-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA MARKETS ANALYSIS: BOE Buy Program, FI, Risk Rally

HIGHLIGHTS

- BOE POSTPONES GILT SALES

- UK PM LIZ TRUSS IS STANDING BY KWASI KWARTENG

- ECB’S KAZAKS SAYS NEXT HIKE MUST BE BIG, SMALLER STEPS AFTER, Bbg

- Hurricane Ian makes landfall in Florida, NYT

US TSYS: Tsys Finish Near Highs, BoE Surprise Bond Buy Program

Tsys finish broadly higher/near highs, curves reversed early steepening to bull flattening after the BoE annc'd a surprise temporary bond buying commitment (GBP5B, over 20Y maturity) ahead the NY open.- The vast majority of the GBP1.025bln in offers accepted by the BoE were made up of two Gilts: 1.25% Jul-51 (GBP670.1mln) and 3.75% Jul-52 (GBP157.7mln). Going forward the BoE will hold daily operations from 14:15-14:45 UK time until 14 Oct. Size is set at the same GBP5bln for future auctions although the BOE "retains the discretion to alter any of the terms at any time"

- Still off pre-BOE tax cut annc levels w/ 30YY currently at 3.6763 (-.1491) Yield curves initially bull steepened to new highs (2s10s -23.62) before reversing and snapping flatter (2s10s -4.681 to -39.084 after the bell).

- Any reaction to Inventories data (and multiple Fed speakers on the session, for that matter) were lost in the shuffle: August reading of the Advance Goods Trade Balance -$87.3B vs. -89.0B est, preliminary August reading of Wholesale Inventories is +1.3% MoM vs. +0.4$ est.

- Tsys holding near highs after $36B 7Y note auction (91282CFL0) stops through: 3.898% high yield vs. 3.905% WI; 2.57x bid-to-cover vs. 2.65x last month.

- The 2-Yr yield is down 19.9bps at 4.0836%, 5-Yr is down 26.4bps at 3.9202%, 10-Yr is down 24bps at 3.7052%, and 30-Yr is down 14.7bps at 3.6781%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00000 to 3.06400% (-0.00543/wk)

- 1M -0.00528 to 3.11529% (+0.02500/wk)

- 3M +0.03228 to 3.67414% (+0.04571/wk) * / **

- 6M -0.03828 to 4.16986% (-0.03143wk)

- 12M -0.07571 to 4.77600% (-0.05886/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.64186% on 9/27/22

- Daily Effective Fed Funds Rate: 3.08% volume: $111B

- Daily Overnight Bank Funding Rate: 3.07% volume: $279B

- Secured Overnight Financing Rate (SOFR): 2.98%, $949B

- Broad General Collateral Rate (BGCR): 2.98%, $376B

- Tri-Party General Collateral Rate (TGCR): 2.98%, $352B

- (rate, volume levels reflect prior session)

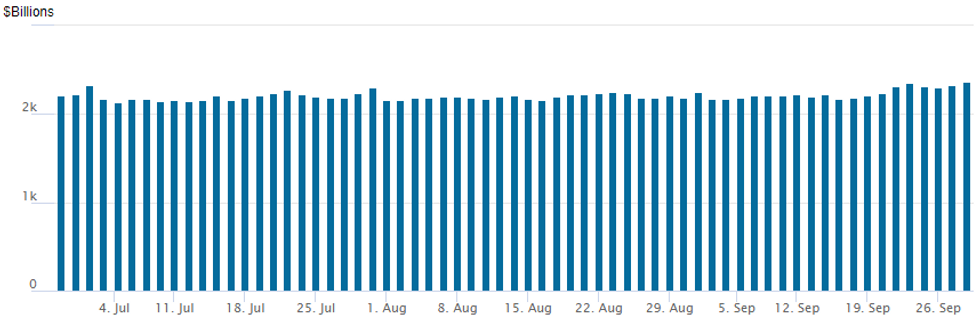

FED Reverse Repo Operation: New Record High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new record high of $2,366.798B w/ 101 counterparties vs. $2,327.111B in the prior session. Surpasses last week's record high of $2,359.227B marked Thursday, September 22.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Theme of the day: Taking profits by accts that had sold a wide array of puts/put spds anticipating some measure of a rebound in the underlying on hopes the BoE would take action to calm markets following last Fri's tax cut plan. Multiple unwinds in 10- and 30Y spreads, upside call buying on the day. Salient trade:- SOFR Options:

- Block, 10,000 SFRH3

- Block, 5,000 SFRZ2 96.00/96.25 call spds, 4.25

- +35,000 SFRZ2 95.87/96.00 call spds, 3.5 vs. 95.71/0.10%

- Block, 4,000 short Dec SOFR 97.75 calls, 1.5 ref 95.795

- Block, 5,000 SFRZ2 95.56/95.68 put spds, 4.5

- Blocks, 27,000 SFRF3 96.37/96.62 call spds, 3.0-3.5

- Block, 4,250 SFRZ3 94.00 puts, 23.5

- 6,500 SFRZ2 96.37 calls, 4.5

- Blocks, 30,000 SFRX2 96.12/96.50 call spds, 2.5 - >15k more on screen

- Eurodollar Options:

- Blocks total 20,000 Dec 95.12/95.25/95.5/96.0 broken put condors, 36.5

- +2,500 Dec 94.75/96.00 strangles, 9.0

- 6,500 short Dec 97.37/98.00 call spds, ref 95.52

- Treasury Options:

- +10,000 TYX 110.5 puts, 34

- 10,000 TYX2 108.75 puts, 16

- +20,000 (10k Blocked) TYX 109/110 put spds, 13 vs 111-30, unwind

- +17,500 USZ 120/122 put spds, 13-17, cover sale at 38 on Tue

- Block, 5,000 TYX2 109 puts, 38 ref 110-27.5

- 10,000 TYX2 112.5 calls, 52 ref 111-17

- 10,000 wk1 TY 109/110 put spds, 13

- 4,500 FVX2 106 puts, 28

- Block, 10,000 TYX2 112.5 calls, 45 ref 111-07.5

- Block/screed, >53,000 FVX2 106.75 puts, 35.5-50.5

- Block, 2,500 FVX2 106.5 puts, 43

EGBs-GILTS CASH CLOSE: 30Y UK Yield Falls 100bp As BoE Steps In

Gilts had a historic rally Wednesday after the BoE stepped in to the ongoing sell-off and re-launched bond purchases (if only temporarily) in order to quell market volatility.

- While yields across the UK curve fell, the 30Y dropped 106bp on the session, trading in a range of 3.874% - 5.142% (the latter a post-1998 high).

- The BoE emergency purchase operation itself was rather underwhelming, with the Bank accepting just over GBP1bln of the GBP5bln potential size - operations continue Thursday, to Oct 14.

- But overall, bond markets calmed down considerably, helping German yields fall across the curve as well, with the short-end strongest despite a parade of ECB speakers discussing a 75bp hike in October and eyeing getting to neutral by end-year.

- The relief rally helped BTPs turn it around today as well: 10Y spreads came off a post-Apr 2020 wide of 258bp to trade just below 241bp at the close.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 12.7bps at 1.856%, 5-Yr is down 14.2bps at 2.028%, 10-Yr is down 11.1bps at 2.12%, and 30-Yr is down 7.5bps at 2.017%.

- UK: The 2-Yr yield is down 35.4bps at 4.293%, 5-Yr is down 40.7bps at 4.292%, 10-Yr is down 49.4bps at 4.012%, and 30-Yr is down 105.6bps at 3.932%.

- Italian BTP spread down 11.7bps at 240.9bps / Spanish down 2.4bps at 118bps

Late Equity Roundup, Energy Shares Power Higher

Stock indexes extending gains after the FI close, SPX lead by Energy shares in-line w/ bounce in Crude (WTI +3.62 at 82.12). Early bounce for equities triggered by BOE move to calm markets by buying longer Gilts. Currently, DJIA up 612.29 points (2.1%) at 29747.77, S&P E-Mini Future up 80.75 points (2.21%) at 3741.75, Nasdaq up 242.1 points (2.2%) at 11071.83.

- SPX leading/lagging sectors: Energy sector (+4.30%) gains after heavy selling last few sessions as crude trades higher: Marathon Petro (MPC) +6.94%, Valero (VLA) +6.76%, Devon Energy (DVN) +5.86%. Communication Services up next (+3.41%) w/media/entertainment outpacing telecom services. Laggers: Information Technology (+1.07%) w/hardware makers underperforming, weighing on software and semiconductor names. Utilities (+1.38%) and Consumer Staples (+1.40%) up next.

- Dow Industrials Leaders/Laggers: Carry-over bid for Home Depot (HD) +13.26 at 281.95, Goldman Sachs (GS) +9.94 at 301.32, United Health (UNH) +6.27 at 514.64 and Boeing (BA) +5.68 at 133.19. Laggers: Apple (AAPL) -2.08 at 149.71 as they tone down IPhone production on softer demand, Intel (INTC) +0.14 at 27.03, Procter Gamble (PG) +0.34 atg 132.32.

E-MINI S&P (Z2): Short-Term Gains Considered Corrective

- RES 4: 4313.50 High Aug 18

- RES 3: 4234.25 High Aug 26

- RES 2: 3983.16/4175.00 50-day EMA / High Sep 13

- RES 1: 3783.25/3936.25 High Sep 23 / 20

- PRICE: 3710.00 @ 1230ET Sep 28

- SUP 1: 3600.00 Round number support

- SUP 2: 3558.97 1.382 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 3: 3506.38 1.50 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 4: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis trend conditions remain bearish following last week’s extension lower and the bearish follow through this week. The move strengthens bearish conditions and attention is on key support at 3657.00, Jun 17 low. This support has been pierced. A clear break would confirm a resumption of the broader downtrend and opens 3600.00 next. Initial firm resistance is at 3936.25, Sep 20 high. Short-term gains are considered corrective.

COMMODITIES: Oil Surges From A Host Of Factors

- Crude oil has jumped 3-4% today with the USD weakening and yields sliding, the EU establishing legal foundation for a Russian oil price cap and EIA crude and product inventories falling contrary to expectations of an increase. There was an additional boost from further Gulf production shut ins in with the intensification of Hurricane Ian, further driving outperformance of WTI to Brent.

- WTI is +4.2% at $81.80, clearing resistance at $80.89 (Sep 8 low) and opening the 20-day EMA of $84.17 in a sharp unwinding of recent bearish conditions.

- Brent is +3.3% at $89.12, moving closer to resistance at the 20-day EMA of $90.88.

- Gold is +1.9% at $1659.72 having cleared resistance at $1654 (Sep 21 low) and next opening firm resistance at $1688.0 (Sep 21 high).

- European gas prices have jumped particularly strongly (TTF 11%, NBP 26%) following sabotaging of Nord Stream pipelines. Late on, an EU report on gas seen by Bloomberg noted lowering gas prices requires a combination of measures, with reduction of demand necessary.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/09/2022 | 0700/0900 |  | EU | ECB Panetta Intro at ECOFIN Hearing | |

| 29/09/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/09/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 29/09/2022 | 0800/1000 |  | EU | ECB de Guindos Speech at BIS/Bank of Lithuania | |

| 29/09/2022 | 0800/1000 |  | IT | PPI | |

| 29/09/2022 | 0815/1015 |  | EU | ECB Elderson Speech at Nederlandsche Bank & OMFIF | |

| 29/09/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/09/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/09/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 29/09/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 29/09/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 29/09/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 29/09/2022 | 0930/1130 |  | EU | ECB de Guindos Opens ECB Research Workshop | |

| 29/09/2022 | 1130/1230 |  | UK | BOE Ramsden Panels Lithuania CB/BIS Conference | |

| 29/09/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 29/09/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/09/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 29/09/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 29/09/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 29/09/2022 | 1330/0930 |  | US | St. Louis Fed's James Bullard | |

| 29/09/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 29/09/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 29/09/2022 | 1500/1600 |  | UK | BOE Tenreyro Panellist at Centre for Economic Policy Research | |

| 29/09/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/09/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/09/2022 | 1700/1300 |  | US | Cleveland Fed's Loretta Mester | |

| 29/09/2022 | 1700/1900 |  | EU | ECB Lane Panels ECB/Cleveland Fed Conference | |

| 29/09/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

| 29/09/2022 | 2045/1645 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.