-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: ECB CB Policy Forum Inflation Focus

- FED POWELL: DON'T SEE US GETTING BACK TO 2% INFLATION IN '23 OR '24, Bbg

- ECB'S LAGARDE: NOT SEEING ENOUGH TANGIBLE EVIDENCE OF FALLING UNDERLYING INFLATION, Bbg

- BOE'S BAILEY: UK ECONOMY PROVING MORE RESILIENT THAN FORECAST .. DATA SHOWING SIGNS OF INFLATION PERSISTENCE, Bbg

- Nvidia Drops on Report US Plans More AI Chip Curbs for China, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS: Bonds Near Late Session Highs, Tsy 7Y Note Sale Well Received

- Treasury futures are drifting near late session highs, climbing steadily since marking lows at midmorning, discounting earlier comment from Chairman Powell at ECB CB forum that consecutive rate hikes are not off the table spurred fast sell interest in short to intermediates.

- Modest two-way trade this morning after higher than expected Retail inventories data: MoM (0.8%, 0.2% est; 0.3% prior/rev), Wholesale Inventories in-line MoM (-0.1%, -0.1% est; -0.3% prior/rev), Advance Goods Trade Balance (-$91.1B, -$93.8B est; -$97.1B prior).

- Curves climbed off deeper inversion briefly after a decent $35B 7Y note auction (91282CHJ3) traded through: 3.839% high yield vs. 3.847% WI; 2.65x bid-to-cover vs. 2.61x last month. Indirect take-up 75.31% vs. 72.30% prior; Direct take-up: 16.55% vs. 17.29% prior; Primary dealer take-up to 8.14% vs. 10.42% prior auction.

- Despite the bounce, bears still hold sway at current levels. Recent pullback in 10s held inside the recent range and the contract remains in consolidation mode. The trend outlook is bearish.

- Meanwhile, market confidence of a hike at the July 26 FOMC has climbed to 79% with implied rate of +19.8bp to 5.267%. September cumulative of +24.4bp at 5.315% while November is pricing in just over a 25bp hike with cumulative at 29.3bp at 5.364%. Fed terminal at 5.385% in Nov'23 this morning.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00287 to 5.10249 (+.01882/wk)

- 3M +0.00255 to 5.24187 (+.00317/wk)

- 6M +0.01237 to 5.33670 (+.00762/wk)

- 12M +0.03611 to 5.29933 (+.01573/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00228 to 5.06614%

- 1M +0.00129 to 5.19300%

- 3M +0.00915 to 5.53786% */**

- 6M +0.01129 to 5.73100%

- 12M +0.02900 to 5.94329%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.55743% on 6/12/23

- Daily Effective Fed Funds Rate: 5.07% volume: $132B

- Daily Overnight Bank Funding Rate: 5.06% volume: $282B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.481T

- Broad General Collateral Rate (BGCR): 5.04%, $594B

- Tri-Party General Collateral Rate (TGCR): 5.04%, $586B

- (rate, volume levels reflect prior session)

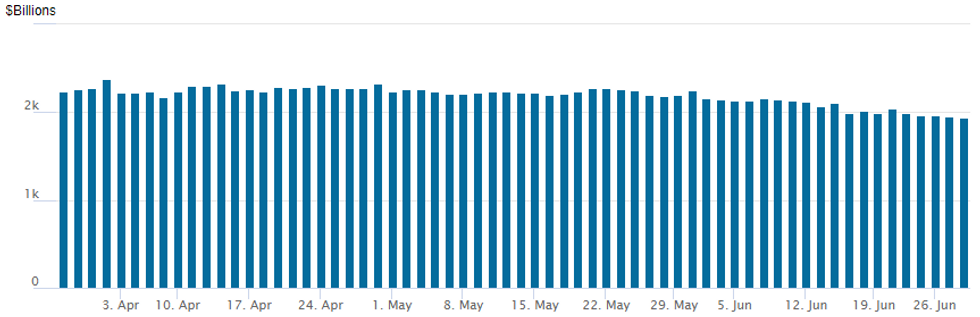

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $1,945.211B w/ 101 counterparties, compared to $1,951.098B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

- Generally quiet FI option trade Wednesday, two-way positioning in SOFR calls and midcurve volatility sales reported. Salient trade includes:

- SOFR Options

- 4,000 SFRM4 96.50/98.50 call spds, 23.0 ref 95.435

- -4,000 SFRH4 98.00 calls, 4.5

- over 3,000 SFRU3 94.56 puts, 1.5 ref 94.635

- 2,500 SFRU3 94.50/94.56/94.62 put flys, ref 94.625 to-.63

- -8,000 OQZ3 94.50/98.00 strangles, 8.5

- -5,000 SFRU3 95.00/95.50/9600 call flys, 1.0 vs. 94.655/0.06%

- +10,000 SFRU3 95.00/95.25 call spds, 1.5 vs. 94.665/0.05%

- +10,000 OQU3 96.50/97.00 call spds vs. 2QU3 97.25/97.75 call spds, 2.0 net steepener

- -5,000 SFRZ3 95.50 calls, 13.0 vs. 94.725/0.20%

- 2,000 SFRU3 94.43/94.62 put spds ref 94.645

- 3,000 SFRU3 94.75/94.87 put spds ref 94.65

- 3,000 OQU3 96.00/96.50/97.5 broken call trees ref 95.85 to -.855

- Treasury Options:

- -6,000 TYU3 111.5/113/114.5 iron flys, 3 net (2xstrangle vs. 1xstraddle)

- over 2,100 FVU3 101.5 puts, 1 ref 107-20.25

- over +7,500 FVQ3 109 calls, 9-9.5 ref 107=20.75

- 2,750 TYQ3 115 calls, 11 ref 112-31

- over 8,100 TYQ3 114 calls, 22 ref 112-30

- over 5,500 TYQ3 112 puts, 24 ref 112-28.5

EGBs-GILTS CASH CLOSE: Soft Italy Inflation Sets Stage For Rally

The UK curve twist steepened amid a strong short-end rally, while Germany's bull steepened Wednesday.

- Core FI rallied in the morning alongside softer-than-expected Italian June flash inflation data, a positive sign for doves ahead of the next two days' crucial eurozone readings.

- This contrasted with a widening of periphery EGB spreads as a few articles pointed to potentially more aggressive ECB balance sheet normalization (including a comment by Vujcic and various media reports).

- A Sintra panel with Lagarde, Bailey, Powell, and Ueda was more hawkish than expected for the most part, though European core yields still resolved lower by the cash close.

- Attention first thing Thursday morning will be on NRW state inflation in Germany, followed by Spain CPI later in the session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.6bps at 3.104%, 5-Yr is down 5.2bps at 2.464%, 10-Yr is down 4.1bps at 2.315%, and 30-Yr is down 3bps at 2.361%.

- UK: The 2-Yr yield is down 12.7bps at 5.146%, 5-Yr is down 10.7bps at 4.568%, 10-Yr is down 5.9bps at 4.316%, and 30-Yr is up 0.3bps at 4.379%.

- Italian BTP spread up 3.5bps at 166.3bps / Greek up 5.4bps at 127.1bps

EGB Options: Mixed Euribor Trade With Broken Ladders And Condors

Wednesday's Europe rates / bond options flow included:

- ERZ3 95.625p, bought for 9.25 in 3.5k

- ERZ3 96.00/95.875/95.375 broken p ladder, bought again for 1.25, now 7k total.

- ERH4 96.375/96.25/95.875/95.625 broken p condor, bought for 0.25 in 2.5k.

FOREX: Greenback Trades On Surer Footing, AUD Extends Post-CPI Decline

- The USD index has risen 0.4% on Wednesday and price action remained supportive throughout the European session and across the first half of US trade. We note the potential link to value date month end flows, with the index putting in the top around the WMR fix.

- AUD & NZD are among the session's poorest performers, both declining over 1%, after a lower-than-expected CPI print from Australia. Headline CPI slowed unexpectedly to 5.6% versus a 6.1% estimate - the lowest reading in just over a year. In response, traders marked down AUDUSD from ~0.6690 to ~0.6619 before stabilising through the European morning.

- The broad greenback strength in the second half of the session saw AUDUSD extend declines, with the pair briefly breaching the 0.66 handle, the lowest level seen since June 05.

- GBPUSD (-0.80%) also moved lower, picking up momentum through last week’s lows around 1.2685/90. Stagflationary concerns since last week’s BOE decision continue to temporarily weigh on sterling and it appears a short-term corrective technical cycle may be in play for the pair. Having breached initial support, the focus is on firm support at the 50-day EMA, at 1.2539.

- Energy prices trade on the front foot, helping aide NOK toward the top-end of the G10 pile. A better-than-expected retail sales release has also helped, with May sales including auto fuel rising by 1.2% M/M vs. Exp. 0.2%. EUR/NOK reversed off a weekly high of 11.8537 in response.

- A busy day in Sweden on Thursday is marked by a slew of economic data releases before the June policy rate decision. The Riksbank are expected to hike by 25bps, however there may be upside risks. Elsewhere on Thursday, second tier releases in the form of Australia and Japan retail sales precede the more significant German and Spanish CPI data.

FX: Expiries for Jun29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-05(E2.8bln), $1.0800(E2.6bln), $1.0825(E628mln), $1.0900(E1.4bln), $1.0950(E555mln), $1.1000(E1.4bln)

- USD/JPY: Y142.00($579mln), Y143.00($536mln), Y143.50($558mln), Y144.00($1.4bln), Y144.30-50($1.6bln)

- GBP/USD: $1.2665-67(Gbp542mln), $1.2700(Gbp544mln)

- EUR/GBP: Gbp0.8600(E919mln)

- AUD/NZD: N$1.0850(A$756mln), N$1.0955(A$716mln)

- USD/CAD: C$1.3150($1.1bln), C$1.3200($644mln), C$1.3225-30($500mln), C$1.3350($710mln)

- USD/CNY: Cny7.2300($1.2bln), Cny7.2500($2.2bln), Cny7.2600($1.3bln)

Equities Roundup

- Stocks trading mixed, off midday highs in the second half with S&P E-Mini futures down 5 points (-0.11%) at 4413.5, DJIA down 106.87 points (-0.32%) at 33819.85, Nasdaq up 33.5 points (0.2%) at 13589.3.

- Leading gainers: Energy sector shares outperforming as crude prices climb higher in the second half (WTI +1.98 at 69.68). Leading oil producers/distributors includes Pioneer Natural Resources +2.25%, Williams +1.75%, Conoco Philips +1.60. Communication Services sector next in line with media/entertainment shares (NFLX +3.6%) outperforming telecommunication services (ATT -.75%).

- Laggers: Utilities, Materials and Consumer Staples sectors underperformed in the second half. Independent power/resources shares weighed on the former with AEP -3.5%, Entergy -3.45%, Pinnacle West -2.6%.

- The technical bull theme in S&P E-minis remains intact and the recent pullback appears to be a correction. The latest move lower has allowed a recent overbought condition to unwind. Attention is on initial key support at the 20-day EMA, which intersects at 4365.83.

- A break of this average would strengthen a short-term bearish theme and signal scope for a deeper pullback. On the upside, the bull trigger is 4493.75, the Jun 16 high

E-MINI S&P TECHS: (U3) Support At The 20-Day EMA Remains Intact

- RES 4: 4556.71 2.382 projection of the May 4 - 19 - 24 price swing

- RES 3: 4532.08 2.236 projection of the May 4 - 19 - 24 price swing

- RES 2: 4512.24 Bull channel top drawn from the Oct 2022 low (cont)

- RES 1: 4493.75 High Jun 16 and the bull trigger

- PRICE: 4415.00 @ 1430 ET Jun 28

- SUP 1: 4365.83 20-day EMA

- SUP 2: 4283.68 50-day EMA

- SUP 3: 4154.75 Low May 24

- SUP 4: 4098.25 Low May 4 and a key support

A bull theme in S&P E-minis remains intact and the recent pullback appears to be a correction. The latest move lower has allowed a recent overbought condition to unwind. Attention is on initial key support at the 20-day EMA, which intersects at 4365.83. A break of this average would strengthen a short-term bearish theme and signal scope for a deeper pullback. On the upside, the bull trigger is 4493.75, the Jun 16 high

COMMODITIES: Oil Boosted By Inventory Drop, Gold Surprisingly Resilient To USD Climb

- Crude oil has been buoyed today by the larger than expected draw on US crude inventories (-9,603 vs -1,266 exp), with WTI and Brent front futures reversing yesterday’s decline.

- The crude draw was driven by an increase in exports back above 5mbpd for the first time since March offsetting higher imports and a drop in refinery utilisation while production remains unchanged. Cushing stocks as expected resumed the trend higher seen since April to the highest since June 2021.

- UBS on the other hand lowered its Brent oil price forecast for this year and next year with Brent prices now averaging $81/bbl in 2023, - $8/bbl from previous estimates earlier this month.

- WTI is +2.5% at $69.38, resistance remains $72.72 (Jun 21 high).

- Brent is +2.2% at $73.84, resistance remains at $77.24 (Jun 21 high).

- Gold is -0.1% at $1912.15 having proven surprisingly resilient to a stronger US dollar, with some offset from softer Treasury yields. An earlier low of $1903.09 pierced support at $1910.3 (Jun 23 low) which next opens $1903.5 (61.8% retrace of Feb 28 – May 4 bull cycle).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/06/2023 | 2350/0850 | * |  | JP | Retail sales (p) |

| 29/06/2023 | 0130/1130 | ** |  | AU | Retail Trade |

| 29/06/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 29/06/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/06/2023 | 0630/0230 |  | US | Fed Chair Jerome Powell | |

| 29/06/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/06/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/06/2023 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 29/06/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 29/06/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/06/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/06/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 29/06/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 29/06/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 29/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 29/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 29/06/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 29/06/2023 | 1230/0830 | *** |  | US | GDP |

| 29/06/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 29/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 29/06/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/06/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/06/2023 | 1600/1800 |  | EU | ECB Lagarde Closing Remarks at ECB Forum | |

| 29/06/2023 | 1630/1730 |  | UK | BOE Tenreyro Speech at SPE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.