MNI ASIA MARKETS ANALYSIS: Projected Rate Cuts Bounce Post-PCE

- Treasuries traded sideways through the second half after climbing to session highs after noon.

- Curves recovered some ground after Thursday's flattening, projected rate cut pricing gained momentum with "supercore” inflation almost at target.

- Market focus turns to next week's employment data for September as the next important metric to gauge the Fed's resolve to cut rates again.

US TSYS: Curves Bounce as Projected Cuts Gain Momentum Post-PCE

- Treasuries are higher after the bell, trading sideways through the second half after marking session high affter noon. Dec'24 10Y Tsy futures are currently +10.5 at 114-23.5 vs. 114-25 high with initial technical resistance at 115-02.5 (Sep 19 high).

- Curves recovered some ground after Thu's flattening as morning data underscored a rise in projected rate cuts into early 2025 gained vs. pre-data levels (*): Nov'24 cumulative -38.5bp (-37.2bp), Dec'24 -76.8bp (-73.9bp), Jan'25 -109.5bp (-104.5bp).

- Personal income and spending were a little softer than expected in August on a nominal basis, but in "real" terms this was a solid report and data going back to the start of the year were largely revised in a stronger direction.

- Core PCE inflation confirmed trend rates very similar to what Fed Governor Waller had indicated last week. That leaves inflation over the latest four months a little below the 2% PCE target and “supercore” inflation almost at target (although both a little stronger more recently).

- UofM inflation expectations: 1Y: 2.7% (cons 2.7, prelim 2.7) after 2.8% in Aug to confirm a dip to its lowest since Dec 2020. 5-10Y: 3.1% (cons 3.0, prelim 3.1) after 3.0% in Aug.

- Looking ahead: relatively quiet start to next week with MNI Chicago PMI on Monday, ISMs Tuesday, ADP private employment data Wednesday and the September jobs report headlining next week Friday.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00134 to 4.84410 (-0.01312/wk)

- 3M -0.01032 to 4.59335 (-0.09790/wk)

- 6M +0.01665 to 4.26185 (-0.08954/wk)

- 12M +0.03824 to 3.78308 (-0.04841/wk)

- Secured Overnight Financing Rate (SOFR): 4.83% (-0.01), volume: $2.329T

- Broad General Collateral Rate (BGCR): 4.83% (+0.00), volume: $782B

- Tri-Party General Collateral Rate (TGCR): 4.83% (+0.00), volume: $747B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 4.83% (+0.00), volume: $100B

- Daily Overnight Bank Funding Rate: 4.83% (+0.00), volume: $256B

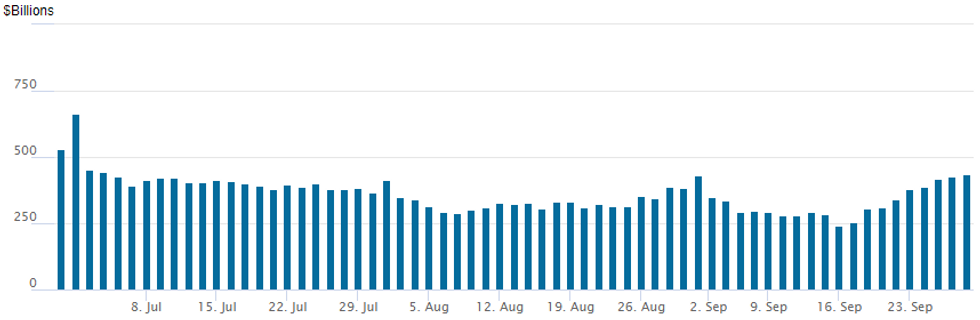

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage climbs to $436.518B this afternoon from $424.916B prior. Compares to $239.386B on Monday September 16 2024 -- the lowest level since early May 2021. Number of counterparties at 59 from 70 prior.

US SOFR/TREASURY OPTION SUMMARY

SOFR/Treasury option flow turned mixed late Friday with a pick-up in call volumes as underlying futures look to finish near highs, curves rebounding following morning data. Core PCE inflation maintains a low bar for further front-loading of rate cuts. As such, projected rate cuts into early 2025 gained vs. pre-data levels (*): Nov'24 cumulative -38.5bp (-37.2bp), Dec'24 -76.8bp (-73.9bp), Jan'25 -109.5bp (-104.5bp). Salient trade includes:- SOFR Options:

- +10,000 SFRV4/SFRX4 95.81/95.93 2x1 put spd spd .5 net

- +4,000 SFRV4 95.87/96.00 2x1 put spds .25 over SFRV4 96.25 calls

- +4,000 3QZ4 96.75/97.25 strangles 22.0-22.5 ref 96.895

- +4,000 0QH5 98.00/98.25 call spds 2.5 ref 97.10

- Block, 6,000 0QH5 97.37/98.12 call spds 1.0 over SFRH5 96.75/97.37 call spds

- +5,000 2QZ4 96.62/97.00 2x1 put spds w/ 2QH5 96.50/97.00 2x1 put spds, 13.25 total

- 7,000 SFRV4 95.87/95.93/96.00 put trees

- 3,500 SFRV4 96.00/96.12 1x2 call spds ref 96.01

- 5,000 SFRM5 95.75/96.00/96.25 call flys ref 96.845

- 4,000 SFRV4 95.81/95.87/95.93 put trees ref 96.01

- 7,500 SFRV4 95.87/96.00 2x1 put spds ref 96.00

- 2,500 SFRX4 95.75/95.81/95.93/96.00 call condors ref 96.00

- 4,000 SFRZ4 96.00/96.12 call spds ref 96.00

- 4,000 SFRZ4 95.75/96.00 3x2 put spds ref 96.00

- over 6,100 SFRX4 95.75 puts, 2.0 ref 96.01

- 3,000 2QV4 96.75/97.00 2x1 put spds ref 96.98 to -.985

- Block/screen, 4,000 SFRV4/SFRX4 96.18/96.25 call spd strip, 2.25 total

- Treasury Options:

- +5,000 USX4 120 puts, 9

- -10,000 Monday TY 114.75 calls, 6

- 3,000 FVX4 108.25/109 put spds

- 2,900 TUZ4 104.5/105 call spds ref 104-05.62

- 8,500 TYX4 115.5/116.5/117.5 call flys ref 114-18.5 to -18

- 15,000 TYX4 113.5/114.25 2x1 put spds ref 114-12.5

- over 5,300 TYX4 113 puts

BONDS: EGBs-GILTS CASH CLOSE: Soft Inflation Makes ECB October Cut The Base Case

European yields fell Friday as global inflation data proved softer-than-expected.

- French flash September HICP came in 0.4pp below consensus at 1.5% Y/Y, with the M/M CPI print of -1.2% the lowest since the series began in 1990 as services prices softened sharply. Spanish core CPI came in 0.4pp below expected at 2.4% Y/Y, with headline HICP 0.2pp below survey at 1.9%.

- US August PCE price data surprised on the downside as well, helping maintain positive momentum in Global FI in European afternoon trade.

- A 25bp rate cut at the October ECB meeting is now 80% market-implied, vs around 60% coming into the day and 20% coming into the week. Multiple sell-side analysts revised their ECB calls to include an October cut.

- The German curve leaned bull steeper on the day, with the UK's bull flattening. Periphery EGB spreads widened moderately; OATs outperformed with spreads in 1+bp vs Bunds, mitigating some of the week's prior underperformance.

- Given the dovish implications of today's country-level data, the German and Italian inflation prints will be in close focus Monday for corroboration on the Eurozone-wide print.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.6bps at 2.084%, 5-Yr is down 4.6bps at 1.961%, 10-Yr is down 4.4bps at 2.139%, and 30-Yr is down 3.2bps at 2.47%.

- UK: The 2-Yr yield is down 1.4bps at 3.949%, 5-Yr is down 1.7bps at 3.834%, 10-Yr is down 2.2bps at 3.988%, and 30-Yr is down 1.5bps at 4.585%.

- Italian BTP spread up 1.4bps at 131.4bps / Spanish up 0.9bps at 79.1bps

OPTIONS: Large Oct/Nov Euribor Structures In Otherwise Light Friday

Friday's Europe rates/bond options flow included:

- ERV4 97.125/97.00/96.875/96.75p Condor sold at 3.5 down to 3 in 23k total

- ERX4 97.12/97.25/97.37c fly, bought for 2.75 in 12.5k

- ERX4 97.00 puts, sold at 2.75 down to -2.25 in 15k

FOREX

The greenback erased mid-week losses to head through Friday broadly flat, but a softer-than-expected set of Personal income/spending and PCE numbers put the dollar on the backfoot through to the Friday close. This countered mid-week month-end tied corporate demand which, once faded, leaves support at the 100.215 level exposed. Next week's ISM numbers and the NFP report should prove key for short-term momentum.

OPTIONS: Expiries for Sep30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1120-25(E668mln), $1.1200(E959mln), $1.1250-65(E1.1bln), $1.1280-00(E1.4bln)

- USD/JPY: Y142.35-50($650mln), Y143.90-00($859mln)

US STOCKS: Late Equities Roundup: Paring Early Gains Ahead Weekend

- Stocks are consolidating ahead of the weekend, the Dow still outperforming Eminis and Nasdaq stocks after climbing to new all-time high of 42,625.70 earlier Friday. Currently, the DJIA is up 112.62 points (0.27%) at 42285.88, S&P E-Minis down 16.5 points (-0.28%) at 5787.75, Nasdaq down 104.8 points (-0.6%) at 18086.

- Energy and Utility sectors continued to lead gainers in late trade, oil & gas shares recovering from better selling as crude prices declined Thursday: APA +3.54%, EQT +3.21%, Coterra +2.52%. Independent power shares buoyed the Utility sector: Vistra +3.79%, AES +2.29%, Eversource +2.14%.

- Conversely, Information Technology and Materials sectors underperformed in the second half, semiconductors continued pare gains for earlier in the week: Nvidia -2.80%, Broadcom -2.75%, Lam Research -2.66%. Late Friday headline from Bbg weighing on Nvidia: “Beijing is stepping up pressure on Chinese companies to buy locally produced artificial intelligence chips instead of Nvidia Corp. products, part of the nation’s effort to expand its semiconductor industry and counter US sanctions.”

- Similarly, metals stocks weighed on the Materials sector as Gold retreated from new highs this week: Newmont Corp -2.76%, Freeport-McMoRan -0.91%.

- Reminder, still two weeks away, but the next corporate earnings cycle kicks off on Friday, October 11 with Bank of NY Mellon, Wells Fargo, and JP Morgan and Blackrock.

EQUITY TECHS: E-MINI S&P: (Z4)

E-MINI S&P: (Z4) Trend Needle Continues To Point North

- RES 4: 5920.08 3.0% 10-dma envelope

- RES 3: 5868.50 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 2: 5861.53 2.0% Upper Bollinger Band

- RES 1: 5830.00 High Sep 26

- PRICE: 5796.50 @ 1450 ET Sep 27

- SUP 1: 5700.77 20-day EMA

- SUP 2: 5635.41 50-day EMA

- SUP 3: 5500.00 Round number support

- SUP 4: 5451.25 Low Sep 6 and a bear trigger

A bull cycle in S&P E-Minis firmed again Thursday with the confirmed break above both round number resistance at 5800 and the 0.50 projection for the Sep 6 - 17 - 8 minor price swing at 5818.12. This confirms a resumption of the long-term uptrend. First key support is 5635.41, the 50-day EMA. Initial support lies at 5700.77, the 20-day EMA.

COMMODITIES: Crude Gains On Mid-East Tensions, Precious Metals Soften

- Oil markets found some support late in Friday’s session as Israel hit Hezbollah’s main HQ targeting Hezbollah leader Hassan Nasrallah.

- WTI Nov 24 is up 0.9% at $68.3/bbl.

- Oil has faced pressure this week over OPEC+ sources led stories suggesting the group will bring barrels back, with Saudi eager on protecting market share.

- For WTI futures, resistance at the 50-day EMA of $71.91 remains the key upside level. A reversal lower would refocus attention on $64.61, the Sep 10 low and bear trigger.

- Spot gold has fallen by 1.0% to $2,645/oz today, leaving the yellow metal $40 below yesterday’s all-time high, but still up by 0.9% on the week.

- This week’s move higher confirms a resumption of the primary uptrend, with focus on $2675.5 next, a Fibonacci projection. Firm support lies at $2583.9, the 20-day EMA.

- After reaching its highest level since end 2012 yesterday, silver is underperforming today and is down by 1.7% at $31.5/oz.

- For silver, bullish conditions remain intact and this week’s climb reinforces this set-up. Clearance of next key resistance at $32.518, would open $33.880, a Fibonacci projection. Firm support lies at $29.69, the 50-day EMA.

- Meanwhile, copper has fallen by 1.1% to $459/lb today, but remains over 5.5% higher on the weak on Chinese demand optimism.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 30/09/2024 | 2350/0850 | ** |  | Industrial Production |

| 30/09/2024 | 2350/0850 | * |  | Retail Sales (p) |

| 30/09/2024 | 0130/0930 | *** |  | CFLP Manufacturing PMI |

| 30/09/2024 | 0130/0930 | ** |  | CFLP Non-Manufacturing PMI |

| 30/09/2024 | 0145/0945 | ** |  | S&P Global Final China Manufacturing PMI |

| 30/09/2024 | 0600/0700 | *** |  | GDP Second Estimate |

| 30/09/2024 | 0600/0700 | * |  | Quarterly current account balance |

| 30/09/2024 | 0600/0800 | ** |  | Import/Export Prices |

| 30/09/2024 | 0600/0800 | ** |  | Retail Sales |

| 30/09/2024 | 0700/0900 | ** |  | KOF Economic Barometer |

| 30/09/2024 | 0800/1000 | *** |  | North Rhine Westphalia CPI |

| 30/09/2024 | 0800/1000 | *** |  | Bavaria CPI |

| 30/09/2024 | 0830/0930 | ** |  | BOE M4 |

| 30/09/2024 | 0830/0930 | ** |  | BOE Lending to Individuals |

| 30/09/2024 | 0900/1100 | *** |  | HICP (p) |

| 30/09/2024 | 0900/1100 | *** |  | HICP (p) |

| 30/09/2024 | 1200/1400 | *** |  | HICP (p) |

| 30/09/2024 | 1300/1500 |  | ECB's Lagarde at ECON hearing | |

| 30/09/2024 | 1345/0945 | *** |  | MNI Chicago PMI |

| 30/09/2024 | 1430/1030 | ** |  | Dallas Fed manufacturing survey |

| 30/09/2024 | 1530/1130 | * |  | US Treasury Auction Result for 13 Week Bill |

| 30/09/2024 | 1530/1130 | * |  | US Treasury Auction Result for 26 Week Bill |

| 30/09/2024 | 1600/1200 | ** |  | USDA GrainStock - NASS |

| 30/09/2024 | 1755/1355 |  | Fed Chair Jerome Powell | |

| 30/09/2024 | 2010/2110 |  | BOE's Greene panellist on 'Perspectives on global MonPol' |