-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Mkt Leans Into 50Bp Liftoff Post CPI

US TSYS: Hot CPI and Hawkish Pivot From StL Fed Bullard

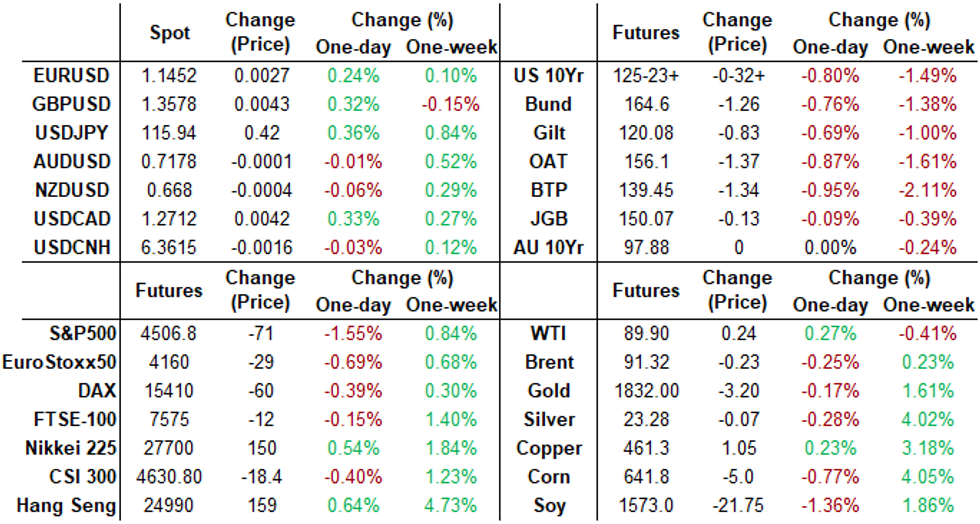

Tsy yields surged back to mid-May levels (30YY 2.3436%) after Jan CPI came out higher than estimates at 0.6% Thu, yield curves bear flattened (2s10s slipped below 43.0, finishing around 43.8 -13.4; 7s10s inverted) while equities fell below 4500.0 after climbing back above 50-day EMA of4564.03 around midday.

- One-Two Punch: The "hot" CPI got "higher/faster" rate hike ball rolling early but hawkish pivot from StL Fed Bullard hammered the point home.

- In a Bbg interview -- ahead the 30Y auction to boot -- Fed Bullard green-lighted a 50bp hike in March (but defers to Powell on move) and potential for inter-meeting hikes in light of the pick-up in inflation. (Remember, Bullard stated a 50bp hike "didn't help us" a week ago).

- Of note, 2YY currently at 1.5827% well above where 10YY started the year (1.5360%).

- Not kind to Bond auction: Tys whipsawed after $23B 30Y auction tail (912810TD0), Bond sale tailed on 2.340% high yield vs. 2.327% WI; 2.30x bid-to-cover vs. 2.35x last month (2.29x 5-month average).

- Counterpoint: MNI INTERVIEW: Fed's Daly Downplays Chances Of 50 BP Rate Hike, interview AFTER CPI. Still on tap: Richmond Fed Barkin (hawk) this evening at 1900ET.

- Heavy volumes, real-vol spiked, heavy Eurodlr and Treasury option volumes chasing renewed rate hike pricing (as much as 150bp by year end).

- After the bell, 2-Yr yield is up 24.5bps at 1.6092%, 5-Yr is up 14.6bps at 1.9624%, 10-Yr is up 10.4bps at 2.0451%, and 30-Yr is up 8.2bps at 2.3272%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00014 at 0.07757% (+0.00057/wk)

- 1 Month +0.00100 to 0.12371% (+0.00842/wk)

- 3 Month +0.01743 to 0.39486% (+0.05586/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.02986 to 0.66443% (+0.10900/wk)

- 1 Year +0.03086 to 1.12457% (+0.12557/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $266B

- Secured Overnight Financing Rate (SOFR): 0.04%, $911B

- Broad General Collateral Rate (BGCR): 0.05%, $350B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $343B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $3.201B accepted vs. $8.064B submitted

- Next updated schedule will be released Friday, Feb 11 at 1500ET

FED Reverse Repo Operation, Receding

NY Fed reverse repo usage falls to $1,634.146B w/ 76 counterparties vs. $1,653.153B yesterday -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

SOFR Options

- Block, 17,000 SRFU2 9850/98.62/98.75 call flys, 2.0

- Block, 3,000 SRFZ2 97.25/97.50 put spds, 4.0

- +20,000 Mar 99.06/99.18 put spds, 1.5

- 5,000 Mar 99.43/99.50 1x2 call spds

- -2,500 Sep 98.25/98.50/98.75 put flys, 4.75

- 10,000 short Jun 97.75/98.00/98.25 put flys

- Block, 10,000 Dec 96.62/96.87/97.62 put flys, 18

- Block, Sep 99.37 calls, 2.5 vs. 98.41/0.05%

- 4,000 Apr 99.00/99.12/99.25 put flys

- 10,500 short Sep 96.75/97.25 put spds

- 10,300 Feb 99.37 puts, 1.5

- 10,000 Mar 99.50 puts, 11.0

- Block, 10,000 Dec 96.62/96.87/97.62 put flys, 8.0

- Block, 10,000 Dec 99.62 calls, 1.5

- +15,000 short Dec 96.62/96.87/97.62 put flys, 17.5-18 ref: 97.715

- Block, -10,000 Dec 98.50/98.75 put spds 6.0 over Blue Dec 97.62/97.87 put spds, steepener

- Block, -10,000 Jun 99.18/99.31 call spds, 1.75

- Block, +10,000 Dec 98.37/98.62/98.87/99.12 put condors, 5.0

- Overnight trade

- +7,000 short Jun 97.75/Blue Jun 76 put spds, 1.0 flattener

- +10,000 short Feb 98.06 puts, 2.0

- -5,300 Feb 99.37/99.43 put spds, 2.75

- +4,000 short Sep 96.75/97.25 put spds, 7.5

- 3,000 Blue Feb 99.37/99.43 put spds

- 5,500 TYH 126 puts, 21

- 1,000 FVJ 115.5/116/117 2x3x1 put flys

- 4,000 FVJ 117.25 puts, 33.5

- Blocks, total 18,000 TYJ 117.25 puts, 35 vs. 117-12

- Update, over 14,000 TYH 127.25 calls mostly from 12-6

- 6,500 FVH 118 puts, 16

- 20,000 TYH 124/125 put spds, 4

- 6,700 TUH 108.12 calls, 1-5.5 adds to overnight trade

- Overnight trade

- Block, 40,000 FVJ 117.25 puts, 26.5 vs. 118-07.25

- Block, -7,500 FVH 118.5 puts, 26.5

- -3,000 TYJ 126 straddles, 159

- 2,500 TUH 108.12 calls, 5

EGB Options: Downside Plays In Bund And Schatz

Thursday's Europe rates/ bond options flow included:

- DUH2 111.50/111.40ps, bought for 1.5 in 2k

- DUJ2 111.30/111.10ps , bought for 10.5 and 11 in 24k

- RXM2 161 put, bought for 130 in 4k

- RXJ2 165.5p, suggest sold at 315 in 2.5k

- RXJ2 159/157.5 ps bought for 18.5 in 20k

FOREX: Greenback Spike Faded Following Above Estimate US Inflation

- US CPI surprised to the upside once more, illustrating the continued momentum for inflation in the US economy. As such, US yields spiked in a bear flattening move prompting an initial relief rally for the US dollar, that has been struggling over the past two weeks.

- The US dollar index was boosted around 0.5% following the data with EURUSD trading down to 1.1375 and USDJPY breaking above the 1.16 handle to closely match the years highs around 1.1635.

- Despite the downward momentum for US fixed income, renewed optimism for the greenback was short-lived. A very strong dollar reversal ensued, aided by a firm bounce off the lows for major equity indices.

- The DXY fell around 0.85% which translated into EURUSD making fresh highs for the year at 1.1495 and USDJPY falling back below 116.

- In a third major move for the session, Fed Bullard's comments on favouring a 50bp hike in March coupled with entertaining the option of inter-meeting increases sparked an equities selloff with the dollar regaining some poise, DXY now residing close to unchanged for Thursday.

- EURUSD’s resilient price action appears to be confirming a bull flag continuation pattern. Once through the day’s high and pivot resistance at 1.1495, the focus will be on 1.1558, a Fibonacci retracement.

- The Swedish krona was the clear underperformer on Thursday, with gains for EURSEK totalling 2.15% approaching the end of the trading day. Following the riksbank meeting, analysts suggested that set against the increasingly hawkish major central banks, Thursday's Riksbank meeting had erred more on the dovish side than markets had expected.

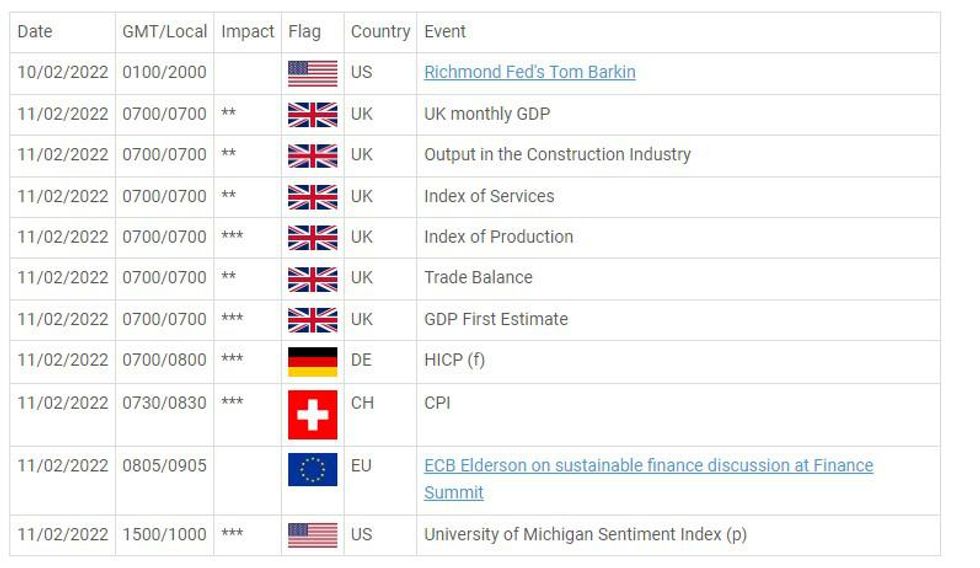

- Overnight, potential comments from RBA Governor Lowe, due to testify at a virtual hearing before the House of Representatives Standing Committee on Economics. Inflation expectations for New Zealand will also be released before UK publishes growth data at the start of the European session.

FX: Expiries for Feb11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1300(E1.4bln), $1.1340-60(E753mln), $1.1400(E701mln), $1.1475(E668mln), $1.1495-05(E3.1bln), $1.1550(E1.0bln)

- USD/JPY: Y115.75($750mln)

- EUR/GBP: Gbp0.8410-25(E608mln), Gbp0.8500-10(E613mln)

- USD/CAD: C$1.2650-60($4.66bln), C$1.2680-85($1.5bln)

EQUITIES: Stocks Shy Away From Multi-Decade High Inflation

- Equities traded uniformly lower Thursday, extending the response to a multi-decade high print in CPI inflation - with all headline and core measures beating analyst expectations. Weight initially went through the e-mini S&P to pressure prices to lows of 4512.50, before a mid-session recovery was quashed by a particularly hawkish speech from Fed's Bullard, who spoke in favour of a cumulative rise of 100bps in the Fed Funds Rate by H2, and even raised the notion of an inter-meeting Fed rate hike.

- Materials were the sole sector to make gains across the S&P 500, with persistent strength in precious metals buoying miners including Freeport-McMoRan - which holds its considerable YTD rally.

- The tech sector was among the poorest performer in the S&P 500, edging lower alongside a rally in short-term US yields. Despite a modest flattening in the curve, a US 2y yield at new multi-year highs was enough to sap the recent recovery in growth names.

COMMODITIES: Oil Ending Softer On Fed Hiking Fears

- Crude oil prices are flat to down as they finish on a weak note after Bullard stoked Fed hiking fears following strong inflation data, with talk of an inter-meeting hike plus favoring a 50bp move in March with 100bps before July.

- WTI is -0.04% at $89.65 having not troubled resistance of $93.17 (Jan 4 high) or support of $88.41 (Feb 9 low).

- The most active strikes in the H2 contract have been $85/bbl puts followed by $95/bbl calls.

- Brent is -0.54% at $91.06, with support seen at $89.93 (Feb 8 low) and resistance at $94 (Feb 7 high) with the outlook remaining bullish.

- Gold dips -0.2% to $1829.2 after a string of steady daily gains, again with late weakness. It remains between the bull trigger of $1853.9 (Jan 25 high) and bear trigger of $1780.4 (Jan 28 low).

Friday Data Calendar

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.