-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

MNI BRIEF: Japan Q3 Capex Up Q/Q; GDP Revised Lower

MNI ASIA MARKETS ANALYSIS: GDP Contracts, Tempers Hike Pricing

US TSYS: GDP Contraction Cools Forward Hike Expectations

Rates and stocks rallied after this morning's recession metric cooled: U.S. GDP contracted by 0.9% in the second quarter, far below analyst expectations for a 0.4% gain, driven by decreases in inventory investment, housing and government spending, according to Wed's advance est by Bureau of Economic Analysis.

- Short end rallied/yield curves bull steepened (well off high -14.369, 2s10s at -20.337 after the bell) as expectations over another 75bp hike in Sep cool - 50bp looking more likely at the moment but remain data dependent.

- Balance of rates followed suit, setting modest session highs by midmorning, 30YY at 3.0162% after the bell.

- Tsys hold range after $38B 7Y note auction (91282CFC0) stops through (after three consecutive tails): 2.730% high yield vs. 2.735% WI; 2.60x bid-to-cover vs. 2.48x last month.

- Focus turns to Friday's data calendar w/ Personal Income (0.5% est), Personal Spending (0.9% est), ECI (1.2% est), Chicago PMI (55.0 est) and U-Mich (51.1 est.).

- Fed comes out of blackout tomorrow, still no scheduled speakers as yet - but will most likely see some commentary on networks.

- Currently, the 2-Yr yield is down 13bps at 2.8683%, 5-Yr is down 14.8bps at 2.6945%, 10-Yr is down 11.4bps at 2.6705%, and 30-Yr is down 4.8bps at 3.017%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.74000 to 2.30343% (+0.73886/wk)

- 1M +0.00085 to 2.37314% (+0.12085/wk)

- 3M -0.02357 to 2.78229% (+0.01600/wk) * / **

- 6M -0.03000 to 3.34071% (+0.01785/wk)

- 12M -0.04986 to 3.76214% (-0.05215/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3.5Y high: 2.80586% on 7/27/22

- Daily Effective Fed Funds Rate: 1.58% volume: $98B

- Daily Overnight Bank Funding Rate: 1.57% volume: $287B

- Secured Overnight Financing Rate (SOFR): 1.53%, $941B

- Broad General Collateral Rate (BGCR): 1.51%, $385B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $368B

- (rate, volume levels reflect prior session)

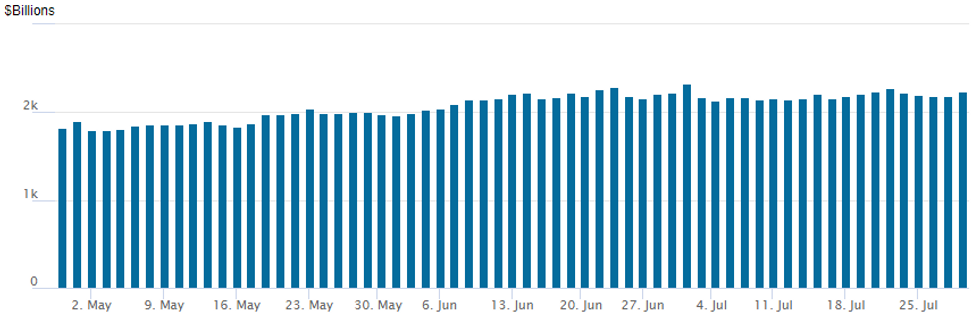

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,239.883B w/ 111 counterparties vs. $2,188.994B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Much better downside put volume reported Thursday as underlying futures rallied in response to U.S. GDP contracting 0.9% in the second quarter, far below analyst expectations for a 0.4% gain. Underlying futures rallied as more aggressive rate hike expectations evaporated, 50bp hike more likely at the next Fed policy meeting in Sep than 75bp.- Eurodollar and SOFR option volumes were light (Block sale of 20,000 Sep 96.50/96.62 put spds at 3.5; -20,000 SFRM3 95.75/95.87 put spds, 2.0 vs. 96.995/0.05%) compared to Treasury options where 10Y put unwinds and repositioning trades noted (-30,000 TYU 115/116 put spds at 1; Block 10,000 TYU2 118.5/120 put spds, 26 vs. 120-27.5/0.18%).

- -10,000 SFRH3 96.00/96.37 put spds, 9.0 ref 96.91-.915

- Block, 20,000 SFRM3 95.75/95.87 put spds, 2.0 vs. 96.995/0.05%

- Block, 10,000 SFRQ2 96.75/96.87 put spds, 1.75

- Block, 2,000 SFRZ2 96.00/96.25 put spds 4.5 vs. 4,000 SFRZ2 96.43/96.56 put spds, 5.0

- Block, 2,000 SFRV2 97.00/97.12 call spds vs. 96.25/96.37 put spds, 0.0

- BLOCK, total 20,000 Sep 96.50/96.62 put spds, 3.5

- Block, 10,000 TYU2 118.5/120 put spds, 26 vs. 120-27.5/0.18%

- 2,600 TYU 121/123 call spds, 30 ref 120-30.5

- 3,400 TYU 122/124 call spds, 28

- 3,000 TYU 117/118 put spds, 23

- 3,000 TYV 117/118 put spds, 10

- -30,000 TYU 115/116 put spds, 1

- 1,700 USU 143/148 call spds, 138

- 2,500 FVU 111.25/111.5 put spds, 3

- 2,500 TYU 119.5 puts, 36

- 2,500 FVU 112.5 puts, 21

- 3,000 TYV 117/118 put spds, 10

- -4,000 TYZ 120.5 straddles 408-407

- 6,500 TYU2 116.5/117/118.5/119 put condors, 10

- 3,500 TYU 116.5/119 put spds, 35

- Block, 10,000 TYU 116.5/118.5 put spds, 23

- 12,300 TYU 118.25/119 put spds

- Block, 20,000 TYU 118/119 put spds, 18

- Block, 8,000 FVU 113 calls, 42.5-44.5

EGBs-GILTS CASH CLOSE: Front-End Yields Crash On Global Growth Fears

European yields collapsed Thursday with many instruments hitting the best levels in 3 months, led by the front end as the rally post-Fed carried through with a disappointing US GDP figure today.

- Growth'/recession fears outweighed higher-than-expected German inflation data.

- Schatz saw one of their biggest-ever rallies (nearly 20bp lower on the session). Gilts were stronger but lagged the Bund rally, with the UK/German 10Y spread testing the April peak.

- Periphery spreads tightened slightly with an easier monetary outlook providing relief.

- Friday sees a slew of data including multiple Eurozone preliminary July CPI reports and Euro area preliminary Q2 GDP.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 19.6bps at 0.248%, 5-Yr is down 18.5bps at 0.523%, 10-Yr is down 12bps at 0.826%, and 30-Yr is down 8.9bps at 1.109%.

- UK: The 2-Yr yield is down 16.3bps at 1.719%, 5-Yr is down 13.8bps at 1.594%, 10-Yr is down 9.3bps at 1.868%, and 30-Yr is down 8.6bps at 2.438%.

- Italian BTP spread down 3.5bps at 234.7bps / Spanish down 2.9bps at 116.4bps

Another Light Day Of Trade

Thursday's Europe rates / bond options flow included:

- OEU2 125/123ps 1x2, bought for 13.5 in 2k

FOREX: USDJPY Sinks To One-Month Low Following Negative US GDP Data

- The market’s dovish reaction following yesterday’s FOMC was exacerbated by disappointing US GDP data on Thursday. The annualized Q/q reading fell 0.9%, well below the surveyed median estimate, sparking a wave of greenback selling following the data.

- The USD weakness was hardest felt against the JPY, with the pair extending its overnight downward trajectory. USDJPY broke through the 135.11 low seen overnight with the pair almost entirely narrowing the gap to key support at 134.26/27 - the 50-dma EMA/ June 23 low. The pair remains down 1.55% approaching the APAC crossover.

- Despite the move in US yields, the USD index remains unchanged on Thursday largely reflected by a mixed reaction among major currencies and an emphasis on the broad-based yen strength. The dovish reaction in US fixed income markets and the subsequent narrowing of yield differentials took the shine off the market’s favourite JPY-short trade and in the face of surging equities, EURJPY and AUDJPY are the weakest pairs on the board.

- Threats to global growth and ongoing headwinds across Europe leaves the technical picture for EURJPY a lot more exposed. Notable support and the bear trigger has been breached below 136.87, the Jul 8 low. A sustained clearance of this level would strengthen bearish conditions and target 136.25 and 135.40 next.

- In similar vein, EURCHF’s break earlier this week below 0.9807 and the 0.98 has seen the pair continue to make fresh cycle lows and print at the lowest levels since the removal of the floor in January 2015, just above 0.9700.

- A flurry of data to finish the week on Friday with multiple Eurozone GDP and Inflation releases, including the Eurozone HICP Flash Estimate.

- In the US, Core PCE Price Index, Employment Cost Index and Personal Income/Spending data will precede the MNI Chicago Business Barometer and UMichigan sentiment figures.

FX: Expiries for Jul29 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9800(E948mln), $1.0050(E1.1bln), $1.0125(E658mln), $1.0200(E789mln), $1.0247-50(E3.0bln), $1.0300(E646mln)

- USD/JPY: Y132.50($1.2bln), Y135.00($539mln), Y135.95-00($991mln), Y140.00($1.3bln)

- GBP/USD: $1.2100(Gbp985mln)

- USD/CAD: C$1.2830($575mln), C$1.2920-30($1.2bln)

- USD/CNY: Cny6.8000($1.2bln)

Late Equity Roundup: Late Earnings for AAPL, INTC, AMZN on Tap

Stocks holding to narrow band near late session highs after the FI close. Currently, SPX eminis trade +50.25 (1.25%) at 4075; DJIA +369.79 (1.15%) at 32571.72; Nasdaq +125 (1%) at 12158.34.

- Initial support on rates pricing in less aggressive rate hike expectations after U.S. GDP contracted by 0.9% in the second quarter, far below analyst expectations for a 0.4% gain. Sources cite rally in DAX (+115.73 at 13282.11) and carry-over bid in Microsoft for SPX rally that kicked off at midmorning.

- Earnings after the close: Apple (AAPL) $1.158 est, Olin Group (OLN) $2.539% est, Intel (INTC) $0.693 est, Amazon (AMZN) $0.137 est.

- SPX leading/lagging sectors: Utilities took the lead late (+3.39%) followed by Real Estate (+3.30%) supported by Equinix (EQIX) +8.50%, while Industrials gained (+2.14%). Laggers: Communication Services receding after Wed's strong gains (-0.78%) with cable and satellite names underperforming (Charter -9.35%, Comcast -8.46%, Dish -3.41%), followed by Energy sector (+0.30%).

- Dow Industrials Leaders/Laggers: United Health (UNH) +8.85 at 543.46, carry-over bid for Microsoft (MSFT) +8.55 to 277.29, Honeywell (HON) +7.00 at 190.66. Laggers: Continued weakness for Travelers (TRC) -3.02 at 155.94, Amgen (AMGN) -0.78 at 250.94, Merck (MRK) -0.52 at 90.71

E-MINI S&P (U2): Bullish Outlook

- RES 4: 4306.50 High May 4

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 4145.75 High Jun 9

- RES 1: 4042.75 High Jul 27

- PRICE: 4007.00@ 14:48 BST Jul 28

- SUP 1: 3913.25 Low Jul 26

- SUP 2: 3820.25 Low Jul 18

- SUP 3: 3723.75/3639.00 Low Jul 14 / Low Jun 17 and a bear trigger

- SUP 4: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis traded higher Wednesday and in the process pierced resistance at 4016.25, the Jul 22 high. The break higher confirms a resumption of the current bull cycle and signals potential for a climb towards 4145.75, the Jun 9 high. The next key resistance is at 4204.75, the May 31 high. On the downside, initial support has been defined at 3913.25, the Jul 26 low. A break below this level would highlight a possible early bearish reversal signal.

COMMODITIES

- WTI Crude Oil (front-month) down $0.21 (-0.22%) at $97.05

- Gold is up $20.92 (1.21%) at $1755.02

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/07/2022 | 0530/0730 | ** |  | FR | Consumer Spending |

| 29/07/2022 | 0530/0730 | *** |  | FR | GDP (p) |

| 29/07/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 29/07/2022 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 29/07/2022 | 0630/0830 | ** |  | CH | retail sales |

| 29/07/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 29/07/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 29/07/2022 | 0700/0900 | *** |  | ES | GDP (p) |

| 29/07/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/07/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 29/07/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 29/07/2022 | 0800/1000 | *** |  | DE | GDP (p) |

| 29/07/2022 | 0800/1000 | *** |  | IT | GDP (p) |

| 29/07/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/07/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/07/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 29/07/2022 | 0900/1100 | *** |  | EU | GDP preliminary flash est. |

| 29/07/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 29/07/2022 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 29/07/2022 | 1000/1200 |  | IT | PPI | |

| 29/07/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/07/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/07/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 29/07/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 29/07/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 29/07/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.