-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

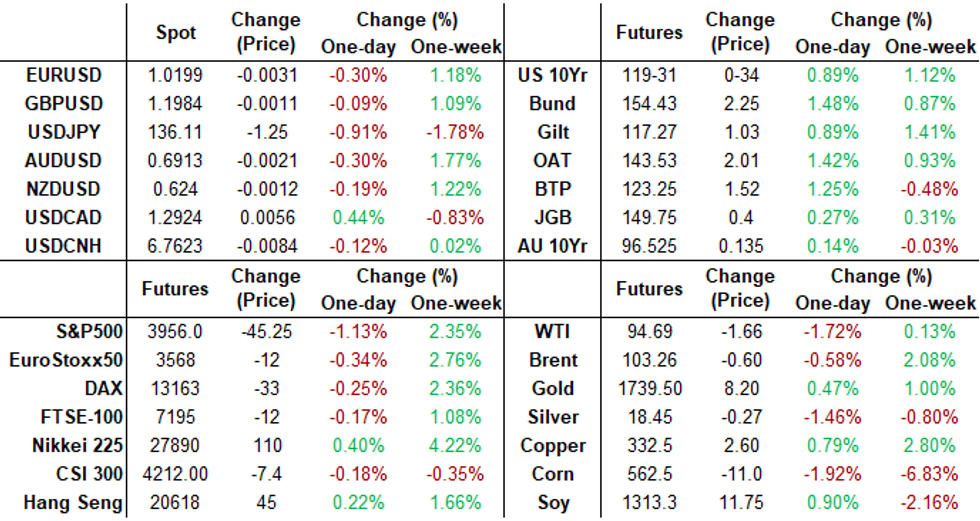

Free AccessMNI ASIA MARKETS ANALYSIS: Risk Off Tone on Weak Global PMIs

US TSYS: Weak Global PMIs

Tsys finish the week with a risk-off tone after weak PMI services read, Tsy broadly higher, curves initially steeper as hawkish forward rate hike guidance for the latter half of the year cooled -- a 75bps hike is still expected next week Wednesday while a 50bps move at the Sep policy meeting looks more likely.

- Tsys surged in early London trade after France and Germany mfg PMIs both missed expectations overnight, contractionary sub-50 reads at 49.6 and 49.2 respectively (UK mfg PMI bucked trend, coming out at 52.2 vs. 52.0 est).

- Volumes spiked as Tsy futures furthered the rally (30YY 2.9477% low) after preliminary July reading of the SP Global mfg PMI of 52.3 vs. 52.0 exp (52.7 in June), service sector miss at 47.0 vs. 52.7 est (steady to June read).

- Heavy volumes by the close w/ TYU2>1.6M. Yield curves turned mixed amid some profit taking in the short end: 2s10s -0.212 at -21.661 vs. -17.316 high, 5s30s however, +7.060 at 12.689.

- Fed terminal rate now seen at 3.33%, from what had been seen at 3.69% after last week's US CPI beat.

- Cross assets: Spot gold firmer but well off highs +4.78 at 1723.59, crude sold off late: WTI -1.54 to 94.81.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00114 to 1.56457% (-0.00057/wk)

- 1M -0.00671 to 2.25229% (+0.13200/wk)

- 3M -0.01671 to 2.76629% (+0.02872/wk) * / **

- 6M -0.05457 to 3.32286% (+0.01157/wk)

- 12M -0.10442 to 3.81429% (-0.08214/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.78300% on 7/21/22

- Daily Effective Fed Funds Rate: 1.58% volume: $96B

- Daily Overnight Bank Funding Rate: 1.57% volume: $287B

- Secured Overnight Financing Rate (SOFR): 1.53%, $960B

- Broad General Collateral Rate (BGCR): 1.51%, $377B

- Tri-Party General Collateral Rate (TGCR): 1.50%, $371B

- (rate, volume levels reflect prior session)

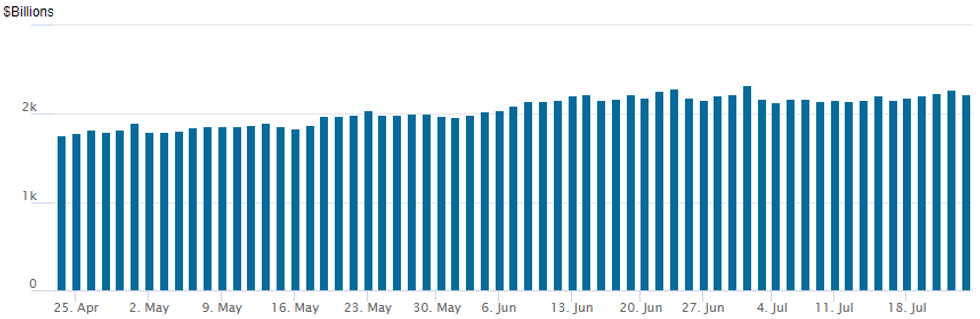

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,228.959B w/ 101 counterparties vs. $2,271.756B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Session theme: long put positions unwinding as weak service sector PMI (47.0 vs. 52.7 est) sees forward rate hike guidance for Sep and Dec cool off, while 75bp still a lock (see 1022ET bullet re: STIR implied probabilities).- Expect to see more put position unwinds or strike roll-ups if rally persists. Summer drag on participation: ironically, volume in upside calls still light, accts unwilling to add risk as yet during summer trade.

- Block, -2,500 SFRV2 96.25/96.37 put spds .25 over SFRV2 97.00/97.12 call spds

- 2,000 SFRU2 96.93/97.00/97.18/97.25 call condors

- 2,000 SFRV2 96.37/96.50 put spds vs. 96.87/97.00 call spds

- 2,000 SFRV2 96.12/96.25 put spds vs. 97.00/97.12 call spds

- 3,000 Dec 95.25 puts, 5.5

- -15,000 Oct 94.93/95.56 put spds, 3.5

- 5,000 TYU 118/120 put spds, 46

- 1,500 TYU 120 straddles, 222

- 10,700 FVQ 112.5 puts, 0.5-2

- 7,600 FVQ 112.75 puts, 2

- over 35,000 TYU 120 calls, wide range from 1-10

- 5,000 TYU 114.5 puts, 6

- 10,300 TYQ 120.5 calls, 1

- 5,900 TYU 116.5/118/118.5/120 put condors

- over 11,500 TYU 119.5 puts, 57 last ref 120-04

- over 23,000 TYQ 119.5 puts, 3-2 ref 119-28 to 120-01.5

- over 30,000 TYU2 118 puts on wide range from 26-47, most prints at 34

- 5,000 wk5 5Y 112.75 calls, 26 ref 112-24.25

- 3,000 TYQ 119.25 puts, 3

- 4,800 FVU 111.75 puts, 22 ref 112-30

- 2,500 wk5 10Y 119 puts, 16 ref 119-28.5

- 2,500 wk5 30Y 140.5 puts, 35 ref 142-00

- 2,500 TYU 118 puts, 32

- -4,700 TYU 116/117.5 put spds14 ref 119-21

- 5,000 TYQ 118.5/TYU 119.5 call spds, 6 Sep over

- -5,000 TYQ 118 calls 7 over TYU 119 calls ref 119-16.5

- 4,000 TYU 120/121 call spds, 24 ref 119-17

EGBs-GILTS CASH CLOSE: German Bull Steepening On Weak PMIs

Weaker-than-expected July PMI data that carried recessionary implications for the eurozone saw front-end EGB yields collapse to end the week, less than 24 hours after the ECB hiked 50bp.

- The bullish steepening move was extended in the afternoon on a big US Services PMI miss, but yields came off lows toward the cash close.

- Schatz yields fell over 22bp (German PMI was especially weak) as another 50bp ECB move in September was put under scrutiny.

- Conversely, UK PMIs beat consensus in contrast to the eurozone misses; Gilts underperformed.

- Periphery spreads tightened slightly amid a broader risk-on move triggered by less-hawkish central bank hike pricing.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 22.3bps at 0.453%, 5-Yr is down 24.7bps at 0.777%, 10-Yr is down 19.2bps at 1.031%, and 30-Yr is down 11.8bps at 1.285%.

- UK: The 2-Yr yield is down 15.5bps at 1.846%, 5-Yr is down 14.2bps at 1.706%, 10-Yr is down 10.8bps at 1.939%, and 30-Yr is down 8bps at 2.451%.

- Italian BTP spread down 3.6bps at 228.6bps / Spanish down 4.2bps at 122.4bps

FOREX: USD Index Reverses Sharply Lower, USDJPY Hits Two-Week Low

- Early greenback strength evaporated on Friday as the USD Index continued to make fresh weekly lows, aided during the US session by weaker US PMI data and a particularly poor services reading.

- USDJPY has extended its short-term downward trajectory having faltered into the Thursday close. Initial support was breached following the US data through 136.33, the 20-day EMA. Momentum selling took the pair down to 135.57, the lowest level for two-weeks with the price action being corroborated by softer sentiment across equity markets. 135.34/134.27 Low Jul 8 / Low Jun 23 will be the primary supports in focus following next week’s open.

- Yen outperformance was particularly evident through the weakness in the crosses. CADJPY was a notable underperformer, retreating 1.3%, even with a stronger Canadian retail sales report for May.

- Throughout European trade, EURUSD had slipped through the overnight lows to touch 1.0130 on the back of a series of particularly poor PMI numbers from Germany and France. This tipped the Eurozone-wide flash composite PMI below 50 for the first time since the lockdown-induced slowdown in early 2021. The late greenback reversal helped EURUSD pare the entirety of its losses and rally to a fresh high of 1.0255, roughly 20 pips shy of the post ECB peak.

- Monday’s data docket remains fairly light, with German IFO the highlight. Wednesday’s FOMC decision and press conference, as well as Thursday’s release of Advance Second Quarter US GDP, provide significant event risk for global markets next week.

FX: Expiries for Jul25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0200(E641mln), $1.0250(E1.8bln)

- USD/JPY: Y134.20($550mln)

- AUD/USD: $0.6750(A$1.1bln), $0.6950-55(A$910mln), $0.7000(A$1.1bln)

- NZD/USD: $0.6100(N$651mln)

- USD/CAD: C$1.3010($700mln), C$1.3100($530mln)

- USD/CNY: Cny6.7500($2.2bln)

Late Equity Roundup: Finishing on Weaker Tone

Week looked to finish w/ a risk-off tone as Tsys held broadly higher, SPX trading near late session lows after climbing to week high of 4013.25 early Friday (highest lvl since June 10).

- Stocks sold off after preliminary July reading of the SP Global mfg PMI of 52.3 vs. 52.0 exp (52.7 in June), service sector miss at 47.0 vs. 52.7 est (steady to June read). After the FI close, SPX eminis trades -50.75 (-1.27%) at 3950; DJIA -236.2 (-0.74%) at 31796.7; Nasdaq -264.5 (-2.2%) at 11794.1.

- SPX leading/lagging sectors: Utilities (+0.76%), Consumer Staples (+0.31%), Real Estate (+0.37%). Laggers: Communication Services (-4.58%) -- surprisingly not lead by Twitter (-0.73%) after earnings miss (-$0.35 loss vs. $0.137 est), but by Verizon (-7.81%) after earnings miss ($1.31 vs. $1.327 est), followed by Meta (-7.59%) and Google (-5.89%).

- Dow Industrials Leaders/Laggers: American Express (AXP) +3.20 at 153.38 after strong earnings ($2.57 vs. $2.389 est), Procter & Gamble (PG) +1.43 at 142.20, Home Depot (HD) +0.41 at 305.41. Laggers: Microsoft (MSFT) -5.01 at 259.83, United Health (UNH) -3.36 at 519.10, Visa (V) -2.87 at 213.32 and Boeing (BA) -2.73 at 158.68

E-MINI S&P (U2): Recovery Extends, Nears Resistance

- RES 4: 4308.50 High Apr 28

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 4017.94 38.2% Mar - Jun Downleg

- RES 1: 4016.25 High Jul 22

- PRICE: 4002.00 @ 15:16 BST Jul 22

- SUP 1: 3723.75/3639.00 Low Jul 14 / Low Jun 17 and a bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis extended the recovery into the Thursday close, topping 4004.75 in the process and nearing first key resistance at 4017.94. The moves mark a clear break of the 55-day EMA and this week’s strength narrows the gap with 4204.75, the May 31 high. On the downside, a resumption of weakness and a break of 3923.75 low, would instead open key support at 3639.00, Jun 17 low.

Oil Ends A Mixed Week Softer On Accelerated Demand Fears

- Crude oil is ending a mixed week on a soft note, falling further today on the US composite PMI at the lowest levels its been since 2009 outside of the depths of the pandemic, building on mid-week EIA data showing sluggish product demand.

- Supply concerns from Russia talking of not supplying any country that pursues a price cap and forming its own commodity price benchmark has been partly offset by Libyan production coming back online.

- Additional US focus has seen WTI underperform Brent, flat on the week vs a 2% gain (both Sep’22 contracts).

- On the day, WTI is -1.6% at $94.81, floating between resistance at $100.53 (20-day EMA) and support at $91.64 (Jul 15 low).

- Brent is -0.5% at $103.32, although between resistance at $107.46 (50-day EMA) and support at $98.17 (Jul 15 low).

- Gold is +0.2% at $1722.92 for +0.8% on a volatile week, seeing a further boost today after yesterday’s surge with on the back of another significant slide in Treasury yields. It currently doesn’t trouble technicals with resistance at $1745.4 (Jul 13 high) and support at $1697.7 (Jul 14 low).

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/07/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/07/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/07/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/07/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/07/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.