-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Everything in Play

US TSYS: HOT CPI, Curve Inversions and Growing Chance of 100Bp Hike

A lot to unpack Wednesday: heavy selling on higher than expected June CPI data: CPI for Services (60% of the whole) is +0.9% MoM, +6.2% YoY; CPI for Goods (40%) is +2.1% MoM +13.6% YoY; Housing related prices were up 0.8% in June. Owners’ Equivalent Rent was +0.7% MoM, +5.5% YoY, highest since 1990.

- Short end rates remained under heavy sell pressure while the long end started to bounce soon after, 30Y bonds had extended session highs by midmorning: broad 30YY range from 3.2256% high to 3.0643% low. Decent $19B 30Y auction re-open (912810TG3) stop through: 3.115% high yield vs. 3.135% WI added to the bounce.

- Trading desks struggled for a good reason to explain the price action as curves extended inversion to new 16+ year lows (21s10s -14.257 to 22.506). Certainly debatable, was a theory over peaking inflation and whether the Fed may be near the end of hawkish policy had spurred the bounce in intermediates to long end.

- Explaining Inversion: heavy short end selling persisted on strong chance of 100bp hike at end of the month. Underscored late: lead quarterly Eurodollar futures EDU2 futures gapped lower, well past earlier CPI session lows to 96.34 (-34.5) after Atlanta Fed Bostic comments of "concerning" CPI while, "everything is in play" the Fed is "not wedded to any specific course of Fed action".

- Chances of a 100bp rate hike at the end of the month jumped from single digits to close to 75% after the move. Note, Fed goes into media blackout at midnight Friday -- going to hear more pop-up comments from Fed speakers by then.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00700 to 1.56129% (+0.00072/wk)

- 1M +0.02771 to 1.99914% (+0.09943/wk)

- 3M +0.02900 to 2.51200% (+0.08900/wk) * / **

- 6M -0.00343 to 3.06100% (+.01257/wk)

- 12M +0.04743 to 3.73414% (+0.08928/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.51200% on 7/13/22

- Daily Effective Fed Funds Rate: 1.58% volume: $98B

- Daily Overnight Bank Funding Rate: 1.57% volume: $275B

- Secured Overnight Financing Rate (SOFR): 1.54%, $941B

- Broad General Collateral Rate (BGCR): 1.51%, $364B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $359B

- (rate, volume levels reflect prior session)

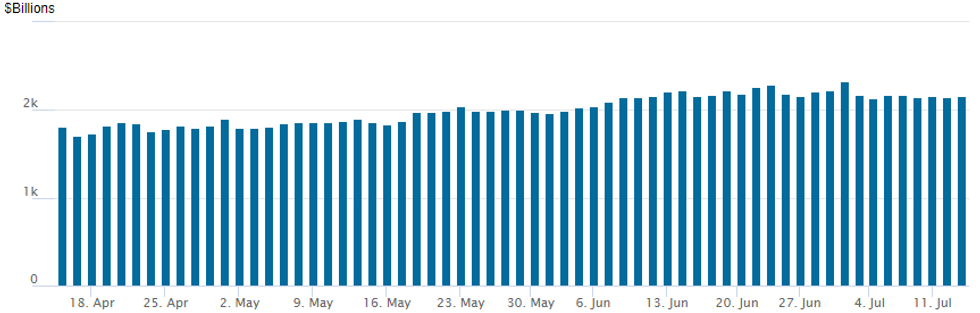

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,155.290B w/ 96 counterparties vs. $2,146.132B prior session. Record high stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Lost opportunity for short end tactical traders or risk hedgers absent or sidelined late Wednesday when short end rates gapped lower. Lead quarterly EDU2 futures gapped lower, well past earlier CPI session lows to 96.34 (-34.5) after Atlanta Fed Bostic comments of "concerning" CPI while, "everything is in play" the Fed is "not wedded to any specific course of Fed action".- Chances of a 100bp rate hike at the end of the month jumped from single digits to close to 75% after the move. Note, Fed goes into media blackout at midnight Friday -- going to hear more pop-up comments from Fed speakers by then.

- Participation grew thin in the second half after traders contended with heavy selling on higher than expected June CPI data as markets locked in expectations of a 75bps hike at month end. Yield curves hit 16+ year inverted lows as bonds rebounded, traded higher by midmorning. Option trade was largely mixed on call and put position unwinds followed by better 10Y call buying around midday.

- 5,000 SOFR short Aug 97.00 straddles

- Block, 5,000 SFRZ2 96.00/96.25 put spds, 7.0

- 10,000 Dec 95.37/96.25 put spds

- +5,000 Sep 96.25/96.50 put spds, 11.75

- +2,000 short Jul 96.87 calls, 6.0 vs. 96.755/0.30%

- -3,000 Dec 95.50 puts, 15.0 vs. 96.075/0.26%

- 2,600 Jul 96.81/97.00 call spds

- 2,000 Dec 98.00 puts, 5.0

- 7,300 TYQ 114.5/115.5 put spds, 10

- +15,000 TYQ 119.5 calls, 25 vs. 118-24.5

- 15,000 TYU 120 calls, 45 ref 118-06.5 total volume >35k

- Block, -10,000 FVU 111/111.75 put spds, 20

- Block, -10,000 TYQ 118.75/120.25 call spds, 19 at 0913:13ET ref 118-03.5

- Block, -10,000 FVU 113 calls, 30 at 0907:16ET ref 111-23.25

- +5,000 TYU 120/121 call spds, 16

- 7,000 TYQ 118/119 call spds vs. 117 puts, -2-1 cr earlier, now -4-3

- 5,000 TYU2 121/123 1x2 call spds, 7

- 13,500 wk3 TY 118/119 call spds

- 9,000 FVQ 110 puts, 2.5

- Blocks, +20,000 FVU 112.75 calls, 51-55

EGBs-GILTS CASH CLOSE: Short-End Shockwaves From Across The Atlantic

The German and UK curves twist flattened Wednesday as global bond markets assessed the latest shock upside surprise to US inflation data.

- Stronger-than-expected UK GDP set an initial bearish tone. And with traders eyeing a 100bp hike at the July Fed meeting post-CPI, and Bank of Canada delivering a surprise 100bp increase, BoE and ECB end-2022 rate hike pricing were boosted by 10-15bps.

- UK short-end/belly yields were flat but faded mid-session rises; in Germany Schatz underperformed with yields rising through the session, punctuated by US CPI. 30Y yields fell on both curves.

- Periphery spreads widened a little on the day. Thursday sees a no-confidence vote in Italy; MNI reports that there is a strong possibility the Draghi government will fall.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 10.3bps at 0.458%, 5-Yr is up 6.3bps at 0.836%, 10-Yr is up 1.3bps at 1.145%, and 30-Yr is down 2.6bps at 1.38%.

- UK: The 2-Yr yield is up 0.6bps at 1.798%, 5-Yr is down 0.1bps at 1.755%, 10-Yr is down 1.5bps at 2.06%, and 30-Yr is down 4.8bps at 2.522%.

- Italian BTP spread up 1.9bps at 200.1bps / Spanish up 1.3bps at 110.8bps

EGB Options: Limited Trade Mostly Focused On Rate Downside

Wednesday's Europe rates / bond options flow included:

- DUU2 110.30c vs DUQ2 109.10c, bought the August for 48.5 in 3k

- RXQ2 152.50/153.00/154.50/155.00 call condor 11 paid 3400

- ERZ2 98.75/98.25ps, bought for 2 in 4.25k

US CPI Sparks Substantial Intra-Day Volatility

- The greenback was pulled in both direction on Wednesday, as opposing forces of higher-than-expected inflation readings and the potential knock-on effects to growth collided.

- Initial USD strength saw EURUSD come within close proximity of parity once more before the significant US data, however, strong demand saw the pair rise sharply back towards 1.01 approaching the CPI deadline.

- The upside surprises for June CPI, both headline and core, sparked a short-term wave of dollar buying and the USD index rallied just shy of 1% from pre-data levels as markets began to price in even bolder action from the Fed in July. Notably, this prompted EURUSD to briefly print fresh cycle lows below parity at 0.9998.

- However, the renewed optimism from USD bulls was extremely short-lived as the market immediately shifted their concerns to the US growth outlook. The US yield curve further inverted with 2s10s hitting the most inverted levels since 2000, substantially weighing on the USD and prompting a 1.02% reversal in the USD index and EURUSD to take out the pre-CPI highs above 1.01 to print 1.0122.

- Short-term price action dynamics were in full flow as the dollar regained its poise approaching the APAC crossover, bolstered by Bostic’s comments suggesting ‘everything is in play’ regarding future monpol decisions.

- Slightly outperforming on the day was CAD (+0.45%) following the BoC’s surprise 100 point rate hike. The clear underperformer in G10 was the Japanese Yen, falling 0.21% despite the weaker greenback.

- Aussie employment kicks off the Thursday data calendar, before the European Commission publish their EU Economic Forecasts. US PPI data will precede the Fed’s Waller, due to speak about the economic outlook at the Annual Rocky Mountain Economic Summit.

FX: Expiries for Jul14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0095-10(E851mln), $1.0150(E682mln), $1.0190-00(E1.0bln)

- GBP/USD: $1.1820(Gbp616mln), $1.2000(Gbp548mln)

- USD/JPY: Y135.70($1.2bln), Y136.00($976mln), Y139.00($1.5bln)

- NZD/USD: $0.6090-00(N$1.0bln), $0.6120(N$1.3bln)

- USD/CAD: C$1.2925-45($ 710mln)

Late Equity Roundup, Peaking Inflation?

Stocks modestly weaker after the FI - well off post-CPI lows amid a debate over peaking inflation and whether the Fed may be near the end of hawkish policy (both unlikely as heavy short end selling prices in strong chance of 100bp hike at end of the month). SPX eminis currently trading +1.25 (0.03%) at 3827.75; DJIA -61.28 (-0.2%) at 30941.28; Nasdaq +43.8 (0.4%) at 11316.56.

- SPX leading/lagging sectors: Consumer Discretionary pared earlier gains but still outperformed (+0.92%), lead by autos w/ Tesla in the lead (+1.75%), Consumer Staples up next (+0.11%) followed by Energy (-0.08%). Laggers: Industrials (-1.08%), Communication Services (-1.05%), and Financials (-0.86%).

- Dow Industrials Leaders/Laggers: Home Depot (HD) +2.49 at 287.61 followed by McDonalds (MCD) +1.54 at 253.02 and Proctor & Gamble (PG) +1.24 at 145.99. Laggers: United Health (UNH) -10.64 at 503.78, Boeing (BA) -3.17 at 143.98, Goldman Sachs (GS) -2.59 at 289.94.

- Reminder: Earnings season picks up in earnest with JP Morgan and Morgan Stanley reporting early Thu, Bank of NY Mellon, Wells Fargo, Citi Group, Blackrock, State Stree and US Bancorp on Friday.

E-MINI S&P (U2): Key Resistance Remains Intact

- RES 4: 4308.50 High Apr 28

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 3974.01 50-day EMA

- RES 1: 3950.00 High Jun 27

- PRICE: 3808 @ 1545ET Jul 13

- SUP 1: 3735.00/3639.00 Low Jun 23 / 17 and the bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis is trading lower again today but remains above its recent lows. The outlook is unchanged and bearish, following the reversal from 3950.00, the Jun 28 high. The next support lies at 3735.00, the Jun 23 low. A breach of this level would expose key support at 3639.00, the Jun 17 low. On the upside, clearance of resistance at 3950.00 is required to reinstate a bullish theme. This would open the 50-day EMA, currently at 3974.01.

COMMODITIES: Oil Climbs Despite Falling US Gasoline Demand, Growth Fears

- Following yesterday's slide, growth concerns following even stronger than expected US CPI inflation and the Fed’s potential reaction to it has had very little impact on crude oil today, edging higher.

- US implied oil demand fell 1.744mbpd to 18.720mbpd in the prior week, yet GS analysts say the “physical market is still screaming that it’s very, very tight”.

- WTI is +0.6% at $96.43, off the intraday low of $93.67 that forms initial support just above $93.45 (Apr 25 low), maintaining the bearish extension.

- Brent is +0.25% at $99.74, off $98.28 having briefly dipped below a bear trigger at $98.5 (Jul 6/7 low).

- European gas climbed 4.5% today whilst Gazprom says there is no guarantee on the functioning of Nord Stream following the return of a turbine from maintenance in Canada.

- Gold meanwhile is +0.6% at $1736.3 after a volatile day, with both inflation fears and the dollar weakening ultimately pushing the yellow metal higher.

- It fleetingly cleared $1721.7 (Sep 29, 2021) on the immediate reaction to CPI, a clear break of which is required to test $1706.8 (1.618 proj of Mar 8 -29-Apr18 price swing).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/07/2022 | 0110/0210 |  | UK | BOE Cunliffe in Conversation w. Bank of Indonesia | |

| 14/07/2022 | 0130/1130 | *** |  | AU | Labor force survey |

| 14/07/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 14/07/2022 | 0600/0800 | * |  | DE | Wholesale Prices |

| 14/07/2022 | 0800/0400 |  | US | Treasury Secretary Janet Yellen | |

| 14/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/07/2022 | 1230/0830 | *** |  | US | PPI |

| 14/07/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 14/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/07/2022 | 1500/1100 |  | US | Fed Governor Christopher Waller | |

| 14/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.