-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Feb Job Gains Tempered by Jan Rvsns

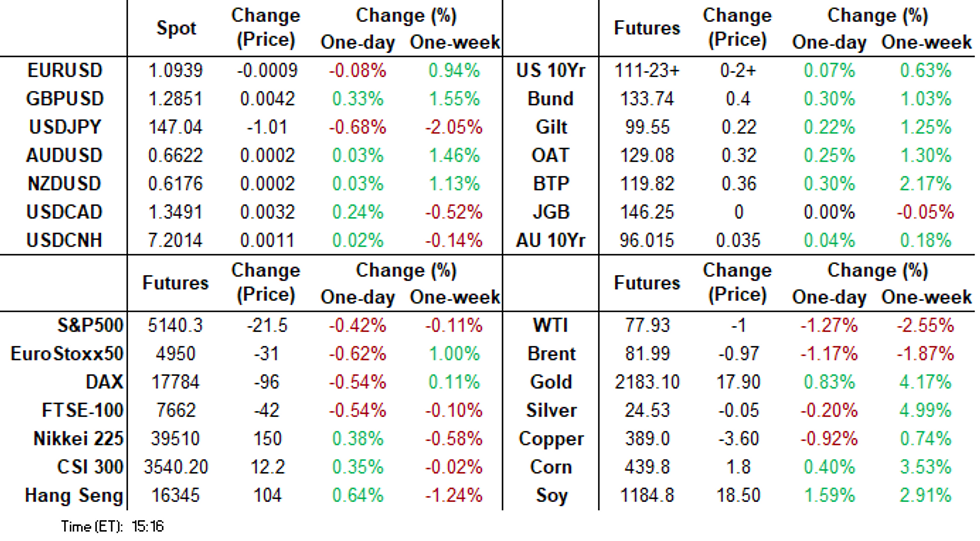

- Treasuries finish near the middle of a wide range after February employment data.

- Rates gapped lower on higher then Expected jobs gain of 275k vs. 200k estimate

- Rates reversed course, gapped higher as focus turned to large down-revision to January (229k from 335k)

Tsys Near Middle Wide Range, Focus on Tue's CPI Data

- Treasury futures are drifting in marginally firmer territory after the bell, near the middle of a wide range on mixed reaction to this morning's February employment data. Tsys gapped lower on the higher than expected jobs gain of 275k vs. 200k est. but reversed course just as quickly as markets digested the large down revisions to January (229k from 335k, private to 177k from 317k).

- The unemployment rate surprisingly increased two tenths from 3.66% to 3.86% (cons 3.7), poking above October’s 3.84 for the highest since Jan’22. The FOMC eyes 4.1% for end-2024.

- Currently, Jun'24 10Y futures are +2.5 at 111-23.5 (111-08 low/112-04.5 high). The contract has this week topped resistance at the 50-day EMA highlighting a bullish reversal. 111-27, 50% of the downleg off the Feb 1 high, has been breached. This opens 112-10+, A Fibonacci retracement. For bears, a reversal lower would return focus back to support at the 109-25+ bear trigger, Feb 23 low. Initial firm support to watch lies at 110-21, the Mar 4 low.

- Focus turns to next week Tuesday's CPI release at 0830ET.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00099 to 5.31870 (-0.00392/wk)

- 3M -0.00038 to 5.32084 (-0.00942/wk)

- 6M -0.00581 to 5.22984 (-0.03747/wk)

- 12M -0.01055 to 4.98694 (-0.06960/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.793T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $695B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $686B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $98B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $280B

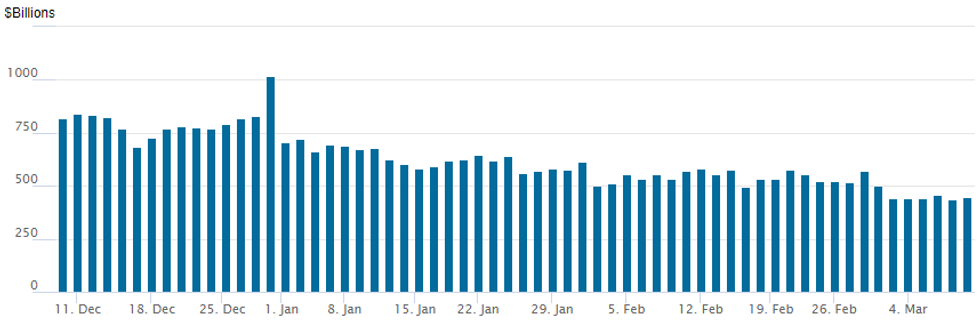

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounded to $444.803B from $436.754B Thursday - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties climbs to 74 from 72 Thursday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury options saw a mix of trades including put unwinds and call positioning after the February employment data -- mixed reaction to this morning's February employment data, trading lower on the higher than expected jobs gain of 275k vs. 200k est. but reversed course as markets digested the large down revisions to January (229k from 335k, private to 177k from 317k).

Projected rate cut pricing hold steady, off early rally highs: March 2024 chance of 25bp rate cut currently -5.4% w/ cumulative of -1.4bp at 5.318%; May 2024 at -22.7% vs. -24.8% this morning w/ cumulative -6.3bp at 5.266%; June 2024 -65.4% from -68% earlier w/ cumulative cut -22.6bp at 5.102%. July'24 cumulative -39.1bp at 4.938%.

- SOFR Options:

- +4,000 SRJ4 94.93/95.06 put spread 1x2 2.75 ref 9497

- +4,000 SRJ4 94.62/94.81/95.00 put flys 2.5 ref 9497.5

- +10,000 SFRU4 95.00/95.25/95.50/95.75 call condors vs. 94.62/94.87 put spds, 4.5-4.75 net/condor over

- Block, 6,000 0QH4 96.12 calls, 4.0 ref 95.92

- 4,600 0QH4 95.62/95.87/96.00/96.12 put condors ref 95.935

- 6,250 SFRM4 95.00 calls ref 94.965

- Block, 6,500 SFRM5 96.50 risk reversals, 41.25 vs. 96.07/100%

- 1,000 SFRH4 94.68/94.81/94.93 put flys

- Treasury Options:

- 10,000 Wed weekly 110.75/111.5 2x1 put spds, 9

- 3,000 USM4 132/133/134/135 call condor ref 121-17

- -20,000 Wed weekly 10Y 111 puts, 5 ref 112-01.5, total volume over 48,000

- 15,000 TYJ4 109/110 put spds, 30 ref 111-29

- over 5,000 TYJ4 110/111 put spds ref 111-28

- +9,000 TYK4 113 calls, 39-40

- +7,000 TYJ4 110/111 put spds, 14

- -5,500 TYM4 114 calls, 36

- 2,000 TYM4 111/113 call spds ref 111-25

- 2,500 TYJ4 110/111.25 put spds vs. wk3 TY 112.25 calls

- 2,100 FVJ4 106.75/108.75 risk reversals ref 107-23.75

- 2,250 TYJ4 108.5/109.5/110.5 put flys, ref 111-24.5

- 3,000 wk3 TY 110.25/111 put spds, 10 ref 111-24, expire next Fri

- +8,700 Wed weekly 10Y 110.25/111 3x2 put spds, 14 ref 111-25.5, expire next Wed

FOREX USD Index Consolidating 1.1% Weekly Decline, JPY Outperforms

- Despite some volatile swings for the greenback following the US employment report on Friday, the USD index is broadly consolidating an impressive 1.10% decline this week. The index has been led lower by an impressive 2% USDJPY selloff as BOJ normalisation speculation builds.

- Post data volatility was stoked by above-estimate headline non-farm and private payrolls prints and then ensuing large downside revision to the prior figures. USDJPY rallied to 147.45 before rapidly falling to fresh session and weekly lows of 146.49. With the details of the US data seemingly not as bad as first feared, the USD traded on a firmer footing into the close.

- Of course, this just tells one side of today’s story, with concurrent BoJ sources reports from both JiJi News and Reuters boosting the yen early on Friday. Both reports eye the possibility of a March BoJ rate hike should the wage negotiation phase with unions next week continue to show signs of healthy wage growth. USD/JPY traded well through overnight Asia-Pac lows to extend losses off the weekly high to over 300 pips.

- A close at current or lower levels would confirm a clean break of both the 50- and 100-dma supports and a print through 146.24 would fully reverse the NFP-inspired rally on Feb 02.

- Elsewhere, late weakness for equities had little impact on either AUD or NZD, which consolidate impressive rallies this week on the back of the broader technical breakdown for the dollar.

- The AUDUSD recovery across the week threatens a recent bearish theme and price has cleared the 50-day EMA. Resistance at 0.6595, the Feb 22 high, has also been cleared and this strengthens a bullish theme, signalling scope for a continuation higher. Potential is seen for a climb towards 0.6708, a Fibonacci retracement.

- All focus turns to US CPI next Tuesday, with consensus firmly centered around a 0.3% M/M increase in core CPI after a surprisingly strong 0.39% M/M in January.

FX Expiries for Mar11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.6bln), $1.0825-40(E1.0bln), $1.0890-00(E1.2bln), $1.0930-50(E1.2bln), $1.1000(E738mln)

- USD/JPY: Y150.00($1.3bln)

- USD/CNY: Cny7.2995-3000($1.1bln)

Late Equities Roundup: Inching Off Lows, Real Estate, Financials Lead

- Stocks are inching off lows in late trade, S&P Eminis near steady after profit taking in chip stocks knocked the index off new all time highs from this morning. Currently, DJIA is up 108.71 points (0.28%) at 38900.38, S&P E-Minis down 10.5 points (-0.2%) at 5151.25, Nasdaq down 90.6 points (-0.6%) at 16184.07.

- Information Technology and Consumer Staples sectors continued to underperform in late trade, semiconductor makers that had buoyed markets all week traded lower as accounts booked profits: Broadcom -5.44% (-4.41%/wk), Nvidia -3.82% (still +5.70%/wk), Intel -2.45% (+0.44%/wk).

- Distribution and retailers weighed on the Consumer Staples sector, Costco -7.23% even after booking quarterly sales of appr $60B. Dollar Tree traded -1.35% while Dollar General traded -0.99%.

- Leading gainers: Real Estate and Financial sectors led gainers in late trade: estate management company CBRE Group +1.95%, SBA Comm +2.61%, Alexandria Real Estate +2.18%.

- Banks and services shares rebounded from heavier selling in regionals earlier this week, Zion Bancorp +2.36%, Comerica +2.13%, Invesco +1.82%.

E-MINI S&P TECHS: (H4) Fresh Cycle High

- RES 4: 5225.35 3.0% Bollinger Band

- RES 3: 5212.20 2.0% 10-dma envelope

- RES 2: 5200.00 Round number resistance

- RES 1: 5179.00 Intraday high

- PRICE: 5153.00 @ 1450 ET Mar 8

- SUP 1: 5065.67 20-day EMA

- SUP 2: 4951.27 50-day EMA

- SUP 3: 4936.50 Low Feb 13

- SUP 4: 4866.00 Low Jan 31 and key support

The trend condition in S&P E-Minis is bullish and This week’s fresh cycle highs reinforce current conditions. Price action continues to highlight the fact that corrections are shallow - this is a bullish signal that highlights positive market sentiment. Support to watch is 5065.67, the 20-day EMA. A clear break of this average would signal potential for a deeper retracement towards 4951.27, the 50-day EMA. Sights are on 5200.00 next.

COMMODITIES Gold Pares Gains After Another Record High, Crude Oil Ends Lower

- Spot gold has given back some of its even further gains today with its new all-time high of $2195.15 in a delayed move after peak USD weakness shortly after the payrolls report, but it still sits a strong +0.7% on the day at $2175.80.

- The high marks yet another new resistance after which now lies $2206.6 (Fibo projection). Short-term conditions are overbought, however, this does not appear to be a concern for bulls - for now

- Crude futures have fallen back today, with WTI headed for losses of around 2.7% on the week. Bearish sentiment around demand outlooks from the US and China continue to provide downside. This is despite the extension to OPEC+’s voluntary supply cuts.

- US oil and gas rigs fell by seven on the week to 622, according to Baker Hughes March 8. Oil rigs were down 2 to 504.

- The OPEC+ alliance pumped 41.21mbpd of oil in February, unchanged in the month. Several members such as Iraq and Kazakhstan continued exceeding their quotas: Platts.

- WTI is -1.3% at $77.90, pulling away from resistance at $80.85 (Mar 1high) but not yet troubling support at $76.45 (50-day EMA).

- Brent is -1.1% at $82.04, also pulling away from $84.34 (Mar 1 high) and not troubling support at $80.84 (50-day EMA).

- Weekly moves: WTI -2.6%, Brent -1.8%, Gold +4.4%, US HH nat gas -1.6%, EU TTF nat gas +2.2%

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/03/2024 | 0130/0930 | *** |  | CN | CPI |

| 09/03/2024 | 0130/0930 | *** |  | CN | Producer Price Index |

| 11/03/2024 | 2350/0850 |  | JP | GDP Final Q4 2023 | |

| 11/03/2024 | 0700/0800 | *** |  | NO | CPI Norway |

| 11/03/2024 | 0800/0900 |  | EU | ECB's Cipollone in Eurogroup meeting | |

| 11/03/2024 | - | *** |  | CN | Money Supply |

| 11/03/2024 | - | *** |  | CN | New Loans |

| 11/03/2024 | - | *** |  | CN | Social Financing |

| 11/03/2024 | 1201/1201 | ** |  | UK | KPMG/REC Jobs Report |

| 11/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/03/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.