-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Bouncing Off Post Job Lows

- MNI US: House To Vote On DHS Secretary Mayorkas Impeachment Today

- MNI RUSSIA-TURKEY: Putin And Erdogan To Discuss Regional Gas Hub

- US RAISED CONCERNS ON CHINA'S INDUSTRIAL POLICY PRACTICES, Bbg

- TRUMP DENIED IMMUNITY IN DC ELECTION CASE BY APPEALS COURT, Bbg

- NEW YORK COMMUNITY BANCORP DROPS 12%; FELL 11% ON MONDAY, Bbg

Key Links: MNI FED: Fed's Mester Sees Rate Cuts Likely Later This Year / MNI BRIEF: Yellen Has Concerns About Commercial Real Estate / MNI: BOC Speech Drops Reference To Need For Rate Hike

US TSYS Fed Rhetoric Cools Slightly

- Treasury futures holding firmer after the bell as markets inched off post-jobs related lows. Markets have come a long way in unwinding rate cut pricing since Friday's blowout job gains for January, while today saw a slight softening of Fed rhetoric.

- Initial muted react to Cleveland Fed Mester economic outlook comments: "POLICY IS IN A GOOD PLACE, MISTAKE TO CUT RATE TOO SOON .. CAN'T COUNT AS MUCH ON SUPPLY SIDE TO LOWER INFLATION" was largely in-line with Chairman Powell comments.

- Addressing the media later in the afternoon, Mester reiterated the likelihood of three rate cuts in 2024. MN Fed President Kashkari also sounded more placative of late.

- In turn, projected rate cut pricing gained slightly by Tuesday's close: March 2024 chance of 25bp rate cut currently -20.3% vs. -17.4% this morning w/ cumulative of -5.1bp at 5.270%, May 2024 at -61.2% vs. -57% w/ cumulative -20.4bp at 5.118%, while June 2024 back to -89.2% from -83.8% (105% pre-NFP for comparison) w/ cumulative -42.7bp at 4.895%. Fed terminal at 5.325% in Feb'24.

- Wednesday Data Calendar: Continued Focus on Fed Speakers, 10Y Sale

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00060 to 5.32309 (+0.00098/wk)

- 3M +0.00645 to 5.32258 (+0.03212/wk)

- 6M +0.02449 to 5.21103 (+0.11493/wk)

- 12M +0.04779 to 4.90712 (+0.21432/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.731T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $688B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $677B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $269B

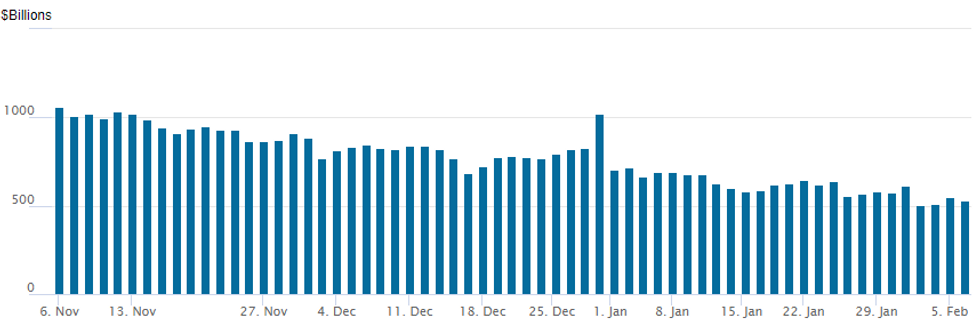

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage slips to $532.439B vs. $552.289B Monday. Holding above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the number of counterparties holds steady at 80 from 74 last Thursday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

SOFR and Tsy option trade remained mixed Tuesday - continued repositioning with moderately higher underlying still near post-NFP lows. Projected rate cut pricing gaining slightly as Fed rhetoric cools slightly (Mester still sees 3 cuts in 2024): March 2024 chance of 25bp rate cut currently -20.3% vs. -17.4% this morning w/ cumulative of -5.1bp at 5.270%, May 2024 at -61.2% vs. -57% w/ cumulative -20.4bp at 5.118%, while June 2024 back to -89.2% from -83.8% (105% pre-NFP for comparison) w/ cumulative -42.7bp at 4.895%. Fed terminal at 5.325% in Feb'24.

- SOFR Options:

- -15,000 SFRH4 94.93/95.37 call spds, 1.5

- +4,000 SFRM4 94.50/94.62 put spds, 1.0

- Block, +5,000 SFRU4 95.00/95.12 put spds 1.0 over SFRU4 95.75/95.87 call spd ref 95.54

- Block, 8,000 SFRH4 95.37 calls, 1.25 ref 94.775

- update, +6,000 SFRZ4 95.00/95.25/95.50/95.75 put condors, 6.5

- -10,000 SFRU4 95.25/95.50 call spds 11.5 vs. 95.535/0.12%

- 3,000 SFRM4 95.31/95.43/95.56/95.68 call condors, ref 95.12

- 9,500 SFRJ4 95.06/95.18/96.25 broken call trees adds to Block

- 2,500 SFRU4 95.00/95.12/95.37 put trees ref 95.505

- Block, 5,000 SFRJ4 95.06/95.18/96.25 broken call trees, 26.0 net vs. 95.125/0.05%

- Block, 5,000 SFRM4 94.56/94.68/94.81 put flys, 1.5

- 3,500 SFRK4 94.50/94.75 put spds, ref 95.125

- 4,100 SFRK4/SFRM4 95.00/96.00 call spd spd

- Block, 10,000 SFRM4 94.62/94.75 put spds, 2.25

- Block, 2,500 SFRH4 94.62/94.75 put spds, 3.0

- Block, 3,000 0QH4 96.00/96.25 put spds 13.0 vs. 96.17/0.22%

- over 17,000 SFRM4 95.87 calls ref 95.14 to -.135

- 10,000 SFRM4 95.12/95.81 1x2 call spds ref 95.15 to -.13

- 1,670 SFRZ4 95.00/95.25/95.50/95.75 put condors ref 95.895

- Treasury Options:

- 2,750 FVH4 107/107.5 3x2 put spds, 8 ref 107-22.25

- +33,000 TYJ4 108.5/110 put spd, 17 ref 111-23

- 6,500 TUJ4 102.12/102.5/102.75/103.0 put condors ref 102-29.75

- over 12,200 TYH4 109 puts, 6 last

- over 9,900 TYH4 110 puts, 17 last

- 1,000 TYHH4 108.5/109.5/110.5 put trees, 14 net ref 110-30.5

EGBs-GILTS CASH CLOSE: Solid Rebound

Gilts and Bunds bounced Tuesday after two consecutive down days.

- The negative tone of the previous sessions carried over in morning trade, exacerbated by a heavy data slate (including 30Y Spain syndication).

- A big upside surprise in German factory orders initially weighed on Bunds, though MNI notes it was largely due to one-off factors (ie aircraft orders) with core orders contracting further. Downward inflation expectations evident in the ECB's monthly consumer survey didn't have much impact.

- Bund and Gilt futures hit fresh lows in late morning but reversed higher in the afternoon.

- Multiple factors were at play, including the conclusion of the day's issuance which was well absorbed (large books for Spain, strong auction of 30Y Green Gilt), and renewed concern over US regional banks. All in all the rebound looked corrective.

- Both the German and UK curves bull flattened, with Gilts outperforming. Periphery EGB spreads ended mixed.

- German industrial production data features early Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.8bps at 2.595%, 5-Yr is down 2.2bps at 2.215%, 10-Yr is down 2.4bps at 2.292%, and 30-Yr is down 1bps at 2.51%.

- UK: The 2-Yr yield is down 3.9bps at 4.47%, 5-Yr is down 4.5bps at 3.953%, 10-Yr is down 5.7bps at 3.95%, and 30-Yr is down 6.5bps at 4.552%.

- Italian BTP spread down 0.5bps at 156.3bps / Spanish bond spread up 0.6bps at 91.8bps

EGB Options Upside Buying Fades Slightly As Rates Rebound

Tuesday's Europe rates/bond options flow included:

- DUH4 106.20/106.40cs, bought for 1.5 in 5k

- OEH4 118.75/119.75cs, bought for 4.5 in 2.2k

- ERH4 96.12/96.00/95.87p fly, sold at 2.25 in 6k

- SFIM4 94.70/94.85/94.90/95.05c condor bought for 5 in 3k

- SFIU4 95.55/95.85/96.00c fly, bought for 6 in 5k

- SFIZ4 95.00/94.80/94.70/94.50p condor, bought for 1.75 in 8.8k

FOREX USD Index Moderates Lower Amid Yields Pullback, AUD Outperforms

- Despite an early test of Monday's highs, the USD index has reversed and now sits 0.25% in the red on Tuesday. The moderate correction looks to be driven by US yields rolling off their highs on a combination of Treasury block buys and risk aversion stemming from the NYCB equity sell-off.

- Corresponding strength across the rest of G10 FX has been broad based, with moderate outperformance seen for the Australian dollar and relative weakness notable for the Euro.

- Initially, the Euro extended its slippage off overnight highs, with EUR/USD's new daily low well in closely matching the Monday pullback and cycle low of 1.0724. Despite the subsequent greenback weakness, EURUSD has only managed to recover to 1.0750, with the day’s range contained to a very narrow 39 pips. Clearance below 1.0923 opens levels last seen in November last year.

- The AUD was also boosted by the RBA not ruling out further tightening, although the subsequent central bank press conference was fairly balanced. AUDUSD has risen back above 0.6500 following yesterday’s breach of the pivotal chart point.

- 148.80 still appears to be capping the topside for USDJPY, with price action unable to build momentum through the prior January highs on Monday. Since then, the sensitivity to core rates has benefitted the Japanese Yen with USDJPY sliding all the way back to below the 148 handle in late trade.

- Similarly, lower US yields have boosted FX sentiment in emerging markets with the likes of ZAR and CLP outperforming. USDZAR is down 1.15% as we approach the APAC crossover and has now erased the entirety of yesterday’s move higher. A recovery in gold (which has bounced over 1% off Monday’s low) is likely accounting for rand outperformance in the EMEA region.

- New Zealand Employment data is first up on Wednesday, before German industrial production and Swiss currency reserves. US and Canadian trade balance data also crosses, as well as further Fed Speak, with expected comments from Fed’s Kugler, Collins, Barkin and Bowman all due.

FX Expiries for Feb07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0725(E1.1bln), $1.0745-55(E772mln), $1.0800(E965mln), $1.0950(E2.9bln)

- USD/JPY: Y146.40-55($2.0bln), Y147.00($1.5bln), Y147.45-60($889mln), Y148.00($710mln)

- AUD/USD: $0.6450(A$624mln), $0.6600(A$735mln)

- USD/CAD: C$1.3500($696mln)

- USD/CNY: Cny7.2000($1.5bln)

Late Equities Roundup: Chemicals, Mining Stocks Outperforming

- Stocks remain mixed in late trade, DJIA firmer vs steady SPX Eminis. Currently, the DJIA is up 54.67 points (0.14%) at 38434.98, S&P E-Minis up 4 points (0.08%) at 4966, Nasdaq down 19 points (-0.1%) at 15578.75.

- Leading gainers: Materials and Real Estate sector continued to outperform in late trade. Recovering from weaker Monday trade, chemicals and mining stocks buoyed the Materials sector in the first half: Dupont +7.47%, Albemarle +4.12%, Linde PLC +3.61%, Freeport-McMoRan +3.59%. Estate management shares supported the Real Estate sector in the first half: CoStar Group +1.49%, CBRE +0.44%.

- Laggers: Information Technology and Communication Services underperformed in late trade, chip stocks paring Monday gains: AMD -3.98%, Micron --3.52%, Nvidia -2.41%. Meanwhile, telecom stocks displaced earlier lag in financial services shares. Verizon and ATT shares -1.0%, T-Mobile not far behind at -0.82%. On a side note, NY Community Bank fell an additional 12%, adding to -11% decline on Monday. KBW Nasdaq regional bank index traded near steady at 93.54.

- Looking ahead: corporate earnings expected after the close: Chipolte, Fortinet, Cognizant Technologies, Snap Inc, Gilead Sciences, Carlisle, Enphase Energy, Amgen, Ford, Prudential Fncl.

E-MINI S&P TECHS: (H4) Bulls Remain In The Driver’s Seat

- RES 4: 5100.00 Round number resistance

- RES 3: 5050.14 1.764 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5012.80 1.618 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 5000.00 Psychological round number

- PRICE: 4967.00 @ 1505 ET Feb 6

- SUP 1: 4866.000/4780.27 Low Jan 31 / 50-day EMA values

- SUP 2: 4702.00 Low Jan 5

- SUP 3: 4594.00 Low Nov 30

- SUP 4: 4550.75 Low Nov 16

A broader uptrend in S&P E-Minis remains intact and the contract is holding on to the bulk of its recent gains. The price has recently traded to fresh cycle highs, confirming a resumption of the uptrend. Recent corrections have been shallow - this also highlights a strong uptrend. The focus is on the psychological 5000.00 handle. On the downside, initial key short-term support has been defined at 4866.00, the Jan 31 low.

COMMODITIES Further Red Sea Attacks Drive Net Increase In Crude Futures

- Crude markets are heading for US close trading higher, although have eased back slightly amid more positive noises from Qatar regarding Hamas view on a ceasefire proposal. Nevertheless, support continues to come from further Red Sea attacks.

- The number of oil tankers diverting around the cape of Good Hope continues to rise amid ongoing Houthi rebel attacks in the Red Sea, Oil Brokerage said.

- Saudi Arabia needs oil prices to average at least $90/bbl for it to balance its 2024 budget, according to Fitch Ratings, boosting the chance that its output cuts will be extended into Q2.

- WTI is +1.1% at $73.58, and Brent is +1.0% at $78.80, neither close to troubling technical levels.

- Gold is +0.6% at $2036.9, gaining as the US depreciated through the US session. It moves away from support at yesterday’s $2015.0 but remains some way off resistance at $2065.5 (Feb 1 high).

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/02/2024 | 0000/1900 |  | US | Philadelphia Fed's Pat Harker | |

| 07/02/2024 | 0645/0745 | ** |  | CH | Unemployment |

| 07/02/2024 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/02/2024 | 0745/0845 | * |  | FR | Foreign Trade |

| 07/02/2024 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/02/2024 | 0840/0840 |  | UK | BoE's Breeden Speaks At Women In Economics Event | |

| 07/02/2024 | 0900/1000 | * |  | IT | Retail Sales |

| 07/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/02/2024 | 1215/1215 |  | UK | BOE's Woods et al : Treasury Select Committee 'work of the PRA' | |

| 07/02/2024 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/02/2024 | 1330/0830 | ** |  | US | Trade Balance |

| 07/02/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/02/2024 | 1600/1100 |  | US | Fed Governor Adriana Kugler | |

| 07/02/2024 | 1630/1130 |  | US | Boston Fed's Susan Collins | |

| 07/02/2024 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 07/02/2024 | 1830/1330 |  | CA | BOC Minutes (Summary of Deliberations) | |

| 07/02/2024 | 1900/1400 |  | US | Fed Governor Michelle Bowman | |

| 07/02/2024 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.