-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Focus on November Jobs Ahead Fed Blackout

MNI ASIA MARKETS ANALYSIS: Consolidation Ahead Nov Jobs Report

MNI ASIA MARKETS ANALYSIS: Bonds, Equities Sell-Off Late

HIGHLIGHTS

- RUSSIA TO SELL ALL EURO ASSETS FROM WEALTH FUND THIS YEAR: IFX

- RUSSIAN WEALTH FUND TO HOLD ONLY YUAN, RUBLES, GOLD: TASS

- YAHOO TO LAY OFF OVER 20% OF STAFF: AXIOS

US TSYS: Late Bond Sell-Off, 2s10s Off 40 Year Lows - For Now

Tsy 30YY hit session high of 3.7459% as selling in futures accelerated in late trade, no obvious headline print or recent block trade to trigger move - though bonds remained soft after $21B 30Y auction tailed 3.1bp (3.686% high yield vs. 3.655% WI) soured interest in long end. Potential factors driving sell-off:- Early selling ahead next week's corporate supply (Tsys see $15B 20Y Bond and $9B 30Y TIPS).

- Technical selling as TYH3 nears support of 112-29 76.4% retracement of the Dec 30 - Jan 19 bull run.

- Curve unwinds following second day of large late 10s/ultra-bond steepeners fading the broader move in curves to multi-decade lows (2s10s currently -82.234 vs. -87.193, a level not seen since 1981.

- Protracted periods of inverted yld curve signaling market expectations of coming recession in the near term. Tsy 2s10s curve spent much of the period between late 1978 through mid 1982 inverted territory, a precursor to recession that ended in late 1982. Yield curve inversion saw wide variance in 1980 after spd fell to -241.65 low in March 1980 and skyrocketed to 130.0 by early July before re-inverting again.

- Meanwhile, short end outperforms mid-late 2023 futures as markets price in continued rate hikes: Fed funds implied hike for Mar'23 at 26.1bp (+0.7), May'23 cumulative 45.4bp (+1.8) to 5.036%, Jun'23 55.2bp (+2.9) to 5.134%, terminal at 5.155% in Jul'23/Aug'23.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00343 to 4.55857% (+0.00586/wk)

- 1M -0.00243 to 4.57257% (+0.00071/wk)

- 3M +0.01328 to 4.88257% (+0.03843/wk)*/**

- 6M -0.03843 to 5.11257% (+0.05514/wk)

- 12M -0.01258 to 5.45571% (+0.20457/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.88257% on 2/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $106B

- Daily Overnight Bank Funding Rate: 4.57% volume: $284B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.184T

- Broad General Collateral Rate (BGCR): 4.52%, $480B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $466B

- (rate, volume levels reflect prior session)

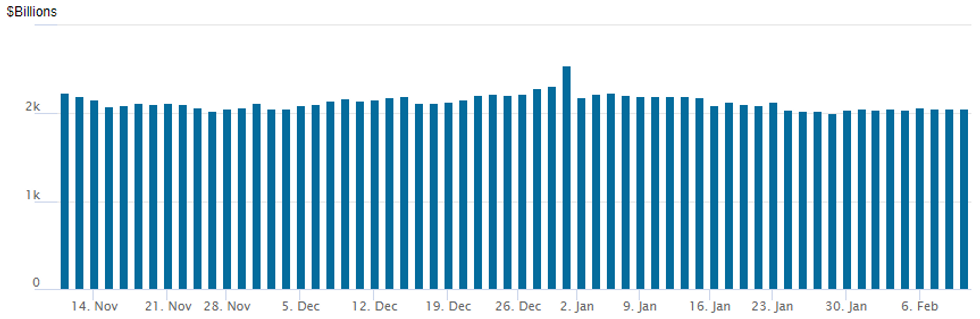

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,058.942B w/ 101 counterparties vs. prior session's $2,059.604B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Volumes picked up as the session wore on, overall trade still revolving around downside puts, positioning for hikes to continue into this fall.- SOFR Options:

- 11,500 SFRN3 94.81/94.93/95.06 put flys, ref 94.915

- 11,500 SFRU3 94.87/95.00/95.12 put flys, ref 94.915

- Block, update over 30,000 2QH3 96.50 puts, 6.5-7.0

- Block, 5,000 SFRJ3 94.62 puts, 2.75 ref 94.85

- 2,500 SFRU3 94.87/95.00/95.12 put flys, ref 94.92

- Block, total 10,000 SFRZ3 96.25/96.75 call spds, 4.5

- 5,000 SFRM3 94.62/94.75/94.93 2x3x1 broken put flys

- Block, 2,500 SFRM3 94.62/94.75 3x2 put spds, 2.75 net ref 94.875

- Update, over -20,000 SFRM3 94.62/95.12 put over risk reversals 0.0-0.5

- +5,000 SFRU3 94.25/95.00 3x1 put spds, 14.5 vs. 94.955/0.20%

- Block, 10,000 SFRZ3 93.93/94.00 put spds, 0.5 ref 95.255

- Block, update 19,000 SFRU3 94.00/94.50 put spds, 6.0 ref 94.965

- -4,000 SFRM3 94.62/95.12 risk reversal, 0.0 -p vs. 94.875/0.44%

- 2,000 SFRJ3 94.37/94.62/94.87/94.93 put condors ref 94.885

- Blocks, 14,000 SFRU3 94.00/94.50 put spds, 6.0 vs. 94.96/0.15%

- 1,500 SFRM3 94.56/94.68/94.81 put flys ref 94.885

- 2,000 SFRJ3 94.50/94.75 put spds, ref 94.88

- 3,500 SFRZ3 96.25/97.00/97.50 broken call flys, ref 95.275

- Block, 2,500 SFRM3 94.62/94.75/94.87 put trees, 1.0 ref 94.87

- Treasury Options:

- 15,000 FVH3 107.5 puts, 9.5-10.5 ref 108-11.25 to -13.25

- over 16,000 TYH3 112.25 puts, 14-11 ref 113-22 to -15.5

- 5,000 TUH3 102.25 puts, 8 ref 102-11.75

- 2,400 USH3 126 puts, 22 ref 128-25

EGBs-GILTS CASH CLOSE: UK Underperforms Amid Broader Flattening Move

Longer-duration instruments outperformed in Europe Thursday as part of a global flattening move, with periphery EGB spreads tightening.

- The UK short-end and belly weakened after an uncovered BoE APF sales operation. BoE Treasury committee testimony didn't really move rate expectations.

- The German curve bull flattened. The data highlight was German inflation which was on the soft side of consensus but consistent with an upward 0.2pp revision to Eurozone inflation in the final Jan reading.

- BTPs outperformed despite little change in implied ECB hike pricing, reflecting a broader risk-on move (Eurostoxx futures hit the highest levels since January 2022).

- Appearances by the ECB's de Cos and de Guindos come after the cash close; attention early Friday is on UK GDP.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.5bps at 2.692%, 5-Yr is down 3.8bps at 2.33%, 10-Yr is down 6bps at 2.303%, and 30-Yr is down 6.2bps at 2.272%.

- UK: The 2-Yr yield is up 3.2bps at 3.5%, 5-Yr is up 3bps at 3.215%, 10-Yr is down 2.2bps at 3.291%, and 30-Yr is down 3.3bps at 3.736%.

- Italian BTP spread down 5.1bps at 181.6bps / Spanish down 0.8bps at 93.3bps

EGB Options: Mostly Upside In Active Session

Thursday's Europe rates / bond options flow included:

- DUJ3 105.6/105.2 put spread 15 paid 3k

- DUH3 105.50/105.10 put spread 5.5k sold 5.25

- DUH3 105.50/105.30ps, bought for 4 in 6k

- DUH3 105.60/105.80cs 1x2, bought for half in 5k

- RXH3 116.75/116.25/115.75 1x1.5x.5 put spread 4000 sold 9

- RXH3 131p, bought for 4.5 in 9k

- OEH3 116.75p, sold at 30 in 25k (Hearing Closing)

- OEH3 117.75/118.00 call spread bought for 7.5 in 5k

- ERJ3 97.00c, bought for 1 in 20k

- ERM4 98.00 call bought for 9.5 in 20k

- ERM3 96.375/96.25ps, bought for 3.25 in 20k

FOREX: USD Index Moderately Softer, Banxico Hawkish Surprise Boosts MXN

- Weakness across major equity benchmarks throughout Thursday’s US session has underpinned a greenback recovery, however, the USD index is has been unable to reverse the entirety of this morning’s move lower and sits 0.2% lower on the day.

- Outperformance in G10 is clearly being led by Scandinavian FX following the Riksbank rate decision, which not only saw a 50bps rate hike, but projected further tightening in the Spring and committed to unwinding their balance sheet from April onwards. EURSEK is down over 2% on the day, breaching multiple technical points, including the medium-term support at 11.1411, the 50-dma.

- Across the major currencies in G10, daily adjustments have been more moderate, however intra-day ranges in the case of the antipodeans and the JPY have been substantial.

- In the case of AUDUSD, the pair initially was clocking an advance of around 1.25% before the turn in global sentiment sent the pair steadily lower, narrowing the gap with the overnight lows at 0.6921.

- Price recently tested support at 0.6880, the 50-day EMA. A clear break and close below this average would signal scope for a deeper retracement.

- In emerging markets, an above consensus Banxico rate hike of 50bps and a hawkish accompanying statement saw the Mexican peso firm around 1%. USDMXN has consolidated around 18.75 ahead of the APAC crossover and will eye key support and the bear trigger at 18.5080, the Feb 02 low.

- Chinese CPI & PPI data is due overnight before UK growth data for December highlights the European docket. Canadian jobs data and US UMich sentiment data will be in focus to round off the week.

FX: Expiries for Feb10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.0bln), $1.0750(E1.2bln), $1.0775-80(E615mln), $1.0800(E921mln), $1.0850-60(E636mln)

- USD/JPY: Y130.00($1.6bln)

- GBP/USD: $1.2150(Gbp529mln)

- EUR/GBP: Gbp0.8800(E506mln)

- AUD/USD: $0.7000(A$505mln)

- USD/CAD: C$1.3400-20($1.4bln)

Late Equity Roundup: Fading Fast

Stock indexes remain weaker, near lows in late FI trade. Earlier support from Information Technology and Consumer Discretionary sectors evaporated while Communication Services sector extend losses. SPX eminis currently trades -33 (-0.8%) at 4097.5; DJIA -223.43 (-0.66%) at 33720.23; Nasdaq -104.7 (-0.9%) at 11803.43.

- SPX leading/lagging sectors: Consumer Discretionary (+0.26%) and Information Technology (-0.06%) well off first half highs. Automakers and parts suppliers still buoyed Consumer Discretionary sector w/ BorgWarner (+4.05%), Tesla (+4.86%). IT more mixed in late trade: Monolithic Power (MPWR) +9.71%, while SolarEdge Technology (SEDG) -8.0%, Enphase (ENPH) -4.88%.

- Laggers: Selling in Communication Services (-2.99%) weighed Google -5.50% continued weakness after AI "Bard" presentation in Paris drew negative comparisons to Microsoft's BING AI yesterday. Materials (-1.41%) and Utilities (-1.03%) follow, the latter weighed by independent/renewable energy shares.

- Dow Industrials Leaders/Laggers: Salesforce (CRM) +4.24 at 173.87, United Health (UNH) +2.37 at 485.95, Walmart (WMT) +0.91 at 141.13. Laggers: Goldman Sachs (GS) -4.61 at 370.49, Home Depot (HD) -3.37 at 317.42, Honeywell (HON) -2.45 at 199.77.

- Equity Earnings cycle continues after the close: Mettler Toledo Int (MTD, $11.66 est), PayPal (PYPL, $1.20 est), Expedia (EXPE, $1.77 est), Mohawk Ind (MHK, $1.27 est) ,Motorola (MSI, $3.43 est)

E-MINI S&P (H3): Outlook Remains Bullish

- RES 4: 4361.00 High Aug 16

- RES 3: 4300.00 Round number resistance

- RES 2: 4250.00 High Aug 26, 2022

- RES 1: 4208.50 High Feb 2 and the bull trigger

- PRICE: 4098.00 @ 1510ET Feb 8

- SUP 1: 4067.18 20-day EMA

- SUP 2: 4002.94 50-day EMA

- SUP 3: 3901.75 Low Jan 19

- SUP 4: 3788.50 Low Dec 22 and a key support

The S&P E-Minis trend condition is bullish. The contract traded higher last week and confirmed a resumption of the bull cycle that started Dec 22. A key resistance and a bull trigger at 4180.00, Dec 13 high, has been pierced. A clear break would confirm a resumption of a broader uptrend and open 4250.00, the Aug 26 2022 high. Initial firm support to watch lies at 4002.94, the 50-day EMA. A pullback would be considered corrective.

COMMODITIES: Gold Tests Support On Higher US Yields Whilst Oil Fades With Equities

- Crude oil pulls back after three successive gains earlier in the week, coming a day after resilience to a further build in US inventories yesterday and today coinciding with equities slipping (SPX e-minis with -1.8% intraday slide for -0.8% on the day).

- Exxon Mobil is creating a global trading division to bring together Exxon’s crude, natural gas, power and petroleum-product desk.

- In gas space, Ukraine’s Naftogaz is proposing a new $835M restructuring plan to rescheduled payments of already-defaulted debt, whilst Germany and Oman are closing in on a 10-year LNG deal.

- WTI is -0.9% at $77.73 off a low of $76.54 that remained comfortably above support at $74.34 (Feb 7 low).

- Brent is -1.1% at $84.19 off a low of $83.05 but still comfortably above support at $81.19 (Feb 7 low).

- Gold is -0.7% at $1862.03 off a low of $1859.94 that tested support at $1861.4 (Feb 3 low) after which sits the 50-day EMA of $1855.2.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/02/2023 | 0130/0930 | *** |  | CN | CPI |

| 10/02/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 10/02/2023 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 10/02/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 10/02/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 10/02/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 10/02/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 10/02/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 10/02/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/02/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 10/02/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 10/02/2023 | 1400/1400 |  | UK | BOE Pill Panellist at BIS SUERF Workshop | |

| 10/02/2023 | 1400/1500 |  | EU | ECB Schnabel Twitter Q&A | |

| 10/02/2023 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 10/02/2023 | 1730/1230 |  | US | Fed Governor Christopher Waller | |

| 10/02/2023 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/02/2023 | 2100/1600 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.