-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI ASIA MARKETS ANALYSIS:Bank Headline Risk Persists Pre-FOMC

HIGHLIGHTS

- MNI WHITE HOUSE: Biden Calls On Congress To Toughen Penalties On Failed Bank Execs

- TSY ADEYEMO: ACTIONS ON FIRST REPUBLIC SHOW SYSTEM IS SAFE, Bbg

- TURKEY WILL RATIFY FINLAND'S NATO MEMBERSHIP, ERDOGAN SAYS, Bbg

- AT LEAST 4 BANKS HAVE CURBS ON TRADES WITH CREDIT SUISSE: RTRS

- DEUTSCHE BANK, SOCIETE PUT CURBS ON TRADES WITH CS: REUTERS

Key links: MNI INTERVIEW: Americans' Top Concern Remains Inflation-UMich / MNI INTERVIEW: Fed Dot Plot To Look Past Bank Crisis -Lockhart / MNI INTERVIEW: Major Instability Would Force Rate Cuts-Papadia / MNI GLOBAL WEEK AHEAD: Fed, SNB, Norges & BOE to Meet /

US TSYS: Late Roundup: Short End Extends Session Highs

- Yield curves are bull steepening (2s10s -46.511 high) with front end Treasury futures extending session highs late trade while bonds hold to session range over last few hours. Front month 2Y futures tapped 103-24.38 (+17.5) before receding to 103-22.5 last few minutes, 2Y yield falls to 3.8520% low.

- Timing of move coincided with headlines that four European banks (including SocGen and Deutsche Bank) have put curbs on trades with Credit Suisse. Not as proactive or positive as receiving a liquidity backstop from SNB, but markets may perceive ringfence move to prevent contagion as systemically positive.

- In the meantime, Short end futures implied rate hikes have drifted back near midweek highs: Fed funds implied hike for Mar'23 at 16.0bp (-3.0bp from this morning), May'23 cumulative 22.1bp (-13bp) to 4.798%, Jun'23 2.7bp (-21.7bp) to 4.608%.

- Implied cut for Jul'23 at -26.3bp to 4.318%, Sep'23 cumulative of -44.5 to 4.323%; peak Fed terminal rate has fallen to 4.795% for May'23 vs. 4.920% earlier.

- Next week outlook, no economic data Monday, while the Tsy will auction bills late morning. FOMC kicks off first of two day FOMC meeting on Tuesday.

US TSYS: Late Roundup: Short End Extends Session Highs

- Yield curves are bull steepening (2s10s -46.511 high) with front end Treasury futures extending session highs late trade while bonds hold to session range over last few hours. Front month 2Y futures tapped 103-24.38 (+17.5) before receding to 103-22.5 last few minutes, 2Y yield falls to 3.8520% low.

- Timing of move coincided with headlines that four European banks (including SocGen and Deutsche Bank) have put curbs on trades with Credit Suisse. Not as proactive or positive as receiving a liquidity backstop from SNB, but markets may perceive ringfence move to prevent contagion as systemically positive.

- In the meantime, Short end futures implied rate hikes have drifted back near midweek highs: Fed funds implied hike for Mar'23 at 16.0bp (-3.0bp from this morning), May'23 cumulative 22.1bp (-13bp) to 4.798%, Jun'23 2.7bp (-21.7bp) to 4.608%.

- Implied cut for Jul'23 at -26.3bp to 4.318%, Sep'23 cumulative of -44.5 to 4.323%; peak Fed terminal rate has fallen to 4.795% for May'23 vs. 4.920% earlier.

- Next week outlook, no economic data Monday, while the Tsy will auction bills late morning. FOMC kicks off first of two day FOMC meeting on Tuesday.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.01000 to 4.56086% (+0.00372/wk)

- 1M +0.01628 to 4.77771% (-0.02086/wk)

- 3M +0.03586 to 4.99843% (-0.13971/wk)*/**

- 6M +0.12000 to 5.05229% (-0.37600/wk)

- 12M +0.20471 to 5.03414% (-0.70400/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $83B

- Daily Overnight Bank Funding Rate: 4.57% volume: $261B

- Secured Overnight Financing Rate (SOFR): 4.57%, $1.272T

- Broad General Collateral Rate (BGCR): 4.55%, $503B

- Tri-Party General Collateral Rate (TGCR): 4.55%, $491B

- (rate, volume levels reflect prior session)

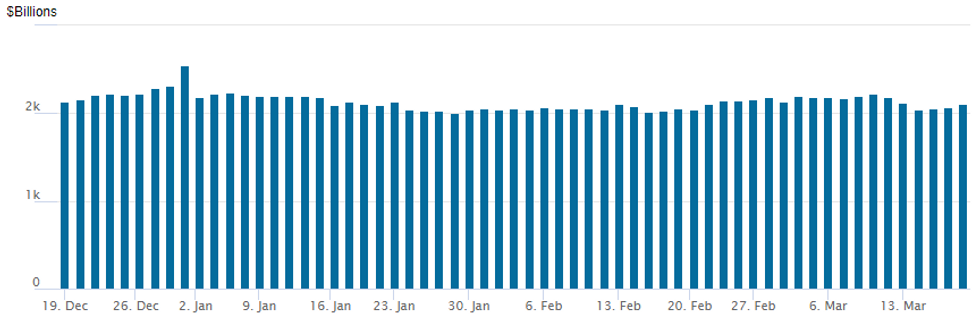

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,106.166B w/ 97 counterparties vs. prior session's $2,.066.319B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Friday's option volume well off pace for the week, lost opportunity for sidelined accounts ahead the weekend and next week's FOMC as underlying futures in the short end surged higher later in the second half. Headline risk tied to banks rekindled implied rate cut expectations by midyear again. Implied cut for Jul'23 at -26.3bp to 4.318%, Sep'23 cumulative of -44.5 to 4.323%; peak Fed terminal rate has fallen to 4.795% for May'23 vs. 4.920% earlier.

- SOFR Options:

- Block, 9,000 SFRM4 93.50 puts, 6.5 ref 96.68

- Block, +5,000 SFRZ3 96.06 straddles, 160.0 ref 96.07

- Block, 7,500 SFRM3 94.50/94.75 put spds, 7.0 ref 95.45

- +10,000 SFRJ3 94.50/95.00 put spds, 12.25 ref 95.355

- Block, +10,000 SFRM3 96.00/97.00 call spds 13.5 ref 95.31 to -.315

- +5,000 SFRJ3/SFRM3 95.00 put spds, 7.0 still bid

- Treasury Options:

- over 15,000 FVJ3 108/108.5 put spds, 3.5-5.0 ref 109-29

- over 4,500 USJ3 127 puts, 3

- over 9,900 TYJ3 115 calls, 36 last ref 114-22.5 to -24.5

- 10,000 TYK3 115/116 call spds vs. TYK3 105/108/109.5/111 broken put condor

- 5,000 TYM3 120/125/130 call flys, ref 114-12

- 1,000 FVK 110.5/111.5 4x5 call spds ref 109-01.75

- 2,000 FVK 112/113 call spds ref 109-04.5

- 4,100 FVJ3 109.5 calls, 21 ref 109-00.25

EGBs-GILTS CASH CLOSE: Bull Steepening In Pre-Weekend Risk Off Move

European curves bull steepened Friday amid strong gains at the short-end, with central bank hikes continuing to get priced out after the ECB meeting yesterday and ahead of the Fed and BoE decisions next week.

- After a fairly quiet start to the European session, highlighted by ECB hawks eyeing further rate hikes sending EGB yields marginally higher, safe havens began rallying as bank stocks dropped sharply throughout the rest of the day.

- There was no specific trigger, more a resumption of concerns over Credit Suisse and US banks, with angst over possible developments over the weekend. Reuters reported Credit Suisse executives would meet over the weekend to discuss options for the bank's future.

- ECB terminal rate pricing fell back 12bp to 3.20%; a 25bp BoE hike next week is less than 50% priced, with terminal dropping as much as 23bp to 4.17%.

- After initially tightening, periphery EGB spreads widened as equities pulled back.

- With a quiet schedule Monday (ECB Lagarde appearance aside), attention over the weekend will continue to be paid to banking sector risks.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 22bps at 2.388%, 5-Yr is down 22.5bps at 2.093%, 10-Yr is down 18.2bps at 2.108%, and 30-Yr is down 15.5bps at 2.157%.

- UK: The 2-Yr yield is down 17.4bps at 3.241%, 5-Yr is down 17.2bps at 3.17%, 10-Yr is down 14.1bps at 3.284%, and 30-Yr is down 9.7bps at 3.756%.

- Italian BTP spread up 4.8bps at 194.6bps / Spanish up 2.7bps at 112bps

EGB Options: Large Euribor Call Selling Features Friday

Friday's Europe rates / bond options flow included:

- ERJ3 96.50/96.375ps, sold at 3.5 in 7k

- ERU3 98.00 call sold at 8 in 20k (v 96.51)

- OEM3 117.00/114.50/113.00p fly, bought for 55 in 3k

- RXJ3 134/131/128p fly, bought for 14 in 1.5k

FOREX: Risk-On Through London Close Tilts EUR/USD to New Highs

- Greenback fading following the London close, with price action picking up in EURUSD to put the pair just above earlier session highs. GBP/USD moving similarly, with 1.2177 the next intraday level of note.

- Move lower in the greenback coincides with very modest uptick further off the lows for the e-mini S&P, which is in the process of chewing through the post-cash open losses at pixel time.

- Moves coincide with Credit Suisse headlines on Reuters, who write that Credit Suisse's CFO teams are being called up to work over the weekend, with the teams set to work on scenarios for the bank going forward. This possibly suggests plans are advancing on reparatory measures for the bank - but unclear if that marks the price catalyst here

FX: Expiries for Mar20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E706mln), $1.0665(E825mln), $1.0705-15(E1.0bln), $1.0730(E701mln)

- USD/JPY: Y131.00($1.2bln), Y132.00-15($706mln), Y132.35-50($690mln), Y132.90-00($811mln)

- AUD/USD: $0.6730(A$538mln)

- USD/CAD: C$1.3750($599mln)

- USD/CNY: Cny6.9000($535mln)

EQUITIES

Front month Tsys futures extending session highs for the third time since the open as broad based selling in domestic and foreign bank stocks returns despite moves to backstop (FRC, CS) over the last couple days.

- Top underperformers at the moment: FRC -32.5%, USB -8.4%, LNC -7.8%, CMA -7.9%, HBAN -7.3%, KEY -6.75. Financials sector -3.00%, weighed on SPX eminis: at 3950 -44.5, still above first support of 3839.25, March 13 low.

- Short end Treasury futures outperformed late (TUM3 taps 103-26.25 high, 2Y yield 3.8208% low), yield curves bull steepening off deeper inverted levels, 2s10s tapped -44.361 high vs. -66.886 overnight low.

- As has been the case since Silicone Valley Bank and Signature Bank collapse, short end rates are back to pricing in looser policy expectations, implied pricing of rate cuts moving back toward midyear again.

WTI Sees Largest Weekly Decline Since Apr’22, Gold Highest Settle In 11 Months

- Crude oil has seen further large declines today, with Bloomberg noting it helped by 43k lots totaling more than 40mln barrels expiring in the money on Thursday, with the size forcing firms who executed the deals forced to dump futures to limit their own risk exposure.

- Following a week of heightened demand concerns with first regional banking issues in the US and then European bank concerns, most notably Credit Suisse, it sees WTI record the largest weekly decline in almost a year at -13%.

- WTI is -2.2% at $66.84 with a low of $65.17 clearing support at $65.60 to open a key support at $62.43 (Dec 2, 2021 cont).

- Brent is -2.2% at $73.04 off a low of $71.40 that cleared the Mar 15 low of $71.67 and came close to $71.30 (1.00 proj of the Nov 7 – Dec 12 – Jan 23 price swing).

- Gold is +3.5% at $1986.85, clearing three resistance levels today as it surges on USD weakness and US yields sliding. It’s just off a high of $1987.59 that fleetingly cleared $1987.4 (3.236 proj of the Sep 28 – Oct 4 – Nov 3 price swing), next opening the round $2000 with a more sustained break of $1987.4.

- Weekly moves: WTI -12.8%, Brent -11.8%, Gold +6.4%, US nat gas -3.1%, EU TTF nat gas -19%.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/03/2023 | 0700/0800 | ** |  | DE | PPI |

| 20/03/2023 | 0730/0730 |  | UK | DMO to Confirm Gilts on Offer at 4/5 April Auctions | |

| 20/03/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 20/03/2023 | - |  | UK | DMO Quarterly Consultation with GEMMs / Investors | |

| 20/03/2023 | 1400/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 20/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/03/2023 | 1600/1700 |  | EU | ECB Lagarde Intro as ESRB Chair at ECON |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.