-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Stay Calm and Carry On

US TSYS: Late Risk Appetite Gathers Momentum

Midweek risk-on tone gathered momentum into Fri's close: Tsys steady/mixed with long end firmer but near second half lows while stocks continued to extend rally.

- SPX eminis were up near 5% for the week as risk appetite improved following Wed's May FOMC minutes release that showed a flexible Fed and no discussion of larger rate hikes ESM2 +105.25 (2.47%) at 4161.0.

- Bonds receded off early session highs post data, Apr core PCE at 4.9% YoY but headline of 6.3% YoY slightly higher than expected and fastest of last three months.

- Aside from PCE, Apr Advance Goods Trade Balance shows deficit of $105.9B vs. $114.9B expected; Wholesale Inventories +2.1% MoM vs. +2.0% exp.

- General quiet ahead Monday, May 30 Memorial Day national holiday. Cash FI markets closed while Globex opens at normal time Sunday evening at 1800ET through Monday at 1300ET. Globex reopens at 1800ET Monday evening.

- Tuesday focus: FHFA House Price Index MoM (2.1%, 2.0%); QoQ (3.3%, --); MNI Chicago PMI (56.4, 54.8); Conf. Board Consumer Confidence (107.3, 103.5); May-31 1030 Dallas Fed Manf. Activity (1.1, 1.5)

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00828 to 0.82557% (+0.00086/wk)

- 1M +0.00214 to 1.06171% (+0.08814/wk)

- 3M +0.02300 to 1.59786% (+0.09143/wk) * / **

- 6M +0.01043 to 2.08614% (+0.00943/wk)

- 12M +0.01414 to 2.69571% (-0.03429/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.57486% on 5/26/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $81B

- Daily Overnight Bank Funding Rate: 0.82% volume: $252B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $955B

- Broad General Collateral Rate (BGCR): 0.79%, $368B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $351B

- (rate, volume levels reflect prior session)

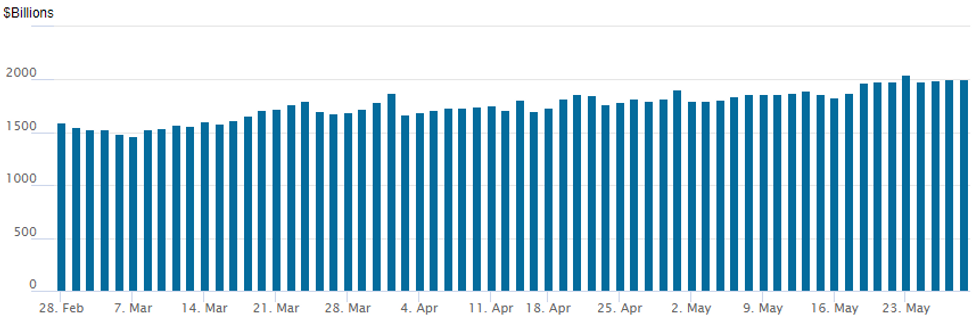

FED REVERSE REPO OPERATION

NY Fed reverse repo usage slips to 2,006.688B w/ 99 counterparties vs. 2,007.702B prior session, compares to Monday's record high $2,044.658B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- 6,000 short Jun 97.25 calls, 1.5-2.5

- Block, +5,000 Dec 96.25/96.50 3x2 put spds, 1.5 net

- +5,000 short Dec 97.75/98.25 call spds, 8.5

- +2,000 short Jul 96.37/96.62 3x2 put spds, 5.5 ref 96.955

- 7,100 TYN 120.25/121/127.75 call trees

- 5,100 FVN 113.25 puts, 28

- 15,000 TYN 117/121 strangles, 40

- +4,000 TYN 116/117 put spds, 3 vs. 120-11.5/0.04%

- 3,300 FVQ 110.25 puts, 5.5

FOREX: Equity Indices Boost Antipodean FX, EUR Underperforms

- Equity markets traded in more optimistic fashion on Friday, lending support to the likes of AUD and NZD. Additionally, there was more supportive price action for the Chinese Yuan with USDCNH retreating around 0.65% and negating Thursday’s advance.

- AUDUSD maintains a firmer short-term tone. The resumption of gains saw the pair rise to just below the 50-day EMA, at 0.7169 today. This average marks an important resistance and a clear break is required to further strengthen bullish conditions.

- Euro was the key laggard on to end the week, sitting marginally in the red after faltering from the overnight peak at 1.0765. Decent two-way price action in EURUSD throughout the session with some notable selling ahead of the WMR fix, potentially related to month-end. The boost in equities kept Eur/crosses on the backfoot.

- Pressure on the Euro kept the USD index from losing ground and remains unchanged for Friday. This week’s greenback weakness has seen the DXY narrowing in on the key 50-dma support, intersecting at 101.32

- Monday will focus on state-level German preliminary CPI figures during the European session before the Eurozone HICP flash estimate is released on Tuesday. US ISM Manufacturing PMI and NFP are the highlights of next week’s data calendar. The Bank of Canada decision is due Wednesday.

- It is worth noting Monday marks Memorial Day holiday in the US. Additionally, there will be UK bank holidays on Thursday and Friday for the Queen’s Jubilee.

FX: Expiries for May30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E828mln), $1.0675(E1.3bln), $1.0725(E503mln), $1.0800(E759mln)

- AUD/USD: $0.7210(A$607mln)

- USD/CNY: Cny6.7500($780mln)

Late Equity Roundup: Holding Highs for Week

Stocks look to finish out the week strong, SPX eminis near 5% higher for the week as risk appetite improved following Wed's May FOMC minutes release that showed a flexible Fed and no discussion of larger rate hikes. SPX emini futures currently +71.55 (1.76%) at 4127.5 -- makes it +4.86% for the week.

- Technicals for SPX emini: ESM2 through 20-day EMA of 4047.83 as well as May 9 high of 4099.0 w/ focus on 4191.98 50-day EMA.

- SPX leading/lagging sectors: Information Technology sector extends gains (+2.57%) as hardware and semiconductor shares rally for second day. Real Estate (+2.59%) outpaces Consumer Discretionary sector (+2.33%) as autos remain strong (Tesla +6.23% at 751.80). Laggers: Consumer Staples (+0.55%) as food/beverage and tobacco underperform. Followed by Utilities (+0.80%) and Financials (+0.83%).

- DJIA +351.13 (1.08%) at 32988.66; Nasdaq +303.4 (2.6%) at 12043.95.

- Dow Industrials Leaders/Laggers: Microsoft (MSFT) +54.92 at 270.82, Apple (AAPL) +4.41 at 148.63 and Boeing (BA) +3.18 at 130.91. Note: United Health Care (UNH) rallied from -4.62 earlier to +0.93 at 503.16. Laggers: JNJ -0.08 at 179.38, Merck (MRK) +0.03 at 92.34.

E-MINI S&P (M2): Gains Expose Key Short-Term Resistance

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4099.00/4191.98 High May 9 / 50-day EMA

- PRICE: 4129.50 @ 1420ET May 27

- SUP 1: 3960.50/3807.50 Low May 26 / Low May 20 and bear trigger

- SUP 2: 3801.97 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont)

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis remain firm and continue to trade above the 20-day EMA at 4047.83. The break above the average suggests scope for a continuation of the current corrective cycle and attention turns to key short-term resistance at 4099.00, May 9 high. Clearance of this hurdle will strengthen bullish conditions. The broader trend remains down though. The bear trigger is unchanged at 3807.50, May 20 low.

COMMODITIES: Oil Nearing 11 Week Highs

- More muted risk-on plus rising tensions in the Persian gulf push crude oil prices higher today to end a week with Brent notably outperforming WTI as EU countries look at workarounds to push ahead with the Russian oil embargo along with a surprising small drawdown in US crude inventories as the key driving season gets underway.

- Latest plans are EU countries making a distinction between shipped and piped deliveries to give Hungary some concessions.

- WTI is +0.7% for +1.5% at $114.95. It comes close to testing resistance at $115.04 (Mar 8 high) after which it eyes the trend high at $116.43 (May 7 high).

- Brent is +1.7% for +6.1% on the week at $119.43 as it moves towards the round number $120 resistance and then $121.13 (76.4% retracement of Mar 7-15 downleg). Support is materially lower the 20-day EMA of $110.94.

- Gold has had a volatile week, rising and falling with USD and Treasury yield fluctuations, but today sits +0.1% to $1852.79 to grind out a +0.35% rise on the week.

- The trend direction is seen down with recent increases considered corrective but still opening resistance at $1869.7 (May 24 high) having recently traded above the 20-day EMA of $1858.3.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/05/2022 | 0600/0800 | *** |  | SE | GDP |

| 30/05/2022 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 30/05/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/05/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/05/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/05/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/05/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 30/05/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/05/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 30/05/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/05/2022 | 1230/0830 | * |  | CA | Current account |

| 30/05/2022 | 1500/1100 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.