-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Tamp Down on Recession Fears

US TSYS: No Recession Here, Move Along

Tsy futures still weaker across the board, but stable after the bell, yield curves flatter but off lows (2s10s -1.728 at 26.625 currently vs. 23.778 low).

- Random volatility/thin liquidity contributing to the whippy trade. "People are trading terminal fed funds rates like they know what is going to happen....they don't," one desk offered. Carry over month end rebalancing played a part in this morning's bounce.

- While hawkish BOC annc may have been a factor, data more likely trigger for sell-off: Much stronger than expected May ISM Manufacturing Index of 56.1 vs. 54.5 exp while the Prices Paid component is 82.2 vs. 80.5; April reading of Construction Spending is +0.2 vs. +0.5% exp.

- FED'S BARKIN ('24 voter) SAYS HE DOESN'T SEE A RECESSION IN THE DATA - DATA SIGNALS THAT CONSUMER SPENDING IS HOLDING UP - bbg

- DALY ('24 voter): DON'T SEE A RECESSION, IT'S NOT MY MODAL OUTLOOK - bbg

- Focus on Thu: ADP Private Employ (+300k est vs. +247k prior), Wkly Claims (210k) -- NFP on Friday.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00286 to 0.81914% (-0.00643/wk)

- 1M -0.00015 to 1.11971% (+0.05800/wk)

- 3M +0.01529 to 1.62600% (+0.02814/wk) * / **

- 6M +0.00329 to 2.10929% (+0.02315/wk)

- 12M +0.03543 to 2.77543% (+0.07972/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.62600% on 6/1/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $76B

- Daily Overnight Bank Funding Rate: 0.82% volume: $235B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.79%, $1.040T

- Broad General Collateral Rate (BGCR): 0.80%, $366B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $351B

- (rate, volume levels reflect prior session)

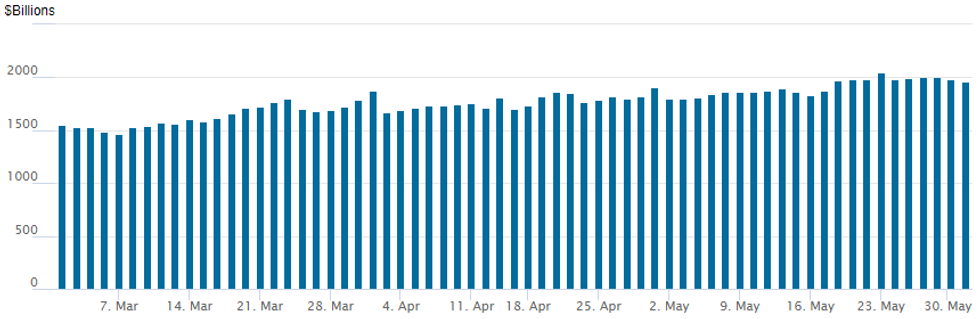

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to 1,965.015B w/ 93 counterparties vs. 1,978.538B prior session, compares to Monday's record high $2,044.658B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI option volume picked up Wednesday as desks re-staffed following the extended holiday weekend. Better put trade mixed amid some decent strike roll-downs as underlying futures continued to sell off amid hawkish Fed speak and stronger than expected data.- While hawkish BOC annc may have been a factor, data more likely trigger for sell-off: Much stronger than expected May ISM Manufacturing Index of 56.1 vs. 54.5 exp while the Prices Paid component is 82.2 vs. 80.5; April reading of Construction Spending is +0.2 vs. +0.5% exp.

- Meanwhile, The Federal Reserve should raise interest rates fairly rapidly to perhaps a little bit above neutral to control inflation that's now comparable to the 1970s, St. Louis Fed President James Bullard said Wednesday.

- 4,000 short Jul SOFR 97.00/97.25/97.50 call flys

- Block, 20,000 SFRM3 95.75/95.87 put spds, 2.5 vs. 96.905/0.10%

- -8,500 Dec 97.00/97.50/98.50/99.00 call condors, 14.5 vs. 96.905/0.20%

- 10,000 Sep 97.12/97.37 put spds vs. Blue Sep 96.87/97.12 put spds, 2.5 net db for conditional bear curve steepener

- Overnight trade

- Block, 6,000 Jul 97.12/97.43 2x1 put spds, 7.0 ref 97.405

- Blocks, total 19,750 short Aug 97.37/97.62 call spds 3.0, 10k vs. 96.795/0.08%

- 2,200 Sep 97.75/98.00/98.12 call flys

- 4,000 Dec 95.75 puts

- 12,000 FVN 112/112.5 put spds, 20

- -18,500 TYN2 116/117 put spds, 11 vs. 118-16.5/0.11%

- 10,000 wk1 TY 120.25 calls, 1

- 10,200 TYN 117.75 puts, 28

- 5,000 TYN 121 calls, 12, total volume >24k

- Overnight trade

- 10,000 TYN 116/117 put spds, 6

- 10,000 TYN 118.5 puts, 36

- 9,400 TYN 121/122 call spds

- 1,000 TYN 113/114/115/116 put condors

- 1,300 USN 137/139 put spds

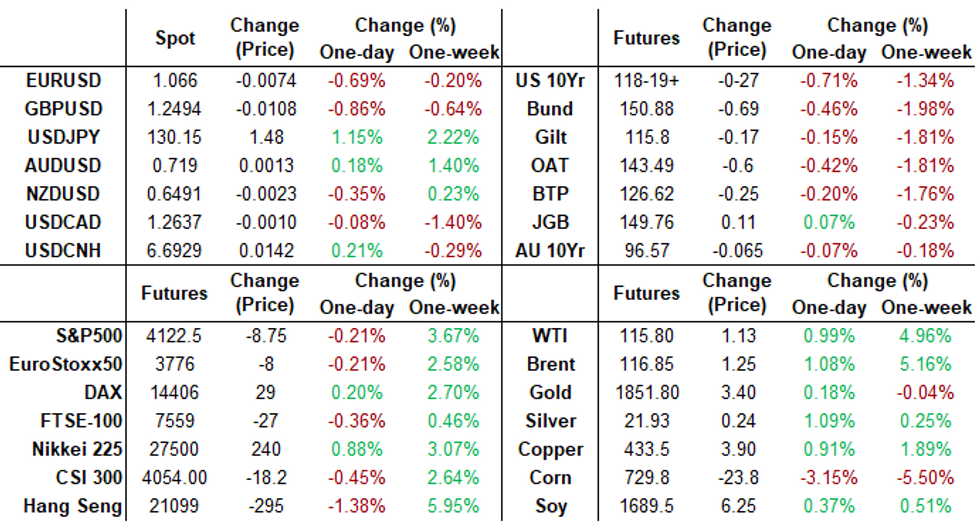

FOREX: US Dollar Back In Favour As DXY Rises 0.8%, JPY Weakness Extends

- The US Dollar came storming back on Wednesday as core yields trended higher once again amid renewed weakness in global equity benchmarks.

- The USD Index advanced 0.8%, its best performance in 3 weeks. The greenback was aided by some stronger ISM Manufacturing data, along with the deteriorating risk sentiment across equity markets on Wednesday.

- The main victim to the dollar’s advance has been the Japanese Yen, retreating 1.15%. USDJPY has moved back above the 130.00 mark. The move higher signals the end of the recent corrective pullback and also highlights the point that corrections in USDJPY are shallow. This reinforces bullish conditions and signals scope for a climb towards the bull trigger at 131.35, May 9 high.

- In similar vein, both the Euro and GBP weakened, with the former falling back below $1.07 to print a low of 1.0627. EURUSD continues to reverse a challenge on the top of the bear channel drawn from the Feb 10 high, currently intersecting at 1.0795. This level marks a key short-term resistance. The primary trend is down though and a reversal lower would reinforce a bearish theme and open 1.0533 initially.

- Relative outperformance was seen in AUD and CAD, both rising 0.1% against the greenback. The Canadian dollar was buffeted by a surprisingly hawkish statement from the BoC, with the key change the Bank now being prepared to act ‘more’ forcefully if needed to meet its 2% inflation target. USDCAD price action was whippy following the release with the pair battling between more hawkish BOC rhetoric and a strengthening dollar throughout the session.

- Thursday marks the beginning of a two-day holiday in the UK. Tomorrow will bring euro area producer price data for April as well as Spanish unemployment. US ADP employment data headlines the US docket before NFP on Friday.

FX: Expiries for Jun02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.8bln), $1.0555(E767mln), $1.0650-60(E723mln), $1.0700(E939mln), $1.0725-45(E3.9bln), $1.0800(E683mln)

- USD/JPY: Y129.50-60($565mln), Y132.00($1.1bln)

- AUD/USD: $0.7300(A$507mln)

- USD/CAD: C$1.2595($540mln)

- USD/CNY: Cny6.6900($600mln)

EQUITIES: Late Equity Roundup: Recouping Earlier Losses

SPX eminis trading modestly weaker, well off midday lows to near middle of session range after the FI close. SPX emini (ESM2) futures currently trading -10.75 (-0.26%) at 4121.5.

- SPX leading/lagging sectors: Energy regains lead as crude rebounds, sector up +2.32% now as energy equipment and servicers outperforms O&G. Utilities and Information Technology sectors both around +0.30%.

- Laggers: Financials (-1.11%) with banks underperforming (JPM's Dimon warned over economy: "you'd better brace yourself" for a "non-benign environment by year end". Health Care (-0.89%) as equipment and services lagged biotech and pharmaceuticals.

- DJIA -72.66 (-0.22%) at 32917.48; Nasdaq -5.4 (0%) at 12076.19.

- Dow Industrials Leaders/Laggers: Salesforce.com (CRM) the top performer +17.32 at 177.56, Chevron (CVX) a distant second +2.64 at 177.30.

- Laggers: Goldman Sachs (GS) trims losses but still leads laggers, -5.85 at 321.00, United Health Care (UNH) -3.14 at 493.64, Home Depot (HD) -4.07 at 298.68.

E-MINI S&P (M2): 50-Day EMA Remains Intact For Now

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4188.24/4202.25 50-day EMA / High May 31

- PRICE: 4155.00 @ 14:26 BST June 1

- SUP 1: 3960.50/3807.50 Low May 26 / Low May 20 and bear trigger

- SUP 2: 3801.97 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont)

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis maintain a firmer tone. The contract yesterday briefly breached its 50-day EMA, at 4188.24 today. A clear break of this average would strengthen current bullish conditions and signal potential for a climb towards a key resistance at 4303.50, the Apr 26/28 high. The recent climb is still considered corrective and the primary trend is down. A reversal lower would refocus attention on the bear trigger at 3807.50.

COMMODITIES: Oil Prices See A Boost From Lower OPEC Global Oil Surplus Forecast

- Crude oil sits slightly higher today despite unwinding earlier support, late in the session to leave it up circa +0.5% (and with larger increases away from the front contract) having been boosted by OPEC reducing its 2022 global oil surplus estimate from 1.9m bpd to 1.4mbpd.

- US crude production increased to 11.7m bpd in March from 11.3 in Feb for the highest month since Nov but is still well below the record high of 12.3m bpd in 2019.

- The EU debate on Russian sanctions is ongoing at Hungary wants more tweaks with timing for approval of the sanctions unclear according to people familiar with the matter. Staying in Europe, the sanctions could paralyse Lukoil’s Italian refinery ISAB, the largest refinery in Italy accounting for 20% of Italian capacity and its power plant providing Sicily with around 20% of its electricity.

- WTI is +0.54% at $115.28 and hasn’t troubled technical levels, with resistance eyed at $119.98 (May 31 high) or support at $109.54 (20-day EMA).

- Brent is +0.65% at $116.35, sitting off support at $115.15 (May 31 low) whilst still off resistance at $120.80 (May 31 high).

- Gold is +0.6% at $1849.03 despite USD strength and higher Tsy yields that would usually compete for haven demand. Technical levels are unchanged: resistance remains $1869.7 (May 24 high) with support at $1807.5 (May 18 low).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/06/2022 | 0130/1130 | ** |  | AU | Trade Balance |

| 02/06/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 02/06/2022 | 0630/0830 | *** |  | CH | CPI |

| 02/06/2022 | 0900/1100 | ** |  | EU | PPI |

| 02/06/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 02/06/2022 | 1230/0830 | * |  | CA | Building Permits |

| 02/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 02/06/2022 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 02/06/2022 | 1400/1000 | ** |  | US | factory new orders |

| 02/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 02/06/2022 | 1445/1045 |  | CA | BOC Deputy Beaudry Economic Progress Report Speech | |

| 02/06/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 02/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/06/2022 | 1600/1200 |  | US | New York Fed's Lorie Logan | |

| 02/06/2022 | 1700/1300 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.