-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Late '22 Hikes Cool on Weak Data

US TSYS: Post-Data Rally, Volume Spike on Roll Surge

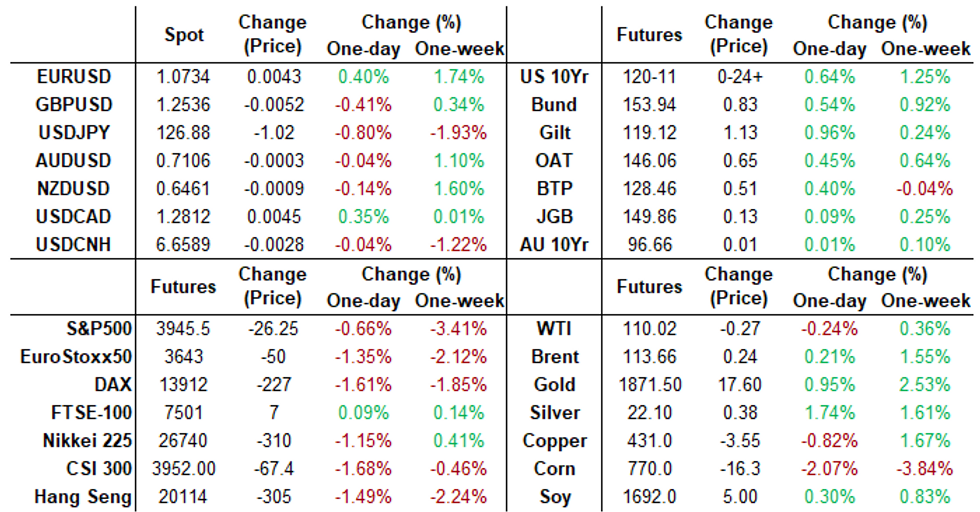

Tsy rallied following midmorning data: miss for April new home sales (591k, -16.6% MoM vs. 794k exp) and weak May Richmond Fed index: -9 was the worst reading since May 2020 and a significant miss vs +10 expected (and +14 prior). Meanwhile, S&P Global composite PMI notably softer than expected in the preliminary May release.- Volume surged amid outright buying, stop triggers and re-positioning of cooling rate hike pricing for late 2022 (* Sep 50bp hike chances closer to 35-40% from appr 50% prior) and heavy roll volumes (FVM/FVU and TYM/TYU each over 1.7M) has pushed total TYM2 volume over 3.3M, and FVM over 2.8M.

- Bull steepening yield curves took a leg higher late: 2s10s climbed to 28.719 high; 5s10s just off inversion to +1.429 high.

- Decent 2Y sale, Tsy futures holding firmer (curves steeper) after $47B 2Y note auction (91282CER8) stops through: 2.519% high yield vs. 2.526% WI; 2.61x bid-to-cover vs. last moth's 2.74x.

- Similar to late last Friday, stocks staged decent late session rebound, SPX still weaker after the FI close but extending highs for the session -- while Dow components trade in the black. Latest levels: DJIA up 93.76 points (0.29%) at 31969.96; S&P E-Mini Future down 23.25 points (-0.59%) at 3947.75; Nasdaq down 239 points (-2.1%) at 11294.03

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00072 to 0.82386% (-0.00085/wk)

- 1M +0.01086 to 1.01657% (+0.04300/wk)

- 3M +0.00714 to 1.53100% (+0.02457/wk) * / **

- 6M +0.00928 to 2.07114% (-0.00557/wk)

- 12M -0.02914 to 2.68886% (-0.04114/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.53100% on 5/24/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $82B

- Daily Overnight Bank Funding Rate: 0.82% volume: $254B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $984B

- Broad General Collateral Rate (BGCR): 0.79%, $364B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $346B

- (rate, volume levels reflect prior session)

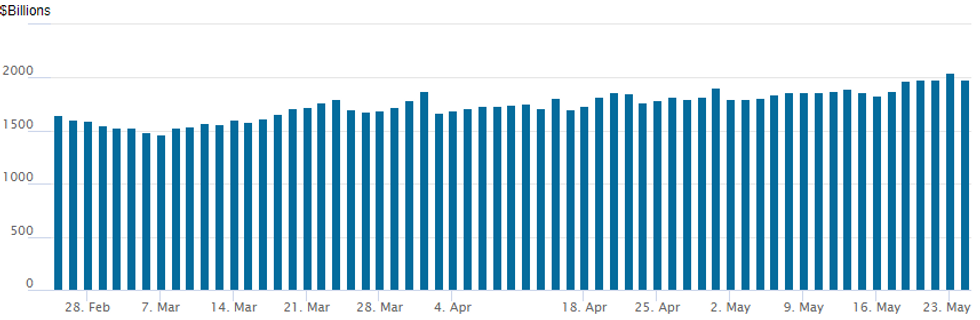

FED Reverse Repo Operation

NY Federal Reserve/MNI

After climbing to five consecutive new highs by Monday, NY Fed reverse repo usage recedes to 1,987.865B w/ 92 counterparties vs. yesterday's record $2,044.658B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Carry-over call buying in Treasury options from the week opener noted Tuesday, while Eurodollar option trade turned mixed and SOFR options added to limited downside put structures after paper bought 7,500 SFRU2 97.37/97.43/97.56/97.62 put condors, 1.75 ref: 97.66 (adds to +16k Mon at 1.75-2.0).

- +7,500 SFRU2 97.37/97.43/97.56/97.62 put condors, 1.75 ref: 97.66 (adds to +16k Mon at 1.75-2.0)

- +10,000 Sep 97.5/98.37 call spds, 14.5 vs. 97.45/0.40%

- +2,000 Dec 98.00 calls, 6.5

- +12,000 Dec 96.75/97.00 put spds 0.5-0.75 over Green Dec 96.25 puts

- +3,000 Dec 97.00/97.25/97.50/97.75 call condors, 4.5 ref 96.88

- -4,000 TYN 118.5/121.5 strangles, 53 ref 120-02

- +5,000 TYN 117/121 call over risk reversals, 13 vs. 119-17/0.40%

- +4,000 TYN 120.25 calls, 38 vs. 119-10.5/0.34%

- +2,000 TYN 120/121.5 call spds, 28 ref: 119-14

- -2,000 USU 131/133 call spds, 22 ref 144-01

EGBs-GILTS CASH CLOSE: UK Curve Bull Steepens On PMI Miss

UK yields easily outperformed Tuesday with bull steepening in the curve, as May Services PMI data fell sharply below expectations.

- Eurozone data was more mixed, and ECB hawk Holzmann put a 50bp July hike on the table.

- But the overall market tone was risk-off with equities sharply lower, and soft US data helped keep downside pressure on yields in the afternoon.

- Periphery spreads reversed earlier widening, with BTPs ending the session basically flat to Bunds.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 4bps at 0.381%, 5-Yr is down 5.2bps at 0.686%, 10-Yr is down 5bps at 0.967%, and 30-Yr is down 3bps at 1.168%.

- UK: The 2-Yr yield is down 11.9bps at 1.453%, 5-Yr is down 10.3bps at 1.566%, 10-Yr is down 8.3bps at 1.887%, and 30-Yr is down 5.4bps at 2.131%.

- Italian BTP spread down 0.4bps at 201.3bps / Spanish down 0.1bps at 112bps

EGB Options: Sonia Call Spread Seller, Rolling Bund Put Spread

Tuesday's Europe rates / bond options flow included:

- RXN2 152.0/149.5ps, bought for 60.5 in 15k (rolling up)

- DUN2 109.70/60/50/30p Condor, bought for -2 (receive) in 2.4k

- 0RZ2 98/75/99.00/99.25c fly, bought for 2.35 synthetic in 5k

- SFIM2 98.65/98.75cs, sold at 2 in 6.1k

FOREX: Cross/JPY Retreats Amid Risk Aversion, USD Extends Pullback

- Risk-off flows swept across G10 currencies on a negative lead from the equity space and lower core yields on Tuesday. Risk aversion was exacerbated by weak US data, including PMIs, Richmond Fed Mfg index and new home sales all missing surveyed estimates.

- The weak US data points continued to weigh on the US Dollar, sending the DXY to a four-week low. The Japanese Yen was the best performer, closely followed by the Swiss Franc in the G10 space. Cross/JPY bore the brunt of the pessimistic sentiment, with the likes of CADJPY and GBPJPY falling over 1.5%.

- The euro remains well bid and shows similarly strong relative against higher beta G10 counterparts. This is largely in part to early comments from ECB President Lagarde in a Bloomberg interview in Davos where she noted that the ECB were attentive to the EUR level. Additional commentary from ECB officials surrounding the potential for larger than 25bp hikes have kept EURUSD back above 1.0700.

- As noted, the current bull cycle started at 1.0350, May 13 low and from the base of a bear channel, drawn from the Feb 10 high. The channel top intersects at 1.0857 and is a potential short-term objective. Initial support remains at 1.0533, May 20 low.

- The second main story throughout the European session on Tuesday was the big UK Services and Composite PMI miss, which saw the Pound plummet around 100 pips from 1.2580 to a 1.2472 low.

- The RBNZ meeting/decision will be the most notable event for the upcoming APAC session. Latest CPI and jobs market data reinforce the case for continued monetary policy tightening, with headline inflation hitting three-decade highs and the unemployment rate holding at a record low.

- US Durable goods data will precede the latest release of the FOMC minutes from the Fed’s May 4 meeting.

Late Equity Roundup: Of Lows, Comm Svrcs Still Lagging

Major indexes trading weaker by the FI close, off lows after breaching earlier support to near middle of session range.

- SPX emini futures currently - 52.25 (-1.32%) at 3920.5, Dow Industrials -92.74 (-0.29%) at 31790.05, Nasdaq -334 (-2.9%) at 11202.

- SPX leading/lagging sectors: Utilities extend earlier gains (+1.32%) with gas and electric utilities outperforming water. Consumer Staples follow (+0.80%) with food, beverage and tobacco gaining. Laggers: Communication Services (-4.59%) with media/entertainment weaker: Meta (FB) -8.51%, Warner Bros/Discovery -8.06%, Google -5.72%. Consumer Discretionary (-3.15%)

- Dow Industrials Leaders/Laggers: McDonalds +6.47 at 244.37, United Health Care (UNH) +2.90 at 494.98. Laggers: Boeing (BA) takes the lead trading -5.55 at 118.52, Goldman Sachs (GS) -5.03 at 311.58, Visa (V) -5.27 at 202.29 while

E-MINI S&P (M2): Trend Needle Still Points South

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4099.00/4217.41 High May 9 / 50-day EMA

- PRICE: 3934.00 @ 14:21 BST May 24

- SUP 1: 3807.50 Low May 20 and the bear trigger

- SUP 2: 3801.97 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont)

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis remain vulnerable. This follows the reversal from last Wednesday’s high of 4095.00. The pullback left key resistance at 4099.00, the May 9 high, intact. The reversal lower, and Friday’s fresh trend low, signals a resumption of the downtrend and opens 3801.97 next, 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont). Clearance of 4099.00 is required to ease the bearish threat and signal a potential short-term base.

COMMODITIES: Mixed Messages On EU Russian Oil Ban, Gold Tests Resistance

- Crude oil markets are ending a relatively restrained session lower, after EC’s Von der Leyen first indicated that the Russian oil embargo is set to pass in coming days before later saying there won’t be a decision on the ban at the EU summit.

- Otherwise, a tight market prevents larger declines despite risk-off flows exacerbated by weak US data.

- WTI is -0.8% at $109.38, at the low end of yesterday’s range but not troubling support at $103.24 (May 19 low).

- Today’s most active strikes in the Jul’22 contract have been $120/bbl calls.

- Brent is -0.2% at $113.2 , towards the middle of yesterday’s range which keeps it close to resistance at $115.69 (May 17 high) whilst support remains is $105.7 (May 13 low).

- Gold benefits from tumbling UST yields and a weaker dollar, rising +0.7% at $1865.9 having tentatively cleared initial resistance at $1865.5 (May 23 high) which next opens the 50-day EMA of $1885.3.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/05/2022 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 25/05/2022 | 0130/1130 | *** |  | AU | Quarterly construction work done |

| 25/05/2022 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 25/05/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 25/05/2022 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/05/2022 | 0600/0800 | ** |  | SE | PPI |

| 25/05/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 25/05/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 25/05/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 25/05/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/05/2022 | 0700/0900 |  | EU | ECB Panetta Speaks at Goethe University | |

| 25/05/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 25/05/2022 | 0730/0930 |  | SE | Riksbank Financial Stability Report | |

| 25/05/2022 | 0800/1000 |  | EU | ECB Lagarde in Stakeholder Dialogue | |

| 25/05/2022 | 0945/1145 |  | EU | ECB Lane Speaks at German Bernacer Prize | |

| 25/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/05/2022 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 25/05/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 25/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 25/05/2022 | 1515/1615 |  | UK | BOE Tenreyro Panels Discussion | |

| 25/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 25/05/2022 | 1615/1215 |  | US | Fed Vice Chair Lael Brainard | |

| 25/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.