-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI ASIA MARKETS ANALYSIS: Beige Book Points To Slower Economy

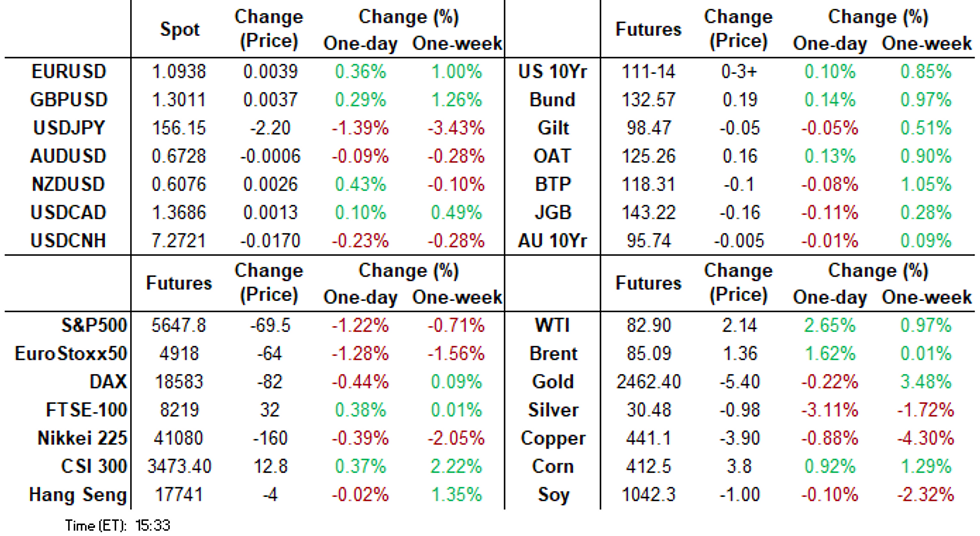

- Treasuries running at/near late session highs, 10s back to mid-March levels after the bell

- Mildly dovish Fed speak from Richmond Fed President Barkin and Gov Waller and Beige Book pointing to slower economy

- While Tsy curves bull flattened, projected cuts through year end cooled vs. late Tuesday levels.

US Treasuries Bull Flatten, Fed Beige Book Points to Slowing Economy

- Treasury futures near late session highs after bell, Fed Beige Book for July supportive amid expectations of slower economic growth tied to election uncertainty, domestic policy, inflation and geopolitical uncertainty.

- Opaque at times, Fed speak from Richmond Fed Barkin and Fed Gov Waller leaned dovish. “While I don’t believe we have reached our final destination, I do believe we are getting closer to the time when a cut in the policy rate is warranted,” Waller said in prepared remarks.

- TYU4 trades 111-13.5 last (+3) vs. -111-15 session high, nearing initial technical resistance of 111-17+ (1.382 of Apr 25-May 16-29 swing), next level at 111-31 (1.382 proj of the Apr 25 - May 16 - 29 price swing).

- Curves hold flatter profile with short end lagging late session gains, 2s10s -2.412 at -28.582. As a result, projected rate cut pricing into year end slightly cooler vs. late Tuesday levels (*): July'24 at -6.5% w/ cumulative at -1.6bp at 5.313%, Sep'24 cumulative -25.7bp (-26.6bp), Nov'24 cumulative -41.1bp (-42.9bp), Dec'24 -63.6bp (-65.4bp).

- Tsy futures dip slightly then recover (TYU4 111-11.5 last) after $13B 20Y bond auction reopen (912810UB2) comes out on the screws: 4.466% high yield vs. 4.466% WI; 2.68x bid-to-cover vs. prior month's 2.74x.

- Focus turns to Thursday's Weekly Claims, 10Y TIPS Sale, TIC Flows and upcoming earnings from M&T Bank and Blackstone on Thursday; Fifth Third, Regions Financial, Comerica, American Express and Huntington next Friday.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00720 to 5.34119 (+0.01339/wk)

- 3M +0.00023 to 5.27947 (-0.00664/wk)

- 6M +0.00226 to 5.13081 (-0.03399/wk)

- 12M -0.00084 to 4.79975 (-0.06579/wk)

- Secured Overnight Financing Rate (SOFR): 5.35% (+0.01), volume: $2.061T

- Broad General Collateral Rate (BGCR): 5.34% (+0.01), volume: $790B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.00), volume: $776B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $234B

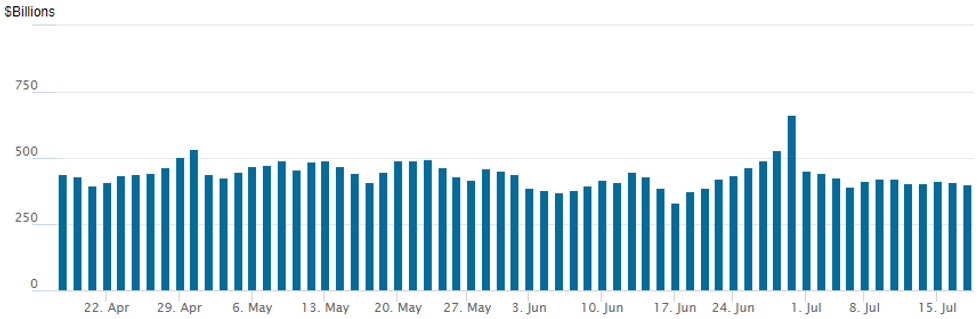

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes up to $399.401B from $409.594B on Tuesday. Number of counterparties at 69 from 67 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

More mixed two-way trade in SOFR options overnight, light Treasury option flow does include decent buying of Aug'24 10Y calls. Underlying futures inching lower, paring Tuesday's rebound off Retail Sales-tied lows. Tsy curves resume flattening, projected rate cut pricing into year end slightly cooler vs. late Tuesday levels (*): July'24 at -6.5% w/ cumulative at -1.6bp at 5.313%, Sep'24 cumulative -25.7bp (-26.6bp), Nov'24 cumulative -41.1bp (-42.9bp), Dec'24 -63.6bp (-65.4bp). Salient flow includes:

- SOFR Options:

- +5,000 SFRH6 95.75 puts 30 ref 96.46

- Block, 8,000 SFRH5 95.50/95.75/96.00/96.25 call condors, 6.5 net vs. 95.735/0.05%

- +20,000 SFRU4 94.81/94.87/94.93 put flys, 1.25

- +4,500 SFRU4 94.68/94.75/94.81 put flys

- +5,000 SFRZ4 94.75/94.87 put spds, 0.75 ref 95.34

- +4,000 SFRU5 95.00 puts, 8.5 vs. 96.21/0.14%

- +6,000 SFRU4 94.68/94.75/94.81 put flys 0.25 ref 94.945

- Block, 5,000 0QZ4 95.25/95.87/96.25 broken put flys, 4.5 ref 96.295/0.05%

- 4,850 0QU4 95.87/96.12 2x1 put spds ref 96.22

- -10,000 SFRU4 94.62/94.75/94.87 put flys 1.0 ref 94.94

- -5,000 SFRU4 94.93 puts, 5.5 ref 94.94

- +5,000 SFRU5 95.00/95.25/95.75 put trees 5.5 ref 96.205

- 5,000 0QQ4 96.00/2QQ4 96.25 put diagonals spds

- -3,000 SFRU4 95.00/95.25 call spds, 2.5 ref 94.945

- 2,500 0QU4 96.25/96.75 1x2 call spds ref 96.22

- Block, -2,974 SFRZ5 96.50/97.50 call spds, 18

- 3,000 SFRZ4 95.31/95.43/95.56 call flys

- +3,600 SFRZ4 94.87/95.12 2x1 put spds, 2.0 ref 95.355

- Treasury Options:

- -6,000 wk1 TY 111.25/111.5 strangles, 101

- 5,000 TYU4 111.5/113 1x2 call spds

- 5,000 USU4 116/117 put spds, 54 ref 120-10

- -6,000 TYU4 111.0/111.5 strangles, 126 (expire August 23)

- 2,500 FVQ4 108/108.25 call spds

- over +26,600 TYQ4 111.5 calls (20k late Tuesday at 20)

EGBs-GILTS CASH CLOSE: Curves Flatten Post-UK CPI, Pre-ECB

The Gilts underperformed Wednesday after firmer-than-expected UK CPI data, with EGBs trading mixed ahead of Thursday's ECB decision.

- The UK curve bear flattened modestly after inflation aggregates came in above expected amid a "noisy" report.

- Trade was mixed for the rest of the session, with highs for yields hit in early afternoon on a 2nd consecutive day of solid US data (this time, housing starts).

- But sliding equities helped boost Bunds and Gilts toward the end of the session, with the German curve twist flattening and the UK's bear flattening.

- Periphery spreads widened modestly, mirroring the risk-off move in equities.

- Thursday kicks off with UK labour market data (MNI preview is here), with the ECB the focus of the session (preview here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.2bps at 2.775%, 5-Yr is up 0.4bps at 2.397%, 10-Yr is down 0.6bps at 2.421%, and 30-Yr is down 1.9bps at 2.597%.

- UK: The 2-Yr yield is up 3.2bps at 4.017%, 5-Yr is up 2.8bps at 3.915%, 10-Yr is up 2.7bps at 4.076%, and 30-Yr is up 1.8bps at 4.566%.

- Italian BTP spread up 2.5bps at 129.7bps / Spanish up 0.8bps at 77.5bps

EGB Options: Large Euribor Upside Pre-ECB

Wednesday's Europe rates/bond options flow included:

- ERH5 98.00 call, bought for 3/3.25 in 80k

- ERM5 98.50/99.00/99.50 call fly, paper pays 1.25 on 5k

- ERZ4 96.625/96.75/96.875/97.00 call condor, paper pays 5 on 5k

FOREX JPY & CHF Main Beneficiaries of Risk Off Sentiment

- JPY remains considerably stronger against all others, as a multitude of triggers push USDJPY (-1.30%) to fresh pullback lows. Considerable weakness for global equity indices, the string of recent weak data in the US and the threat of BOJ intervention continue to be primary drivers behind the USDJPY selloff.

- Nearby support in USDJPY has been cleared, with the pace of the decline picking up on the break of Y156.83 - the 38.2% retracement of the Dec'23 - Jul'24 bull leg. USDJPY’s low so far on the move has been 156.10. Further out, 155.72 (Jun 12 low) will be in focus.

- A weaker dollar backdrop pervades, with the USD index 0.4% lower on the session. Desks have noted Trump's appearance in Bloomberg Businessweek posted late yesterday, within which he flagged his concern with the strong dollar exchange rate, citing weakness in both JPY and CNY as causing issues with international trade.

- With analysts also noting that carry trade strategies may be losing their attractiveness due to the narrowing of rate differentials, other funding currencies such as the CHF also exhibited significant strength. USDCHF sits 1% lower on the session, and price action may have been exacerbated by a break of trendline support, drawn from the December lows. Concurrently, USDCHF has also broken below the 200-day MA, which intersects at 0.8880. Spot now trades at a 4-week low around 0.8850. Below here, the June lows and strong pivot support is seen between 0.8820/27. 50-day EMA resistance moves down to 0.8980.

- Notably, GBPUSD broke above the 1.30 level and touched a year-to-date high on the back of a moderate beat for UK CPI. Additionally, EURUSD rose to its highest level since March 14. A clear break of key resistance at 1.0916, Jun 4 high, had been the next key hurdle for bulls and price action confirms the bullish trend structure for the pair.

- Focus Thursday turns to Australian employment data, UK labour market figures and the July ECB meeting and press conference.

FX OPTIONS: Expiries for Jul18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0880-00(E3.3bln), $1.0915-25(E937mln), $1.0950(E540mln), $1.1000-05(E977mln)

- USD/JPY: Y156.95-10($1.9bln), Y158.00($3.9bln), Y158.50($1.0bln)

- GBP/USD: $1.2975-80(Gbp1.2bln)

- EUR/GBP: Gbp0.8375(E516mln)

- AUD/USD: $0.6800(A$1.1bln)

- NZD/USD: $0.6040(N$500mln)

- USD/CNY: Cny7.2500($719mln), Cny7.3000($857mln)

Late Equities Roundup: Another New High for the Dow

- Stocks remain mixed late Wednesday, the Dow still extending new highs (41,208.5), S&P Eminis and Nasdaq indexes still weaker but climbing off lows in late trade. with semiconductor stocks underperforming. Currently, the DJIA is up 236.35 points (0.58%) at 41189.52, S&P E-Minis down 71.5 points (-1.25%) at 5645.25, Nasdaq down 487.1 points (-2.6%) at 18023.13.

- Information Technology and Communication Services sectors continued to lead laggers in late trade, semiconductor stocks weighing on the former: Applied Materials -9.03%, Lam Research -8.84%, Advanced Micro Devices -8.48%. Interactive media and entertainment weighed on the Communication Services sector: Meta -5.27%, Omnicom Group -4.07%, Take Two Interactive -2.08%.

- Consumer Staples and Energy sectors led gainers in the second half, food makers supported the Staples sector: General Mills +3.98%, Conagra +3.76%, Kraft-Heinz +3.41%. Oil and Gas shares buoyed the Energy sector as crude prices gained (WTI +2.06 at 82.82): Hess +1.93%, Chevron +1.73%, Exxon Mobil +1.48%.

- Note, after reporting earnings this morning, Citizens Financial trades +3.79%, US Bancorp +4.53%, Ally Financial -2.86%. After the close, Discover Financial Services, Equifax, Steel dynamics , Alcoa Corp and United Airlines.

- Upcoming bank earnings: M&T Bank and Blackstone on Thursday; Fifth Third, Regions Financial, Comerica, American Express and Huntington next Friday.

E-MINI S&P TECHS: (U4) Corrective Pullback

- RES 4: 5786.66 3.50 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5764.00 3.50 proj of the Apr 19 - 29 - May 2 price swing

- RES 2: 5741 34 3.382 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5721.25 High Jul 16

- PRICE: 5641.75 @ 1500 ET Jul 17

- SUP 1: 5593.47 20-day EMA

- SUP 2: 5502.75/5479.87 Low Jul 2 / 50-day EMA

- SUP 3: 5398.75 Low Jun 11

- SUP 4: 5267.75 Low May 31 and key support

The trend condition in S&P E-Minis is bullish and today’s move lower appears to be a correction - for now. The continuation higher last week and this week’s cycle high, confirms a resumption of the uptrend and maintains the bullish sequence of higher highs and higher lows. MA studies are in a clear bull-mode set-up too, highlighting positive market sentiment. Sights are on 5741.34, a Fibonacci projection. Firm support is at 5593.47 the 20-day EMA.

COMMODITIES Crude Rebounds, Spot Gold Retreats From Record High

- WTI is on track for its highest close since July 8 after a larger than expected draw in US crude inventories.

- WTI Aug 24 is up 2.6% at $82.9/bbl.

- For WTI futures, support to watch lies at $80.20, the 50-day EMA. For bulls, attention is on resistance at $84.52, the Jul 5 high.

- Meanwhile, spot gold has fallen by 0.5% to $2,457/oz today, having earlier in the session hit a fresh all-time high of $2,483.73/oz.

- From a technical perspective, the trend condition in gold remains bullish and the breach of key resistance at $2450.1, the May 20 high, this week opens the $2500.00 handle next.

- Analysts note that with positioning and sentiment not at extreme levels, this level could be tested soon enough.

- Silver is also down by 3.2% on the day at $30.2/oz, bringing it to its lowest level since July 3.

- Silver is currently in consolidation mode. Key resistance and the bull trigger is at $32.518, the May 20 high. On the downside, key support and the bear trigger, lies at $28.573, the Jun 26 low.

- Copper has also fallen by 0.9% today to $441/lb, taking losses this week to 4% amid uncertainty over Chinese demand and a deterioration in risk sentiment.

- A bearish corrective cycle that started May 20, remains in play for now, with first support at $432.90, the Jun 27 low.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/07/2024 | 2350/0850 | ** |  | JP | Trade |

| 18/07/2024 | 0130/1130 | *** |  | AU | Labor Force Survey |

| 18/07/2024 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 18/07/2024 | - |  | US | ECB Meeting | |

| 18/07/2024 | 0900/1100 | ** |  | EU | Construction Production |

| 18/07/2024 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 18/07/2024 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 18/07/2024 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 18/07/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 18/07/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 18/07/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 18/07/2024 | 1245/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 18/07/2024 | 1415/1615 |  | EU | ECB's Lagarde presents MonPol decision on podcast | |

| 18/07/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 18/07/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 18/07/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 18/07/2024 | 1605/1205 |  | US | San Francisco Fed's Mary Daly | |

| 18/07/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 18/07/2024 | 1745/1345 |  | US | Dallas Fed's Lorie Logan | |

| 18/07/2024 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.