-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY195.3 Bln via OMO Wednesday

MNI ASIA OPEN: Late Rate & Stock Rally, 5Y Sale Well Received

MNI ASIA MARKETS ANALYSIS: Tsys Rebound Late Session Highs

US TREASURY AUCTION CALENDAR: 5Y Stops Through

MNI ASIA MARKETS ANALYSIS: UK PM Awaits Confidence Vote

US TSYS: UK PM Hat in Hand; Musk Twitter Tiff

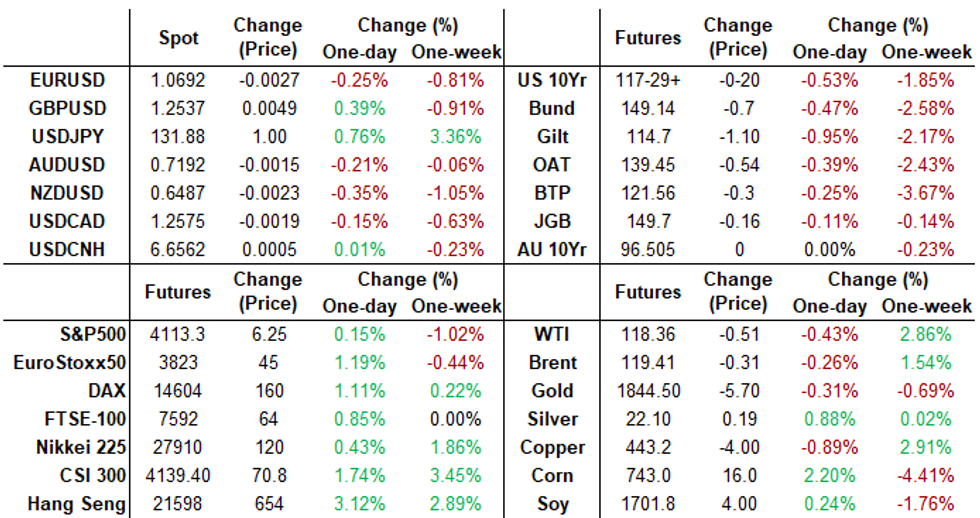

Tsy/Eurodollar futures continue to extend session lows after the close, overall volumes still rather light (TYU2<945k) despite yields grinding to the highest levels since early May (all over 3%: 5YY 3.0368%, 10YY 3.0380%, 30YY 3.1908%). Yield curves bear steepen: 2s10s north of 30.0 again at 30.387 high (+2.921). Tsy 30YY at 3.1798 high (+.0936).

- No data to start the week (no Fed-speak either w/ Fed in Blackout through June 16). Markets pre-occupied with Elon Musk threat to pull out of Twitter bid due to lack of spam/bot documentation, and UK PM Boris Johnson confidence vote in late trade. Main focus on public Jan 6 insurrection hearing that start June 9.

- Limited data Tue: Trade Balance (-$89.4B est) and Wholesale Inventories MoM (2.1% est).

- CPI for May on Friday (0.7% est vs. 0.3% prior). Credit Suisse see core CPI slowing slightly to +0.4% M/M in May (cons. 0.5%) after the reacceleration to 0.6% in April, which should lead to a continued decline in the year-ago rate from 6.2% to 5.8% Y/Y. Risks could be skewed to the upside from goods inflation as we haven't seen the pass-through from supply chain disruptions from China lockdowns.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00229 to 0.82143% (-0.00643 total last wk)

- 1M +0.04000 to 1.15971% (+0.05800 total last wk)

- 3M +0.03900 to 1.66500% (+0.02814 total last wk) * / **

- 6M +0.07871 to 2.18800% (+0.02315 total last wk)

- 12M +0.07686 to 2.85229% (+0.07972 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.62600% on 6/1/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $85B

- Daily Overnight Bank Funding Rate: 0.82% volume: $252B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $954B

- Broad General Collateral Rate (BGCR): 0.79%, $365B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $354B

- (rate, volume levels reflect prior session)

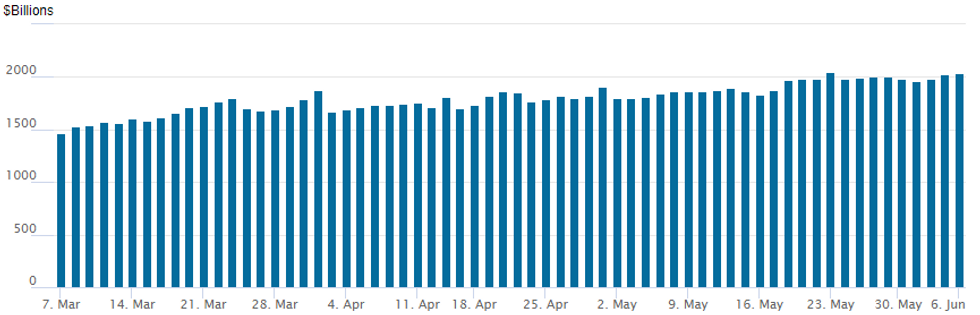

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 2,040.093B w/ 98 counterparties vs. 2,031.228B prior session, shy of Monday, May 23 record high $2,044.658B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Generally light FI option volume Monday, same for underlying futures (TYU2 <870k) despite yields grinding to the highest levels since early May (all over 3%: 5YY 3.0368%, 10YY 3.0380%, 30YY 3.1908%).- No data to start the week (no Fed-speak either w/ Fed in Blackout through June 16). Markets pre-occupied with Elon Musk threat to pull out of Twitter bid due to lack of spam/bot documentation, and UK PM Boris Johnson confidence vote in late trade. Main focus on public Jan 6 insurrection hearing that start June 9.

- No overarching theme to describe Monday's trade, just short term positioning and/or tactical plays, such as a sale of 10,000 TYN 117.5/118.5 put spds at 22 (ref 118-08.5) looking for yields to retrace off current highs. Simpler directional plays via buying July 10Y 121, 121.5 and 121.75 calls from 4-2. Scant Eurodollar trade had paper selling 10,000 short Jun 96.62 puts at 19.5 vs. 96.45/0.85%.

SOFR Options:

- 3,000 SFRU2 97.12/97.31/97.43/97.56 put condors

- 3,000 SFRZ2 97.75/98.00 call spds

- Block, 10,000 short Jun 96.62 puts, 19.5 vs. 96.45/0.85%

- 2,000 short Jun 96.31/96.37 put spds

- 1,500 Blue Jun 97.00

- 4,000 TYN 121.75 calls, 2

- 4,000 TYN 121 calls, 4

- 1,500 TYN 117/117.25/118 broken put trees

- -10,000 TYN 117.75/118.5 put spds, 22 ref 118-08.5

- -4,500 USN 139 calls, 61

- Block, -10,000 TYN 118/119 3x2 put spds, 28 net/2-legs over

- 11,000 TYN 118/119 put spds, 34

- 1,000 TYU 108/129 strangles

EGBs-GILTS CASH CLOSE: Gilts Underperform As PM's Future Hangs In Balance

Gilts underperformed as both UK and German yields hit multi-year highs Monday.

- UK focus was on a confidence vote in PM Johnson (results set for 2100BST), with EGB traders eyeing this week's ECB meeting. The German curve bear steepened, with the UK a little flatter in the return from a 4-day weekend. 10Y yields hit post-2014 highs in both cases.

- Italy 10Y spreads narrowed by over 9bp shortly after the open as markets digested multiple reports that the ECB was eyeing anti-fragmentation tool plans.

- Greece went in the opposite direction, with spreads widening as much as 18bp with little apparent explanation, though some desks pointing to both a retracement of last week's rally, as well as low liquidity.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 3.1bps at 0.693%, 5-Yr is up 3.5bps at 1.05%, 10-Yr is up 4.9bps at 1.322%, and 30-Yr is up 5.3bps at 1.575%.

- UK: The 2-Yr yield is up 9.5bps at 1.78%, 5-Yr is up 10.2bps at 1.869%, 10-Yr is up 9.2bps at 2.247%, and 30-Yr is up 6.5bps at 2.481%.

- Italian BTP spread down 3.7bps at 209.4bps / Greek up 11bps at 256bps

EGB Options: Euribor Put Spread Trade Eyes Big ECB Hikes

Monday's Europe bonds/rates options included:

- RXN2 149.5/149ps, bought for 21.5 in 5.25k

- OEQ2 122/126 combo, bought the put for 5 in 12.5k

- ERZ2 98.62/98.25ps 1x1.25ps, bought for 5.5 in 22.5k. Going for 150bps of hikes

- 0RM2 98.25p, bought for 6 in 13.3k (ref 98.275, 44% del)

FOREX: USDJPY Firms To Fresh 20-Year Highs Above 131.50

- Initial greenback strength on Monday saw the USD index trade within close proximity of key support at the 50-dma, which today sits at 101.71. However, a grinding recovery throughout late European hours then led to the index surging to session highs, looking likely to post a 0.25% daily gain as we approach the APAC crossover.

- The key victims of the US dollar advance were CHF (-0.80%) and JPY (-0.67%), while GBP (+0.41%) bucked the trend, holding on to the majority of gains made earlier in the session.

- USDJPY extended on recent strength, rallying firmly into the London close and taking out the bull trigger at 131.35 - the May 9 high. The pair has now made fresh highs of 131.78 as of writing - the highest rate since 2002. Today's break higher confirms a resumption of the primary uptrend, narrowing the gap with initial resistance at 131.96, a Fibonacci projection. Support remains at 128.63, the 20-day EMA.

- GBP had been the focal point for G10 FX markets to start the week, with PM Boris Johnson facing a no confidence vote. Johnson is expected to win the vote, which requires 180 of his lawmakers voting against him to be upheld. This would make the PM immune from further no confidence votes for the next 12 months - potentially removing an element of political uncertainty and explaining the supportive GBP price action ahead of the vote.

- Lastly, commodity-tied currencies are trading well, putting CAD and NOK near the top of the G10 pile amid the Bloomberg commodity index rising 1.94% from Friday’s close, led by higher NatGas prices.

- Tuesday’s APAC session will be headlined by the June RBA meeting. The RBA is set to hike the cash rate target for the second consecutive month, however, the key question is whether or not this move will come in a 25bp or 40bp step. Sell-side forecasts remain close, with 10 of the 24 surveyed by Bloomberg looking for a 25bp hike and 11 looking for a 40bp move. The remaining 3 look for a bolder 50bp adjustment.

- Thursday’s ECB meeting remains in focus this week before Friday’s release of US CPI.

FX: Expiries for Jun07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0525-45(E1.3bln), $1.0600(E1.4bln), $1.0700(E612mln), $1.0730-35(E1.4bln), $1.0780-00(E731mln)

- USD/JPY: Y127.50($1.2bln), Y128.90-00($567mln), Y129.95-15($686mln), Y131.00($531mln)

- GBP/USD: $1.2600-15(Gbp537mln)

- EUR/GBP: Gbp0.8650(E501mln)

- EUR/JPY: Y136.80-00(E581mln)

- AUD/USD: $0.7220-25(A$561mln)

- NZD/USD: $0.6445(N$546mln)

- USD/CAD: C$1.2695(C$610mln)

Late Equity Roundup: Stable Near Lows

Stocks still firmer in late FI trade, near session lows established early in the second half w/ SPX emini futures ESM2 +14.0 at 4121.0 vs. 4105.25 low.

- Market preoccupied awaiting result of UK PM Johnson vote of confidence expected soon after 1600ET. Otherwise, earlier news in equities was Tesla's Elon Musk lodging contract breach complaint w/ SEC over Twitter not providing spam/bot data from micro-blogger (TWTR -1.77% at 39.45 in late trade vs. 37.91 low).

- SPX leading/lagging sectors: Google (GOOG +2.37% at 2345.69) helping Communication Services sector outperform (+1.03%), hampered by Twitter. Materials (+0.90%) and Financials (+0.60%) follow. Laggers: Real Estate and Energy (both -0.14%) followed by Information Technology (-0.12%).

- DJIA +10.18 (0.03%) at 32917.38; Nasdaq +44 (0.4%) at 12058.53.

- Dow Industrials Leaders/Laggers: Modest bounce for United Health Care (UNH) +3.82 at 489.43 after falling from 503.62 early last week. Goldman Sachs (GS +2.70 at 321.38). Laggers: Amgen (AMGN) -3.42 at 245.03, Microsoft (MSFT) -1.20 at 268.78 and Nike (NKE) -1.14 at 119.81.

E-MINI S&P (M2): Maintains A Firmer Tone

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4181.33/4202.25 50-day EMA / High May 31

- PRICE: 4149.50 @ 14:24 BST June 6

- SUP 1: 3960.50/3807.50 Low May 26 / Low May 20 and bear trigger

- SUP 2: 3801.97 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont)

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis maintain a firmer tone and are trading closer to recent highs. The contract last week tested the 50-day EMA, at 4181.33 today. A clear breach of this EMA would strengthen current bullish conditions and signal scope for a climb towards a key resistance at 4303.50, the Apr 26/28 high. Recent gains however are still considered corrective and the primary trend is down. A reversal lower would refocus attention on 3807.50, the bear trigger.

COMMODITIES: Natural Gas Surges As Oil & Gold Dip Lower

- US natural gas stands out today, rising 9% as forecasts of hotter-than-usual weather across southern and western states could see additional power demand for cooling in what’s already a stretched market. It leaves prices up 150% ytd.

- Crude oil meanwhile sits little changed from Friday’s settlement. It opened higher as China emerges from covid lockdown restrictions and Saudi Arabia raised its official selling prices, before largely sliding through the day from perhaps a combination of India increasingly turning to Russian crude and equities rolling with the US open.

- WTI is -0.1% at $118.76, pulling back from an overnight high of $120.99 but still comfortably above support at the 20-day EMA of $111.01.

- Brent is +0.1% at $119.84, again comfortably above the 20-day EMA of $112.61 after an earlier high of $121.95.

- Gold is -0.5% at $1841.85 in a continuation of its primary downtrend direction after recent gains were considered corrective. Support is eyed at $1828.6 (Jun 1 low), clearance of which could open $1807.5 (May 18 low).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/06/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 07/06/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 07/06/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 07/06/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 07/06/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/06/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 07/06/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/06/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/06/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 07/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/06/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/06/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/06/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.