-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Bitcoin Rout

HIGHLIGHTS

- UK AND EU ARE CLOSE TO BREAKTHROUGH IN LONG-RUNNING BREXIT SPAT, Bbg

- FEDEX HAS CUT FLIGHTS, PARKED PLANES AS DEMAND DROPS, CFO SAYS, Bbg

- BITCOIN EXTENDS LOSS TO MORE THAN 15% TO BELOW $17,500

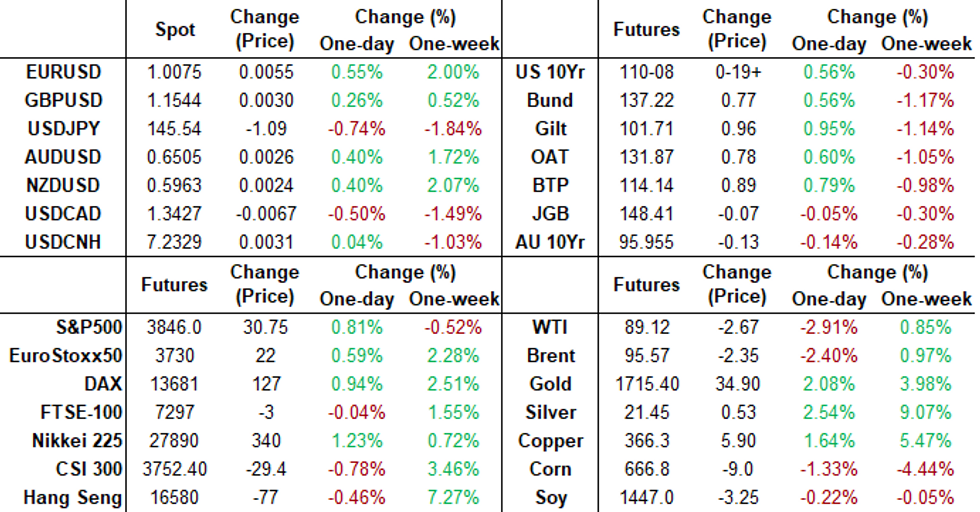

US TSYS: Rates, Stocks, Metals Stronger, Bitcoin Rout

Treasury futures finished broadly higher Tuesday, near late session highs, yield curves bull-flattening (2s10s -1.701 at -53.145 vs. -56.297 low) after holding steeper earlier in the first half.- Skittish first-half trade: Tsys sold off ahead the NY open apparently reacting to a misinterpreted German debt headline (more than doubling debt issuance next year).

- Tsys followed Bunds off lows as it became clear Germany is not doubling net debt, just a comparison to earlier projections, as opposed to an actual figure.

- Tsys see-sawed higher from midmorning on - no obvious headline trigger for move, volumes rather modest (TYZ2<575k) while some trading desks noted stops triggered on the way up. Dec 10Y futures at 110-06 still well off first resistance of 110-25 20D DMA.

- Cross asset: Gold surged over 40.0 to 1716.75 high, while equities gaining upside support - lead by metals and mining shares. Sharp rout in Bitcoin (-15%) coincided with stocks reversing gains in late trade before staging a late rebound.

- Treasury futures helding gains after $40B 3Y note auction (91282CFW6) stops through: 4.605% high yield vs. 4.615% WI; 2.57x bid-to-cover steady to last month.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00243 to 3.81557% (-0.00072/wk)

- 1M +0.00357 to 3.85571% (+0.00057/wk)

- 3M +0.03471 to 4.59200% (+0.04171/wk) * / **

- 6M +0.11157 to 5.13443% (+0.12314/wk)

- 12M +0.02815 to 5.64029% (-0.02614/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.59200% on 11/8/22

- Daily Effective Fed Funds Rate: 3.83% volume: $99B

- Daily Overnight Bank Funding Rate: 3.82% volume: $291B

- Secured Overnight Financing Rate (SOFR): 3.78%, $981B

- Broad General Collateral Rate (BGCR): 3.76%, $405B

- Tri-Party General Collateral Rate (TGCR): 3.75%, $393B

- (rate, volume levels reflect prior session)

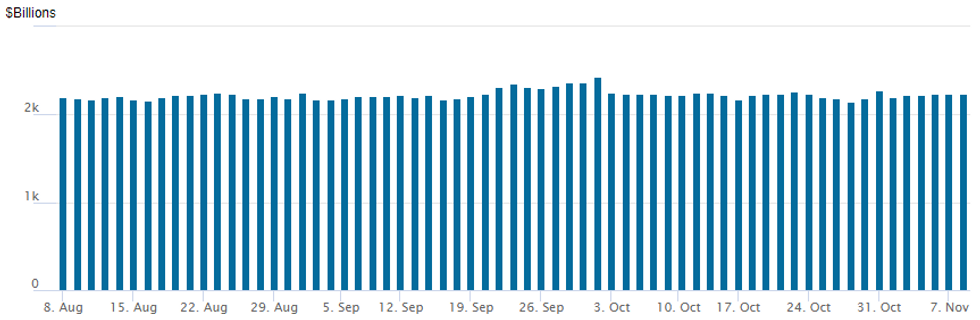

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,232.555B w/ 101 counterparties vs. $2,241.317B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

More consistent upside call and call spread buying reported Tuesday, though overall volumes fairly muted. Caution ahead Thursday's CPI inflation metric to gauge year-end policy stance.

- SOFR Options:

- +5,000 SFRM3 93.75/94.00 put spds, 2.0 ref 94.95/0.05%

- 4,000 short Dec 96.62/99.00 call spds

- Block, 2,000 SFRZ2 95.37/95.43/95.50/95.56 call condors, 2.25 ref 95.385

- 2,000 SFRH 94.93/95.12/95.31 call flys

- 3,000 SFRX2 95.56 calls

- Eurodollar Options:

- 2,000 Feb 95.00/95.25 call spds

- 2,000 Dec 94.43/94.68/95.06/95.31 call condors

- 4,200 Gold Jun 97.50 calls, 6.5 ref 95.95

- Treasury Options:

- 2,000 TYZ2 112/112.75 call spds, 8 ref 110-02.

- 6,400 TYF3 111.5/114.5 call spds, 37 ref 110-12

- +2,000 USZ 122/123/124 call flys, 5

- +7,000 TYH2 112/116/120 call flys, 42

- 2,500 TYZ2 112.25/112.75/113.75 broken call flys

EGBs-GILTS CASH CLOSE: Squaring Higher Pre-US Elections

After starting the session on the back foot, an afternoon rally left Gilts and Bunds stronger by Tuesday's close.

- Both the UK and German curves flattened, with long-end yields falling sharply in the afternoon. While there was no particular catalyst, some contacts suggested that desks were squaring positions ahead of US elections later.

- A BBG report that the UK and EU were close to a "breakthrough" on N Ireland helped boost risk appetite, with GBP jumping and Bund and Gilt futures extending session highs.

- BoE's Pill commented on potential de-anchoring of inflation expectations, though hike pricing was largely unchanged on the day.

- Periphery spreads tightened in a risk-on session, with equities rallying and the US dollar weakening - with all attention on overnight US election results.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 11.5bps at 2.324% (reflecting new Schatz becoming benchmark), 5-Yr is down 3.7bps at 2.199%, 10-Yr is down 6.2bps at 2.281%, and 30-Yr is down 8.2bps at 2.185%.

- UK: The 2-Yr yield is up 2.4bps at 3.254%, 5-Yr is down 3.6bps at 3.504%, 10-Yr is down 8.6bps at 3.552%, and 30-Yr is down 11.5bps at 3.738%.

- Italian BTP spread down 3.4bps at 211.2bps / Spanish down 1bps at 103.4bps

EGB Options: Upside In Euribor And Bunds Features

Tuesday's Europe rates / bond options flow included:

- DUZ2 106p, bought for 6.5 and 7 in 9k

- RXZ2 142 call bought for 18/19 in 7k

- RXZ2 134.00/132.50ps, bought for 31 and 32 in 2.5k (12 del)

- ERM4 99.00/99.75cs bought for 5.5 in 20k

- ERH3 97.125^ sold at 44 in 2k

FOREX: Lower Yields Ignite An Extension Of USD Weakness

- A developing theme in the aftermath of the payrolls report has been a souring of greenback optimism, which extended once again on Tuesday. The Japanese Yen outperforms with USDJPY sliding back below 146 and EURUSD extending gains above parity.

- A slightly strange session for risk as an initial rally across equity markets was met with a significant rout across the cryptocurrency market, potentially bolstering the sentiment for gold, which saw 2.2% gains throughout the session.

- Currency markets appeared to take this volatility in its stride and the lower yields weighed on the greenback throughout US trade.

- EURUSD had consolidated much of the European session around parity, however, once breaking yesterday’s highs around 1.0030, the single currency appreciated sharply to the next target of 1.0094, the high on Oct 27 and a technical bull trigger. Despite a brief pullback, the pair maintains a supportive tone ahead of the APAC crossover.

- Similarly in cable, despite pulling back to 1.1430, the broad USD weakness saw the pair rally aggressively before topping out at 1.1600.

- The Japanese Yen is leading G10 gains on Tuesday, as the lower yields work against the favourite trade of 2022. Furthermore, interventions to strengthen the yen continue to linger for short-sellers, especially as we approach the important US CPI data on Thursday.

- Chinese CPI/PPI data is due overnight before another light day for European/US data on Wednesday.

FX: Expiries for Nov09 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900-09(E690mln)

- USD/JPY: Y147.00($543mln)

- USD/CAD: C$1.3520($780mln)

Late Equity Roundup: Bounce off Late Reversal

Rocky second-half trade for stocks, reversing second half highs to mildly lower/new session lows before bouncing back to near middle of the range. Materials sector continued to outperform while Information Technology shares pared gains/made way for Real Estate shares.

- Timing of the reversal coincided with a sharp sell-off in Bitcoin (-15%) and worrisome headlines for Fedex: HAS CUT FLIGHTS, PARKED PLANES AS DEMAND DROPS, CFO SAYS, Bbg. SPX eminis currently trading +21 (0.55%) at 3836.5; DJIA +344.5 (1.05%) at 33175.32; Nasdaq +39.1 (0.4%) at 10604.25.

- SPX leading/lagging sectors: Materials (+1.97%) -- lead by metals and mining shares as metals continue to climb: Gold (+2.05%, +.3.96%/wk), Silver (+2.42%, +8.94%/wk) and Copper (+1.57%, +5.4%/wk): Newmont (NEM) +6.15%, Freeport McMoran (FCX) +3.00%. Real Estate (+0.93%) and Industrials (+0.86%) followed. Laggers: Consumer Discretionary (-0.37), Energy and Consumer Staples both +0.22%.

- Dow Industrials Leaders/Laggers: Amgen (AMGN) +13.74 at 290.76, United Health (UNH) +5.44 at 550.46, Boeing (BA) +4.04 at 168.95. Laggers: Disney (DIS) -0.98 at 99.45, Walgreens Boots (WBA) -0.55 at 38.04, Chevron (CVX) -0.22 at 185.39.

COMMODITIES: Oil Sees Sharp Fall Whilst Gold Opens Bull Trigger

- Crude oil sees a sharper fall today, currently down 2.5-3% as uncertainty remains over China’s zero-Covid policy after rising infections in Guangzhou and other cities, with the decline accelerating with the EIA now expecting US gasoline consumption to shrink next year in a reversal of last month’s forecast (seen falling from 8.79mbpd this year to 8.75mbpd vs prior expected increase to 8.8mbpd).

- WTI is -3.2% at $88.86 but remains above support at $87.6 (Nov 3 low) having surged both before and after US payrolls last week, with key support at $85.30 (Oct 31 low).

- Brent is -2.6% at $95.34 in a reversal of the trend needle pointing north. It next eyes support at $93.55 (20-day EMA) after which lies key support at $91.46 (Oct 31 low).

- Gold meanwhile is +2.1% at $1711.7 as the USD and Tsy yields fall, clearing two resistance levels including $1714.8 (Oct 7 high) before retreating. It opens the bull trigger of $1729.5 (Oct 4 high).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/11/2022 | 0130/0930 | *** |  | CN | CPI |

| 09/11/2022 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/11/2022 | 0700/0800 | ** |  | SE | Private Sector Production |

| 09/11/2022 | 0800/0300 |  | US | New York Fed's John Williams | |

| 09/11/2022 | 1000/1100 |  | EU | ECB Elderson Panels EMEA Event at COP27 | |

| 09/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/11/2022 | 1300/1300 |  | UK | BOE Haskel Speech at Digital Futures at Work | |

| 09/11/2022 | 1500/1000 | ** |  | US | Wholesale Trade |

| 09/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 09/11/2022 | 1600/1100 |  | US | Richmond Fed's Tom Barkin | |

| 09/11/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/11/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.