-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:Dueling Fed Speak Ahead Jackson Hole

- MNI INTERVIEW: FED'S HARKER: CAN HOLD RATES STEADY FOR A WHILE

- MNI RUSSIA: Lavrov-BRICS Plan To Set Up Alternative Payment System

- MNI GLOBAL POLITICAL RISK: CHINA MFA: BRICS Expansion Was Transparent And Diplomatic

- MNI GLOBAL POLITICAL RISK: Saudi To Take "Appropriate Decision" On BRICS Invitation

- BOSTON FED COLLINS: EXTREMELY LIKELY FED HAS TO HOLD FOR SOME TIME, Bbg

- BULLARD: REACCELERATION IN US ECONOMY IS BIGGEST QUESTION NOW, Bbg

- TURKEY RAISES ONE-WEEK REPO RATE BY 750BPS TO 25%; EST. 20.00%, Bbg

Key Links:MNI INTERVIEW: Fed’s Harker Says Probably Time To Stop Hiking / MNI INTERVIEW2:Fed’s Harker-Soft Landing In Sight, Jobs Weaker / MNI INTERVIEW: Transcript of MNI Interview With Fed's Harker / MNI BRIEF: Fed's Collins Expects Rates High For Longer / US Treasury Auction Calendar

US Tsys Off Week Lows Ahead Jackson Hole Eco-Summit

- US Rates are trading weaker after the bell, trading sideways near lows since midday. Early session saw fast two-way trade as Treasury futures extended lows after briefly bouncing post data: weekly claims lower than expected at 230k vs. 240k, Durable Goods Orders -5.2% vs. -4.0% est (4.6% prior), ex-transportation gains 0.5% vs 0.2% est.

- After establishing lows (TYU3 109-17), dovish comments from Philly Fed Harker this morning ahead if Fri's Jackson Hole eco-summit spurred a round of short covering across the board,

- Rates and equities reacted positively (if delayed) to Philly Fed Harker telling MNI he is inclined to support holding interest rates at their current level at least through the end of the year and possibly longer.

- Rates came back under pressure while stocks continue to trade weaker after Boston Fed Collins urged keeping rates higher for longer. "I don't think it's helpful to say a preset path, we may need additional increments, and we may be very near a place where we can hold for a substantial amount of time," Collins said.

- While there may be additional sideline comments from central bank officials this evening (eco-summit agenda to be released at 2000ET tonight), main focus is on Chairman Powell's speech at 1005ET.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00529 to 5.32024 (+.00597/wk)

- 3M -0.00315 to 5.38790 (+0.00473/wk)

- 6M -0.01268 to 5.44501 (+0.00047/wk)

- 12M -0.03594 to 5.37539 (-0.00799/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $105B

- Daily Overnight Bank Funding Rate: 5.32% volume: $265B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.270T

- Broad General Collateral Rate (BGCR): 5.27%, $542B

- Tri-Party General Collateral Rate (TGCR): 5.27%, $536B

- (rate, volume levels reflect prior session)

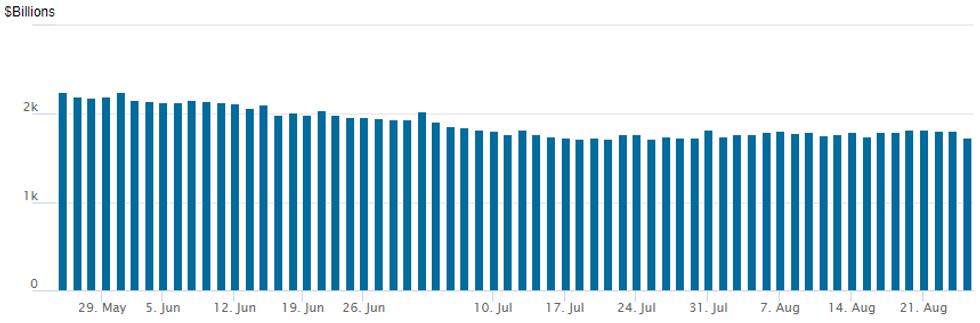

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation falls to $1,731.623B w/96 counterparties, compared to $1,816.533B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Carry-over upside SOFR call trade from Wednesday generated decent volumes Thursday even as underlying futures pared some of yesterday's gains. Salient trade: a buyer of 100,000 Dec'23 SOFR call spreads looking for a 25bp rate cut by year end. Rate hike projections through year end are gaining as short end trades weaker, Sep 20 FOMC is 17% w/ implied rate change of +4.3bp to 5.371%. November cumulative of +13.2bp at 5.460, December cumulative of 11.6bp at 5.445%. Fed terminal up to 5.460% in Nov'23.

- SOFR Options:

- +100,000 SFRZ3 94.75/94.87 call spds, 1.0-1.25, mostly 1.25 outright

- +4,000 SFRH4 94.75/95.00/95.25/95.50 call condor 1.0 over SFRH4 94.12/94.25 put spd

- +15,000 SFRM4 97.00/97.50 call spds, 3.25 ref 95.03

- 2,000 0QU3 96.00/96.50 call spds vs. SFRV3 93.87/94.37/94.50 broken put flys

- 4,000 0QZ3 96.00/96.25/96.50 call flys ref 95.735

- 4,500 SFRM3 95.75/97.00 2x3 call spds ref 95.07

- 3,200 SFRZ3 94.68/94.81/94.93 call flys ref 94.58

- 2,100 SFRZ3 94.93 calls ref 94.58

- Treasury Options: Reminder, Sep'23 options expire Friday -- unwinds making up much of today's volume.

- 2,000 TYU3 110.5/111 1x2 call spds

- over 28,800 TYU3 110 calls 6-7 after trading as high as 17

- 3,000 TYV3 111.5/112 call spds, 8 ref 110-06

- Block, +11,000 TYZ3 106 puts, 27 vs. 109-21/0.17%

- 2,000 TYU3 108/108.5/109 put flys ref 109-26.5

- 3,100 TYX3 112 calls, 45 ref 110-11.5

- 14,300 TYU3 109.5 puts, 11

- 19,400 TYU3 109 puts, 3-4

- 13,900 TYU3 108.5 puts, 2

- 4,800 TYU3 108 puts, 1

EGBs-GILTS CASH CLOSE: UK Bull Flattening, BTPs Underperform

The German curve twist steepened while the UK's bull flattened Thursday.

- After a strong open, Bunds and Gilts pulled back gradually for the next several hours.

- Yields hit session highs in mid-afternoon before fading alongside US Treasuries after MNI's interview with Philadelphia Fed Pres Harker who provided the first (dovish) comments from Jackson Hole.

- BTPs underperformed the European space, with Italian banking sector uncertainty rekindled as BBG reported that the government is set to is eyeing a borrower-friendly measure on bad loans.

- Looking ahead, the Jackson Hole agenda is released overnight, with Friday's focus being German IFO and speeches by Fed's Powell and ECB's Lagarde. We also get a BTP Short-Term auction.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.1bps at 2.963%, 5-Yr is unchanged at 2.519%, 10-Yr is up 0.2bps at 2.519%, and 30-Yr is down 0.5bps at 2.625%.

- UK: The 2-Yr yield is down 1.3bps at 4.96%, 5-Yr is down 1.5bps at 4.475%, 10-Yr is down 4bps at 4.428%, and 30-Yr is down 5.1bps at 4.645%.

- Italian BTP spread up 0.6bps at 165.8bps / Spanish up 0.1bps at 102.6bps

EGB Options: Light Flow Ahead Of Jackson Hole

Thursday's Europe rates / bond options flow included:

- DUU3 105.3c, bought for 2 in 4k

- SFIV3 94.50/94.60cs, bought for 1.5 in 5k

FOREX USD Index Recovers Towards Trend Highs, Turkish Lira Surges

- Despite yesterday’s sell-off following the weaker than expected US data, the greenback regained its poise on Thursday and the USD index is narrowing back in on trend highs around 104.00 as we approach the APAC crossover.

- Weaker equity benchmarks and slightly higher US yields have underpinned the renewed optimism for the greenback, with the more risk sensitive currencies in G10 most heavily impacted. AUD, NZD and GBP have all declined around 0.9% on Thursday as markets now await any signals from Chair Powell on Friday regarding the path for US monetary policy.

- For cable, the pair has pierced initial support at 1.2621, the Aug 14 low and the short-term bear trigger. Further weakness places the key focus on 1.2591, the Jun 29 low and an important support. A break below here would confirm a resumption of the downtrend.

- Elsewhere, USDJPY had a substantial bounce from the 144.60 overnight lows to trade just below 146 and EURUSD was slowly grinding south throughout the session, hovering around 10 pips above the 1.0800 mark.

- In emerging markets, a bumper rate hike of 750bps from the CBRT has placed the Turkish Lira as the best performing currency. USDTRY is down an impressive 5.8% after the central bank ramped up their tightening to establish the disinflation course as soon as possible and to anchor inflation expectations.

- Tokyo Core CPI data is due overnight before German IFO data for August. Aside from final UMich sentiment data and inflation expectations, all focus will be on the Jackson Hole symposium and associated central bank speakers.

FX Expiries for Aug25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800-25(E2.3bln), $1.0850(E1.1bln)

Late Equities Roundup, Extending Lows

- Stocks are trading weaker in late trade, well off early highs as longs squared ahead the start of the Jackson Hole economic symposium early Friday. Rates and stocks continue to trade weaker after Boston Fed Collins urged keeping rates higher for longer.

- Hawkish messaging a headwind for stocks ahead Chairman Powell's speech tomorrow a 1005ET. Currently, S&P E-Mini futures are down 40.25 points (-0.91%) at 4406.75, Nasdaq down 180.2 points (-1.3%) at 13539.03, DJIA down 238.61 points (-0.69%) at 34232.27.

- IT lead laggers the day after Nvidia beat earnings, shares of the chip maker up another 2.05% after surging over 6% late Wednesday. Nvidia also announced a $25B share buyback today. Other chip stocks, however, are not faring as well with AMD -7.6%, Enphase -6.25%, Solaredge -5.4%.

- Meanwhile, Communication Services and Consumer Discretionary reversed the prior session gains. Netflix -3.95% weighed on the former the day shares surged on pass-word crackdown and subscriber gains. Autos weighed on discretionary sector with Tesla -2.2%.

- Leading gainers: Financials, Energy and Real Estate sectors outperformed, insurance names buoyed the former: Prudential +2.4%, Key Corp +1.65%, Aflac +1.75%.

E-MINI S&P TECHS: (U3) Resistance Is At The Former Bull Channel Base

- RES 4: 4593.50/4634.50 High Aug 2 / Jul 27 and key resistance

- RES 3: 4560.75 High Aug 4

- RES 2: 4517.75 High Aug 15

- RES 1: 4493.98 Former bull channel base drawn from Mar 13

- PRICE: 4406.00 @ 1520 ET Aug 24

- SUP 1: 4399.50/4350.00 Low Aug 23 / 18 and a bear trigger

- SUP 2: 4344.28 38.2% retracement of the Mar 13 - Jul 27 bull cycle

- SUP 3: 4305.75 Low Jun 8

- SUP 4: 4254.62 50.0% retracement of the Mar 13 - Jul 27 bull cycle

The latest recovery in the E-mini S&P contract has resulted in a break of both the 20- and 50-day EMA values. This signals potential for a stronger short-term recovery. Attention is on resistance at 4493.98, the base of a bull channel that was breached last week. The channel is drawn from the Mar 13 low. Clearance of this level would open 4517.75, the Aug 15 high. Support to watch lies at 4399.50, yesterday’s low. A break would be bearish.

COMMODITIES Crude Nearly Tests Important Support, Gold Surprisingly Resilient

- Crude edged back down after finding some earlier support amid global demand concerns and some tentative supply optimism. Current weakness is due to economic concerns in US and China combined with high flows out of Iran, optimism around a return of Iraqi flows via Turkey and the possible temporary lifting of US sanctions against Venezuela.

- Saudi Arabia’s Foreign Minister Prince Faisal bin Farhan said the Kingdom has efficient tools to stabilize the energy market during the BRICS summit.

- Political Risk: BRICS Invite Six Nations To Become Members, Inc. Saudi & Iran.

- OPEC’s core members may need to consider further production cuts as some of the group’s most troubled nations - Iran, Iraq, Libya, Nigeria and Venezuela - achieve unexpected supply growth, Ed Morse, Citigroup’s head of commodities research, said.

- WTI is -0.2% at $78.74 off a low of $77.59 that came close to support at $77.42 (50-day EMA).

- Brent is -0.2% at $83.03 off a low of $81.97 that came close to support at $81.68 (50-day EMA).

- Gold is +0.1% at $1917.17, in surprising resilience considering the renewed push higher in the USD index and higher Treasury yields. It was revealed today that the Polish central bank made its biggest gold purchases in four years in July, boosting its share to more than a tenth of reserves.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/08/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 25/08/2023 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/08/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 25/08/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/08/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/08/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index Direction |

| 25/08/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/08/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 25/08/2023 | 1405/1005 |  | US | Fed Chair Powell on economic outlook | |

| 25/08/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 25/08/2023 | 1900/2100 |  | EU | ECB's Lagarde speaks at Jackson Hole | |

| 26/08/2023 | 1625/1725 |  | UK | BoE's Broadbent speaks in Jackson Hole |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.