-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS:Poor 3Y Note, Heavy Corp Debt Weighs

HIGHLIGHTS

- MNI FED Powell: Main FOMC Message Is Disinflation Has Begun But Early Days

- MNI NATO: Swedish PM-We Are Ready To Restart Talks w/Turkey As Soon As They Are Prepared

- TURKEY'S PRESIDENT ERDOGAN: DECLARING STATE OF EMERGENCY FOR THREE MONTHS, Rtrs

- LULA TO MEET WITH BIDEN ON FRIDAY AFTERNOON: BRAZIL MINISTRY,Bbg

- ECB NAGEL: ECB MUSTN'T STOP RAISING RATES TOO SOON: BOERSEN-ZEITUNG, Bbg

- ECB NAGEL: ECB RATES AREN'T YET IN RESTRICTIVE TERRITORY: BOERSEN

Key links: MNI INTERVIEW: Inflation Drop Looks Sustainable-Fed’s Wright / MNI Banxico Preview - February 2023: Focus On Future Guidance

US TSYS: $40B 3Y Note Sale Tail, $37B Corporate Debt Issuance Weighed on Tsys

Another whip-saw session for US FI markets, weaker/near late session lows after extending gains immediately after Fed Chair Powell, Economic Club of Washington interview. No react to Trade Balance (-$67.4B vs -$68.5B est) or Redbook Feb store sales (+4.3%).

- Initial risk-on reaction to Powell saying disinflationary process has begun but it's very early. Risk-on short lived as Powell reiterated the process is likely to take quite a bit of time. Then comes the labor market report for January, it's certainly stronger than anyone expected. But I would say it shows you why this will be a process that takes a significant period of time.

- Treasury futures scaling back (Chair Powell-tied) support after $40B 3Y note auction (91282CGL9) tailed 4.3bp: 4.073% high yield vs. 4.035% WI; 2.33x bid-to-cover vs. 2.84x last month.

- Tsys pressed on incoming corporate bond issuance, $11B Intel 7pt jumbo, foreign banks and sovereign wealth fund multi-tranche issuance totaled over $37B Tues, spurring early rate lock selling across the curve.

- Cross asset: US$/Yen sold off earlier, Gold bounces while Crude has been marching higher last couple hours (WTI +3.20 at 77.31).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.01128 to 4.55329% (+0.00058/wk)

- 1M -0.00758 to 4.58071% (+0.00885/wk)

- 3M +0.00186 to 4.84500% (+0.01086/wk)*/**

- 6M -0.00471 to 5.13500% (+0.07757/wk)

- 12M +0.03557 to 5.44000% (+0.18886/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.84500% on 2/7/23

- Daily Effective Fed Funds Rate: 4.58% volume: $99B

- Daily Overnight Bank Funding Rate: 4.57% volume: $278B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.209T

- Broad General Collateral Rate (BGCR): 4.52%, $473B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $460B

- (rate, volume levels reflect prior session)

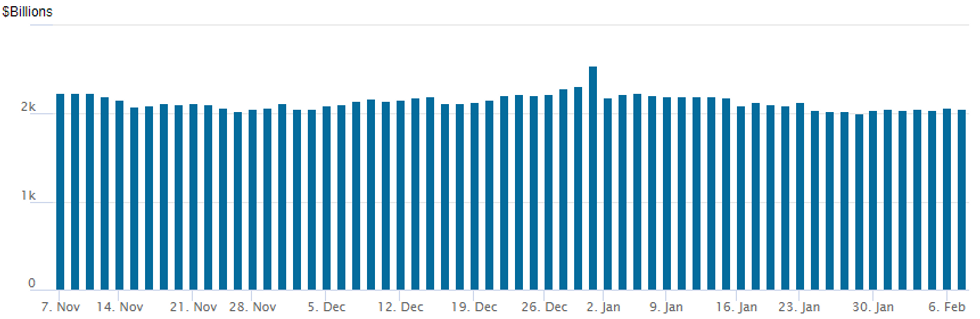

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,057.958B w/ 104 counterparties vs. prior session's $2,072.261B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Heavy derivatives volume resumed Tuesday, focus on downside (rate hike) insurance buying via puts as markets continue to (re)price in more rate hikes out the curve. Salient SOFR trade, buyers over 100,000 Sep'23 SOFR 94.00/94.50 put spds from 5.5 to 6.0 on the day.SOFR Options:

- Block, +60,000 SFRU3 94.00/94.50 put spds, 6.0 vs. 94.955/0.14%

- Blocks, 22,500 SFRU3 94.00/94.50 put spds, 5.5 ref 94.965

- Blocks, +15,000 SFRH3 95.00/95.06/95.12 put trees 2.75-3.0

- Block 5,000 SFRM3 94.50 puts, 3.0 vs. 94.855/0.10%

- Block, -10,000 SFRM3 94.62/94.75 put spds, 3.5 (-13k total on day)

- Block, +8,000 SFRG3 94.87/95.06 put spds, 0.75 ref 95.9 more offered in pit

- 8,500 OQM 95.50/97.00 strangles, 18.5

- Blocks, 15,000 SFRH4 93.75/94.75/95.75 put flys, 24.5 ref 95.75

- Blocks, 12,000 SFRZ3 94.50/94.75/95.25/95.50 put condors, 9.0 ref 95.265 to -.275

- BLOCK, 12,000 SFRU3 94.50/94.75/95.00/95.25 put condors, 9.0 ref 94.975

- 10,000 SFRM3 94.68/94.81 put spds, ref 94.885

- 5,000 OQH3 95.75/96.00 put spds, ref 95.785

- Block, 3,000 SFRM3 94.62/94.75 put spds, 3.25 ref 94.875

- Block, 4,000 SFRN3 94.87/95.00 put spds, 6.0 vs. 94.945/0.10%

- 3,600 SFRH3 95.00/95.06/95.18/95.25 put condors ref 95.09

- Block, 4,000 SFRG3 95.12/95.18/95.25 put trees, 3.0 vs. 95.105/0.70%

- Block, 3,000 OQH3 95.87/96.00 put spds, 8.0 ref 95.78

- 2,000 SFRU3 95.06/95.12/95.18/95.25 call condors ref 94.985

- Treasury Options:

- 12,400 TYH3 112/115 put over risk reversals, 7 ref 113-07.5

- over 10,500 FVH 110 calls, 4.5 ref 108-15.75

- 3,000 TYH3 114.25 calls, 27 ref 113-18

- 2,600 wk2 TY 112.25/112.5/112.75/113 put condors ref 113-14.5

- 2,400 FVJ3 108.25/109.75 put spds ref 108-31.75

- 1,500 FVH3 106.5/107/108 broken put flys ref 108-15.25

FOREX: Greenback Marginally Lower Following Powell Remarks, JPY Leads Gains

- Despite some volatile price action following Fed Chair Powell’s remarks on Tuesday, the USD index sits just moderately lower on Tuesday approaching the APAC crossover. With Powell once again leaning into the disinflation process narrative, global equity indices are advancing into the close, providing a less optimistic backdrop for the USD.

- Greenback weakness has been led by USDJPY where the majority of the downward price action was seen in the lead up to Chair Powell’s remarks. The reversal has been helped by the overall technical outlook remaining bearish and the pair holding the 50-day exponential moving average almost perfectly on Monday around 132.90.

- Tuesday’s selloff was then exacerbated by short-term positioning and the pair filling the gap from Sunday’s open between 131.60-131.20. Although some further weakness ensued on Powell, to print fresh lows at 130.48, those losses have been pared and USDJPY remains close to unchanged on the week.

- The Euro has underperformed, largely led by the move lower in EURJPY. However, EURUSD did extend to fresh four-week lows of 1.0669, coming within two pips of 1.0667, the 50-day EMA and a key support.

- AUDUSD (+0.89%) sits higher for the first session in four following the RBA rate decision, at which the bank raised rates by 25bps to 3.35%, and hinted that another 50bps of rate rises could be still to come in an effort to rein in inflation.

- There are no major economic data releases on Wednesday which places the focus on the speaker slate. Fed’s Williams, Cook, Barr, Bostic, Kashkari and Waller may make remarks.

FX: Expiries for Feb08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-15(E759mln), $1.0735-50(E1.3bln), $1.0800-15(E621mln)

- USD/JPY: Y130.00($595mln), Y132.85-00($801mln)

- EUR/JPY: Y140.25-26(E1.3bln)

- EUR/GBP: Gbp0.8850-70(E825mln), Gbp0.8900(E673mln), Gbp0.8950(E501mln)

- AUD/USD: $0.7190(A$1.4bln)

- USD/CNY: Cny6.6500($650mln), Cny6.7390-00($869mln)

Late Equity Roundup: Energy Shares Lead Rally, Crude Near Highs

Major indexes trading firmer after the FI close - near second half highs after occurred at the start of Fed Chairman Powell's interview at the Economic Club of Washington. While both rates and equities reversed post-Powell gains, stocks rebounded late as crude climbed over $3bbl, supporting Energy sector stocks.

- SPX eminis currently trades +1.5 (+0.01%) at 4124; DJIA -79.24 s (-0.23%) at 33809.81; Nasdaq +23.9 (0.2%) at 11910.34.

- SPX leading/lagging sectors: Energy (+2.53%) outperforms as WTI crude prices climbed to 77.25, O&G shares leading (VLO +4.97%, MPC +4.44%, OXY +3.90%, FANG +3.65%). Information Technology (+1.97%) and Communication Services (+1.72%) follow, the former lead by semiconductor shares (SWKS +12.26%, FISV +7.89%, QRVO +6.85%).

- Laggers: Consumer Staples (-0.58%), Utilities (-0.42%) and Real Estate (-0.39%), the latter weighed by specialized REITs.

- Dow Industrials Leaders/Laggers: Microsoft (MSFT) +10.03 at 266.80, Boeing (BA) +5.52 at 212.33, Chevron (CVX) +3.69 at 173.24. Laggers: Home Depot (HD) -4.68 at 324.55, Caterpillar (CAT) -2.13 at 2149.29, McDonalds (MCD) -1.53 at 266.39.

E-MINI S&P (H3): Uptrend Intact

- RES 4: 4361.00 High Aug 16

- RES 3: 4300.00 Round number resistance

- RES 2: 4250.00 High Aug 26, 2022

- RES 1: 4208.50 High Feb 2

- PRICE: 4166.75 @ 1525ET Feb 7

- SUP 1: 4048.39 20-day EMA

- SUP 2: 4007.50/3990.47 Low Jan 31 / 50-day EMA

- SUP 3: 3901.75 Low Jan 19

- SUP 4: 3788.50 Low Dec 22 and a key support

The S&P E-Minis trend condition remains bullish. The contract traded higher last week and confirmed a resumption of the bull cycle that started Dec 22. A key resistance and a bull trigger at 4180.00, the Dec 13 high, has been pierced. A clear break of this level would confirm a resumption of a broader uptrend and open 4250.00, the Aug 26 2022 high. Initial firm support to watch lies at 4007.50, Jan 31 low. The latest pullback is considered corrective.

COMMODITIES: Crude Buoyed By Supply Concerns Plus Late Dollar Boost

- Crude oil gained ground today on supply concerns and increased optimism over demand but it remains in contango suggesting ample near term supplies against the current weak demand, plus some late support from the USD on balance depreciating after Powell’s remarks.

- Longer dated spreads are also slightly up on the day although have pulled back from earlier gains. Concern for supplies with outages in Turkey and Norway added to optimism around future Chinese demand to support the futures today.

- WTI is +4.2% at $77.21, jumping closer towards resistance at the 50-day EMA of $78.39 and away from support at yesterday’s low of $72.25.

- Brent is +3.5% $83.78, also pushing closer to resistance at the 50-day EMA of $84.08 and off support at $79.10.

- Gold meanwhile sees a relatively tight range today compared to moves in days following the payrolls surge, +0.2% at $1870.66. Resistance remains at $1899.9 (20-day EMA) and support at $1861.4 (Feb 3 low).

Wednesday Economic Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/02/2023 | 0101/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 08/02/2023 | 0700/0800 | ** |  | SE | Private Sector Production |

| 08/02/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 08/02/2023 | 0900/1000 |  | EU | ECB Elderson Hosts Banking Supervision Press Conf on SREP | |

| 08/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/02/2023 | - |  | EU | ECB Lagarde at European Council meeting | |

| 08/02/2023 | 1420/0920 |  | US | New York Fed's John Williams | |

| 08/02/2023 | 1430/0930 |  | US | Fed Governor Lisa Cook | |

| 08/02/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 08/02/2023 | 1500/1000 |  | US | Atlanta Fed's Raphael Bostic | |

| 08/02/2023 | 1500/1000 |  | US | Fed Vice Chair Michael Barr | |

| 08/02/2023 | 1500/1000 |  | NL | DNB President Klaas Knot speaks at MNI event | |

| 08/02/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 08/02/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/02/2023 | 1730/1230 |  | US | Minneapolis Fed's Neel Kashkari | |

| 08/02/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 08/02/2023 | 1830/1330 |  | CA | BOC minutes from last rate meeting | |

| 08/02/2023 | 1845/1345 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.