-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Bowman Soft Landing Possible

HIGHLIGHTS

- MNI TURKEY: Earthquake Prompts Talk Of Postponing General Election

- MNI US-CHINA: Kirby: US Working With Allies On "Unidentified Aerial Phenomena"

- TOP US, CHINA DIPLOMATS WEIGH FIRST MEETING SINCE BALLOON DRAMA, Bbg

- BLACKROCK CUTS JAPANESE STOCKS TO "UNDERWEIGHT" ON HAWKISH BOJ RISKS

- NATO STOLTENBERG: WAR CONSUMING 'ENORMOUS AMOUNT' OF AMMUNITION, Bbg

- NATO STOLTENBERG: NEED TO RAMP UP AMMUNITION PRODUCTION, INVESTMENT, Bbg

Key links: MNI US CPI Preview: Watching If Newfound Strength Sustained / MNI BRIEF: Fed's Bowman Says Possible To Achieve Soft Landing / MNI INTERVIEW: UK Productivity Suffering Long-Term Scarring

US TSYS: Late Rate Lock Unwinds Underpins Tsys, Focus on Tue's CPI

Tsys trading mixed, bonds near midmorning highs after early whipsaw action, curves re-flattening (2s10s -3.351 at -82.290) after the close. Thin early volumes with no data Monday, many sidelined to await Tuesday's CPI release MoM (0.1% rev, 0.5%); YoY 6.5%, 6.2%).

- Tsys gained ahead the NY open, coinciding with Fed Gov Bowman talk at bank conf. Nothing exceptionally market moving "I'll expect that we will continue to increase the federal funds rate, because we have to, we have to bring inflation back down to our 2% goal," she said in a question and answer session at an American Bankers Association event.

- Tsys reverse from pre-open highs on rate lock selling vs. several multi-tranche issuers CVS, Pepsi, Philip Morris. Precedent: CVS ranks third overall largest debt issuer w/ $40B over 9 tranches in Sep 2018. Philip Morris issued $6B over 5tranches in Nov 2022 while Pepsi has averaged $2.75B last couple years.

- Tsys rebounded - see-sawing to new session highs over the next hour on the back of 5s (6.6k) and 10Y (16.9k) Block buys.

- Late rate lock unwinds following $18.45B swappable corporate bond issuance provided late support across the curve.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00043 to 4.55886% (+0.00658 total last wk)

- 1M +0.00986 to 4.58786% (+0.00614 total last wk)

- 3M -0.00586 to 4.86357% (+0.03529 total last wk)*/**

- 6M +0.02486 to 5.15200% (+0.06971 total last wk)

- 12M +0.02043 to 5.50500% (+0.23343 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.87257% on 2/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $112B

- Daily Overnight Bank Funding Rate: 4.57% volume: $291B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.186T

- Broad General Collateral Rate (BGCR): 4.52%, $468B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $455B

- (rate, volume levels reflect prior session)

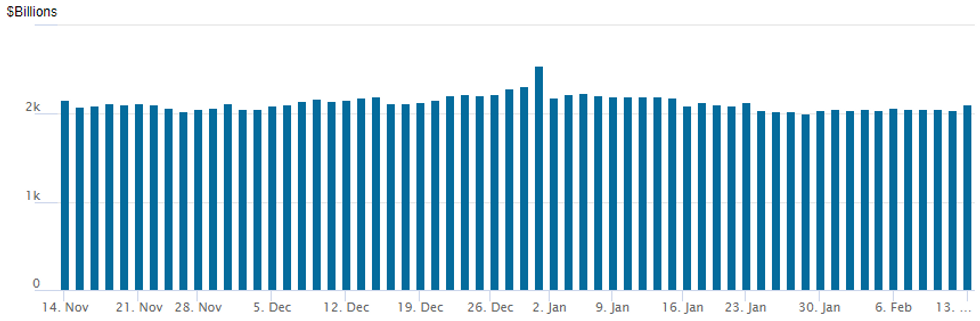

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces to $2,107.775B w/ 102 counterparties vs. prior session's $2,042.893B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

- SOFR Options:

- Block, update 40,000 SFRH3 95.12/95.50 2x1 put spds, 28.0-27.5 ref 95.07-.06

- Block, +15,000 SFRH3 95.06/95.12 2x1 put spds, 0.5 ref 95.0625

- Block/screen over 36,000 2QH3 96.25 puts, 4.0 ref 96.695 to -.70

- Block, 5,000 SFRK3 94.50/94.62 put spds, 2.0 ref 94.80

- Block, 5,000 SFRM3 94.50/94.62 put spds, 2.25 ref 94.805

- Block, 6,000 SFRZ3 94.25 puts, 11 ref 95.105

- Block, 5,000 SFRM3 94.25/94.50/94.75 put spds, 5.0 ref 94.80

- 2,000 SFRH3 94.87 puts, 0.5

- 2,500 SFRU3 94.93/95.31 2x1 put spds

- Block, -20,000 SFRM3 94.93/95.31 2x1 put spds, 10.5 ref 94.80

- Block, update 11,000 SFRZ3 94.25/94.50/94.75 put flys, 2.5 ref 95.115

- Block, update 27,250 OQJ3 96.00 puts, 24.5-25.0 ref 96.035 to -.015

- Block, 3,625 SFRN3 94.00/94.50 3x2 put spds, 11.0 net ref 94.86

- 6,165 SFRU3 94.87/95.31 strangle vs. EDM3 94.62 puts

- 5,000 SFRH3 95.12 calls, 1.75 ref 95.0675

- Treasury Options:

- update, over 20,700 FVH3 107 puts, 11 rev 107-28 to -27

- over 12,900 TYH3 112.25 puts, 28-29 ref 112-23.5

- 3,000 TYH3 114.5.115.5 call spds

- +10,000 TYH3 110.5 puts, 4

- 3,500 USH3 125 puts, 33 ref 126-28

- 4,600 TYH3 115 calls, 3 ref 112-18.5

- 6,000 TUH3 102.87 calls, 1 ref 102-04.38

- 4,850 TUH3 102/102.75 put spds, ref 102-05.5

- 15,000 FVH3 109.5 calls,2.5 ref 107-26.75

- 2,600 FVH3 106/106.5 put spds, 3 ref 107-27

- 2,500 TYH3 110.5/111.5 put spds, ref 112-22

- 2,000 wk3 TY 111.5/112 put spds, ref 112-22.5

EGBs-GILTS CASH CLOSE: BTPs Outperform

The UK and German curves flattened modestly to start the week, with the short end/belly continuing to weaken on firming central bank hike expectations.

- In early morning trade, Gilt and Bund futures ticked to their weakest levels since early January, but recovered over the course of the session to close nearly unchanged.

- Italian spreads saw their tightest close to Bunds since Feb 2 (ECB meeting), testing 180bp again as equities strengthened throughout a risk-on session.

- Gilts edged higher in the afternoon after the BoE's long-dated Gilt APF sale, which saw unremarkable 1.33x cover but somewhat of a relief compared with last week's short-dated sale which didn't see the full target amount sold.

- Tuesday sees UK jobs data and the prelim Eurozone Q4 GDP release, with the US inflation report the main event.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.1bps at 2.782%, 5-Yr is up 2.3bps at 2.423%, 10-Yr is up 0.4bps at 2.368%, and 30-Yr is down 0.1bps at 2.322%.

- UK: The 2-Yr yield is up 1.1bps at 3.639%, 5-Yr is up 1.3bps at 3.349%, 10-Yr is up 0.6bps at 3.402%, and 30-Yr is up 0.1bps at 3.814%.

- Italian BTP spread down 4.2bps at 180.3bps / Spanish down 1.1bps at 93.8bps

Sonia Call Spread Buying Stands Out Monday

Monday's Europe rates / bond options flow included:

- RXH3 137.00/139.50cs 1x1.5, bought for 39.5 in 2k

- SFIJ3 95.90/96.00cs, now bought for 1.5 in 8.88k and for 1.25 in 4k (12,880 total)

FOREX: Greenback Moderately Weaker, JPY Under Pressure Ahead Of US CPI

- The USD index is moderately lower on Monday, amid some optimism across major equity indices ahead of the key event risk for the week on Tuesday in the form of US CPI. The Japanese Yen is set to post standout losses on Monday with the currency weaker against all others in G10.

- The firmer sentiment in equity markets this afternoon has lent underpinned cross/JPY support, with notable advances of around 1.5% for the likes of AUDJPY, NZDJPY and GBPJPY.

- USDJPY has briefly traded above the 50-day EMA, at 132.77, an average that represents a key short-term level. A sustained break is required to suggest scope for an extension higher that would expose 134.77, the Jan 6 high.

- In EURJPY, attention is on 142.99, the Feb 6 high, where a break would confirm a continuation of the recovery that started on Jan 3.

- Markets look to Tuesday for short-term impetus, with the key January US CPI report in focus. Analysts look for CPI to slow to 6.2% Y/Y, and 5.5% for the core metric.

FX: Expiries for Feb14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600-05(E1.0bln), $1.0700(E2.3bln), $1.0800(E554mln), $1.0845-50(E772mln)

- USD/JPY: Y132.50($551mln), Y133.00($628mln)

Late Equity Roundup: IT Remains Strong

Stock indexes holding near late session highs, bounce in Information Technology shares continue to outperform. SPX eminis currently trading +33.25 (0.81%) at 4133; DJIA +258.22 (0.76%) at 34126.81; Nasdaq +135.7 (1.2%) at 11854.16.

- SPX leading/lagging sectors: Information Technology sector extends gains (+1.70%) w/ software/services narrowly outpace hardware and chip makers (MSFT +3.39%, DCX +3.18%, CRM +2.38%). Consumer Discretionary (+1.3%) gained in the second half, followed by Consumer Services (+1.17%). The former lead by textiles, apparel and luxury goods (RL +4.2%, NKE +2.61%), the latter supported by media and entertainment (WBD +5.7%, META +3.57%, NFLX +3.31%).

- Laggers: Energy (-0.54%), Health Care (+0.35%) and Utilities (+0.44%). Energy sector weighed by O&G refiners/marketers (EQT -2.7%, COP -1.96%, APA -1.56%).

- Dow Industrials Leaders/Laggers: Microsoft (MSFT) +8.45 at 271.56, Home Depot (KHD) +6.09 at 322.63, Salesforce (CRM) +3.51 at 170.54. Laggers: United Health (UNH) -0.68 at 493.57, Chevron (CVX) -0.40 at 171.57, Caterpillar (CAT) -0.26 at 247.41.

COMMODITIES: Crude Pares Gains On Further SPR Sales

- Crude oil ends the session with WTI moving ~1% lower with the US set to sell 26million barrels from its SPR, with delivery for new sales expected between April and June.

- Just before the SPR headlines, crude had edged out gains after trading lower through Asia hours in particular before moving higher through both the European and US session as USD weakness developed.

- In the US, the EIA sees major shale drillers as set to boost oil production in March to an all-time high on expectations for a recovery in petroleum consumption, the latter helped by a robust return of China oil consumption.

- WTI is -0.6% at $79.23 having pulled back off a high of $80.62 that cleared initial resistance at $80.33 (Feb 10 high) to open key resistance at $83.14 (Dec 1 high). Support at $76.52 (Feb 9 low).

- Brent is -0.7% at $85.81, having earlier pushed through $86.90 (Feb 10 high) with $86.95 to tentatively open the bull trigger at $89.00. Support at $83.05 (Feb 9 low).

- Gold is -0.7% at $1852.86 ahead of tomorrow’s US CPI, despite USD weakness and relatively little change in US Tsy yields. Potentially some technical levels at play having pushed through the 50-day EMA at $1855.5 to open a key near-term support at $1825.2 (Jan 5 low).

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/02/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 14/02/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 14/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 14/02/2023 | 1000/1100 | *** |  | EU | GDP (p) |

| 14/02/2023 | 1000/1100 | * |  | EU | Employment |

| 14/02/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/02/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 14/02/2023 | 1330/0830 | *** |  | US | CPI |

| 14/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/02/2023 | 1600/1100 |  | US | Dallas Fed's Lorie Logan | |

| 14/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 14/02/2023 | 1800/1300 |  | US | Philadelphia Fed's Patrick Harker | |

| 14/02/2023 | 1905/1405 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.