-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:

HIGHLIGHTS

- Persistent talk of emergency BOE rate hike weighing on short end rates

- LAGARDE: EXPECT TO HIKE FURTHER OVER THE NEXT SEVERAL MEETINGS, Bbg

- US DOESN'T SEE IRAN DEAL COMING TOGETHER SOON: NED Spox PRICE

Key links: MNI INSIGHT: Emergency Hike Out Of Character For BOE / MNI INTERVIEW: Fed May Need Unemployment To Rise To 7% - Ball /

BoE Emergency Action Talk Spurs Higher US Tsy Ylds

Tsys remain weaker - bonds extending lows through midday, as yield curves bear steepened back near last Thu's inverted highs: 2s10s +9.389 to -43.334 after 2YY made new 15Y high of 4.3450% overnight, currently 4.3147% +.1136.

- Carry-over selling in US FI this morning partially tied to London mkt pricing in chance of BOE emergency rate hike (before next BoE in Nov) in aftermath of UK gov's "Growth Plan" (ie fiscal event) and further comments from the Chancellor over the weekend that more tax cuts are to come.

- Bonds looking to test session lows after latest BOE headlines: "BOE BAILEY WON'T HESITATE TO CHANGE RATES BY AS MUCH AS NEEDED" .. "TO ASSESS POUND DROP, FISCAL PLAN AT NEXT SCHEDULED MEETING", bbg

- Limited react to Fed speak refrain on the day: Atlanta Fed Bostic virtual event:

NEED TO CONTROL INFLATION, WILL BE VOLATILE UNTIL THEN .. WE'VE STILL GOT A WAYS TO GO TO CONTROL INFLATION, Bbg. - Otherwise limited react to second tier data: CHICAGO FED AUG. NATIONAL ACTIVITY INDEX: 0.00, Consensus 0.23 from 0.29 in Jul; US SEPT. DALLAS FED MANUFACTURING INDEX AT -17.2 VS -12.9, consensus -10.

- Tsy futures remained broadly weaker/near lows after $43B 2Y note auction (91282CFN6) tails again: 4.290% high yield vs. 4.275% WI; 2.51x bid-to-cover vs. 2.49x prior.

- Currently, the 2-Yr yield is up 10.3bps at 4.3039%, 5-Yr is up 17.8bps at 4.1567%, 10-Yr is up 19.7bps at 3.8817%, and 30-Yr is up 9.6bps at 3.7018%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00614 to 3.06329% (+0.75386 total last wk)

- 1M +0.03285 to 3.11314% (+0.06643 total last wk)

- 3M +0.01243 to 3.64086% (+0.06314 total last wk) * / **

- 6M +0.04457 to 4.24586% (+0.07800 total last wk)

- 12M +0.07014 to 4.90500% (+0.16272 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.64143% on 9/22/22

- Daily Effective Fed Funds Rate: 3.08% volume: $109B

- Daily Overnight Bank Funding Rate: 3.07% volume: $295B

- Secured Overnight Financing Rate (SOFR): 2.99%, $968B

- Broad General Collateral Rate (BGCR): 2.99%, $382B

- Tri-Party General Collateral Rate (TGCR): 2.98%, $358B

- (rate, volume levels reflect prior session)

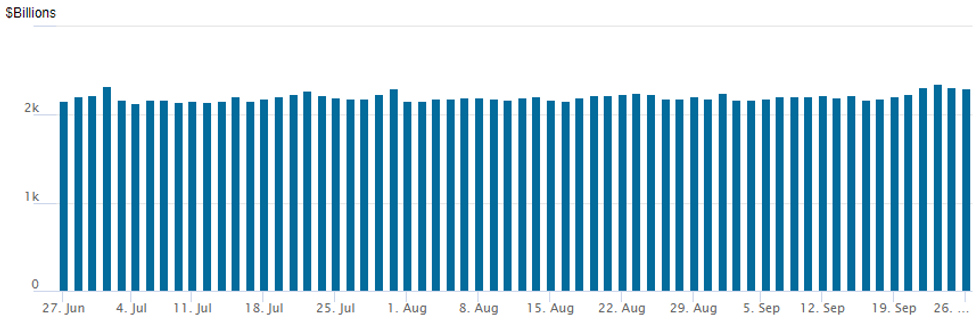

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,299.011B w/ 103 counterparties vs. $2,319.361B in the prior session.

Record high of $2,359.227B marked Thursday, September 22 - first new high since Thursday June 30: $2,329.743B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Session trade remained mixed by the close, moderate downside put buying in addition to fair amount of upside call buying from specs looking to fade the continued selling in underlying vs. pick-up in put and vol buyers amid chatter of BOE emergency rate hike after the CB hiked 50bp last Thu.- SOFR Options:

- Block, 10,000 SFRV 95.43/95.56 put spds, 4.0

- +8,000 short Mar 97.50/98.00 call spds, 2.75 ref 95.795

- 3,500 SFRZ2 96.37/96.50/96.62/96.75 put condors

- Block, 2,000 short Dec 96.75/96.87 call spds, 1.0 vs. 95.55/0.05%

- Block, 3,000 short Oct 96.25/96.75 call spds, 1.5 vs. 95.57/0.05%

- Eurodollar Options:

- 8,500 Dec 94.68/95.12 1.5x1 put spds

- 3,000 short Oct 95.00/95.50 put spds

- 2,000 Dec 95.56 calls

- Treasury Options:

- 5,000 TYX 111/112/113 put flys

- Block, 10,000 FVX2 106.75/108.75 2x1 put spds, 12

- 3,000 USX2 120/125 put spds, 55 ref 127-31

- 4,000 FVX 110/112 call spds

- Update, over 17,000 TYX2 110 puts adds to Block

- 7,000 FVZ2 110 calls, 15.5

- Block, 10,000 TYZ2 120 calls, 6 ref 111-30

- 5,000 TYZ2 117.5 calls, 15 ref 111-29.5

- 5,000 TYZ2 118 calls, 13 ref: 111-29.5

- 1,750 FVX2 105.5 puts, 17

- 4,000 FVX2 106.5 puts, 32 ref 107-05.75

- Block, 5,000 TYX2 114 calls, 31

- Block, 10,000 FVX2 106.75/108.25 2x1 put spds, 12

- Block, 5,000 FVX2 106.5 puts, 34

- Block, 5,000 TYX2 110 puts, 31

- Block, 10,000 TYX2 110/114 strangles, 58

Late Equity Roundup: Late Bounce Consumer Discretionary/Staples Lead

Stocks weaker but rebounding off session lows after the FI close, Consumer Discretionary and Consumer Staples outperforming, Dow components underperforming. Currently, SPX eminis trade -19.25 (-0.52%) at 3690; DJIA -199.22 (-0.67%) at 29391.34; Nasdaq +15.8 (0.1%) at 10883.25.

- SPX leading/lagging sectors: Consumer Discretionary (+0.56%) lead by retailing and auto maker shares, followed by Consumer Staples (+0.20%) and modest rebound in Information Technology (+0.05%). Laggers: Real Estate extends sell-off (-2.57%), Utilities (-2.37) and Energy (-1.97%) sectors continue to underperform, the latter hammered -7.26% last Fri lead by oil shares as crude levels fell (WTI -5.17 at 78.33 - appr Jan'21 lows).

- Dow Industrials Leaders/Laggers: Walmart (WMT) +1.45 at 131.51, Apple (AAPL) +1.04 at 151.47, Microsoft (MSFT) +0.71 at 238.63. Laggers: Goldman Sachs (GS) -6.0 at 295.97, Travelers (TRV) -4.68 at 150.42, Home depot (HD) -3.93 at 267.01.

E-MINI S&P (Z2): Approaching Critical Support

- RES 4: 4313.50 High Aug 18

- RES 3: 4234.25 High Aug 26

- RES 2: 4009.81/4175.00/47 50-day EMA / High Sep 13

- RES 1: 3783.25/3936.25 High Sep 23 / 20

- PRICE: 3682.0 @ 1530ET Sep 26

- SUP 1: 3660.25 Low Sep 23

- SUP 2: 3657.00 Low Jun 17 and a key M/T bear trigger

- SUP 3: 3600.00 Round number support

- SUP 4: 3558.97 1.382 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis trend conditions remain bearish following last week’s extension lower - the trend has accelerated following the break of the July support. The break lower strengthens bearish conditions and attention is on key support at 3657.00, Jun 17 low and an important medium-term bear trigger. A break would confirm a resumption of the bear trigger. On the upside, initial firm resistance has been defined at 3936.25, the Sep 20 high.

COMMODITIES: Recession Fears Dominate

- Crude oil falls circa -2.5% on dollar strength, surging yields and recession fears, despite the US not seeing the Iran deal coming together soon according to State Dept spokesman Price.

- WTI is -2.5% at $76.78 and close to session lows, eyeing support at $76.11 (1.618 proj of Jul 29 – Aug 16 – 30 price swing) in the bear trend extension.

- Most active strikes in the CLX2 at $90/bbl calls followed by $70/bbl puts.

- Brent is -2.3% at $84.16 as it tests support at $84.11 (1.5 proj of Jul 29 – Aug 17-30 price swing), with further support at $82.59 (1.618 proj of same swing).

- Gold is -1.2% at $1623.77, extending lower after its recent bear flag breakout. It next eyes $1610.5 (1 proj of the Jun 13 – Jul 21- Aug 10 price swing).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/09/2022 | 0600/0800 | ** |  | SE | PPI |

| 27/09/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/09/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/09/2022 | 1015/0615 |  | US | Chicago Fed's Charles Evans | |

| 27/09/2022 | 1100/1200 |  | UK | BOE Pill Panels CEPR Barclays Monetary Policy forum | |

| 27/09/2022 | 1130/1330 |  | EU | ECB Lagarde in Panel at Banque de France | |

| 27/09/2022 | 1130/0730 |  | US | Fed Chair Jerome Powell | |

| 27/09/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/09/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/09/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/09/2022 | 1300/1500 |  | EU | ECB de Guindos Speaks at Barclays-CEPR Forum | |

| 27/09/2022 | 1355/0955 |  | US | St. Louis Fed's James Bullard | |

| 27/09/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 27/09/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/09/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.