-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: FOMC Hikes 25Bp, Dovish Statement

HIGHLIGHTS

- MNI FED: Powell Presser Highlighted Uncertainty Of Credit Tightening Impact

- MNI FED: No Discussion Of QT Changes With Powell Seeing Reserves As Ample

- MNI FED: Powell Says Speed Of SVB Run Suggest Need For Regulatory Changes

- TSY YELLEN TO SAY TAXPAYERS WON'T BEAR COSTS LINKED TO FAILED BANKS, Bbg

- CHINA PREMIER LI STRESSES DEVELOPMENT OF MANUFACTURING SECTOR, Bbg

- WUNSCH: IF MARKETS STABILIZE, ECB MAY HAVE TO DO MORE ON RATES, Bbg

- ECB OFFICIALS CLAIM VINDICATION ON RATE HIKE AMID PRICE RISKS, Bbg

Key links: MNI: Fed Raises Rates 25BPS, Flags More Hikes / MNI: March 22 FOMC Statement Comparison / MNI: BOC Worried About Sticky Prices Before Rate Pause-Minutes

US TSYS: Bonds Near Highs After Fed Delivers Expected 25Bp Hike

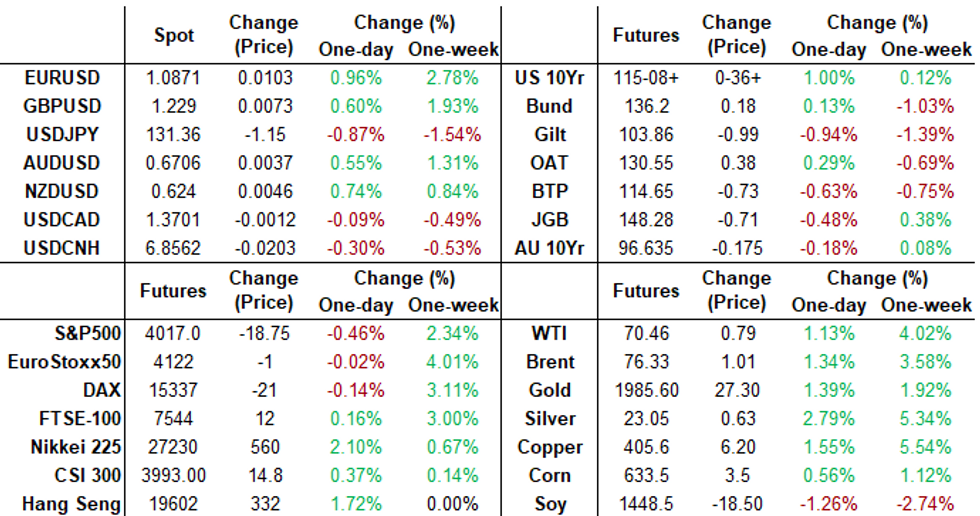

- Treasury futures extending highs after the bell, yield curves steeper as short end rates outpace bonds after the Federal Reserve delivered a second consecutive and widely anticipated 25bp hike. Though signaling additional hikes, the Fed statement was largely deemed dovish in it's efforts to stem inflation.

- After an initial knee-jerk rally and price pull-back, Tsys rebounded as Chairman Powell stressed the Fed is "no longer state that we anticipate that ongoing rate increases will be appropriate to quell inflation. Instead, we now anticipate some additional policy firming may be appropriate."

- Yield curves forged steeper with 2s10s hitting -45.799 high before settling back to around -50.164 with short end outperforming, TUM3 +15 at 103-18.

- Implied hikes evaporate despite the Fed flagging additional 25bp hikes. Snapshot of current levels after the second consecutive 25bp hike:

- Fed funds implied hike for May'23 11.1, Jun'23 cumulative 0.3bp to 4.815%, Jul'23 slips to -20.0bp to 4.623%. Fed Terminal currently at 4.925% in May'23. Implied rate cuts accelerate by year end with Dec'23 cumulative -66.2 at 4.150.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00200 to 4.55857% (-0.00229/wk)

- 1M +0.01771 to 4.79700% (+0.01929/wk)

- 3M +0.06229 to 5.08000% (+0.08157/wk)*/**

- 6M +0.10857 to 5.11514% (+0.06285/wk)

- 12M +0.18258 to 5.17929% (+0.14515/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $92B

- Daily Overnight Bank Funding Rate: 4.57% volume: $278B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.247T

- Broad General Collateral Rate (BGCR): 4.52%, $515B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $502B

- (rate, volume levels reflect prior session)

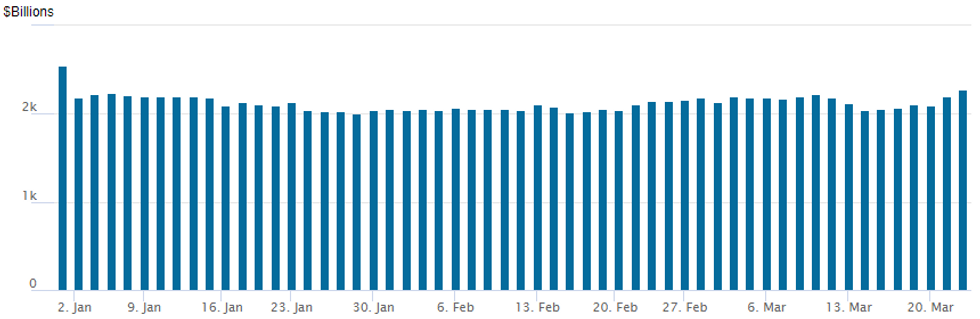

FED Reverse Repo Operation: New High For 2023

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new 2023 high of $2,279.608B w/ 104 counterparties vs. prior session's $2,.194.631B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

- SOFR Options:

- Block, total 27,000 OQM3 94.75/95.12/95.75 broken put flys, 6.0 net ref 96.61

- Block, total +20,000 SFRU3 94.75/95.00/95.25/95.50 put condors vs. SFRU 94.37 puts 0.0 net

- -5,000 SFRZ3 93.75 puts, 5.0 ref 95.63

- Block, 5,000 SFRZ3 97.50/98.50 call spds, 10.5 ref 95.575, 10k total

- +12,500 SFRU3 94.50/94.75/94.87/95.00 broken put condor, 1.75-2.0

- Block, 5,000 SFRJ3 94.50/94.62 put spds, 1.0 ref 95.10

- 9,000 SFRJ3 95.25/95.37/95.50 call flys ref 95.10 to -.095

- Block, 5,000 SFRZ3 97.50/98.50 call spds, 11.0 ref 95.635

- Block, 2,500 SFRM3 93.93/94.12 put spds, 0.75 ref 95.21

- 7,500 SFRJ3 94.31/94.50/94.62 broken put flys ref 95.20 to -.21

- 2,000 OQU3 97.50/98.00/98.50/99.00 call condors, ref 96.615 to -.62

- Treasury Options:

- over +18,500 FVK3 106.5 puts, 5 ref 109-28 to -29

- +15,000 FVK3 106.25 puts, 4.5 ref 109-13.75 to -14

- over 12,000 TYM 123/127 call spds 4 ref 114-08 to -06.5

- Block, 7,500 TYM 125/130 call spds, 3 ref 114-05

- Update, appr +35,000 TYJ3 112.5/113.5 2x1 put spds mostly at 12 after small traded 11 overnight

- over 5,000 FVJ3 106.25/106.75 put spds ref 108-23.25

- over 11,000 TYJ3 116.5 calls, 2-4 ref 114-10.5 to 113-26.5

- over 5,300 TYJ3 113.5 puts, 20 ref 113-28

- 4,000 FVJ3 106/106.75 put spds, ref 108-26.75 to -27

- 2,000 FVJ3 107.5/108 put spds, 3.5 ref 109-00.5

EGBs-GILTS CASH CLOSE: Strong UK CPI Boosts BoE Hike Prospects

The UK curve bear flattened sharply Wednesday as a stronger-than-expected February CPI reading boosted implied BoE tightening.

- A jump in February services inflation was the highlight of the CPI beat, and led BoE terminal hike pricing jumped over 30bp, with around 68bp of further increases seen to a September peak. A 25bp hike Thursday is now 92% priced.

- Despite closing 5bp below session highs, 2Y UK yields increased by the most in a single session since September on the higher BoE rate pricing.

- The German curve also bear flattened, mirroring the UK move but by a lesser degree (unsurprising given Tues saw the biggest Schatz selloff in 15 years).

- The bearish moves peaked by early afternoon trade, pulling back thereafter with the Federal Reserve rate decision awaited an hour after the cash close.

- EGB periphery spreads were mixed on the session, with BTPs underperforming.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9bps at 2.707%, 5-Yr is up 6bps at 2.372%, 10-Yr is up 3.6bps at 2.328%, and 30-Yr is up 0.4bps at 2.323%.

- UK: The 2-Yr yield is up 21.6bps at 3.494%, 5-Yr is up 15.8bps at 3.374%, 10-Yr is up 8.4bps at 3.451%, and 30-Yr is up 4.4bps at 3.886%.

- Italian BTP spread up 1.8bps at 184.2bps / Spanish down 0.1bps at 103.9bps

EGB Options: Large Schatz Spread Trades And Euribor Flies Feature Wednesday

Wednesday's Europe rates / bond options flow included:

- DUK3 104.80/104.60ps, bought for 4 and 4.25 in 29.4k and for 3.5 in 1k

- DUK3 105.90/106.10cs sold at 7 in 16.6k

- RXK3 135/133/131 put fly sold at 32 in 3k

- ERJ3 96.75/96.625ps sold at 8.5 in 5k

- ERM3 96.625/96.50/96.375 p fly, bought for 1.5 in 13k and 1.25 in 13k

- ERU3 98.00c, bought for 8.5 in 10k

- ERK3 96.50/96.37/96.25/96.12p condor, bought for 3.5 in 8k

- ERM3 96.62/96.50/96.37p fly, bought for 1.25 in 11k

- SFIM3 95.75/95.90/96.05 call fly bought for 1.75 in 8k

FOREX: Greenback Extends Weakness Following FOMC Decision

- A dovishly perceived hike from the Federal Reserve was enough to build the momentum for a weaker dollar on Wednesday, with the USD index (-0.85%) extending to the lowest level since February 03.

- With the Fed statement and the latest summary of economic projections leaning dovish, the greenback came under immediate pressure, from which it did not recover.

- EURUSD is the strongest performing major in G10, currently up 1.02% as we approach the APAC crossover. An immediate spike above the 1.08 handle sparked a wave of demand that saw the pair trade as high as 1.0912.

- This closely tied with noted resistance at 1.0911, the 76.4% retracement of the Feb 2 - Mar 15 bear leg, holding well during the press conference with Powell’s reiteration that the Fed are prepared to hike above expectations then aiding the brief bounce for the greenback.

- However, after dipping to 1.0853, EURUSD continues to trade buoyantly and is approaching the 1.09 handle once more. Further greenback weakness overnight will pave the way for a move to 1.1033, the Feb 2 high and key resistance for the pair.

- The initial bounce in equities saw the likes of AUD and NZD extend gains well over 1% on the session. However, with major indices sliding back into the red, Antipodean FX surrendered a portion of these gains into the close. USDJPY (-0.96%) is also trading heavily as we approach the end of the US session, narrowing the gap with the week's lows at 130.54.

- More central bank fun on Thursday as the SNB and Norges Bank kick proceedings off. Focus then turns to the Bank of England, who is widely expected to hike rates after the above expectation CPI data earlier today.

FX Expiries for Mar23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0580-00(E1.8bln), $1.0650-52(E848mln), $1.0800(E874mln), $1.0890-05(E553mln), $1.0920-25(E541mln)

- USD/JPY: Y130.00($574mln), Y130.37-55($1.3bln), Y131.00($631mln), Y131.50($1.5bln), Y132.00($827mln)

- EUR/GBP: Gbp0.8900(E1.1bln)

- AUD/USD: $0.6640-50(A$643mln)

- USD/CNY: Cny6.7500($1.3bln), Cny6.9500($576mln)

Equities Reverse Support After Marking Highs

Minutes after marking new session high of 4069.75, S&P emini futures reverse course, extend lows to 4008.00, 4025.0 last. Leading laggers remain Real Estate (-2.20%), Energy (-1.36%) followed closely by Financials (-1.30%) the latter weighed by bank shares as Chairman Powell questions revolve around banks, regulatory environment and financial conditions.

E-MINI S&P (M3): Trades Through The 50-Day EMA

- RES 4: 4148.48 76.4% retracement of the Feb 2 - Mar 13 downleg

- RES 3: 4119.50 High Mar 64

- RES 2: 4089.39 61.8% retracement of the Feb 2 - Mar 13 downleg

- RES 1: 4057.50 High Mar 9

- PRICE: 4010.00 @ 1510ET Mar 22

- SUP 1: 3981.75 Low Mar 21

- SUP 2: 3897.25/3839.25 Low Mar 20 / 13

- SUP 3: 3822.00 Low Dec 22 and a key support

- SUP 4: 3778.00 Low Nov 3

S&P E-Minis maintains a firmer tone with the recovery from 3839.25, Mar 13 low, intact - for now. Key short-term resistance to watch is the 50-day EMA at 4025.43. The average was breached yesterday and a clear break would strengthen a short-term bullish theme and signal scope for a climb towards 4119.50, the Mar 6 high. A failure to hold on to recent gains would refocus attention on key support at 3839.25, the Mar 13 low.

COMMODITIES: Gold Boosted By Post-FOMC Dollar Slide

- Crude oil has pushed higher today for the third session running, although most recently has unwound a small further boost on a bullish reaction for risk sentiment to the FOMC decision to hike 25bps and Chair Powell’s press conference.

- Earlier, EIA oil inventories surprisingly rose 1.1m bbls last week vs expectations of a drawdown, although it was smaller than the API’s survey released just a day earlier.

- WTI is +1.2% at $70.50, clearing resistance at $69.83 (Mar 17 high) to open $72.71 (Mar 15 high). Under more limited volumes, most active options strikes in the CLK3 have been $75/bbl calls.

- Brent is +1.3% at $76.32, clearing resistance at $75.92 (Mar 17 high) to open $78.84 (Feb 6 low).

- Gold is +1.2% at $1963.66 as the dollar slides and Treasury yields fall. It’s off a session high of $1978.49 touched mid Powell press conference whilst resistance remains at $2009.7 (Mar 20 high) after its recent run of strength.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/03/2023 | 0830/0930 |  | CH | SNB interest rate decision | |

| 23/03/2023 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 23/03/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 23/03/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 23/03/2023 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 23/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 23/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/03/2023 | 1230/0830 | * |  | US | Current Account Balance |

| 23/03/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 23/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/03/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/03/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/03/2023 | 1500/1600 |  | EU | ECB Lane Panels Peterson Institute Conference | |

| 23/03/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/03/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 24/03/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.