-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS - Market Hones In on Fiscal Details

HIGHLIGHTS:

- Dollar dropped as markets hone in on fiscal details

- US curve marginally steeper

- WTI, Brent futures hit new post-crisis highs

US TSYS SUMMARY: Steeper Curve as Fiscal Details Awaited

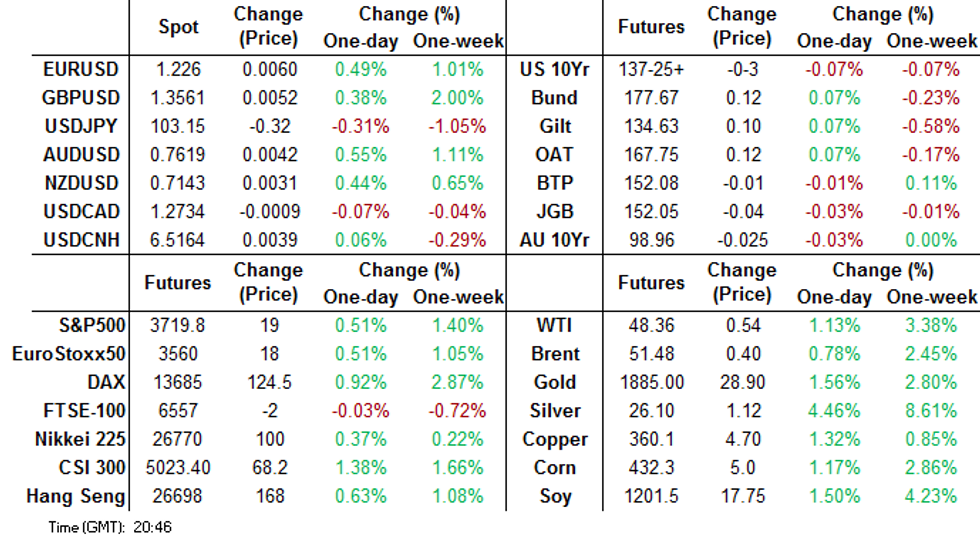

The curve traded marginally steeper into the close Thursday, with markets awaiting the final details of the $900bln fiscal package from US lawmakers, on which the details are expected ahead of the Friday close. The price action wasn't one-way however, with March futures pushing lower at the end of the London session, moving swiftly from 137-29+ to 137-24 (last 137-25+) as the curve bear steepened on no material headline catalyst.

- 3M10Y +1.0, 84.3

- 1Y10Y +0.7, 84.6

- 2Y10Y +0.5, 81.2

- 2Y30Y +1.4, 156.0

- 5Y30Y +1.5, 130.6

EGBs-GILTS CASH CLOSE: Mixed Risk Reactions

Bunds outperformed for most of the session but came back to the pack, and it was a mixed risk picture overall with core FI in general doing fine and periphery spreads widening despite higher equities.

- BoE unch decision didn't have much of an impact. Brexit headlines continue to be mixed-to-positive, with most concerns cited today being of a procedural variety (ie when can bill passage be made).

- Late session brought news that the UK reported a record 35.6k COVID cases - but Gilts fell.

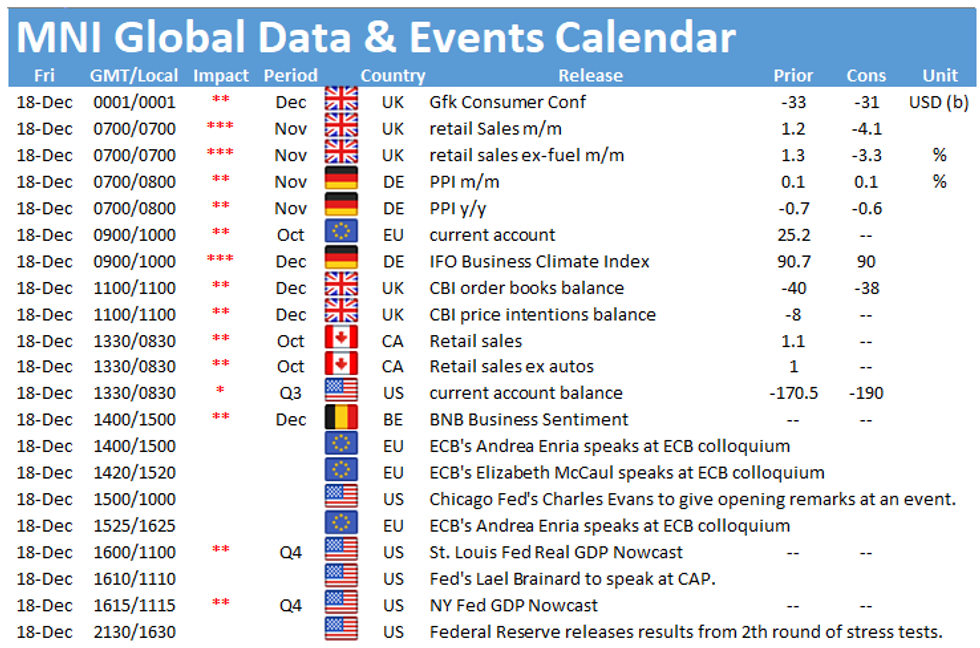

- On Friday, UK Nov retail sales is the clear data highlight, with German IFO following thereafter. No bond supply and no central bank speakers.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is unchanged at -0.725%, 5-Yr is down 0.2bps at -0.746%, 10-Yr is down 0.3bps at -0.57%, and 30-Yr is up 0.7bps at -0.155%.

- UK: The 2-Yr yield is up 2.6bps at -0.051%, 5-Yr is up 2.5bps at -0.006%, 10-Yr is up 1.5bps at 0.287%, and 30-Yr is up 1.3bps at 0.847%.

- Italian BTP spread up 0.7bps at 111bps

- Spanish bond spread up 0.9bps at 59.9bps

- Portuguese PGB spread up 2bps at 58.1bps

- Greek bond spread up 0.4bps at 115.4bps

EUROPE SUMMARY: Short-Term Plays, Diagonals, And Condors

Thursday's options flow included:

- DUH1 112.30/40/50/60 c condor vs 112.20/10ps, bought the condor for 1.5 in 5k

- OEG1 135/134.5ps, 1x2, bought for 6.5 in 1.5k

- RXF1 177/176/175p fly, bought for 8 in 1k

- RXF1 177/RXG1 175p diagonal, bought the front for 3 in 1k

- RXG1 177/176/175/174p condor trades 20 in 1k

- RXH1 177/176.5ps, bought for 16 in 1.5k

- ERU2 100.25/100.87 RR, bought the put for 1 in 4k

- LM1 100.00/100.12/100.25c fly, bought for 1.25 in 2k

- LM1 100.00/12/25/37c condor, old at 1.75 in 15k

- LM1 100^, sold at 11 in 1.5k

- LU1 100.125/100.25/100.375 call fly bought for 1.25 in 4k

- 2LM1 99.62/99.37ps, bought for 2 in 2.5k {ref 99.89)

FOREX: Dollar Dropped as Markets Hone In On Stimulus Prospects

The greenback was once again the poorest performer in G10, with decent risk appetite in equity space sapping the USD of any safe haven status. Market focus remains on US stimulus deal prospects, with reports suggesting that differences are continuing to narrow, with just the final details remaining in a package worth up to $900bln.

At the other end of the table, the NOK was stronger against all others Thursday following the Norges Bank rate decision. The Bank sharply steepened their rate path projections, bringing forward the timing of the first rate hike by around six months to mid-2022.

Despite recent outperformance, GBP was distinctly mid-table Thursday after solid gains were sold into the close after the conclusion of a phonecall between UK's Johnson and EU's von der Leyen. Both sides cautioned that no deal remained a real possibility, with distinct differences remaining between both sides.

Focus Friday turns to German IFO data and Canadian retail sales. The Russian central bank rate decision is also due.

EQUITIES: Stocks Eke Out New Alltime Highs

Fiscal stimulus prospects remain the key driver for equities across Europe and the US. With US lawmakers narrowing differences and making a $900bln stimulus package more likely by the end of the week, markets were bid higher, resulting in new alltime highs for the S&P 500. Real estate and materials sectors were the strongest performers, with energy and communication services lagging.

The VIX resumed its decline, with a test on the late November lows of 19.51 now looking likely.

COMMODITIES: WTI Adds to Recent Gains

Oil futures traded solidly Monday, with both WTI and Brent crude futures striking new multi-month and post-COVID crisis highs. Brent now looks increasingly comfortable north of $50/bbl, while a test on that level for WTI now looks increasingly likely. Firm stock sentiment and the higher prospects of stimulus in the US remain a key driver, with a bipartisan package seen being agreed upon ahead of the end of Friday.

Thanks to a weaker greenback, both spot gold and silver erased early underperformance to trade with decent gains into the close of well above 2.5% for silver, and 1% for the yellow metal.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.