-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS: Strong Data Green Lights More Hikes

HIGHLIGHTS

- SF FED DALY: DECEMBER DOT PLOT GOOD INDICATOR WHERE RATES HEADED, Bbg

- SF FED DALY: I'M PREPARED TO DO MORE THAN THAT IF MORE IS NEEDED, Bbg

- US-CHINA: ABC-Blinken Visit To China Postponed Over 'Spy' Balloon

- UKRAINE: VdL-No Rigid Timelines For Ukraine EU Accession, Still Goals To Be Met

- EU AGREES TO IMPOSE $100 PRICE CAP ON RUSSIAN DIESEL EXPORTS, Bbg

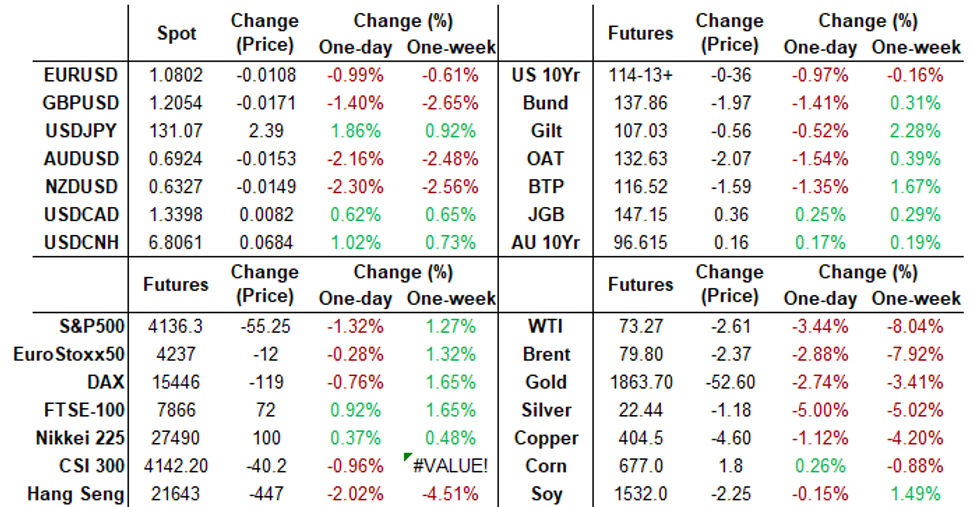

US TSYS: FED Remains in Play Post-NFP/ISM Data

Off lows, Tsy futures remain broadly weaker after this morning's surge in job gains for January of +517k, 2.75x larger than the mean estimate of 188k (and well over 320k high estimate survey of 77 economists by Bbg). Tsy 30YY at 3.6288% +.0840, yield curves extend inversion: 2s10s -6.590 at -78.151%).

- Unemployment rate sank a tenth to 3.4%, the lowest since 1969, the Bureau of Labor Statistics reported Friday. November and December payrolls figures were also revised 71,000 higher.

- Meanwhile, ISM services was far stronger than expected in January at 55.2 (cons 50.5), back at the 55.5 in Nov via December's 49.2. The largest increase since Jun'20 followed the largest downward surprise since 2008.

- Short end rates gapped lower as markets reverted back to more (possibly larger) rate hikes ahead - but moderated somewhat in the second half. Fed funds implied hike for Mar'23 at 22.5bp (vs. 23.3bp post-ISM), May'23 cumulative 37.5bp to 4.957%, Jun'23 41.5bp to 4.997%, terminal climbs to 4.980% in Jun'23.

- Goldman Sachs' chief economist Jan Hatzius tweeted “this morning’s report provides strong evidence of continued economic expansion in January. We continue to expect two more 25bp fed funds rate hikes in March and May, and we continue to expect no rate cuts in 2023."

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00614 to 4.55271% (+0.24800/wk)

- 1M -0.00814 to 4.57186% (-0.00701/wk)

- 3M +0.02800 to 4.83414% (+0.00885/wk)*/**

- 6M -0.00243 to 5.05743% (-0.04486/wk)

- 12M -0.02872 to 5.25114% (-0.06500/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.83414% on 2/2/23

- Daily Effective Fed Funds Rate: 4.58% volume: $99B

- Daily Overnight Bank Funding Rate: 4.57% volume: $282B

- Secured Overnight Financing Rate (SOFR): 4.56%, $1.290T

- Broad General Collateral Rate (BGCR): 4.52%, $489B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $468B

- (rate, volume levels reflect prior session)

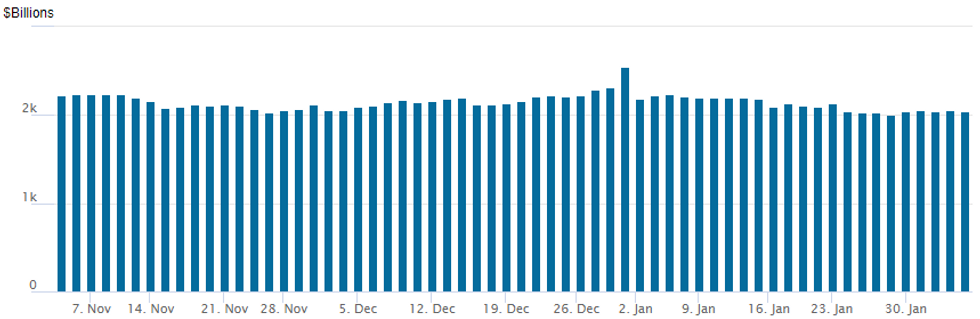

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,041.217B w/ 103 counterparties vs. prior session's $2,050.063B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better put volumes on net reported Friday as SOFR and Treasury futures repriced increased rate hike expectations after the jump in January job gains of +517k, 2.75x larger than the mean estimate of 188k, and far stronger than expected ISM services 55.2 (cons 50.5). Salient trade includes:- SOFR OPTIONS:

- Block, 15,000 OQM3 95.43 puts, 5.5 ref 96.43

- Block, 20,000 OQM3 95.50 puts, 5.5-6.0 ref 96.435

- Block/screen -18,000 SFRU3 95.00/95.50/96.00 call flys, 11.5

- Block, 5,000 SFRU3 94.25/94.50 put spds

- over 5,500 SFRG3 95.06 puts, cab

- Block, 5,000 SFRM3 94.62/94.75 put spds, 1.25 ref 95.03

- Block, 7,500 SFRK3 94.75/94.87 put spds, 1.5 ref 95.045

- +10,000 SFRZ3 95.50/97.50 call spds, 33.5-34.0 ref 95.545

- 3,000 OQH3 95.50/95.62/95.87 broken put trees, ref 96.02 to -.025

- Block, 7,500 OQH3 95.62/95.87 put spds, 3.5-4.0

- 12,200 SFRJ3 95.00/95.06/95.12 put flys, 0.5 ref 95.13

- Block, 4,000 SFRZ3 96.25/96.62 put spds, 6.5 ref 95.695

- Block, 2,500 OQM3 96.12 puts, 12.0 vs. 96.665 vs. 96.665/0.24%

- Block, 5,000 SFRZ3 97.00/97.50 call spds, 2.0 vs. 95.63/0.05%

- Block, 6,000 OQM3 96.00/96.25/96.50 put trees, .25 net, 2-legs over ref 96.665

- Treasury Options:

- 4,000 TYH3/TYJ3 119 call calendar spds, 7

- 4,000 TUH2 102.75 puts, 13 ref 102-22.25

- 5,000 FVJ3 108.5/109.75 put spds ref 109-25

- +2,000 TYH3 114.5 straddles 128

- Update, over 26,500 TYH3 114 puts, 27 last ref 114-22 vs. 14 earlier ref 115-16

- 4,000 USH3 124/126 put spds, 7 ref 130-13

- over 8,700 TYH3 114.75 puts, 28 ref 115-16.5

- over 5,000 wk1 TY 114.75/115.25 put spds, 10 ref 115-15.5 to -16

- 4,800 TUH3 102.5/102.75 put spds, ref 103-01

FOREX: USD Index Trades To Three-Week High On Above-Estimate US Data

- A combination of a punchy non-farms payroll print and above expectation ISM services in the US have sparked renewed demand for the greenback on Friday, with the USD index climbing to three-week highs and showing no signs of retreating approaching the close.

- Antipodeans are leading declines in G10FX amid a sharp reversal lower for crude futures. Both AUD and NZD have slipped over 2%, with Japanese Yen weakness following closely behind.

- The impressive near-300 pip bounce for USDJPY now places the focus for bulls on clearance of 131.58 which would be a positive development and signal a short-term reversal.

- For AUDUSD, short-term support at 0.6984, the Jan 31 low, has been broken which brings an important technical area into play around 0.6872, the low on Jan 19 and the 50-day exponential moving average.

- Higher US yields have particularly impacted several emerging market currencies. The most notable laggard is the South African rand, however LatAm FX has also been heavily bearing the brunt of the turn in sentiment. USDMXN, after making a new four-year low on Thursday, has no bounced the best part of 2.5% with 18.50 firmly capping the peso strength in 2023.

- No tier-one data releases on Monday, however, Tuesday will bring the RBA rate decision and later that day, Fed Chair Powell is due to participate in a moderated discussion at the Economic Club of Washington.

Expiries for Feb06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E623mln), $1.0875-80(E1.0bln), $1.0900(E745mln)

- USD/JPY: Y130.25-50($1.5bln), Y131.00($1.1bln)

- AUD/USD: $0.6940($1.4bln)

- USD/CAD: C$1.3350($545mln), C$1.3500($690mln)

- USD/CNY: Cny6.7500($500mln)

Late Equity Roundup: Early Support Evaporates Ahead Weekend

Major indexes have been scaling off midday highs, trade moderately weaker going into the FI close. More a lack of support than the presence of heavy sell interest has SPX eminis currently trading -54.25 (-1.29%) at 4137.5; DJIA -224.64 (-0.66%) at 33828.21; Nasdaq -222.5 (-1.8%) at 11977.48.

- SPX leading/lagging sectors: Energy sector outperforming at steady on the day, equipment & services leading O&G consumables (SLB +1.18%, XOM +0.75%, FANG +0.85%). Health Care (-0.35% and Financials (-0.40%) edge past Information Technology (-0.75%), bio-tech and pharmaceuticals buoying the former (REGN +4.57%, GILD +3.87%, LLY +2.15%, BMY +1.66%). Banks lead latter (MTB +1.46%, JPM +1.32%, BAC +0.70%).

- Laggers: Consumer Discretionary (-3.03%) weighed by internet/direct retailing names (AMZN -7.8%, EBAY -1.80%), Real Estate (-2.68%) and Communication Serrices (-2.42%) follow.

- Dow Industrials Leaders/Laggers: American Express (AXP) +4.42 at 177.55, Apple (AAPL) +5.35 at 155.17, Caterpillar (CAT) +3.07 at 247.97. Laggers: Home Depot (HD) -8.13 at 331.66, Microsoft (MSFT) -6.40 at 258.20, Honeywell (HON) -4.37 at 203.01.

E-MINI S&P (H3): Uptrend Remains Intact

- RES 4: 4361.00 High Aug 16

- RES 3: 4300.00 Round number resistance

- RES 2: 4250.00 High Aug 26, 2022

- RES 1: 4208.50 High Feb 2

- PRICE: 4137.25 @ 1515ET Feb 3

- SUP 1: 4007.50/3969.70 Low Jan 31 / 50-day EMA

- SUP 2: 3901.75 Low Jan 19

- SUP 3: 3788.50 Low Dec 22 and a key support

- SUP 4: 3735.00 Low Nov 3

S&P E-Minis have traded higher this week and in the process cleared recent highs to confirm a resumption of the current bull cycle that started Dec 22. A key resistance and a bull trigger at 4180.00, the Dec 13 high, has also been pierced. A clear break of this level would confirm a resumption of a broader uptrend and open 4250.00, the Aug 26 2022 high. Initial firm support lies at 4007.50, the Jan 31 low. Today’s pullback is considered corrective.

COMMODITIES: Higher Dollar And Yields Take The Axe To Commodities

- Crude oil ends the session lower, having caught a rally off the back of a bumper US payrolls report which it failed to hold ahead of end-of-week positioning as the dollar continued to strengthen and Treasury yields cranked higher with rate expectations.

- The EU backed the $100 price cap for Russian diesel as an import ban looms, whilst supporting a $45 cap for other fuels including some naphtha.

- WTI is -3.0% at $73.55, through support at $74.97 (Feb 2 low) to open $72.74 (Jan 5 low). Continued downward momentum could open the bear trigger at $70.56 (Dec 9 low).

- Brent is -2.7% at $79.97, through support at $80.42 (76.4% retrace of Jan 5-23 rally) to open $77.77 (Jan 5 low).

- Gold slumps -2.5% to $1865.05, tumbling through multiple support levels including the 20-day EMA at $1907.4 and $1867.2 (Jan 11 low) to next eye the 50-day EMA at $1852.6.

- Weekly moves: -7.7%, Brent -7.7%, Gold -3.3%, US nat gas -22%, EU TTF nat gas +4.4%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/02/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 06/02/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/02/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/02/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/02/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/02/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 06/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.