-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

MNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA MARKETS ANALYSIS: Jan Retail Sales Surprises

HIGHLIGHTS

- MNI US-EU: Ger Fin Min: Expansion Of EU Subsidies Not Right Response To IRA

- MNI US-RUSSIA: Russia To Call UN Security Council Meeting On Nord Stream "Sabotage"

- MNI SECURITY: Netherlands Denies Reports It Has Changed Position On Tanks

- ECB LAGARDE: INTEND TO RAISE RATES BY 50 BPS IN MARCH, Bbg

- CBO SAYS US TREASURY RISKS PAYMENT DEFAULT AS SOON AS JULY, Bbg

- AUSTAN GOOLSBEE BEING CONSIDERED TO SERVE AS FED VICE CHAIR: WSJ

- DOJ RAMPS UP WORK ON POTENTIAL APPLE ANTITRUST COMPLAINT, DJ

US TSYS: Retail Sales Surge Green Lights Longer Period of Rate Hikes

Bonds hold weaker levels/near lows after the bell, 2s10s curve well off this morning's 40-year inverted low in 2s10s from -91.943 to -80.405 in the first half, unconfirmed talk of large fund driven unwind in play.

- Tsys had sold off after this morning's higher than expected Jan Retail Sales (3.0% vs. +1.9% forecasted, ex-auto/gas at +2.6% vs. -0.4% in Dec the strongest print since March 2021) 2s10s extended inversion amid brief speculation over larger rate hikes over extended period from the Fed.

- Pricing larger hikes is moderating, however, with short end outperforming, while pricing in longer period of hikes remains. Fed funds implied hike for Mar'23 steady at 26.8bp, May'23 cumulative steady 47.3bp to 5.052%, Jun'23 at 61.4bp to 5.194%, while terminal rate has slipped to 5.24% in Aug'23 from 5.29% this morning.

- Robust overall volumes, TYH3 >1.6M, rate locks weighing w/ $24B Amgen 8pt mega-deal and $5B MUFG 5pt launched in second half.

- Tsy futures held weaker/near midday lows after $15B 20Y bond auction (912810TQ1) comes out nearly on the screws: 3.977% high yield vs. 3.975% WI; 2.54x bid-to-cover vs. prior month's 2.83x.

- Tsy Mar/Jun futures roll also underway ahead first notice date of Tuesday, February 28.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00243 to 4.56186% (+0.00257/wk)

- 1M +0.01143 to 4.60143% (+0.02343/wk)

- 3M +0.00500 to 4.87657% (+0.00714/wk)*/**

- 6M +0.02186 to 5.18029% (+0.05315/wk)

- 12M +0.08529 to 5.58443% (+0.09986/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.87657% on 2/15/23

- Daily Effective Fed Funds Rate: 4.58% volume: $105B

- Daily Overnight Bank Funding Rate: 4.57% volume: $287B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.216T

- Broad General Collateral Rate (BGCR): 4.52%, $466B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $455B

- (rate, volume levels reflect prior session)

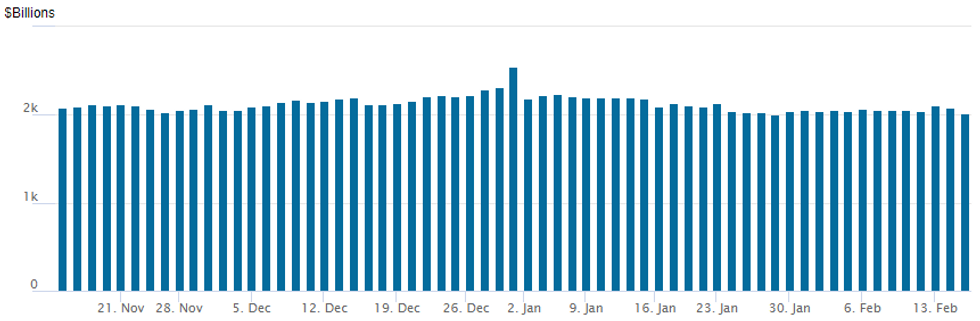

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage declines to $2,011.998B w/ 96 counterparties vs. prior session's $2,076.548B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Pick-up in rate hike insurance positioning in late 2023 to 2024 Wednesday, strong Retail Sales green-lighting a longer period of rate hikes. Salient trade:- SOFR Options:

- Block, 9,000 2QH3 96.50 puts, 15.5 ref 96.485

- Block, total 10,000 SFRM4 94.50/95.50 2x1 put spds, 13.5

- Block, 46,000 OQM3 95.50 puts, 24.5 ref 95.765

- Block, 5,000 OQM3 95.50/95.87/96.50 2x3x1 broken put flys, 67.0 net, wings over ref 95.735

- over 6,100 OQH3 95.12 puts, 8.0 ref 95.33

- Block, 5,000 OQJ3 96.12 calls, 14.0 ref 95.83/0.33%

- Block, 15,000 OQM3 94.50/95.12/95.75 put flys, 13.0 ref 95.83

- 1,000 OQJ3 95.37/95.62/95.75/96.00 put condors ref 95.83

- 2,000 SFRJ3 95.12/95.18 call spds ref 95.055

- 2,000 3MG3 111.25/111.5/112.25/112.5 put condors, 6.0 ref 112-12

- 3,000 SFRZ3 94.00 puts, 8.5 ref 94.99

- 2,600 SFRM3 95.18 calls, 1.25 ref 94.745

- 1,500 SFRM3 95.06/95.18/95.31 call flys ref 94.745

- Block, 3,000 OQH3 94.87/95.25 2x1 put spds, 6.0 vs 95.40/0.12%

- Treasury Options:

- 3,000 TYJ3 109/110 2x1 put spds, 2 net/2-leg over ref 112-18.5

- 4,000 TYK3 115.5/116.5 call spds, 14 ref 112-18

- over 5,700 USH3 124 puts, 12 ref 126-25

- 27,000 wk3 TY 112 puts, 4 ref 112-06

- Block, 5,000 SFRM3 94.50/95.50 2x1 put spds, 13.0

- over 4,000 USJ3 124 puts, 40 ref 128-14

- over 3,700 TYJ 113 puts, 38 ref 112-31.5

- 3,000 TYH3 111 puts, 5 ref 112-15

- 2,600 TYJ3 114.5 calls, 28 ref 113-02

- 2,500 TYH3 111.25/113.5 call spds, 111 ref 112-13.5

EGBs-GILTS CASH CLOSE: Gilts Outperform On Soft UK CPI

Gilts easily outperformed Bunds Wednesday, with European curves steeper and yields finishing well off session lows.

- UK yields fell sharply early on soft core CPI (2Y yields fell more than 14bp at the low) but stabilised and closed only slightly lower on the session, with strong US retail sales data contributing to the rebound.

- German yields were led lower early by Gilts, but retraced and finished higher across the curve. The 10Y Bund yield saw its highest close since Jan 2.

- EGB weakness mirrored a continued rise in ECB hike expectations (terminal depo rate now seen close to 3.70%, up 3bp) ahead of Pres Lagarde's appearance just after the cash close.

- BTPs underperformed, with spreads widening further after a 30Y syndication announcement in late afternoon (as had been anticipated by MNI).

- Thursday sees French and Spanish bond auctions, and multiple ECB speakers.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.5bps at 2.883%, 5-Yr is up 2.4bps at 2.529%, 10-Yr is up 3.7bps at 2.475%, and 30-Yr is up 5.6bps at 2.434%.

- UK: The 2-Yr yield is down 3.7bps at 3.793%, 5-Yr is down 8.4bps at 3.426%, 10-Yr is down 3.4bps at 3.487%, and 30-Yr is down 2bps at 3.87%.

- Italian BTP spread up 7bps at 185.6bps / Spanish up 3.6bps at 96.3bps

EGB Options: Large Bund Rolling Package Features Wednesday

Wednesday's Europe rates / bond options flow included:

- RXH3 134.50p sold at 42 in 20k vs 138.50/139.50c strip, sold at 11 in 10k (closing)

- Large package:

- Combos sold: Mar 134.5/139.5 (-p) and Mar 134.5/138.5 (-p).

- PS vs Calls bought: Apr 133/131 vs 138 (+ps/-c) and Apr 132.5/130.5 vs 138.5 (+ps/-c).

- Rolling combos to Apr net premium sold 55 ticks

- ERM4 96.75 ^ v ERH4 96.50^ sold at 11.75 in 1.5k

- ERM3 96.50/96.375/96.125 broken put ladder bought for 1.25 in 20k

FOREX: USD Index Set To Close With 0.65% Advance

- The USD index (+0.65%) briefly traded above the 1.04 mark on Wednesday for the first time since January 06. Although late equity gains have moderately trimmed the advance, the index looks to consolidate just below session highs approaching the end of the US session. Upward pressure on US yields continues to underpin the strength in the greenback.

- AUD and GBP continue to be the day’s worst performing majors, both declining around 1.25%. AUD trades heavily on the back of local equity weakness and softer stock markets in China and Hong Kong.

- GBPUSD has stabilised back above the 1.20 mark for now, however, today’s weakness is a result of CPI falling short of forecast across both headline and core measures, resulting in a print of 1.1990.

- Cable maintains a sell-on-rallies theme and recent weakness reinforces a S/T bearish theme and signals scope for a continuation. Sights are on the 200-dma at 1.1947. A move through this level would expose key support at 1.1842, the Jan 6 low.

- After topping the key short-term level marking the 50-day EMA on Tuesday, USDJPY’s break above 132.77 suggests scope for an extension higher that would expose 134.77, the Jan 6 high.

- EURUSD sits close to its 50-day EMA approaching the APAC crossover, a key support level, of which a break would strengthen the bearish cycle. A close below may signal a move that exposes 1.0634 initially, the Jan 9 low. Below here, attention would turn to 1.0484, the Jan 6 low and a key support.

- Consumer inflation expectations and employment data for Australia highlight Thursday’s APAC calendar. Focus then shifts to US PPI data.

FX: Expiries for Feb16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750-60(E540mln)

- USD/JPY: Y128.50($550mln)

- EUR/GBP: Gbp0.8930-50(E976mln)

- NZD/USD: $0.6200(N$671mln)

- USD/CAD: C$1.3435-50($1.1bln), C$1.3550($906mln)

Late Equity Roundup: Nasdaq Pulling Higher Late

Stocks remain mixed in late afternoon trade, Nasdaq shares outperforming. SPX eminis currently trading -1.75 (0.04%) at 4141.25; DJIA -53.5 (-0.16%) at 34001.93; Nasdaq +74.5 (0.6%) at 11997.31..

- SPX leading/lagging sectors: Energy continues to underperform (-2.15%) weighed by O&G, Equipment and services names (DVN -11.01%, OXY -5.16%, MRO -4.55%). Next up: Health Care (-0.56%) and Consumer Staples (-0.35%) sectors, pharmaceuticals and bio-techs weighing on the former (BIIB -3.83%, PKI).

- Leaders: Communication Services (+0.91%), Consumer Discretionary (+0.73%) followed by Utilities (+0.30%). Media and entertainment shares underpinned the former (PARA +9.00%, TTWO 3.0%, WBD +2.92%).

- Dow Industrials Leaders/Laggers: Caterpillar (CAT) +3.60 at 247.96, Apple (AAPL) +1.96 at 155.16, Goldman Sachs (GS) +1.58 at 373.3.6 Laggers: Microsoft (MSFT) -4.10 at 268.07, Chevron (CVX) -3.35 at 168.95, United Health (UNH) -4.02 at 488.81.

- Earnings after the close: Republic Services (RSG $1.02 est), Energy Transfer (ET $0.38 est), Invitation Homes (INVH $0.41 est), Cisco (CSCO $0.85 est), Synopsys (SNPS $2.51 est), Roku (ROKU -$1.74 est), CF Ind (CF $4.23 est), Marathon Oil (MRO $0.84 est), Equinix (EQIX $4.81 est), American Int Group (AIG $1.26 est), Albemarle (ALB $8.19 est), Welltower (WELL $0.82 est)

E-MINI S&P (H3): Corrective Pullback

- RES 4: 4361.00 High Aug 16

- RES 3: 4300.00 Round number resistance

- RES 2: 4250.00 High Aug 26, 2022

- RES 1: 4208.50 High Feb 2 and the bull trigger

- PRICE: 4150.00 @ 1435 ET Feb 15

- SUP 1: 4060.75 Low Feb 13

- SUP 2: 4006.63 50-day EMA

- SUP 3: 3901.75 Low Jan 19

- SUP 4: 3788.50 Low Dec 22 and a key support

The S&P E-Minis trend condition is bullish and the latest pullback is considered corrective. The contract has pierced initial support at 4069.52, the 20-day EMA. Firmer support lies at the 50-day EMA, at 4006.63. A clear break of this average would signal scope for a deeper pullback and potentially highlight a reversal. Key resistance and the bull trigger intersect at 4208.50, the Feb 2 high. A breach would resume the uptrend.

COMMODITIES: Crude Oil Ending Lower Despite Reversing Slide On Inventory Build

- Crude oil is ending the session lower on the day but has seen a solid intraday recovery off lows after a big build in US crude inventories due to lower refinery utilisation.

- Crude inventories showed a big build as refinery runs fell with output impacted by the strong maintenance season. Refinery rates had not recovered following the December cold weather disruption before units have started going offline for maintenance.

- The build came despite a drop in imports, higher exports and with production levels holding at recent highs. Cushing inventories reached the highest since Jun 2021.

- WTI is -0.6% at $78.56 off a low of $77.25 although one that didn’t test support at $76.52 (Feb 9 low). Resistance remains at $80.62 (Feb 13 high).

- Brent is -0.35% at $85.28 off a low of $83.88 that also held above support at $83.05 (Feb 9 low).

- Gold is -1.0% at $1836.33, suffering amidst USD strength, off an earlier low of $1830.66 that now forms initial support after which sits the near-term support at $1825.2 (Jan 5 low).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/02/2023 | 0030/1130 | *** |  | AU | Labor force survey |

| 16/02/2023 | 0915/1015 |  | EU | ECB Panetta in Discussion at Centre for European Reform | |

| 16/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 16/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/02/2023 | 1330/0830 | *** |  | US | PPI |

| 16/02/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 16/02/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/02/2023 | 1345/0845 |  | US | Cleveland Fed's Loretta Mester | |

| 16/02/2023 | 1500/1600 |  | EU | ECB Lane Dow Lecture at NIES London | |

| 16/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 16/02/2023 | 1600/1100 |  | CA | BOC Governor Macklem at House of Commons hearing | |

| 16/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 16/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 16/02/2023 | 1700/1700 |  | UK | BOE Pill Fireside Chat at Warwick University Think Tank | |

| 16/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 16/02/2023 | 1830/1330 |  | US | St. Louis Fed's James Bullard | |

| 16/02/2023 | 1945/2045 |  | EU | ECB de Guindos Students Discussion | |

| 16/02/2023 | 2100/1600 |  | US | Fed Governor Lisa Cook | |

| 16/02/2023 | 2255/1755 |  | CA | BOC Deputy Beaudry speaks on "The importance of the Bank of Canada’s 2% inflation target" | |

| 16/02/2023 | 2315/1815 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.