-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Italy Aims At NGEU Wriggle Room Over 2026 Deadline

MNI UK Inflation Preview: December 2024

MNI POLITICAL RISK - First Trump Nominee Faces Senate Scrutiny

MNI US MARKETS ANALYSIS - Recovery for Equities Weighs on USD

MNI INTERVIEW: Fed Model Suggests Wage Growth Normalizing Soon

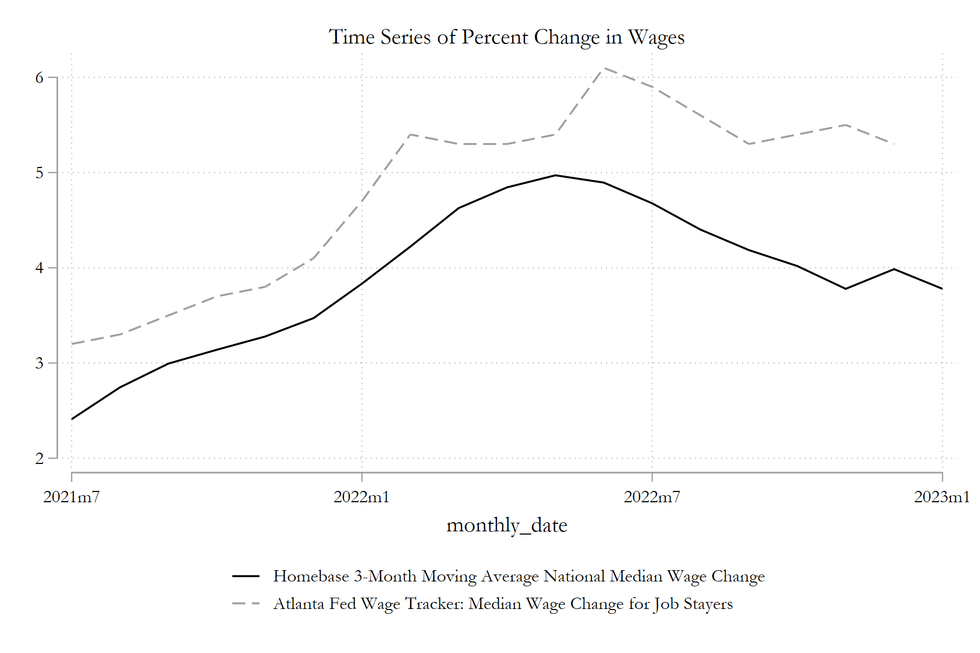

High frequency U.S. pay data collected by Homebase shows "promising" signs of slowing through the first month of the year and suggests wage growth could cool to pre-Covid levels by early next year, Federal Reserve Bank of St. Louis economist Max Dvorkin told MNI Friday.

Tracking the same worker over time using the Homebase payroll software, Dvorkin found the median wage increase in January declined to 3.8% from around 4.4% in 2022. There's no comparable figure for earlier periods due to data limitations. However, a trimmed mean of wage changes over a four-week period also show the typical seasonal spike in wage growth is 1 to 2 percentage points lower this January compared to last year, Dvorkin said.

"If you worry about inflation and where it’s going, these are very promising figures," he said. "Since the second quarter of 2022, wages increases have been slowing, and if this continue we’ll be able to see something that resembles the kinds of increases seen before the pandemic early next year or late this year."

The Homebase data add to other evidence that wage inflation is moderating even as the labor market remains extraordinarily tight. (See: MNI INTERVIEW: Atlanta Fed Wage Tracker Shows Wage Growth Peaked)

Hiring blew past analyst expectations in January with U.S. employers adding 517,000 jobs and the unemployment rate hitting a fresh 50-year low of 3.4%, the Labor Department reported Friday. Even so, average hourly earnings decelerated by a tenth, lowering the year-on-year increase to 4.4% from a peak of 5.9% last March.

BROADER PATTERN

ADP, another private payroll service company, said pay growth for job stayers held at 7.3% in January, down from 7.7% in mid-2022.

The trimmed mean measure of wage changes for the 800,000 or so workers in the Homebase system dipped to 5.8% in 2022 from 6.2% in 2021, but was still much higher than the 3.6% rate seen in 2019. Average measures of wage increases are typically subject to distortions from shifts in the composition of workers, Dvorkin noted. Still, the Homebase data are showing the same patterns visible in other wage growth measures.

"The Fed is increasing rates and trying to cool down the economy and it seems to be working in terms of inflation. Yet the labor market is not suffering all that much," Dvorkin said, noting the breakdown in the tradeoff between inflation and unemployment presents a puzzle for economists.

"Employers are still trying to attract people and retain them, and that’s still translating to wage increases. The battle against inflation is not over. But the new data continue to arrive pointing in the right direction." (See MNI INTERVIEW: US Labor Market Could Have Soft Landing-Paychex)

Source: St. Louis Fed

Source: St. Louis Fed

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.