile, Treasury futures still held weaker/near lows after $46B 3Y note auction (91282CEH0) trades through: 2.738% high yield vs. 2.740% WI; 2.48x bid-to-cover vs. 2.39x last month.

- Speaking of supply, FI markets also weighed down by rate lock hedging vs. Amazon 7pt debt issuance spanning 2Y -40Y.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00171 at 0.32586% (+0.00028 total last wk)

- 1 Month +0.01057 to 0.52457% (+0.07643 total last wk)

- 3 Month +0.01072 to 1.02143% (+0.04871 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01300 to 1.55343% (+0.05129 total last wk)

- 1 Year +0.00886 to 2.28043% (+0.10000 total last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $77B

- Daily Overnight Bank Funding Rate: 0.32% volume: $258B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $905B

- Broad General Collateral Rate (BGCR): 0.30%, $337B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $328B

- (rate, volume levels reflect prior session)

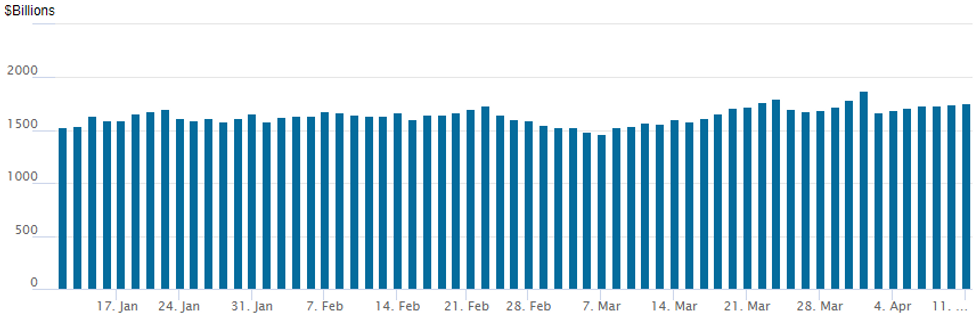

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches higher: 1,758.958B w/ 85 counterparties from prior session 1,750.498B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Option flow remained largely put-centric with a few exceptions Monday. Traders noted decent put selling on the day, unwinds/profit taking as Tsy curves continued to bear steepen (2s10s back to mid-march levels 28-29, well off -9.561 inversion from week ago) with bonds extended and held near late session lows by the bell.- Traders reported selling in 2- and 3Y midcurve put plays (-10,000 Blue Sep 96.87/97.37 put spds at 24.25, -5,000 Green May 96.37/96.62/96.87 put flys, 4.5 vs. 96.845) and intermediate to longer Treasury options (-5,000 TYM 120 puts at 126, -5,000 USM 138/142 put spds, 122).

- Highlight upside skew play had paper buying 5,000 TYM 121.5/124 call spd w/122/124 call spds 32 over 117/118 put spds covered.

- -10,000 Blue Sep 96.87/97.37 put spds, 24.25

- +2,500 Gold Jul 96.75/97.00 put spds, 9.5 vs. 97.09/0.12%

- -5,000 Green May 96.37/96.62/96.87 put flys, 4.5 vs. 96.845

- Overnight trade

- +4,000 Gold Jul 96.75/97.00 put spds, 9.0 ref 97.17

- Block, +10,000 Green Jul 96.25/96.62 put spds, 10.5 vs. 96.865

- Block, +6,500 Green Sep 96.25/96.62 put spds, 11.5 vs. 96.875, another 3.5k screen

- -5,000 TYM 120 puts, 126

- +5,000 TYM 121.5/124 call spd w/122/124 call spds 32 over 117/118 put spds covered

- -5,000 USM2 138/142 put spds, 122

- -7,100 TYK 127/127.5/128 call flys, 0.0

- 1,700 USK 142 puts, 128, total volume over 4.2k

- +3,000 USK 140 puts, 35

- -10,000 FVM 114.5 calls, 18.0-18.5

- Overnight trade

- +5,200 FVK 110.25/111.25 put spds, 3 ref 112-30

- Block, +5,000 FVK 113.25/FVM 112.5 2x3 put calendar spds, 50.5 Jun over

- 4,000 TYM 120 puts, 132

EGBs-GILTS CASH CLOSE: OAT Spreads Tighten After Macron Win

Bunds modestly underperformed Gilts Monday, with both underperforming US Treasuries following Sunday's better-than-expected result for France Pres Macron in the 1st round of presidential elections.

- With Macron a firmer favourite to win re-election, 10Y OAT spreads tightened ~4bp (as did BTPs).

- As the France election safe haven bid evaporated (and exacerbated by US curve steepening), 10Y yields hit new multi-year highs: UK since Jan 2016, Germany since Sept 2015.

- Attention turns to Tuesday's US CPI report and Thursday's ECB meeting.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 8.4bps at 0.134%, 5-Yr is up 9.8bps at 0.626%, 10-Yr is up 10.9bps at 0.816%, and 30-Yr is up 11.9bps at 0.928%.

- UK: The 2-Yr yield is up 8bps at 1.56%, 5-Yr is up 8.4bps at 1.614%, 10-Yr is up 9.8bps at 1.848%, and 30-Yr is up 8.6bps at 1.985%.

- Italian BTP spread down 3.9bps at 165.1bps / Spanish down 5.9bps at 93.7bps

Bearish Structures, Including An ECB Downside Play

Monday's Europe rates / bond options flow included:

- OEM2 134.00 call, bought for 3 in 10k

- RXK2 160.50/161.50cs, bought for 3 in 7k

- DUK2 111/110.90ps, sold at 9 in 5k

- DUM2 111.10/111.30cs, sold at 2 and 2.5 in 6k

- ERM2 100.12/100ps, bought for 1.25 in 13k (Covers the June ECB meeting on the 9th June, expiry on the 13th)

- ERZ2 99.62/99.75/99.87c fly, bought for 1.5 in 5k

- 0RM2 98.62/98.50/98.25p ladder, bought for -1.75 (receives), in 7.5k

FOREX: CHFJPY Rises 1.25%, Breaches Mid 2015 Highs

- USDJPY in particular has started the week on a firmer note and has breached key near term resistance 125.09, the Mar 28 high. The break higher confirms the end of the recent corrective cycle and more importantly, confirms a resumption of the primary uptrend.

- Price extended to highs of 125.77, narrowing the gap with 125.86, the Jun 5 2015 high and a major resistance. Above here price may initially target 126.26 -- 3.382 proj of the Dec 3 ‘21 - Jan 4 -24 price swing.

- Slightly mixed performance for the greenback on Monday with obvious gains against the yen offset by losses against the CHF and the Euro. The USD index resides in positive territory however and is hovering close to recent cycle highs and the best levels since May 2020 around the 100 mark. Latest commentary from the Fed’s Evans suggests the US dollar reflects Fed policy pivot toward neutral.

- Weakness in Equities weighed on the likes of AUD, NZD and CAD, all falling between 0.2-0.45%.

- Notable Strength in the Swiss Franc throughout Monday’s US session with EURCHF retreating from 1.0206 morning highs and grinding consistently lower to print a fresh month low below 1.0130.

- EURCHF tested minor Fibonacci support at 1.0124, with more notable support residing at 0.9972, the March lows.

- CHF strength comes amid equity weakness and in stark contrast to the resumption of JPY weakness. Exacerbating this divergence was the CHF/JPY cross rising above the mid 2015 highs around 134.50, currently up 1.25%. The next most notable level for the pair is up around 139 which represents the SNB peg removal highs.

- Focus for tomorrow will be US CPI where the consensus has the headline print surging +1.2% M/M in Feb on sharp rises in energy (~12% M/M) and less so food (1% M/M). That would see year-on-year inflation rise further from 7.9% to 8.4%. UK unemployment as well as German ZEW sentiment data are notable releases during early European trade.

Late Equity Roundup -- Late Selling Breaks Support

Equity indexes extending session lows after the rate close, SPX eminis through key support - ESM2 currently -76.00 (-1.7%) at 4407.0 - well through 50-day EMA of 4456.43 and 4425.96, a Fibonacci retracement -- eying round number of 4400.0 next key support.

- Current selling may be positioning ahead Tue's CPI as well as squaring up ahead start of latest earnings cycle that kicks off with financials making up the bulk of releases. JP Morgan and BlackRock due Wed, before Citigroup, Goldman Sachs, Morgan Stanley and Wells Fargo follow.

- SPX leading/lagging sectors: Industrials sector (-0.29%) capital goods including airlines, aerospace and defense outperforming; Materials, Consumer Staples and Financials sector follows (the three around -0.45%-0.48%) with banks seeing mild rebound after heavy selling late last week/unwinds ahead earnings.

- Laggers: Energy sector (-3.11%) with oil and gas weighing -- underperforming Information Technology sector (-2.60%) as semiconductors continued to lag on chip scarcity (BMW warning scarcity could last until 2023), software outpacing hardware.

COMMODITIES: Oil Prices Dip On China Lockdowns, Opening WTI Bear Trigger

- Oil prices have suffered today as Chinese lockdowns prompt further demand fears as virus cases rise in Shanghai and with no clarity on when restrictions will be lifted.

- WTI is -4.2% at $94.2 having earlier cleared initial support at $93.81 (Apr 3 low), opening the bear trigger of $92.2 (Mar 15 low).

- Demand fears see oil prices slide across the futures curve whilst within the May’22 contract, the most active strikes have been in $90/bbl and $85/bbl puts.

- Brent is -4.3% at $98.35, through initial support at $98.41 (Apr 7 low) and opening key support at $94.61 (Mar 16 low).

- Gold meanwhile is +0.2% at $1951.4 as it continues to edge higher. Resistance seen at $1966.1 (Mar 24 high) whilst support remains the bear trigger of $1890.2 (Mar 29 low).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/04/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 12/04/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 12/04/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 12/04/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 12/04/2022 | 0645/0845 | * |  | FR | Current Account |

| 12/04/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/04/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/04/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/04/2022 | 1230/0830 | *** |  | US | CPI |

| 12/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/04/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 12/04/2022 | 1610/1210 |  | US | Fed Governor Lael Brainard | |

| 12/04/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/04/2022 | 1700/1300 |  | US | Philadelphia Fed's Patrick Harker | |

| 12/04/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/04/2022 | 2245/1845 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.