-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:Rates Trim Early Gains, On Lows Late

US TSYS: Risk-Off Tone Cools, Techs & Retailers Bounce

Bonds lead the carry-over risk-on rally early Thursday, 30YY falling below 3% to 2.9723% low, curves bull flattening with 2s10s falling to 18.454 low, 5s10s inverting to -2.059 low after the open.- Better buying across the curve after weekly claims climbs 218k vs. 200k est, Philly Fed 2.6 vs. 15.0 est.

- Early carry-over weakness in stocks as supply shocks and operation costs still hitting large retailers: Kohl's fell -11.0% after earnings miss, profit guidance cut -- but managed to rebound 4.3% in late trade.

- Rates see-sawed off highs through the second half as major indexes held mildly weaker levels for the most part in late trade, Nasdaq outperforming as tech and large retailer companies stage a rebound while Industrials underperform. Earnings after the close: Ross Stores (RSS) and Applied Materials (AMAT).

- Two-way trade ahead Fri's June option expiration and June/Sep rolling saw volumes surge, particularly in 5s (FVM/FVU lead w/ over 170k late) and 10s (TYM/TYU over 112k after the bell).

- Cross-asset update: Gold surged (+26.05 at 1842.65), crude bounced (WTI +2.26 at 111.85) and US$ index fell by roughly 1%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00029 to 0.82000% (-0.00571/wk)

- 1M +0.03342 to 0.96071% (+0.07400/wk)

- 3M +0.02686 to 1.50486% (+0.06115/wk) * / **

- 6M -0.00757 to 2.02557% (+0.03057/wk)

- 12M -0.03500 to 2.70600% (+0.05386wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.50486% on 5/19/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $75B

- Daily Overnight Bank Funding Rate: 0.82% volume: $252B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.79%, $939B

- Broad General Collateral Rate (BGCR): 0.80%, $355B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $341B

- (rate, volume levels reflect prior session)

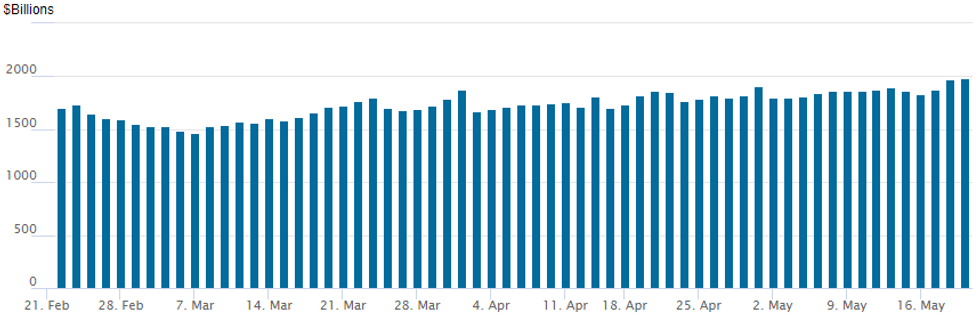

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new all-time high of 1,981.005B w/ 92 counterparties vs. Wednesday's prior record $1,973.373B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Not a lot of follow-through trade from overnight as underlying futures extended session highs by midmorning, rate hike pricing by year end cooling slightly (but still targeting 50bp hikes for at least the next two meetings).- Scale buyer over 45,000 July 97.37 calls from 10-11 noted overnight. Volume faded as futures see-sawed off midmorning highs into the close. Treasury option volumes dominated by unwinds of soon to expire June options this Friday.

- 3,500 Green Jun 97.37/97.44 call spds, 1.0

- 2,000 Sep 96.93/97.12 put spds

- 2,500 short Jul 95.56/96.12/96.25/96.62 put condors

- Block, 5,000 Dec 98.50/98.75 call spds, 1.0 vs. 96.90/0.05%

- Block, 5,000 Green Dec 97.87/98.25 call spds, 6.0 ref 97.065

- 5,000 Jul 97.12/97.25 put spds

- 2,700 Dec 98.62/99.00 call spds

- 2,400 Sep 97.00/97.87 call spds vs. 96.31 puts

- 45,000 Jul 97.37 calls, 10-11

- 1,250 Jul 97.37/Dec 98.37 2x3 call spds

- -6,000 TYM 119.5 puts, 6 ref 119-29

- +4,000 FVM 113 puts, 6-6.5 total volume >16,000

- 2,000 TYN 113/114/115/116 put condors, 4

- +7,000 TYM 120 calls, 28

- 6,500 TYM 119 puts, 3

- 4,000 FVM 112 puts, 0.5

- 6,000 TYN 120.5 calls

- 4,000 TYN 116/119 put spds

- 2,000 TYM 115.5/118.5 put spds

- 10,000 TYN 122 calls, 17

- Block, 5,000 TYN2 118 puts, 38

EGBs-GILTS CASH CLOSE: Gilts Underperform Amid Safe Haven Move

Gilts reversed early gains but Bunds held up Thursday as equities came off afternoon lows. Curves ended the session flatter, with periphery spreads a little wider.

- Most of the price action in the session was safe-haven driven. 10Y Bund yields fell by 8+bp (and 13bp at one point), the most in a week.

- There was little market reaction to the ECB April meeting account release, as nothing to dissuade market consensus for a July rate hike.

- Indeed, neither BoE nor ECB rate pricing changed much on the session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 2bps at 0.372%, 5-Yr is down 4.5bps at 0.692%, 10-Yr is down 8.1bps at 0.949%, and 30-Yr is down 7.8bps at 1.07%.

- UK: The 2-Yr yield is up 3.2bps at 1.491%, 5-Yr is up 0.3bps at 1.586%, 10-Yr is unchanged at 1.865%, and 30-Yr is up 0.1bps at 2.094%.

- Italian BTP spread up 2.3bps at 195.5bps / Greek up 3.9bps at 259.9bps

EGB Options: Bund Downside Eyed

Thursday's Europe rates / bond options flow included:

- OEN2 124/128 combo, bought the put for 2 and 3 in 25k

- RXN2 139p, was bought for 4.5 in ~10k

- RXN2 136.50p, bought for 3.5 in 12k

FOREX: Lower Treasury Yields Sees USD Index Slide Over 1%

- Lower yields and consolidating equity indices weighed on the greenback on Thursday. The USD index fell by roughly 1%, which represents a fourth losing session within the last five trading days.

- Gains against the greenback were broad based, however, the oil bounce especially bolstered the Norwegian Krone which gained 2.3% against the dollar.

- The Swiss Franc was another notable beneficiary, with USDCHF retreating 1.8%. Markets still reacting to yesterday’s SNB comments, saying it is ready to act if inflation pressures continue.

- US dollar weakness has filtered through to the likes of AUD and NZD, both rising over 1.5% as well as EURUSD trading back above 1.06 to trade at a two-week high.

- EURUSD found resistance on Wednesday at 1.0564, just ahead of the 20-day EMA, however the path of least resistance saw the pair grind through this moving average today, intersecting at 1.0569. The broader trend direction remains down with moving average studies remaining in a bear mode condition. Key resistance is unchanged at 1.0642, May 5 high.

- New Zealand Trade Balance data overnight before UK retail Sales for April headlines a very quiet Friday docket. Worth noting parliamentary elections are due this weekend in Australia.

Late Equity Roundup: Techs Boost Nasdaq, Industrials Lagging

Major indexes held mildly weaker levels for the most part in late trade, Nasdaq outperforming as tech and large retailer companies stage a rebound while Industrials underperform. Earnings after the close: Ross Stores (RSS) and Applied Materials (AMAT).

- SPX emini futures currently -6.5 (-0.17%) at 3915.5, Dow Industrials -123.92 (-0.39%) at 31368.01, Nasdaq +49.4 (0.4%) at 11467.82.

- SPX leading/lagging sectors: Consumer Discretionary continues to firm up (+1.44%) as retailers and auto shares bounce; Materials (+1.29%) and Energy (+0.84%) sector gain late. Laggers: Consumer Staples (-1.74%) remain week as food, alcohol and tobacco retailers underperform. Utilities and Financials (-0.75%), Industrials (-0.33%) as road and rail names under pressure.

- Dow Industrials Leaders/Laggers: United Health Care (UNH) gains +6.33 at 477.71, Home Depot (HD) +4.58 at 289.76, while Boeing (BA) and Goldman Sachs both up 1.55 at 308.28 and 127.07 respectively.

- Laggers: Cisco -7.05 at 41.31, Travelers Ins (TRV) -5.01 at 169.31, PG -4.08at 141.08.

E-MINI S&P (M2): Reversal Lower Leaves Support Exposed

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4099.00/4254.88 High May 9 / 50-day EMA

- PRICE: 3907.00 @ 14:35 BST May 19

- SUP 1: 3855.00/3843.25 Low May 12 / Low Mar 25 2021 (cont)

- SUP 2: 3820.25 2.50 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis found resistance at yesterday’s high of 4095.00. This leaves initial key resistance - 4099.00, the May 9 high - intact. The reversal lower yesterday signals a potential resumption of the primary downtrend and attention is on support and bear trigger at 3855.00, May 12 low. A break would resume the downtrend and open 3843.25, the Mar 25 2021 low (cont). Clearance of 4099.00 is required to ease the bearish threat.

COMMODITIES: Volatile Crude Oil And Surging Gold

- Crude oil has seen a volatile day, sliding through the European session on global growth fears and then weak US data (another weak regional Fed survey plus a small rise in initial claims) before recovering strongly.

- The rebound has been helped by an explosion at South Korea’s Ulsan refinery, a new record high for US gasoline, a pause in the slide in equities and US Energy Secretary Granholm telling the Senate that the US won’t be importing any oil from Iran or Venezuela.

- WTI is +2.4% at $112.20 having cleared support at the 20-day EMA of $106.5 but now moving nearer to $115.56 (May 17 high).

- Brent is +2.6% at $111.93, having cleared support at $107.79 (May 13 low) before retreating to eye $115.69 (May 17 high).

- Gold is +1.4% at $1841.63 on continued haven demand, accentuated by the slide in the US dollar. Bucking its recent vulnerable patch, it nears resistance at $1858.8 (May 12 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/05/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 20/05/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/05/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 20/05/2022 | 0730/0830 |  | UK | BOE Chief Economist Huw Pill speech | |

| 20/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 20/05/2022 | 1200/1400 |  | EU | ECB Lane in Discussion at Stockholm Uni | |

| 20/05/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/05/2022 | 1400/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.