-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

MNI BRIEF: Japan Q3 Capex Up Q/Q; GDP Revised Lower

MNI ASIA MARKETS ANALYSIS: Sour Apple Spoils Mkt Risk Appetite

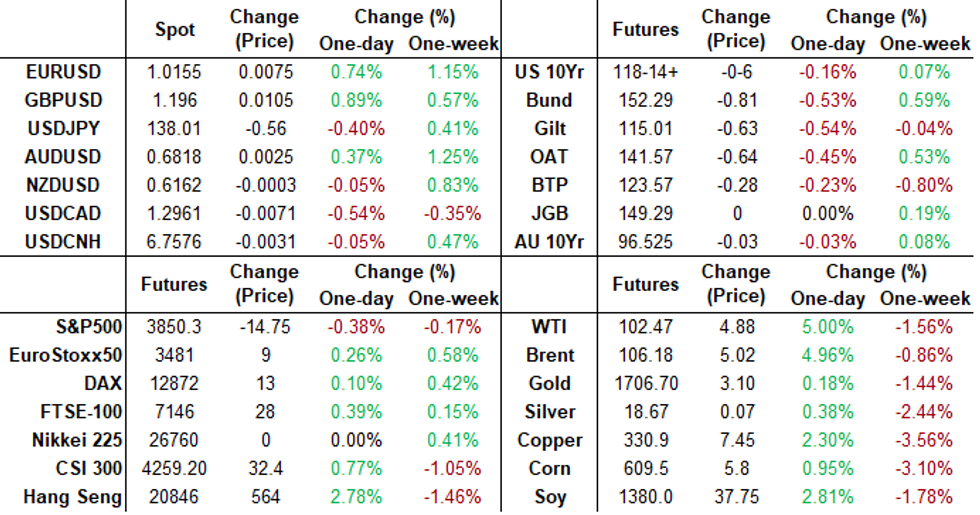

US TSYS: Risk-On Evaporates

Tsys trading weaker after the bell, off midday lows where 30YY tapped 3.1771% high, yield curves inching steeper on the day: 2s10s +1.084 at -20.257, 5s10s +1.040 at -11.349, amid light summer volumes (TYU2 <835k after the bell).

- Rates appeared to draw at least some short cover support as stocks reversed gains early in the second half. The reversal in stocks coincided with headlines that Apple plans to slow hiring expenditures for some teams next year.

- No reaction to the weaker than expected homebuilder sentiment report, NAHB July housing index of 55 vs. 65 est is the largest monthly decline in the index this side of the pandemic and prior to the pandemic is the lowest level since May'15.

- Light FI option related hedging in the first half while incoming corporate issuance generated some early rate lock hedging on the following:

- $7B #JP Morgan $3.5B 6NC5 +175, $3.5B 11NC10 +193

- $6.5B #Wells Fargo $3B 6NC5 +175, $3.5B 11NC10 +195

- $4B #Morgan Stanley $2B 4NC3 +152, $2B 11NC10 +192

- $2.5B *Bank of Montreal 3Y SOFR+79

- On tap for Tuesday:

- Housing Starts (1.549M, 1.580M); MoM (-14.0%, 2.0%)

- Jul-19 0830 Building Permits (1.695M, 1.650M); MoM (-7.0%, -2.7%)

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00500 to 1.57014% (+0.00457 total last wk)

- 1M +0.00614 to 2.12643% (+0.22058 total last wk)

- 3M -0.02771 to 2.70986% (+0.31457 total last wk) * / **

- 6M -0.04386 to 3.26743% (+.26286 total last wk)

- 12M -0.03343 to 3.86300% (+0.25157 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.74029% on 7/14/22

- Daily Effective Fed Funds Rate: 1.58% volume: $97B

- Daily Overnight Bank Funding Rate: 1.57% volume: $276B

- Secured Overnight Financing Rate (SOFR): 1.54%, $950B

- Broad General Collateral Rate (BGCR): 1.51%, $368B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $359B

- (rate, volume levels reflect prior session)

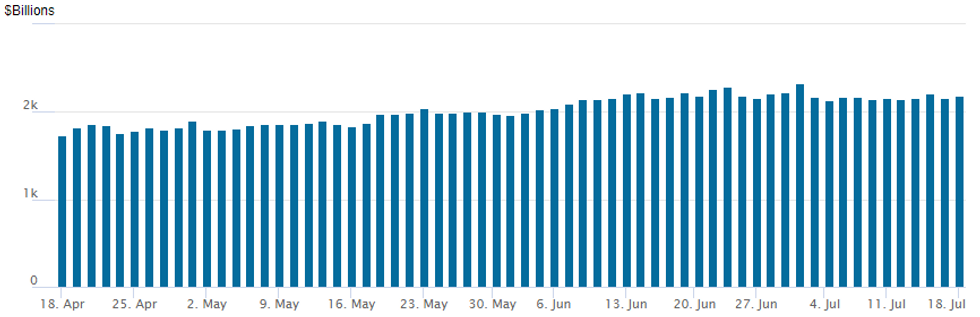

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,190.375B w/ 98 counterparties vs. $2,153.750B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Monday's scant overall option volumes appeared to favor bullish/upside call plays, fading the modest sell-off in underlying futures on the day. Largest trade was a ratio 10Y note call fly: 5,000 TYU2 118.5/120/121 broken call flys on a 1x3x2 ratio, 14 net/belly over, reference futures at 118-09. Earlier trade included 6,700 TYQ/wk1 TY 119.5 call spds and 4,500 TYQ 120.5/122.5/124.5 1x1x2 call trees.SOFR Options:

- 1,000 SFRQ2 96.50/96.62 put spds vs. 97.12 calls

- 2,500 Dec 95.00 puts, 5

- 2,000 Dec 95.50 puts, 12.0

- +2,500 Dec 95.25/95.50/95.75/96.00 put condors, 5.5

- 5,000 TYU2 118.5/120/121 1x3x2 call flys, 14 net

- 6,700 TYQ/wk1 TY 119.5 call spds

- 4,500 TYQ 120.5/122.5/124.5 1x1x2 call trees

- 3,000 TYQ 118 puts, 18

- 1,000 TYQ 116.75 puts, 3

- 1,100 TYQ 116.25/117/118 broken put trees, 16

- 3,000 TYU 114/115 put spds

EGBs-GILTS CASH CLOSE: BTP Relief

Core European FI retraced most Friday's gains on Monday, with the German and UK curves bear steepening amid a broader risk-on move.

- Yields gained alongside a softer US dollar and stronger equities / commodity prices, with volumes light and no important data.

- Buffered by speculation that Italy PM Draghi's resignation could be averted this week, BTPs pared recent losses, with spreads vs Germany falling for the first session in 7.

- The key central bank commentary (with the ECB and Fed in blackout) came from BoE's Saunders, who said 2+% rates were not implausible.

- Attention turns to the next round of the UK Tory leadership contest after hours, and of course the ECB later this week.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 5.8bps at 0.525%, 5-Yr is up 7.8bps at 0.91%, 10-Yr is up 8.3bps at 1.216%, and 30-Yr is up 8.3bps at 1.443%.

- UK: The 2-Yr yield is up 6.2bps at 1.986%, 5-Yr is up 6.5bps at 1.87%, 10-Yr is up 6.8bps at 2.159%, and 30-Yr is up 5.1bps at 2.636%.

- Italian BTP spread down 7.5bps at 206.8bps / Spanish up 7.1bps at 122.9bps

FOREX: Greenback Weakness To Start Week, USD Index Off Session Lows

- Initial strength across equity and commodity markets bolstered risk sentiment in currency markets on Monday, weighing on the US dollar. The weakness put the USD Index well through last Wednesday's lows, extending the pullback from the Thursday high to around 2.20% at its lowest point.

- Overall, the USD index remains in negative territory on Monday, although a late reversal lower for major equity benchmarks has seen the greenback climb around 0.5% off its worst levels ahead of the APAC crossover.

- One of the main beneficiaries today was the single currency. EUR/USD now trades just ahead of 1.0150 having topped out at 1.0201 shortly before the WMR fix.

- Following the break of 1.0122, the Jul 13 high, this may highlight the possibility of a short-term correction from the base of the bear channel. Focus on the topside now turns to 1.0270, the 20-day EMA. Thursday's ECB rate decision remains the focus going forward, with any hawkish turn from the central bank likely to bolster the short-term bullish potential.

- Another outperformer was GBP ahead of key political and data risks later this week. Today’s price action marks an extension of the corrective bounce in the pair, but markets need to top 1.2049, the 20-day EMA to secure any further move higher. For now, however, the outlook remains bearish, with the downtrend still initially targeting 1.1673, the 1.00 projection of the May 27 - Jun 14 - 16 price swing.

- CAD, AUD and JPY all rising around half a percent, with NZD the notable underperformer despite the stronger CPI data from New Zealand published shortly after the open.

- RBA minutes are scheduled to be published overnight before UK employment data at the start of the European session. Final Eurozone CPI readings for June will also hit the wires. On the speaker slate, BOE Governor Bailey is due to speak at the Mansion House Financial and Professional Services Dinner. Also there may be comments from Fed’s Brainard.

FX: Expiries for Jul19 NY cut 1000ET (Source DTCC)

- EUR/USD: Jul20 $1.0100(E1.0bln); Jul21 $1.0000(E1.2bln), $1.0200(E1.4bln)

- AUD/USD: Jul22 $0.6800(A$1.1bln)

- USD/CAD: Jul20 C$1.3285-00($1.0bln)

- USD/CNY: Jul20 Cny6.6000($3.7bln), Cny6.7000($3.7bln), Cny6.8000(1.1bln)

Late Equity Roundup: Sour Apple Weighs

Stocks trading modestly weaker in late trade, extending session lows after trading modestly higher for much of the session. The reversal coincided with headlines that Apple plans to slow hiring expenditures for some teams next year. Currently, SPX eminis trading -13.25 (-0.34%) at 3851.75; DJIA -85.08 (-0.27%) at 31203.11; Nasdaq -37.6 (-0.3%) at 11415.08.

- It's not much of a trigger, but enough during thin summer trade where initial support for stocks seemed ephemeral. Early bid as Q2 earnings annc's resumed: large beat for Goldman Sachs at $7.73 vs. $6.647 est, Charles Schwab beat: $0.97 vs. $0.902 est, Bank of America miss: $0.73 vs. $0.746 est.; Synchrony (SYF; $1.60 vs. $1.445 est) and Prologos (PLD; $1.11 vs. $1.108 est) also outpaced.

- IBM reports after the close: $2.288 est. Earnings expected Tuesday: JNJ and Netflix.

- SPX leading/lagging sectors: Energy sector outperforming (+2.45%) with crude rallying (WTI +5.07 at 102.66), Consumer Discretionary next up (+0.96%) with autos/auto parts trimming earlier gains but still outperforming: BorgWarner (BWA) +1.75%, Tesla (TSLA) +1.69% -- Tesla earnings this Wednesday. Laggers: Health Care (-1.44%), Communication Services (-0.80%) and Utilities (-0.74%),

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) +5.69 at 299.56, Chevron (CVX) +2.27 at 139.91 and Salesforce Inc (CRM) +2.15 at 169.53. Laggers: United Health (UNH) -5.87 at 523.88, JNJ -2.85 at 175.38, Amgen (AMGN) -3.35 at 245.34.

E-MINI S&P (U2): Starting The Week On A Firmer Note

- RES 4: 4308.50 High Apr 28

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 3956.84 50-day EMA

- RES 1: 3950.00 High Jun 27

- PRICE: 3870.00 @ 1400 ET Jul 18

- SUP 1: 3723.75/3639.00 Low Jul 14 / Low Jun 17 and a bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis have started the week on a firmer note, extending Friday’s gains and the rebound from last Thursday's low of 3723.75. Short-term gains are considered corrective - for now. Resistance to watch is at 3950.00, the Jun 27 high and the 50-day EMA, at 3956.84. A clear breach of this zone would strengthen a bullish case. On the downside, a resumption of weakness and a break of 3923.75 low, would open key support at 3639.00, Jun 17 low.

COMMODIITIES: Oil Surges With Limited Supply And Risk-On

- Crude oil prices have surged today on a combination of supply concerns and broader risk-on sentiment helped by a weaker USD. Those latest supply concerns come from Gulf officials saying output increases would be left to OPEC+ interests rather than those of the US, following the conclusion of President Biden visiting Saudi ministers.

- WTI is +3.7% at $101.23 off a high of $102.38 to move closer to resistance at the 50-day EMA of $105.04, clearance of which would open $111.45 (Jul 5 high).

- Brent is +4.1% at $105.3, also getting close to the 50-day EMA of $107.6.

- A busy day for natural gas meanwhile sees US Henry Hub prices jump 7% with the heatwave but European gas eventually settle lower (TTF -1.5%, NBP -3.3%) after Gazprom declared force majeure on supplies to several European buyers, according to people familiar with the matter, but that in a letter dated Jul 14 that this notice applied to supplies over the past month having already curbed shipments.

- Finally, gold nudges +0.1% higher to $1709.73 in a move that does little to change its downtrend, with support eyed at $1697.7 (Jul 14 high), clearance of which opens $1690.6 (Aug 9, 2021 low).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/07/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 19/07/2022 | 0800/1000 |  | EU | ECB Bank Lending Survey | |

| 19/07/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/07/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/07/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 19/07/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/07/2022 | 1700/1800 |  | UK | BOE Bailey at Mansion House Dinner | |

| 19/07/2022 | 1835/1435 |  | US | Fed Vice Chair Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.