-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Bear Steepening Ahead August CPI

US TSYS: Tsy Yld Curve Bear Steepening Ahead August CPI

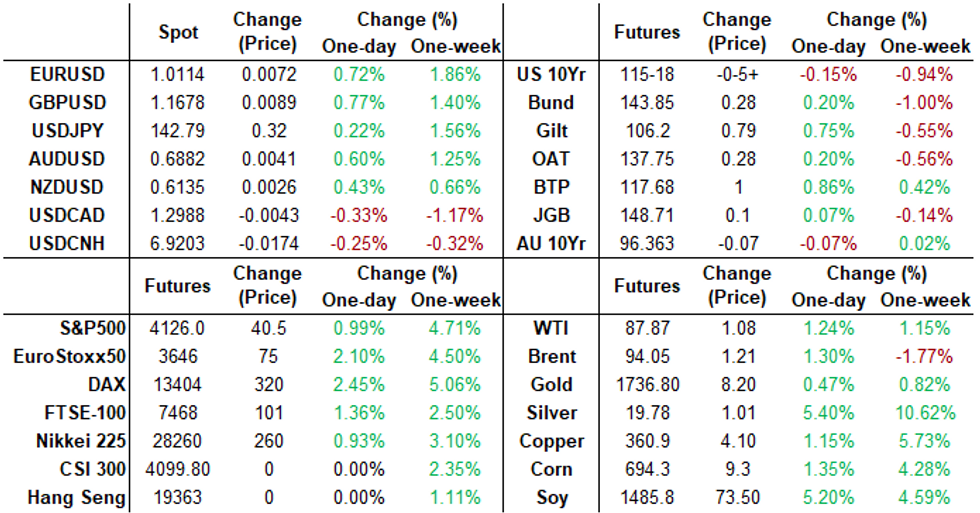

Tsys trading near late session lows after starting off near highs - bonds experienced a wide range (30YY 3.5284% late high vs. 3.4102% low) on light overall volumes (TYZ2 <985k) with no economic data to trade off of - participants close to the sidelines ahead Tuesday's CPI read for August MoM (0.00% prior, -0.10% est); YoY (8.5% prior, 8.0% est).

- Rush of Treasury issuance Mon-Tue due to Thu settle, maintains 2 day gap between last auction and settle generated some midday interest:

- Treasury futures pare gains slightly after $41B 3Y note auction (91282CFK2) tail: 3.564% high yield vs. 3.545% WI; 2.49x bid-to-cover vs. 2.50x last month.

- Futures sale accelerated after $32B 10Y note auction re-open (91282CFF3) underperformed: large tail w/ 3.330% high yield vs. 3.302% WI; 2.37x bid-to-cover vs. last month's 2.53x.

- Despite a late Block sale of 7,531 FVZ2 at 110-03.75, yield curves extended steepener move w/ 2s10s tapping -20.167 high.

- Note on short end Eurodollar futures expiration: The CME Group has confirmed the final settlement price for Sep'22 Eurodollar (EDU2) futures (and 3M Sep options expiration) will be based on the 3M USD Libor fix published this Friday, Sep 16 due to UK bank closure for the Queen's funeral next Monday Sep 19.

- Currently, the 2-Yr yield is up 0.9bps at 3.5652%, 5-Yr is up 1.9bps at 3.4545%, 10-Yr is up 4.6bps at 3.3558%, and 30-Yr is up 5.6bps at 3.503%.

SHORT TERM RATES

US DOLLAR LIBOR: Settlements resume

- O/N +0.00314 to 2.31771% (-0.00014 total last wk)

- 1M +0.01029 to 2.78343% (+0.11743 total last wk)

- 3M +0.02471 to 3.27014% (+0.08729 total last wk) * / **

- 6M -0.00471 to 3.80643% (+0.07457 total last wk)

- 12M +0.05657 to 4.24557% (-0.03157 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.27014% on 9/12/22

- Daily Effective Fed Funds Rate: 2.33% volume: $101B

- Daily Overnight Bank Funding Rate: 2.32% volume: $299B

- Secured Overnight Financing Rate (SOFR): 2.28%, $958B

- Broad General Collateral Rate (BGCR): 2.26%, $395B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $386B

- (rate, volume levels reflect prior session)

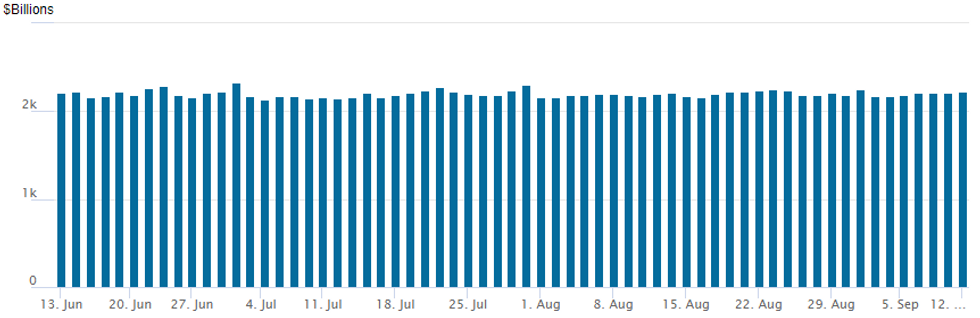

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usages climbs to $2,218.546B w/ 102 counterparties vs. $2,209.714B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Mixed option trade Monday, appeared two-way/consolidative with some accounts unwinding puts after underlying futures extended session lows in the second half, preceded by modest upside call buying across the board. Overall volumes light with accounts plying the sidelines ahead Tue's August CPI read. Highlight trade:- SOFR Options:

- 3,000 SFRH3 96.18 puts

- Block, 5,000 SFRZ2 96.50 calls, 5.5

- 2,500 SFRZ 95.75/96.00/96.37 broken put flys

- 4,000 short Aug SOFR 96.06/96.31 put spds

- Eurodollar Options:

- Block, -10,000 Nov 95.50 puts, 3.25 ref 95.83

- 5,500 Green Dec 97.37 calls

- 4,000 (screen/block) Nov 95.50/95.75 3x2 put spds

- 4,200 short Sep 96.25 calls

- Treasury Options:

- -4,100 USZ 128/136 call over risk reversal, 5 net ref 132-11

- 4,000 FVX 111 calls, 30

- Block, +15,000 TYV 117.5/118.5 call spds, 8 ref 116-00.5

- +5,000 USZ 124 puts, 46 ref 133-14

- +8,000 TYV 115.25 puts, 25 ref 116-02

- 2,500 TYZ 120/123/126 call trees

- Block, 10,000 FVX 109.75 puts, 43-39

EGBs-GILTS CASH CLOSE: German Short End Reverses Early Weakness

Bunds outperformed and the German curve bull flattened to start the week, with UK yields also trading lower.

- Core EGBs enjoyed a bounce from large losses late last week, amid a risk-on session for equities (most Eurozone bourses were up around 2%) and FX, with the Euro and Sterling bouncing. Periphery EGB spreads tightened, led by Greece.

- Early attention was on the weekend's hawkish ECB speaker commentary, following on from various media sources pieces late last week that largely pointed to ECB tightening ambitions for the rest of the year.

- Even so, short-end German yields reversed lower over the course of the session.

- ECB hike pricing finished flat and BoE marginally softer, with Tuesday's U.S. inflation report awaited to set the near-term direction.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 0.8bps at 1.319%, 5-Yr is down 4.6bps at 1.492%, 10-Yr is down 4.5bps at 1.653%, and 30-Yr is down 5.8bps at 1.75%.

- UK: The 2-Yr yield is down 2bps at 3.034%, 5-Yr is up 0.2bps at 2.989%, 10-Yr is down 1.3bps at 3.082%, and 30-Yr is down 2.6bps at 3.45%.

- Italian BTP spread down 1bps at 231bps / Greek down 4.3bps at 253.9bps

EGBs-GILTS CASH CLOSE: Limited Trade

Monday's Europe rates / bond options flow included:

- RXV2 140.00p, bought for 23 in 3.25k

FOREX: Early USD Weakness Consolidates Ahead of Inflation Data

- The USD index is registering 0.6% losses on Monday, extending the most recent pullback from last week’s cycle highs to 2.3%.

- Greenback weakness has largely been driven by a firmer Euro, rallying alongside broadly hawkish tones from a number of ECB members both over the weekend as well as early Monday. Bundesbank chief Nagel flagged a persistent tightening bias at the ECB, stating that more clear ECB steps are needed if inflation lingers. Other speakers including de Guindos have suggested that another 75bps move is possible depending on data outcomes between now and the October meeting.

- EURUSD did breach the channel top, drawn from the Feb 10 high, which intersected at 1.0149 and represents a key resistance. Despite some early momentum, the Aug 17 high at 1.0203 has capped the topside and the pair has reversed back to 1.0110 ahead of the APAC crossover.

- Jumping on the coat tails of the single currency, GBP and CHF are the best performers, both rising over 0.7% against the greenback, with a notable 0.7% reversal lower in EURGBP after making a new marginal high for the year at 0.8722.

- A degree of optimism continues to filter through to risk sentiment, bolstering recent gains for major equity benchmarks. This has provided more moderate gains for the likes of AUD, NZD and CAD. The Japanese Yen is also underperforming alongside the greenback following another volatile session. USDJPY sits in the middle of today’s 142-143.50 range and will likely be the focus for investors approaching tomorrow’s significant US inflation readings given the pair's recent volatility over data releases.

- August CPI print is expected to see similar sequential figures as those in July, with a second month of core at a ‘lower’ 0.3% M/M (0.31% in July) and headline at -0.1% M/M (-0.02%) after another drag from energy.

- Before US CPI, we have the release of UK employment data and German/Eurozone ZEW sentiment readings.

FX: Expiries for Sep13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0050(E1.3bln), $1.0100(E628mln), $1.0175(E1.0bln) USD/JPY: Y142.00($640mln)

- GBP/USD: $1.1500(Gbp647mln)

- NZD/USD: $0.6300(N$718mln)

- USD/CNY: Cny6.8500($997mln)

Late Equity Roundup: Energy Strong, IT Mixed Showing

Stock indexes drifting near the the top of session range, Energy and Information Technology sectors continue to outperform. Currently, SPX eminis trade +38.5 (0.94%) at 4123.5; DJIA +199.24 (0.62%) at 32350.21; Nasdaq +128 (1.1%) at 12240.22.

- SPX leading/lagging sectors: As noted, Energy sector outperforming (+1.57%) lead by APA Corp +4.46%, Devon Energy (DVN) +3.93% and Hess Corp (HES) +3.47%; Information Technology shares follow (+1.43%) lead by DCX Tech +4.41% and Apple (AAPL) +4.0% on strong I-phone pre-order volume, an array of hardware makers followed. Laggers: Communication Services (+0.18%) Twitter weighing -1.78%, Consumer Staples (+0.44%) and Industrials sectors (+0.52%).

- Dow Industrials Leaders/Laggers: United Health (UNH) +7.57 at 531.91, American Express (AXP) +3.55 at 161.99, Caterpillar (CAT) +2.58 at 192.07. Laggers: Amgen (AMGN) -9.40 at 238.29, Home Depot (HD) -2.78 at 296.69, Intel flat at 31.46 after reports the chip/pc maker looking to delay Mobil Eye IPO.

E-MINI S&P (Z2): Extends Gains Above The 50-Day EMA

- RES 4: 4345.75 High Aug 16 and a bull trigger

- RES 3: 4313.50 High Aug 18

- RES 2: 4234.25 High Aug 26

- RES 1: 4175.47 61.8% retracement of the Aug 16 - Sep 7 bear leg

- PRICE: 4129.25 @ 14:59 BST Sep 12

- SUP 1: 4022.50/3900.00 Low Sep 9 / Low Sep 7 and the bear trigger

- SUP 2: 3851.50 Low Jul 19

- SUP 3: 3741.75 Low Jul 14

- SUP 4: 3657.00 Low Jun 17 and a major support

The S&P E-Minis trend condition trend condition remains bearish, however, a short-term corrective cycle has unfolded following the recovery from last Wednesday’s low. Resistance at 4073.13, the 50-day EMA, has been cleared and this suggests potential for a stronger recovery towards 4175.47, a Fibonacci retracement. On the downside, a reversal lower would refocus attention on the key support and bear trigger at 3900.00.

COMMODITIES: Dollar Dip Boosts Oil, Gold

- Crude oil has tracked sideways for most of the session but early gains see a circa 1% increase to continue late week’s late recovery, helped by the lower USD, before a levy on fossil fuel companies being included in the EU’s draft energy plan plus a strategy of a mandatory cut in power demand added some volatility.

- A re-steepening of the slope in backwardation suggests early signs that crude is bottoming.

- WTI is +1.1% at $87.76 having fleetingly cleared resistance at the 20-day EMA of $89.01. More sustained upward pressure would open the 50-day EMA of $92.20.

- Brent is +1.2% at $93.96, with a clearer break of the 20-day EMA of $94.61 before retracing, but opening the 50-day EMA of $96.93 in the process.

- Gold is +0.5% at $1725.82 but also cleared the 20-day EMA of $1730 and opens the 50-day EMA of $1754.7 as bears pause for breath.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/09/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 13/09/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/09/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/09/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/09/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/09/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/09/2022 | 1230/0830 | *** |  | US | CPI |

| 13/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/09/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 13/09/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/09/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.