-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

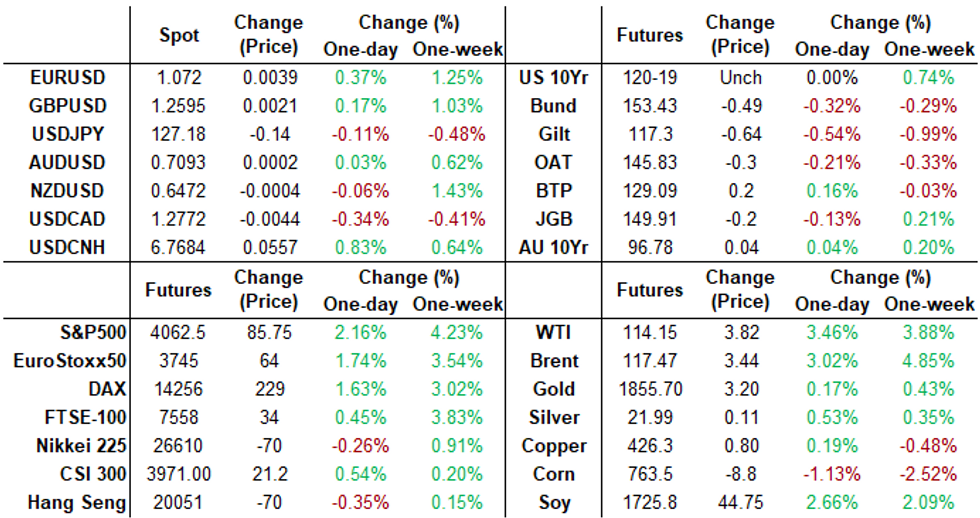

Free AccessMNI ASIA MARKETS ANALYSIS:Risk Improves, Mixed Data, Long Wknd

US TSYS: Risk Appetite Continues to Improve

Tsys hold mixed levels after the bell, inside range across the board, curves steeper with bonds underperforming most of the session. Decent volumes are off Tue-Wed pace as June/Sep roll climbs near 90% complete ahead next Tue's First Notice date when Sep takes lead quarterly.- Early carry-over risk-on tone after May minutes showed no discussion of larger rate hikes. MNI interview MN Fed research Dir Mark Wright said policymakers may consider slowing the pace of interest rate hikes as they approach a neutral rate of interest, although officials have divergent views as to where that key juncture lies.

- Bonds receded after mixed data: Q1 GDP weaker than exp at -1.5% vsd -1.3% exp, GDP Price Index little stronger than expected at +8.1% vs. +8.0%, Personal Consumption stronger +3.1% vs +2.8% exp, weekly claims lower ay 210k while continuing claims rise 1.346M vs. 1.310M est.

- Bonds bounced off lows after strong $42B 7Y note auction (91282CES6) stops through: 2.777% high yield vs. 2.802% WI; 2.69x bid-to-cover vs. 2.41x last month.

- Indirect take-up: climbs to 77.86% vs. 64.95% in April; Primary dealer take-up: 15.76% vs. 15.22% prior; Direct take-up: falls to new low of 6.38% vs. 19.82%.

- Friday data calendar includes: Personal Income/Spending, Advance Goods Trade Balance and U-Mich Sentiment.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00214 to 0.81729% (-0.00742/wk)

- 1M +0.03657 to 1.05957% (+0.08600/wk)

- 3M +0.02200 to 1.57486% (+0.06843/wk) * / **

- 6M +0.02142 to 2.07571% (-0.00100/wk)

- 12M -0.00243 to 2.68157% (-0.04843/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.57486% on 5/26/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $85B

- Daily Overnight Bank Funding Rate: 0.82% volume: $260B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $942B

- Broad General Collateral Rate (BGCR): 0.79%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $346B

- (rate, volume levels reflect prior session)

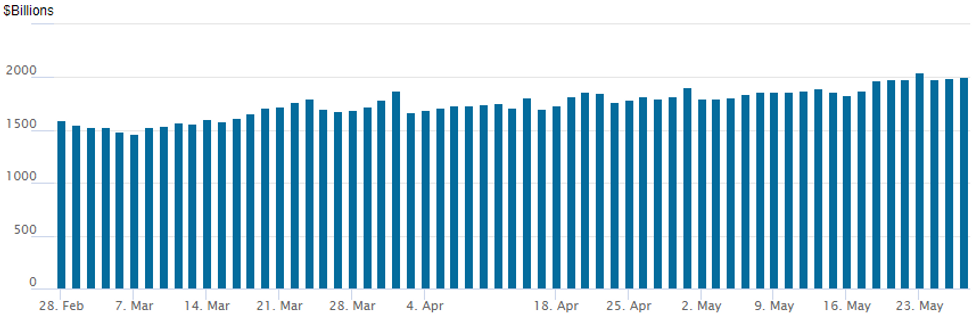

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs back over $2T to 2,007.702B w/ 95 counterparties vs. 1,995.750B prior session, compares to Monday's record high $2,044.658B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Mixed FI option trade Thursday as SOFR and Eurodollar options focused on upside calls as underlying futures in the short end outperformed as rate hike pricing through the fall moderated (chance of 50bp hike in Sep well below 50%). Treasury options focused on puts while trade volumes evaporated as longer rates traded weaker ahead midday.SOFR Options:

- Block, 1,500 SFRU2 97.43/97.56/97.68/97.93 call condors, 0.5 belly over

- -3,000 Dec 97.50 calls14.5 vs. 97.055/0.28%

- -5,000 Dec 97.00 puts, 29.5 vs. 97.045/0.46%

- +5,000 short Aug 96.50/97.00 call spds, 12.5

- -20,000 short Jun 97.25 calls vs. Blue Jun 97.62 calls, 1.0 net bull flattener

- +4,000 Dec 98.00/99.00 call spds, 5.0

- 6,000 Blue Sep 98.25 calls

- 8,500 Jun 98.25/98.31 call spds

- 25,000 Sep 97.75/98.00/98.12 broken call flys

- 1,500 short Mar 96.25/96.75 put spds

- 2,000 short Jun 96.81/96.93 put spds

- 4,000 Green Sep 96.00/96.50 put spds

- +5,000 wk2 FV 111.75/112.25 put spds, 3.5

- 6,000 wk2 FV 115 calls

- 13,000 TYN 116/117 put spds

- 2,000 TYN 118.5/119.5 put spds

EGBs-GILTS CASH CLOSE: BTPs Shine; Gilts Underperform On Fiscal Boost

BTP yields dropped sharply Thursday, with 10Y spreads falling well below the 200bp to Bund mark amid a broad global risk rally.

- The UK and German curves bear steepened, with Gilts underperforming out to 10Y.

- The main (unscheduled) event of the day was the UK government's announcement of financial assistance to households to mitigate higher energy costs.

- BoE hiking bets inched higher (end-2022 to up 5bp to 2.20%) given the fiscal boost to GDP / household incomes.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 1.6bps at 0.356%, 5-Yr is up 2.7bps at 0.682%, 10-Yr is up 4.6bps at 0.998%, and 30-Yr is up 8.4bps at 1.281%.

- UK: The 2-Yr yield is up 2.3bps at 1.453%, 5-Yr is up 3.9bps at 1.599%, 10-Yr is up 5.8bps at 1.968%, and 30-Yr is up 6.9bps at 2.229%.

- Italian BTP spread down 10.3bps at 189.8bps / Greek down 7.5bps at 254.4bps

EGB Options: Largely Bund Puts And Calls

Thursday's Europe rates / bond options flow included:

- RXN2 153.5 put, bought for 80.5 in 2.5k

- RXN2 156.50/158cs, bought for 30 in 1.7k

- RXN2 157.50c sold from 43 down to 41.5 in 3.75k (ref 154.55)

- ERU2 99.62/99.87/100/100.25c condor 1x1x1x0.5, sold at 7.75 in 7k

FOREX: Major Currency Pairs Hold Narrow Ranges, CNH Underperforms

- Major currencies traded in subdued fashion on Thursday, taking a back seat amid the ongoing risk rally evident across the equity/commodity space. Ascension Day holidays throughout Europe may have played a part in the muted reaction across currency markets.

- The USD index remains close to unchanged with EURUSD gradually edging back above the 1.0700 mark to trade within close proximity of recent highs at 1.0749.

- Price action indicates a positive short-term technical theme remains intact. The latest recovery started from the base of a bear channel, drawn from the Feb 10 high. The channel top intersects at 1.0831 which continues to represent a potential target for the move.

- The Chinese yuan retreated despite Shanghai's reported progress on clearing ports and re-opening schools. The overhang of Premier Li's suggestion that the local economy is in some aspects faring worse than in 2020 loomed large. USDCNH gained 0.82%, comfortably the biggest move seen on Thursday.

- In line with single currency strength, EURGBP (0.31%) slightly outperformed potentially highlighting that the break higher this week reinstates a S/T bullish theme. Attention is on 0.8619, May 12 high which represents the next hurdle for bulls. Clearance of this level would resume a 3.5 month uptrend. Initial support lies at 0.8476, the 20-day EMA.

- Australian retail sales will be the focus for the APAC session. Focus will then turn to US Core PCE Price index data before Uni Michigan Sentiment data rounds off the week.

FX: Expiries for May27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E2.9bln), $1.0525(E1.2bln), $1.0550(E1.5bln), $1.0570-75(E1.0bln), $1.0625-35(E2.4bln), $1.0650-60(E3.6bln), $1.0690-00(E1.5bln), $1.0750-65(E1.9bln)

- AUD/USD: $0.7165(A$804mln)

- USD/JPY: Y125.70-75($550mln), Y126.98-05($1.8bln), Y127.75($1.2bln)

- EUR/GBP: Gbp0.8450-60(E680mln), Gbp0.8650(E588mln)

- NZD/USD: $0.6475(N$553mln)

- USD/CAD: C$1.2750-70($1.1bln), C$1.2900-10($705mln)

- USD/CNY: Cny6.7250($780mln)

Late Equity Roundup: Holding Near Highs

Stocks held firmer levels in late FI trade, near second half highs amid generally improved risk appetite following Wed's May minutes showing no discussion of larger rate hikes.

- SPX emini futures currently +86.25 (2.17%) at 4063.25 -- focus on key resistance of 4099.00/4197.54 High May 9 / 50-day EMA; DJIA +580.56 (1.81%) at 32700.53; Nasdaq +330.1 (2.9%) at 11764.86.

- SPX leading/lagging sectors: Consumer Discretionary sector continues to outperform (+4.99%) again lead by autos (Tesla +7.92% at 711.00) and retailing. Information Technology sector bouncing back late (+2.63%) as semiconductors gain. Laggers: Real Estate (-0.14%) followed by Utilities (+0.57) and Health Care sector (+0.61%) as bio-tech and pharmaceuticals lagged for second day running; .

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) takes the lead +8.965 at 323.86, outpacing strong showing for Home Depot (HD) climbs +8.20 to 301.77 followed by Boeing (BA) +6.49 at 128.55. Laggers: Merck (MRK) -1.77 at 91.88, JNJ +0.4 at 179.66.

E-MINI S&P (M2): Trend Needle Still Points South

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4099.00/4197.54 High May 9 / 50-day EMA

- PRICE: 4063.5 @ 1500ET May 26

- SUP 1: 3807.50 Low May 20 and the bear trigger

- SUP 2: 3801.97 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont)

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis continue to trade above recent lows, but remain vulnerable. This follows the reversal from 4095.00 on May 18. The pullback has left key resistance at 4099.00 intact, May 9 high. The move lower, and last Friday’s trend low, opens 3801.97 next, 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont). Clearance of 4099.00 is required to ease the bearish threat. This would signal a potential short-term base.

COMMODITIES: Oil Buoyed By Risk-On And OPEC+ Hesitancy

- Crude oil has been boosted by risk-on following the US open, reports that OPEC+ will not raise outputs beyond the currently announced increases plus an earlier nudge from signs lockdowns in China are easing.

- WTI is +3.5% at $114.17, clearing initial resistance at $113.20 (May 17 high) and close to testing $115.04 (Mar 08 high) after which it eyes the trend high at $116.43.

- The most active strikes by far today in the Jul'22 have been $120/bbl calls.

- Brent is +3.1% at $117.52, clearing a bull trigger at $115.76 (Mar 24 high) and opening $121.13 (Fibo retracement of the Mar 7-15 downleg).

- Gold meanwhile dips -0.15% to $1850.57 despite USD weakness as Treasury yields creep higher on the day.

- The trend direction is seen down with recent increases considered corrective but still opening resistance at $1869.7 (May 24 high) having recently traded above the 20-day EMA of $1859.7.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/05/2022 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 27/05/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 27/05/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 27/05/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/05/2022 | 1135/1335 |  | EU | ECB Lane Panelist at BOJ-IMES Conference | |

| 27/05/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 27/05/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/05/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 27/05/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.