-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI GLOBAL WEEK AHEAD: Fed, SNB, Norges & BOE to Meet

After a volatile week in markets, next week’s Fed, SNB, Norges and BOE rate decisions could see a variety of outcomes.

MONDAY

Germany Producer Prices: German factory-gate inflation is projected to cool for a fifth consecutive month in February, with consensus looking for a 3.1pp deceleration to +14.5% y/y. January and February deadline PPI will likely be revised down in the March release as the delayed effects of the electricity and gas price breaks will be taken into account.

TUESDAY

Germany ZEW Survey: The ZEW survey of financial market experts will likely see outlooks fall back in March due to financial market turmoil. Around a ten-point reduction in survey expectations is currently pencilled in.

Canada CPI: Canadian inflation is expected to ease further by around 0.5bp to +5.4% y/y in February, after having cooled to +5.9% y/y in January.

At their March meeting, the BOC held the overnight rate at 4.5% as unanimously expected as it drew a potentially temporary end to the 425bp hiking cycle started last March. The Bank still sees CPI inflation coming down to around 3% in the middle of this year.

WEDNESDAY

UK CPI: UK inflation is seen lower again in February, with consensus looking for a 0.3pp deceleration to +9.8% y/y. Prices are expected to pick up on the month, accelerating by +0.5% m/m after having fallen -0.6% m/m in January. Further signs of cooling core CPI will be watched for. This data will feed into the Thursday rate announcement.

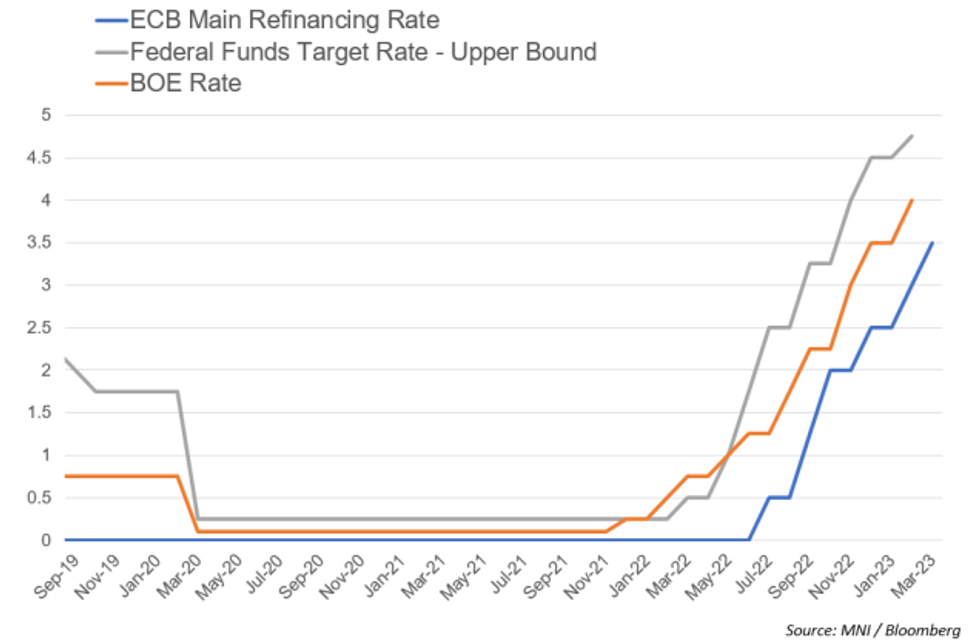

FOMC Rate Decision: The Federal Reserve still looks like it could hike 25bp next week, after another strong payrolls report and sticky core pressures warranting another hike. A break in its interest rate increases at its March meeting is however on the table against the current backdrop of turmoil in global financial markets.

THURSDAY

Swiss National Bank Rate Decision: A 50bp hike to 1.5% is pencilled in for the SNB on Thursday, which would be their third hike in this cycle. This follows the upside surprise to January inflation, which edged up to +3.4% y/y a record high for Swiss core CPI of +2.5% y/y. Financial market stress has increased substantially over the last week as the SNB stepped in to provide a liquidity backstop for flailing Credit Suisse. Current financial strain in markets is at current not seen to deter the SNB for now but remains a very real possibility.

Norges Bank Rate Decision: Norges Bank is likely to hike 25bp to 3.00% at their March meeting, also likely for now to be undeterred from financial market strains. The slowdown in headline and core CPI in February made a 50bp hike less likely.

Bank of England Rate Decision: The BOE’s March rate announcement will be a close call between no hike and 25bp. Recent financial market volatility will likely have influenced the BOE to shy away from further tightening, whilst, albeit cooling, still elevated CPI (barring the possibility of surprises to Feb data) and inflation expectations would underpin a decision to hike.

FRIDAY

UK Consumer Confidence / Retail Sales: UK consumer confidence is forecasted to improve by another three points to -35 in March after surprising to the upside in February. Despite recent improvements, all sub-indices remain severely depressed, implying that spending will remain pressured in the near term, along with growth.

In line with this, UK February retail sales are likely to be only marginally above a flat reading. The BOE's February projections expect household consumption to fall in H1 and rise again from Q3.

Spain Final GDP: The Spanish economy grew +0.2% q/q, in the flash estimate, holding pace with Q3. The Spanish Statistics Institute flagged that Q4 provisional data is based on substantially less information than regular quarterly flash estimates. As such, a revision to Q4 growth is on the cards.

March Flash PMIs: Flash March PMI data for the eurozone, UK and US is anticipated to convey common themes of a small cooldown in services (which have recently re-entered expansive territory), as demand eases slightly. Meanwhile modest upticks are expected across manufacturing, underpinned by easing supply pressures, despite the PMIs largely remaining below the 50 breakeven level.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/03/2023 | 0700/0800 | ** |  | DE | PPI |

| 20/03/2023 | 0730/0730 |  | UK | DMO to Confirm Gilts on Offer at 4/5 April Auctions | |

| 20/03/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 20/03/2023 | - |  | UK | DMO Quarterly Consultation with GEMMs / Investors | |

| 20/03/2023 | 1400/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 20/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/03/2023 | 1600/1700 |  | EU | ECB Lagarde Intro as ESRB Chair at ECON | |

| 21/03/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 21/03/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 21/03/2023 | 1230/0830 | *** |  | CA | CPI |

| 21/03/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/03/2023 | 1230/1330 |  | EU | ECB Lagarde Panellist at BIS Summit | |

| 21/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/03/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/03/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 22/03/2023 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 22/03/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 22/03/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 22/03/2023 | 0845/0945 |  | EU | ECB Lagarde Address at ECB and its Watchers Conference | |

| 22/03/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 22/03/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 22/03/2023 | 0930/1030 |  | EU | ECB Lane in Debate at ECB and its Watchers Conference | |

| 22/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 22/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/03/2023 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2023 | 1345/1445 |  | EU | ECB Panetta in Debate at ECB and its Watchers Conference | |

| 22/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/03/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting | |

| 22/03/2023 | 1800/1400 | *** |  | US | FOMC Statement |

| 23/03/2023 | 0830/0930 | *** |  | CH | SNB PolicyRate |

| 23/03/2023 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 23/03/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 23/03/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 23/03/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 23/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 23/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/03/2023 | 1230/0830 | * |  | US | Current Account Balance |

| 23/03/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 23/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/03/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/03/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/03/2023 | 1500/1600 |  | EU | ECB Lane Panels Peterson Institute Conference | |

| 23/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 24/03/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 24/03/2023 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 24/03/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/03/2023 | 0700/0800 | ** |  | SE | PPI |

| 24/03/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 24/03/2023 | 0730/0730 |  | UK | DMO to Publish Apr-Jun Gilt Op Calendar | |

| 24/03/2023 | 0800/0900 | ** |  | ES | PPI |

| 24/03/2023 | 0800/0900 | *** |  | ES | GDP (f) |

| 24/03/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/03/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/03/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/03/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 24/03/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/03/2023 | 1330/0930 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/03/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/03/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 24/03/2023 | 1600/1600 |  | UK | BOE Mann Panellist at Global Independence Center Conference Ukraine | |

| 24/03/2023 | 1630/1630 |  | UK | BOE Announces Q2 Active Gilt Sales Schedule |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.