-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:Powell Slowdown Pace to Balance Risk

HIGHLIGHTS

- Fed Powell: Fed Does Not Want to Overtighten -- Cutting Not Something We Want To Do Soon

- POWELL: SLOWING DOWN HIKE PACE IS GOOD WAY TO BALANCE RISKS

- JANET YELLEN PLANS TO STAY IN ROLE AS TREASURY SECRETARY

- YELLEN: US, GLOBAL ECONOMIES ARE HEALING FROM PANDEMIC

- U.S. OFFICIALS ALSO WEIGHING FUTURE SPR DRAWDOWNS IN NEW YEAR IF PRICES SPIKE POST-EMBARGO/PRICE CAP- CNBC REPORTER TWEET

- EU warns Musk that Twitter faces ban over content moderation

Key links: MNI: Powell: Peak US Rate 'Somewhat Higher' Than Sept Forecast / MNI BRIEF: US Economy, Inflation Slowed in Nov- Beige Book

US TSYS: FI, Stocks Surge: Mkt Expected More Hawkish Chairman Powell

Initial delayed reaction to the Fed chairs speech on policy at Brookings Inst conf, Tsy bid across board as it became apparent gist of statements was less hawkish than markets had priced in/feared. Tsy 2s10s curve topped -67.252 high before scaling back to -72.001 late.

- Bonds pared gains ("Cutting Not Something We Want To Do Soon") while yield curves climbed steeper as short end support gained traction (slowing down pace of hikes a "good way to balance risks").

- Dec step-down expectations gains as Fed funds implied hike for Dec'22 holds at 51.8bp vs 53bp earlier, Feb'23 cumulative 88.5bp (92.2bp prior) to 4.724%, terminal at 4.95% in Jun'23 vs. brief climb to 5.07% as Chairman Powell headlines initially hit.

- Heavy first half data: ADP employment growth was softer than expected in November at 127k, below the 200k expected and 190k consensus for private payrolls in Friday's release, led by a sizeable 86k decline in goods-producing industries. No revision to offset the miss.

- Tsys reverse course, extend lows post GDP, Wholesale Inventories beat:

- GDP Annualized QoQ (2.9% vs. 2.8% est. 2.6% prior)

- GDP Price Index (4.3% vs. 4.1% est, 4.1% prior)

- Personal Consumption (1.7% vs. 1.6% est, 1.4% prior)

- Core PCE QoQ (4.6% vs. 4.5% est, 4.5% prior)

- Retail Inventories MoM (-0.2% vs. 0.5% est, -0.1% rev)

- Wholesale Inventories MoM (0.8% vs. 0.5% est, 0.6% prior)

- Advance Goods Trade Balance (-$99.0B vs. -$90.6B est, -$91.9B rev)

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00571 to 3.82314%

- 1M +0.02186 to 4.14200%

- 3M +0.01800 to 4.77857%

- 6M -0.00543 to 5.20343%

- 12M +0.01814 to 5.57157%

- Daily Effective Fed Funds Rate: 3.83% volume: $95B

- Daily Overnight Bank Funding Rate: 3.82% volume: $269B

- Secured Overnight Financing Rate (SOFR): 3.81%, $1.026T

- Broad General Collateral Rate (BGCR): 3.77%, $409B

- Tri-Party General Collateral Rate (TGCR): 3.77%, $398B

- (rate, volume levels reflect prior session)

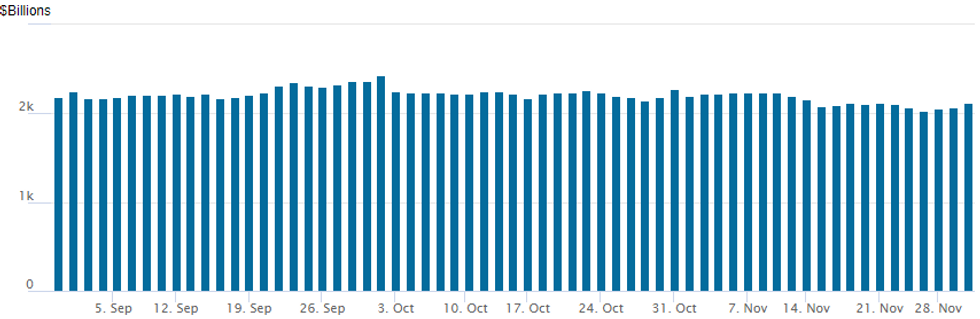

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,115.913B w/ 102 counterparties vs. $2,064.377B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Mixed trade on net, early trade pared on net and leaned towards better call buying in the first half - fading the initial weaker underlying. Interest turned to some chunky put buying/rate hike insurance ahead of Fed Chairman Powell's Brookings speech before fading off late.- SOFR Options:

- Block, total 5,000 SFRF3/SFRH3 94.62/95.00 put spd spds, 2.5 net/March over

- Block, 4,000 short Feb 97.00 calls, 3.0 vs. 95.765/0.07%

- Block, 20,000 SFRH3 94.87/95.25/95.75/95.50 broken put condors, 3.25 net/wings over ref 94.995

- Block, 4,500 SFRH3 94.62 puts, 6.0 ref 94.995

- -15,000 SFRZ2 95.25/95.37 put spds, 2.5 vs. 95.43/0.22%

- +5,000 SFRG3 95.06/95.18/95.25/95.37 call condors, 3.0 ref 95.00

- 1,100 SFRH 94.75/94.87/95.00/95.12 put condors ref 95.04

- 1,000 short Mar 95.25/95.37/95.62 broken put flys

- 1,000 short Jun 95.50/96.00 put spds vs. Green Jun 96.12/96.62 put spds

- Block, 2,000 short Dec 95.00 puts, 3 vs 95.42/0.13%

- Eurodollar Options:

- 2,000 Jan 94.93/95.12 call spds ref 94.795

- Treasury Options:

- +5,500 FVF 109 calls, 26 ref 108-15

- 10,000 TYF3 111.25 puts, 16 ref 113-11.5

- +2,000 wk1/wk3 TY 113 straddle spd 53-54 pre-data

- 5,000 TYF 113/114 call spds, 26 ref 113-02

- 3,000 wk1 TY 111.5/112 2x1 put spds, 1 net ref 113-02.5

EGBs-GILTS CASH CLOSE: Rare Downside Euro CPI Surprise, Hawkish Outcome

Core Europe FI continued to weaken Wednesday, despite the first below-expected Eurozone inflation print since March 2021 (10.0% vs 10.4% expected).

- While the headline data confirmed pricing for a 50bp vs 75bp ECB hike in Dec, EGB yields rose as terminal rate pricing jumped as the unchanged core Y/Y was seen indicating sticky price pressures.

- The Bund yield rise stalled by late morning, but Gilts continued to weaken, while BTP spreads widened, with a speech by Fed Chair Powell eyed with caution after the European cash close.

- A very weak MNI Chicago PMI reading pulled back global yields temporarily, but overall US data was positive and maintained pressure.

- Gilts underperformed Bunds; the UK curve bear steepened, with Germany's bear flattening on higher ECB rate expectations.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.6bps at 2.132%, 5-Yr is up 1.3bps at 1.938%, 10-Yr is up 0.9bps at 1.931%, and 30-Yr is up 0.2bps at 1.824%.

- UK: The 2-Yr yield is up 5.6bps at 3.309%, 5-Yr is up 5bps at 3.274%, 10-Yr is up 6.3bps at 3.163%, and 30-Yr is up 6.9bps at 3.427%.

- Italian BTP spread up 4.1bps at 194bps / Greek down 1.4bps at 222.6bps

EGB Options: Slew Of Early '23 Expiry Bunds

Wednesday's Europe rates / bond options:

- RXF3 142/144 call spread sold at 43 in 4k

- RXF3 138.50p sold at 92 down to 75 in 5k

- RXG3 137.00/135.00/133.50p ladder, bought for flat in 1.5k

- RXH3 137/132/127 put fly bought for 72 in 1.175k

- 0RZ2 96.875/96.625 put spread sold at 4.5 in 3.7k

FOREX: Month-End and Fed Chair Powell Prompt Volatile Currency Markets

- The USD index encountered multiple substantial swings on Wednesday as a mixture of month-end flows and central bank rhetoric frustrated short-term positioning as we approach Friday’s US employment report.

- The greenback spent the majority of early Wednesday trading on the backfoot as some renewed optimism surrounding China was underpinning equity markets. Additionally, some weaker data from the US (lowest MNI Chicago PMI print, of 37.2, since the 2008/09 crisis) prompted the USD index make new intra-day lows.

- However, potential growth concerns then started to weigh on risk/equity markets which not only supported the USD but ignited a complete reversal over the next hour. The price action also tied in with the month-end WMR fix with the USD printing a fresh high right around 1600GMT/1100ET.

- With markets then potentially gearing up for a hawkish Powell, disappointment rightly ensued as the Fed Chair alluded to everything being aligned for inflation to return to target, except for the labour market which showed initial signs of slowing in today’s ADP release.

- The initial reaction was very positive for equity markets and a substantial USD sell-off has followed. USDJPY has fallen from around 139.50 and is now breaching below the 138 mark. In similar vein, EURUSD is now pushing back above 1.04.

- Mixed performance in emerging market FX, however worth noting some particular underperformance for the South African Rand amid reports that President Ramaphosa may have violated the constitution, setting up a case for impeachment. USDZAR is up 0.85% at 17.15 as of writing, despite the USD weakness.

- The Chinese Yuan has extended yesterday’s rally with CNY up 1.20% and CNH 0.94% against the USD with the weaker greenback acting as an additional tailwind for the Yuan.

- The moves come amid reports that community covid testing can be dropped for those not needing to venture outside. This comes a day after officials in the city of Guangzhou, "announced late on Tuesday they would allow close contacts of COVID cases to quarantine at home rather than being forced to go to shelters", according to Reuters.

- Swiss CPI, US Core PCE Price index and ISM Manufacturing PMI headline the data docket on Thursday before Friday’s non-farm payrolls report.

FX Expiries for Nov30 NY cut at 1000ET (Source DTCC)

- EURUSD: 1.0300 (1.14bn), 1.0310 (374mln), 1.0350 (393mln), 1.0500 (516mln).

- USDJPY: 139 (285mln), 140.00 (347mln).

- EURGBP: 0.8710 (316mln).

- AUDUSD: 0.6710 (207mln).

- USDCNY: 7.00 (390mln), 7.15 (403mln).

Late Equity Roundup: Well Bid, Powell Less Hawkish Than Feared

Stock indexes staged late session rally after Fed Chairman Powell's speech and Q&A session at Brooking's conf deemed less hawkish than could have been. SPX eminis extending highs through resistance/bull trigger (4050.75 High Nov 15).

- SPX eminis currently trade +104.25 (2.63%) at 4066; DJIA +573.64 (1.69%) at 34423.1; Nasdaq +409.2 (3.7%) at 11392.22.

- SPX leading/lagging sectors: Communication Services (+4.58%) and Information Technology (+4.49%) strong outperformers - interactive media supporting the former w/ Meta +7.24%, Netflix +8.93%. IT sector lead by surge in semiconductor stocks (Nvidia +6.20%, MPWR +5.9%, AMD and QCOM +5.65% . Laggers: Energy (+0.76%), Industrials (+1.29% and Financials (+1.36%) with bank stocks off lows but lagging sector.

- Dow Industrials Leaders/Laggers: United Health (UNH) surges +14.54 at 542.54, Microsoft (MSFT) +11.21 at 251.54, Salesforc.com (CRM) +6.63 at 158.31. Laggers: MMM -0.54 at 125.59, Walmart (WM=T) -0.43 at 152.54, DOW +0.06 at 50.71.

E-MINI S&P (Z2): Bull Cycle Extends

- RES 4: 4234.25 High Aug 26

- RES 3: 4175.00 High Sep 13 and a key resistance

- RES 2: 4146.63 76.4% retracement of the Aug 16 - Oct 13 downleg

- RES 1: 4100.00 Round number resistance

- PRICE: 4072.00 @ 20:36 GMT Nov 30

- SUP 1: 3912.50/3890.09 Low NOv 17 / 50-day EMA values

- SUP 2: 3750.00 Low Nov 9

- SUP 3: 3704.25 Low Nov 3 and key short-term support

- SUP 4: 3641.50 Low Oct 21

S&P E-Minis remain in an uptrend and today’s gains reinforce a bullish theme. The rally today has resulted in a break of initial resistance at 4050.75, the Nov 15 high. This confirms a resumption of the uptrend and marks an extension of the price sequence of higher highs and higher lows. Sights are on the 4100.00 level next. On the downside, key short-term support has been defined at 3912.50, the Nov 17 low.

COMMODITIES Oil Extends Gains With China Demand, OPEC Uncertainty And Lower Crude Stocks

- Crude oil sees another day of solid gains, pushed higher on increased optimism for Chinese oil demand, uncertainty over the upcoming OPEC meeting and after API data showed a big draw in crude stocks.

- Coming later but helping support the prior increase was a much larger than expected draw in US crude stocks (-12581 vs -2908 exp) although was partly offset by oil demand concern after a fall in gasoline and distillates product supplied data.

- Since then, EU talks are seen focusing on a $60/bbl price cap, down from $62/bbl most recently mentioned, before some late support from a weaker USD post-Fed Chair Powell’s remarks.

- WTI is +3.0% at $80.52, clearing resistance at $79.90 (Nov 25 high) to open $82.43 (Nov 18 high).

- Brent is +2.9% at $85.43, moving closer to resistance at $86.87 (Nov 25 high).

- Gold is +1.1% at $1768.78, starting to close in on the bull trigger of $1786.5 (Nov 15 high) after surging with a weaker USD and Treasury yields.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/12/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/12/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/12/2022 | 0700/0800 | ** |  | DE | Retail Sales |

| 01/12/2022 | 0700/0700 | * |  | UK | Nationwide House Price Index |

| 01/12/2022 | 0730/0830 | *** |  | CH | CPI |

| 01/12/2022 | 0730/0830 | ** |  | CH | retail sales |

| 01/12/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/12/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/12/2022 | 1000/1100 | ** |  | EU | Unemployment |

| 01/12/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 01/12/2022 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 01/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 01/12/2022 | 1425/0925 |  | US | Dallas Fed's Lorie Logan | |

| 01/12/2022 | 1430/0930 |  | US | Fed Governor Michelle Bowman | |

| 01/12/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/12/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/12/2022 | 1500/1000 | * |  | US | Construction Spending |

| 01/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 01/12/2022 | 1600/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 01/12/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 01/12/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/12/2022 | 1645/1745 |  | EU | ECB Lane at Banque de France / EUI conference | |

| 01/12/2022 | 1730/1830 |  | EU | ECB Elderson Speech at Lustrum Symposium | |

| 01/12/2022 | 2000/1500 |  | US | Fed Vice Chair for Supervision Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.