MNI ASIA MARKETS ANALYSIS: Anti Coercion Bill Talk Buoys US$

HIGHLIGHTS

- Treasuries gravitated higher early Friday amid cautiously placative Fed speak, NY Fed Williams still sees policy as "modestly restrictive" amid uncertainty.

- Curves twisted steeper as bonds reverse course/extend lows after Pres Trump spoke on a host of topics including April 2 "Liberation Day" when reciprocal tariffs will bring money back to the US.

- As such, projected rate cuts through mid-2025 have gained vs. morning levels (*) as follows: May'25 at -5.2bp, Jun'25 at -21.2bp (-20.5bp), Jul'25 at -33.5bp (-31.5bp), Sep'25 -50.2bp (-47.8bp).

- Treasury futures remain mixed after the bell, curves twist steeper after bonds reversed course/extended lows after Pres Trump spoke on a host of topics including April 2 "Liberation Day" when reciprocal tariffs will bring money back to the US.

- Tsy 5s30s nears 60.0 (+5.147 at 59.336) the steepest since late September.

- Jun'25 10Y futures holding steady at 111-05.5, well within technicals: resistance above at 111-25 (High Mar 11), initial support below at 110-19 (20-day EMA).

- Bbg US$ index extended session high (1271.61) on headlines France wants the EU to consider deploying "anti-coercion .. tool: designed to strike back against nations that use trade and economic measures coercively".

- Meanwhile, stocks are paring losses, Super Micro Computer +5.68% and Boeing +4.46% leading gainers, BA surge after Trump said the plain maker won a $20B contract to produce next generation jet fighter.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00092 to 4.32011 (+0.00371/wk)

- 3M -0.00501 to 4.29783 (+0.00278/wk)

- 6M -0.03057 to 4.20466 (+0.00629/wk)

- 12M -0.06551 to 4.02338 (+0.00554/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.29% (+0.02), volume: $2.438T

- Broad General Collateral Rate (BGCR): 4.28% (+0.00), volume: $954B

- Tri-Party General Collateral Rate (TCR): 4.28% (+0.00), volume: $932B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $109B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $300B

FED Reverse Repo Operation

RRP usage rises to $200.850B this afternoon from $192.640B Thursday. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 42.

US SOFR/TREASURY OPTION SUMMARY

SOFR options tended toward low delta calls Friday while Treasury options were more mixed on much better volumes amid continued positioning/position squaring ahead today's April expiration. Underlying futures modestly bid, upper half of narrow range w/ TYM5 at 111-08.5 (+3), curves steeper wi the 5s30s climbing to 59.686 - steepest since late September. As such, projected rate cuts through mid-2025 have gained vs. morning levels (*) as follows: May'25 at -5.2bp, Jun'25 at -21.2bp (-20.5bp), Jul'25 at -33.5bp (-31.5bp), Sep'25 -50.2bp (-47.8bp).

SOFR Options:

2,800 SFRN5 95.56/95.62/95.68 put flys ref 96.18

+4,000 SFRM5 95.75/95.87 2x1 put spds 3.25

2,000 SFRK5 95.87/95.93/96.00/96.12 broken call condors ref 95.925

3,000 SFRK5 95.75/95.81/95.87/95.93 call condors ref 95.915 to -.92

+4,000 SFRK5 96.00/96.50 call spds, 5.0 ref 95.92

6,000 SFRU5 97.00 calls, 6.0 last

1,500 SFRU5 96.50/96.75 call spds

4,000 SFRZ5 97.50 calls ref 96.33

1,000 0QM5 96.00/96.25 put spds vs. 96.75/97.00 call spds ref 96.51

1,000 SFRK5 95.81/95.93/96.00/96.12 call condors ref 95.91

2,100 SFRJ5 96.00 calls ref 95.90

Treasury Options: Aoril serial options expire today

Update on May structures: closer to 20,000 TYK5 111.5/112.5/113 1x3x2 broken put AND call flys ref 111-02 to -03.5

7,000 TYK5 105.5/107 2x1 put spds ref 111-03

-10,000 wk4 TY 112.5 calls, 2 vs. 111-04.5

+5,000 wk4 TU 103.75 calls, 3 vs. 103-19.6

Block: 10,000 TYK5 112.5/114 call spds vs. TYM5 112/113.5 call spd, 10 net/Jun over ref 111-08

over 8,000 TYK5 113 calls, 18-20 ref 111-08

5,000 TYJ5 111.25/111.5 1x3 call spds vs. 111 put ref 111-07

appr 4,000 FVJ5 108 straddles

over 3,400 FVJ5 108.25 calls

MNI BONDS: EGBs-GILTS CASH CLOSE: Steeper With Gilts Underperforming

The UK and German curves steepened Friday, with Gilts underperforming Bunds.

- Core FI was a little stronger in early trade, with US equities leading a global stock retreat. Stocks would bounce in mid-afternoon Europe trade, pulling Bunds and Gilts back from the session's best levels.

- In a session with little headline/macro data flow, attention was paid to further trans-Atlantic trade tension (Bloomberg reported France's push for strong EU retaliatory tariffs on the US), which saw a fleeting bounce in Bunds/Gilts that faded into the cash close.

- Bunds saw little reaction to the Bundesrat passing incoming Chancellor Merz's fiscal package, as this was was widely expected.

- The German curve twist steepened on the day, with the UK's bear steepening, with some anticipation ahead of next week's Spring budget statement/Gilt remit.

- Nonetheless, for the week, the German curve bull flattened (2s10s -5.8bp) with the UK's bear flattening (2s10s -3.7bp).

- Periphery/semi-core EGB spreads closed mostly tighter to Bunds on the day.

- Next week's calendar highlights include preliminary PMIs, UK and Eurozone inflation data, and the UK government's Spring budget statement/Gilt remit.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.9bps at 2.132%, 5-Yr is down 3.2bps at 2.404%, 10-Yr is down 1.5bps at 2.765%, and 30-Yr is up 0.9bps at 3.103%.

- UK: The 2-Yr yield is up 2.6bps at 4.265%, 5-Yr is up 3.3bps at 4.346%, 10-Yr is up 6.6bps at 4.712%, and 30-Yr is up 9.4bps at 5.31%.

- Italian BTP spread down 1.2bps at 111.5bps / Spanish down 0.3bps at 64.2bps

MNI EGB OPTIONS: Call Spreads / Condor Buying In European Rates To Close The Week

Friday's Europe rates/bond options flow included:

- 2RJ5 97.75/97.875 call spread vs 97.3125 put, paper pays 3.25 for the call spread on 10k

- 0RJ5 98.00/98.125 call spread, bought for 3.25 on 5k

- SFIK5 95.70/95.85/96.00/96.15 call condor, paper pays 7.75 on +5k

- SFIZ5 96.20/96.30 call spread vs 95.75/95.65 put spread, paper pays 0.75-1.00 on 6k

MNI FOREX: USD Index Gains for Third Straight Session

- Early weakness for both European and US stock indices on Friday was enough to boost the greenback, culminating in a 0.22% rise for the USD Index, its third consecutive session of gains. The shaky risk appetite has weighed on the likes of AUD and NZD, while GBP has also suffered, however, it is worth noting that daily adjustments/ranges have remained relatively contained owing to a lack of major news developments.

- For AUDUSD (-0.46%), we have noted that 0.6400 continues to provide important pivot resistance, and the resumption of weakness since Tuesday (four consecutive losing sessions) highlights the medium-term bearish technical outlook. Price action was supported by the weaker-than-expected Australian jobs data earlier in the week, and AUDUSD has today tested the initial support level for the pair at 0.6259, the Mar 11 low. Below here, key short-term support remains at 0.6187.

- Cable’s inability to post a weekly close above the psychological 1.3000 mark may leave the pair vulnerable to a deeper technical correction, a dynamic that may be exacerbated as we approach the Spring statement on March 26. Firm support remains much lower at 1.2705.

- EURUSD continues to trade below its recent highs, consolidating a short-term correction seen during the latter part of this week, currently trading ~1.0820. . Initial key support to watch remains much further down at 1.0609, the 50-day EMA. The uptrend is overbought, and the pullback is allowing this set-up to unwind.

- The Eurozone week ahead is headlined by the March flash PMIs, which will be a key barometer of activity levels ahead of the ECB's April 17 decision. In the UK, CPI data and the Spring Statement are highlights. The Norges Bank decision crosses Thursday.

MNI FX OPTIONS: Expiries for Mar24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0775(E706mln), $1.0800(771mln), $1.0850-60(E1.3bln), $1.0925(E1.1bln)

- USD/JPY: Y148.40-50($701mln), Y149.00-20($1.5bln)

MNI US STOCKS: Late Equities Roundup: Triple Witching, Well Off Early Lows

- Major US indexes have see-sawed off early session lows Friday into the first triple witching expiration of 2025. In light of Pres Trump's reciprocal tariff "Liberation Day" that starts April 2, the bounce off lows was more position squaring related ahead of the weekend than going long risk as global trade remains uncertain.

- Currently, the DJIA trades down 83.96 points (-0.2%) at 41870.24, S&P E-Minis down 17.25 points (-0.3%) at 5696, Nasdaq down 9 points (-0.1%) at 17683.24.

- Communication Services and Consumer Discretionary sectors helped lead the rebound in the second half, interactive media and entertainment supported the former: Meta Platforms +1.50%, Fox Corp +1.17% and Electronic Arts +1.02%.

- Tesla +4.47%, Norwegian Cruise Line Holdings +1.94%, Deckers Outdoor +1.77% and Ulta Beauty +1.45% led second half gainers in the Discretionary sector.

- Materials and Energy sectors underperformed in late trade. Weighing on the former: Nucor -5.84%, Steel Dynamics -2.87% and Amcor -2.52% while Texas Pacific Land -6.79%, Phillips 66 -2.56% and Valero Energy -2.17% weighed on the Energy sector.

- Other notable laggers: FedEx Corp -6.17% after missing earnings, while NIKE Inc -5.47% and Lennar Corp -4.05% despite beating expectations.

MNI EQUITY TECHS: E-MINI S&P: (M5) Trend Needle Points South

- RES 4: 5937.64 50-day EMA

- RES 3: 5864.25 Low Jan 13 and a recent breakout level

- RES 2: 5810.56 20-day EMA

- RES 1: 5770.50 High Mar 19

- PRICE: 5698.00 @ 1338 ET Mar 21

- SUP 1: 5559.75 Low Mar 13 and the bear trigger

- SUP 2: 5483.50 2.00 proj of the Dec 6 ‘24 - Jan 13 - Feb 19 swing

- SUP 3: 5396.00 2.236 proj of the Dec 6 ‘24 - Jan 13 - Feb 19 swing

- SUP 4: 5341.87 2.382 proj of the Dec 6 ‘24 - Jan 13 - Feb 19 swing

The trend condition in S&P E-Minis is bearish and the latest recovery appears corrective. Moving average studies are unchanged and remain in a bear-mode set-up, highlighting a dominant downtrend. Sights are on 5483.50, a Fibonacci projection. Note that the short-term trend condition is oversold. Recent gains are allowing this set-up to unwind. Firm resistance to watch is 5937.64, the 50-day EMA. The bear trigger is 5559.75, the Mar 13 low.

MNI GOLD: Sharp Pullback Towards $3,000/oz; Uptrend Still Intact

Sharp pullback in gold spot gold prices over the last 30 minutes, now -1.5% on the session and re-approaching the $3000/oz mark. We haven’t seen an obvious headline trigger for the move, with the broader cross-asset backdrop not suggestive of a positive shift in risk sentiment. Silver is also down 2.7% on the session.

- Despite today’s sell-off, a clear uptrend remains intact and this week’s resumption of the bull cycle, including a push to fresh all-time highs, reinforces current conditions.

- The March 18 low at $2999.5 provides initial support, clearance of which would expose the 20-day EMA at $2953.5.

- Gold has been in demand amid heightened global uncertainty stemming from US trade policies, with fresh demand seen this week on a renewed intensification of Israel/Hamas tensions.

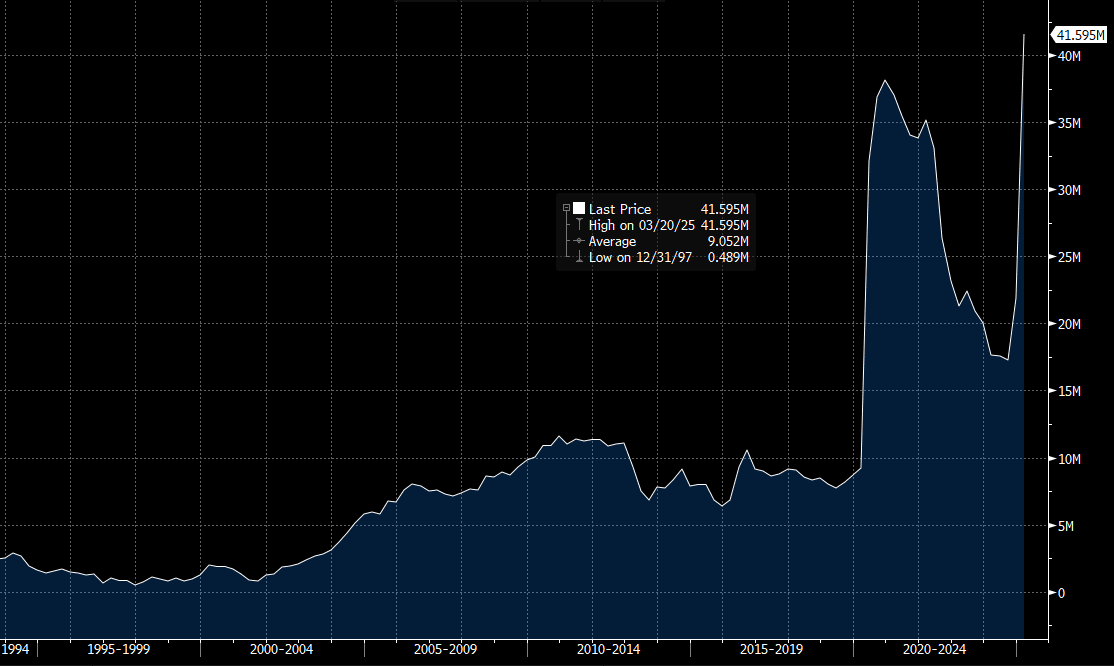

- Demand for physical gold has also been a notable theme Q1 this year (see chart below of Comex Gold inventories, which are at record highs). A reminder that the US January goods trade data was notably skewed by imports of physical gold from Switzerland to the US, possibly related tariff front-running.

- Note that Comex Silver inventories have also increased to record highs.

Figure 1: Comex Gold Inventories

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 24/03/2025 | 0815/0915 | ** | S&P Global Services PMI (p) | |

| 24/03/2025 | 0815/0915 | ** | S&P Global Manufacturing PMI (p) | |

| 24/03/2025 | 0830/0930 | ** | S&P Global Services PMI (p) | |

| 24/03/2025 | 0830/0930 | ** | S&P Global Manufacturing PMI (p) | |

| 24/03/2025 | 0900/1000 | ** | S&P Global Services PMI (p) | |

| 24/03/2025 | 0900/1000 | ** | S&P Global Manufacturing PMI (p) | |

| 24/03/2025 | 0900/1000 | ** | S&P Global Composite PMI (p) | |

| 24/03/2025 | 0930/0930 | *** | S&P Global Manufacturing PMI flash | |

| 24/03/2025 | 0930/0930 | *** | S&P Global Services PMI flash | |

| 24/03/2025 | 0930/0930 | *** | S&P Global Composite PMI flash | |

| 24/03/2025 | 1345/0945 | *** | S&P Global Manufacturing Index (Flash) | |

| 24/03/2025 | 1345/0945 | *** | S&P Global Services Index (flash) | |

| 24/03/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 24/03/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 24/03/2025 | 1800/1800 | BOE's Bailey lecture on UK growth | ||

| 24/03/2025 | 1910/1510 | Fed Governor Michael Barr |