-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: April CPI Not as Hot as Feared

- MCCONNELL SAYS THERE WILL BE EVENTUAL AGREEMENT ON DEBT LIMIT, Bbg

- ECB’S VILLEROY: ‘MARGINAL’ DISTANCE LEFT TO COVER WITH HIKES, Bbg

- VILLEROY: MOST IMPACT ON INFLATION TO COME FROM PAST HIKES, Bbg

- VILLEROY: INFLATION TOO HIGH BUT PASSING PEAK, Bbg

- SOME ECB OFFICIALS START TO THINK SEPT. RATE HIKE MAY BE NEEDED, Bbg

- ECB'S CENTENO: RATES MAY BE CUT AT SOME POINT NEXT YEAR, Bbg

Key Links: MNI INTERVIEW: Sticky Prices Could Require More Hikes-Fed Econ / MNI: EU Loses Patience As Italy Blocks Bank Backstop-Officials / MNI BRIEF: US Deficit Up Over 200% Year-To-Date / MNI BRIEF: US CPI Shows Encouraging Step-Down-Atl. Fed's Meyer

US TSYS: Rates, Stocks Finish on Positive Tone After In-Line CPI

Treasury futures see-saw near late session highs after initial gap bid followed in-line CPI read for April, MoM 0.4%, YoY 5.5%, and off-setting CPI figures: higher used car and medical care services vs. lower than expected lodging and airfare items. Late support tied to nascent hopes of a debt ceiling breakthrough that also buoyed stocks.

- Tsy 10s currently 115-25.5 vs. 115-31 high, yield off 3.4275% low at 3.4502%. Curves steeper but off highs, 2s10s currently +4.186 at -46.584 (-44.525 high).

- Projected rate cuts for late 2023 are firmer but still off last week's highs: November cumulative -53.3bp (-58.7bp last wk) at 4.544%, Dec'23 cumulative -77.9bp (-84.3bp last wk) at 4.293%, while Jan'24 cumulative is running at -101.8bp at 4.048%.

- For a technical perspective, initial resistance at 116-12 High May 5, a resumption of gains would open key resistance at 117-01+, the Mar 24 high. This is the bull trigger.

- Treasury futures had pared gains briefly following the $32B 10Y note auction (91282CHC8) tail: 3.448% high yield vs. 3.437% WI; 2.45x bid-to-cover vs. 2.36x prior. Indirect take-up 67.05% vs. 62.95% prior; direct bidder take-up 19.46% from 19.91% prior; primary dealer take-up falls to 13.04% vs. 17.14% prior.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00279 to 5.05709 (+.00683/wk)

- 3M +0.01418 to 5.09811 (+.05938/wk)

- 6M +0.02049 to 5.05101 (+.10550/wk)

- 12M +0.03473 to 4.73358 (+.17998/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00114 to 5.06029%

- 1M +0.00229 to 5.10800%

- 3M +0.00329 to 5.34243% */**

- 6M +0.00857 to 5.39843%

- 12M +0.05486 to 5.35286%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.34243% on 5/10/23

- Daily Effective Fed Funds Rate: 5.08% volume: $112B

- Daily Overnight Bank Funding Rate: 5.07% volume: $277B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.482T

- Broad General Collateral Rate (BGCR): 5.03%, $574B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $564B

- (rate, volume levels reflect prior session)

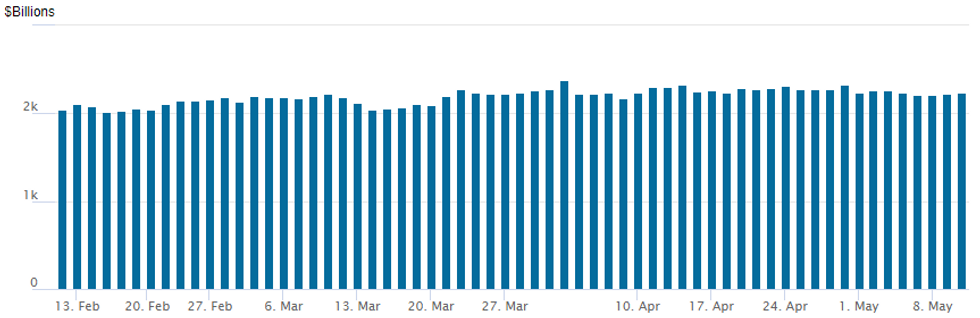

FED Reverse Repo Operation

NY Federal reserve/MNI

NY Fed reverse repo usage climbs to $2,233.149B w/ 104 counterparties, compares to prior $2,222.864B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTIONS SUMMARY

Early mixed option trade segued to large and varied put trade Wednesday, position unwinds leading volume as underlying futures extended a post-CPI rally into the close.- SOFR Options:

- Block, 20,000 SFRU 94.81/94.93/95.12/95.25 put condors, 5.5 ref 95.275

- Block, 5,000 SFRZ3 95.00 puts, 16.0 vs. 95.725/0.25%

- -40,000 SFRU3 95.43/95.56 put spds, 9.5 ref 95.265

- -10,000 SFRM3 94.93/95.00 put spds, 4.75 ref 94.935

- +2,500 SFRM3 94.81/94.93/95.06 put flys, 6

- 2,000 SFRU3 94.87/95.00 put spds vs. SFRU3 96.50/97.00 call spds

- Block/screen, 8,500 SFRN3 95.12/95.37/95.62 call flys, 2.0 ref 95.205

- 5,000 SFRU3 95.50/95.56/95.62/95.68 call condors ref 95.20

- 1,750 OQM3 95.56/95.68 put spds, ref 96.605

- Block, 4,000 OQM3 95.25 puts, 1.0 vs 96.59/0.05%

- 6,500 SFRQ3 94.75/95.00/95.25/95.50 put condors ref 95.19

- Block, 5,000 SFRU3 95.12/95.35/95.62 call flys, 1.25

- 2,000 SFRK3 94.81/94.94 2x1 put spds, ref 94.895

- 2,000 SFRU3 94.62/94.87 put spds ref 95.185

- 1,000 SFRU3 94.75/94.87/95.00/95.12 put condors ref 95.19

- over 12,000 SFRK3 94.93/95.06/95.18 call trees vs. SFRM3 94.93/95.06/95.18 call flys, ref 94.90

- Treasury Options:

- 15,000 FVM 109 puts, 5.5, total volume over 25k

- -20,000 FVM 111 calls 18.5-17

- over 31,500 FVN3 112 calls, 29.5-30 ref 110-14

- over 12,800 FVN3 109.25 puts, 27-26 ref 110-16

- over 5,800 FVN3 109.5 puts, 34 ref 110-14

LATE EQUITIES ROUNDUP: Hope or Risk Springs Eternal

- Still off this morning's post-CPI driven highs, stocks are gradually climbing again on hopes over a debt ceiling agreement breakthrough. Not aparent at the time, but Treasury futures and equities both moved higher following Bbg headline: "MCCONNELL SAYS THERE WILL BE EVENTUAL AGREEMENT ON DEBT LIMIT," Bbg.

- At the moment: S&P E-Mini Futures are up 12.5 points (0.3%) at 4146.25; DJIA down 93.14 points (-0.28%) at 33463.57; Nasdaq up 115.8 points (1%) at 12294

- Communication Services and Information Technology sectors lead the rebound in the second half, shares of Google up approximately 4.5% following headlines: GOOGLE REIMAGINING ALL CORE PRODUCTS, INCLUDING SEARCH ... CEO SHOWS HOW USERS CAN USE GENERATIVE AI IN GMAIL, Bbg.

- From a technical point of view, S&P E-minis remain above the 50-day EMA, which intersects at 4103.05. A continuation higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high. A breach of this level would confirm a resumption of the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A move through this support would be bearish.

E-MINI S&P TECHS: (M3) Remains Above The 50-Day EMA

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4223.00 High Feb 14

- RES 1: 4175.25/4206.25 Intraday high / High May 1

- PRICE: 4164.50 @ 14:21 BST May 10

- SUP 1: 4062.25 Low May 4 and key near-term support

- SUP 2: 4052.50 Low Mar 30

- SUP 3: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

- SUP 4: 4006.00 Low Mar 29

S&P E-minis are trading higher today and price remains above the 50-day EMA, which intersects at 4103.05. A continuation higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high. A breach of this level would confirm a resumption of the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A move through this support would be bearish.

COMMODITIES: Crude Markets Still Focused On Weak Demand

- Crude oil is holding onto earlier losses with market focus still on weak demand after the updated EIA inventory data showing a crude build and oil product draws. Gasoline and diesel crack spreads are edging higher driven by the lower inventories and a slight recovery in implied demand.

- WTI is -1.7% at $72.43 off a post-CPI high of $73.87 that came close to resistance at $73.93 (Apr 28 low) before retreating.

- Continued sizeable puts today, with the day’s most active strike at $70/bbl puts but this time followed by $75/bbl calls.

- Brent is -1.5% at $76.28, with its high of $77.56 poking above yesterday’s high and opening resistance at the 20-day EMA of $78.49.

- Gold is -0.2% at $2030.96 having pulled back off a post-CPI high of $2048.19 with the retreat despite Treasury yields continuing to push lower after the 10Y auction. Resistance seen at $2063 (May 4 high).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/05/2023 | 0130/0930 | *** |  | CN | CPI |

| 11/05/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 11/05/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 11/05/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 11/05/2023 | 1200/1400 |  | EU | ECB Schnabel Talk at Federal Ministry of Finance | |

| 11/05/2023 | - |  | EU | ECB Lagarde & Panetta in G7 Finance Meeting | |

| 11/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 11/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/05/2023 | 1230/0830 | *** |  | US | PPI |

| 11/05/2023 | 1245/0845 |  | US | Minneapolis Fed's Neel Kashkari | |

| 11/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/05/2023 | 1430/1030 |  | US | Fed Governor Christopher Waller | |

| 11/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/05/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 11/05/2023 | 1730/1930 |  | EU | ECB de Guindos Panels Diario Madrid Foundation Event |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.