-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

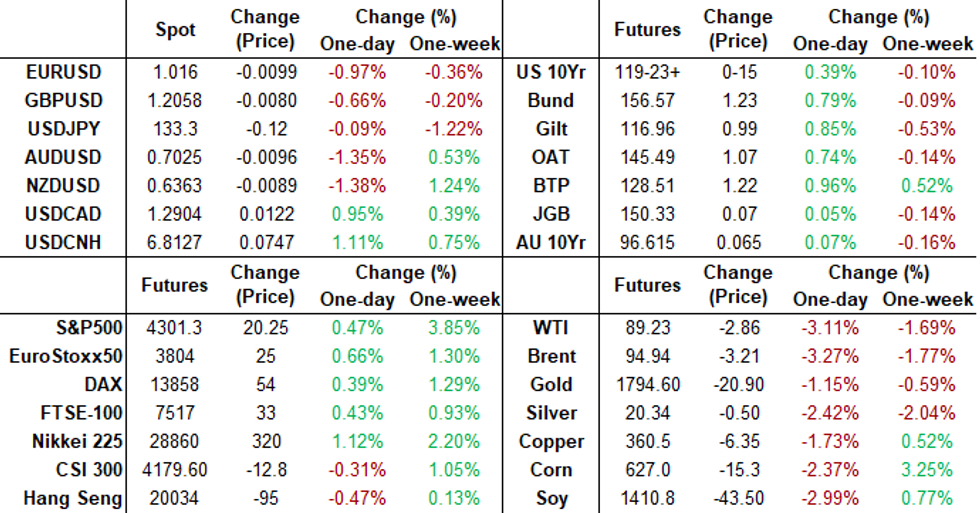

Free AccessMNI ASIA MARKETS ANALYSIS: Summer Bond Susuration

US TSYS: Off Highs/Narrow Range Since Weak Data, More Housing Tue

Tsy futures trade higher after the bell, holding to narrow range since scaling back from midmorning high soon after the NAHB Housing data miss, yield curves holding mildly steeper. Tsy 30YY fell to low of 3.0503%, running at 3.098% at the moment

- Low volume session w/ TYU2 just over 840k vs 640k at late morning after Tsys extended early highs after the NY Fed Empire State index gapped -31.5 vs. 5.0 estimate - "with sharp declines in orders and shipments" for the second largest monthly decline since May 2020; August read of NAHB Housing Market Index is 49 vs. 54 est.

- Moderate option-tied and supply related hedging contributed to two-way flow on the session Tsys bill sales include $54B 13W and $42B 26W up shortly, high-grade corporate issuance resumed: $3B Amgen 3pt, $2.25B Rabobank 3pt launched while $3B KFW 2Y SOFR was rolled to Tuesday.

- Starting to see the start of Sep/Dec Tsy futures rolling ahead Aug 31 first notice when Dec takes lead quarterly position, roll volumes still muted.

- Data on tap for Tuesday (est, prior): Building Permits (1.696M rev, 1.640M), MoM (0.1% rev, -3.3%), Housing Starts (1.559M, 1.528M), MoM (-2.0%, -2.0%), Industrial Production MoM (-0.2%, 0.3%), Capacity Utilization (80.0%, 80.2%) and Mfg Production (-0.5%, 0.4%).

- The 2-Yr yield is down 4.6bps at 3.1967%, 5-Yr is down 4.6bps at 2.91%, 10-Yr is down 4.3bps at 2.7878%, and 30-Yr is down 1.1bps at 3.0972%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00400 to 2.31886% (+0.00286 total last wk)

- 1M -0.00715 to 2.37971% (+0.01743 total last wk)

- 3M +0.02029 to 2.94186% (+0.05486 total last wk) * / **

- 6M +0.02371 to 3.53300% (+0.08372 total last wk)

- 12M +0.03557 to 3.99457% (+0.09914 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.94186% on 8/15/22

- Daily Effective Fed Funds Rate: 2.33% volume: $97B

- Daily Overnight Bank Funding Rate: 2.32% volume: $286B

- Secured Overnight Financing Rate (SOFR): 2.28%, $966B

- Broad General Collateral Rate (BGCR): 2.26%, $396B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $380B

- (rate, volume levels reflect prior session)

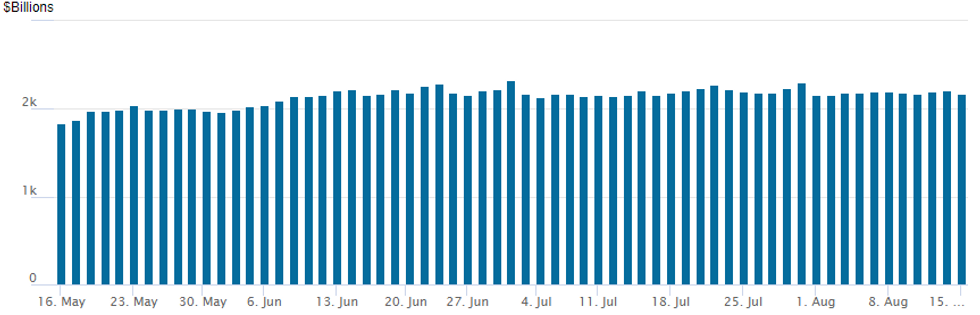

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls back to $2,175.857B w/ 102 counterparties vs. $2,213.193B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Fixed income option accounts took the opportunity to buy more downside put positions at cheaper levels Monday as underlying futures remained strong in late trade. Eurodollar and it's soon to replace SOFR options saw better put fly and condor option plays on the day while Treasury option volumes lagged.- SOFR Options:

- +5,000 short Aug SOFR 95.00 puts, 1.5 vs. 96.86/0.05%

- Block, 10,000 SFRZ2 95.87/96.00/96.25/96.37 put condors, 3.5 vs. 97.50 calls at 3.25

- Block, 2,500 SFRV2 96.68 calls 1.0 over SFRU2 96.75/96.87 call spds covered

- 1,800 SFRV2 96.50 puts

- Eurodollar Options:

- Block, 40,000 Sep 96.12/96.50/96.87 put flys, 19.25 vs. 96.65/0.68%

- Block, 20,000 Sep 95.50/96.25/97.00 put flys, 34.5 vs. 96.6475/0.98%

- 5,000 SFRV 95.87/96.00 put spds

- Block, 5,748 Green Mar/short Mar 98.00 1x2 call spd, 2.5, additional 3k on screen

- 2,000 Sep 96.25/96.37 put spds

- Treasury Options:

- 3,000 TYX 123/125 call spds

- 1,700 FVU 112 puts, 12

- 2,000 USU/USV 142 call spds, 28

- 4,000 TYU 119.75 straddles

- -6,000 TYV 121 calls, 34-30

- 5,000 TYX 116/118 put spds

EGBs-GILTS CASH CLOSE: Steady Rally

European bonds rallied for most of Monday's session following some weakness at the open, amid light trading volume with holidays in several countries (including France, Germany, Italy, and Spain).

- The fall in yields came amid a sharp drop in oil prices (Brent -4%) and unexpectedly weak economic data overnight in China and in the afternoon from the US.

- Apart from the steady drop in yields throughout the session, there were few key themes: German yields outperformed the UK in the short-end/belly, but the converse was true further down the curve.

- No bond issuance (back Tuesday w Gilt and Bobl auctions), key data (UK employment and German ZEW feature Tuesday), or central bank speakers.

- Greek debt underperformed, with the 10Y spread to Bunds nearly 4bp wider (other periphery EGB spreads were relatively unchanged).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 7.8bps at 0.53%, 5-Yr is down 7.7bps at 0.678%, 10-Yr is down 8.7bps at 0.9%, and 30-Yr is down 8.2bps at 1.155%.

- UK: The 2-Yr yield is down 2.1bps at 2.032%, 5-Yr is down 7.6bps at 1.855%, 10-Yr is down 9.4bps at 2.017%, and 30-Yr is down 10.1bps at 2.435%.

- Italian BTP spread down 0.8bps at 207.5bps / Greek up 3.7bps at 228.9bps

EGB Options: Bobl Downside Structures Feature

Monday's Europe rates / bond options flow included:

- DUV2 109/108.50ps, bought for 10 in 3.75k

- OEV2 126/125.5ps vs 128/128.75cs, bought the ps for flat in 2k

- OEV2 126/125.5ps vs 128/128.50cs, bought the ps for 1 in 1k

- RXU2 153/151/150 broken put fly sold at 10.5 in 4.5k

- ERU2 99.12/98.87ps, bought for 1.75 for 5k

- 0RU2 98.25/97.875/97.75 broken p fly, bought for 8 in 10k

FOREX: Firmer Greenback Sees EURUSD Back Below 1.0200

- Dollar indices took their cues from a surging USD/CNH on Monday largely in response to overnight PBOC action on rates and the lower-than-expected Chinese economic activity data. Bullish momentum has been picking up for USDCNH in late trade following the break of the July and August highs around 6.7950. The pair is now trading up 1.12% at 6.8130.

- Dampened risk sentiment bolstered safe haven demand for the greenback and despite lower US yields and recovering stock indices throughout the US session, the USD Index looks set to post a 0.85% advance to start the week.

- Despite AUD and NZD being the weakest major currencies and both falling around 1.3%, the more notable price action has been in the Euro.

- In the process of sliding back below 1.0200, EURUSD has reversed the entirety of the post US CPI gains and has notably rejected the previous breakdown area between 1.0341/59 that had been a strong inflection point earlier this year. Additionally, the pullback highlights - for now - a failure to deliver a clear break of the bear channel resistance, currently at 1.0326. With the 100 pip grind lower on Monday, the pair also narrows the gap with the Aug 3 low at 1.0123.

- The softer single currency was noted last Friday with strong moves lower for some Euro crosses and lingering uncertainties regarding Europe’s energy crisis may be exacerbating the renewed weakness.

- The main beneficiary of lower US yields was understandably the Japanese Yen. USDJPY was well off the 13360 highs approaching the US Empire Manufacturing data, however, the softer prints sparked a swathe of selling down to fresh lows of 132.56. The firmer dollar overall has led to a strong bounce for the pair back to levels close to unchanged, however, significant weakness is noted in the likes of AUDJPY (-1.61%) and EURJPY (-1.12%) with the latter now trading 300 pips off last week’s highs.

- Highlight for Tuesday’s APAC session will be the RBA minutes before UK employment data and Germany’s ZEW sentiment release. Canadian CPI will be the focus for the North American session with US housing starts and IP to also be released.

FX: Expiries for Aug16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0000(E1.3bln), $1.0048-50((E563mln), $1.0070-75(E1.3bln), $1.0100-10(E1.0bln), $1.0125-40(E1.3bln), $1.0250(E932mln), $1.0300(E949mln)

- USD/CNY: Cny6.89-90($859mln)

EQUITIES: Stocks Strengthen Through London Close, Hits New Recovery High

- US equity futures taking another leg higher through the London close, with the e-mini S&P bumping to a new intraday and recovery high of 4295.50 (and gaining). The Sep-22 future sees a modest uptick in volumes on the latest leg higher, bringing the May 4 High at 4306.50 into view. This marks the next key resistance going forward, with staples leading the way forward followed by communication services.

- The move higher in equities looks relatively idiosyncratic here, with no parallel shift in either currency or bond markets - although the USD/CNH rate persists to fresh session highs, while commodity-tied currencies recover off the day's lowest levels (AUD, CAD etc).

- Progress through 4306.50 resistance opens the 4345.75, the 2.00 proj of the Jun 17 - 28 - Jul 14 price swing.

COMMODITIES: WTI Clears Bear Trigger On Iran Deal Hopes, Soft Data

- Crude oil is currently down circa -3% today, having at one point declined 5%, with the major driver being optimism that a renewed Iran nuclear deal was being readied before cooling somewhat as time passed with comments such as the “only way to Iran deal is for Tehran to abandon extraneous demands” from the US State Department.

- Further downward pressure came from weak China data overnight plus a large miss in the US NY Fed Empire State survey for August as new orders tumbled.

- WTI is -2.8% at $89.55 and with a low of $86.82 cleared the bear trigger at $87.01 (Aug 5 low), opening $85.37 (Mar 15 low).

- Brent is -3.02% at $95.16 having hit a low of $92.78, exactly matching support at the Aug 5 low before bouncing, leaving the bear trigger at $91.22 (Jul 14 low) untested.

- Gold is -1.35% at $1778.10 as it suffered with a return of dollar strength. It pushes back from the bull trigger of $1807.9 and eyes support at the 20-day EMA of $1771.2, with a key short-term support at $1754.4 (Aug 3 low) should today’s bearish momentum continue.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/08/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/08/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/08/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 16/08/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 16/08/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/08/2022 | 1230/0830 | *** |  | CA | CPI |

| 16/08/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 16/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/08/2022 | 1315/0915 | *** |  | US | Industrial Production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.