-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rate Cut Door Left Ajar

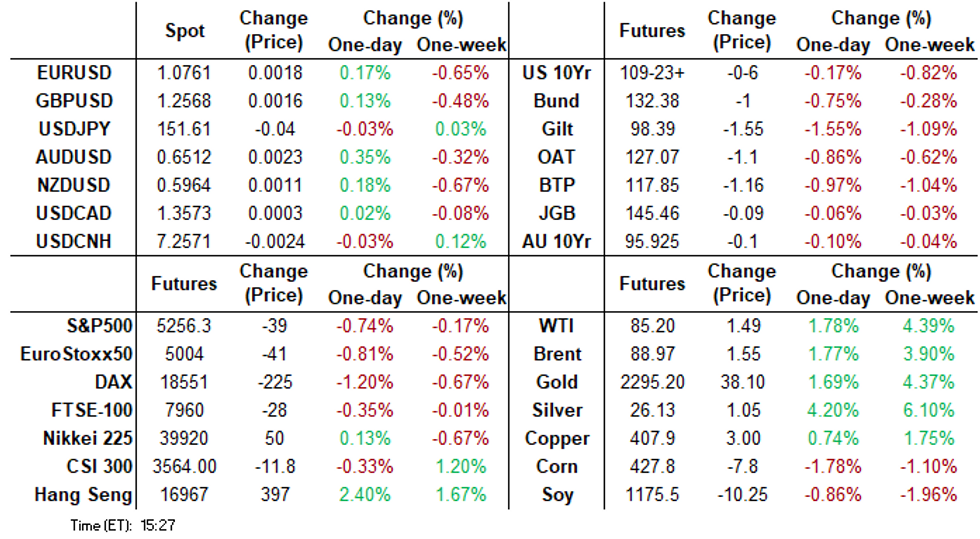

- Treasuries are mostly weaker but off lows late Tuesday, curves broadly steeper as Fed Speak buoyed the short end.

- SF Fed President Daly said three rate cuts in 2024 is still a "reasonable baseline"

- Projected rate cuts back to pricing in the first 25bp cut in July with a second in November.

US TSYS: Rate Cut Hopes Kept Alive

- Treasuries continued to retreat Tuesday on heavy volumes (TYM4 >1.9M) as Europe returned from extended Easter holiday weekend. Treasury curves broadly steepened: 2s10s +6.013 to -33.801 (highest since March 21) as short end rates outperformed.

- Intermediate to long end rates held near the middle of the day's range following this morning's slightly higher than expected JOLTS job openings at 8.756m (cons 8.73m) in Feb after an downward revised 8.748m (initial 8.86m) in Jan. The ratio to unemployed fell to 1.36x, helped by the strong 0.33m rise in unemployment in Feb.

- Fed speakers supported short end rates on the day: Cleveland Fed Mester ('24 voter but retiring in June) won't rule out a rate cut in June, while SF Fed Daly said three rate cuts in 2024 is still a "reasonable baseline".

- In turn, projected rate cut pricing rebounded from morning lows: May 2024 steady at -6.7% w/ cumulative -1.7bp at 5.312%; June 2024 -59.7% vs -53.3% earlier w/ cumulative rate cut -16.6bp at 5.163%. July'24 cumulative at -24.6bp vs -23.6bp earlier, Sep'24 cumulative -41.9 vs. -40.0bp.

- Wednesday Data Calendar: ADP Jobs, S&P Global US Services/Composite PMIs (final), ISM Services and multiple Fed Speakers through the session. Main focus, however, is on Friday's March employment report, current job gain estimate at +205k.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00008 to 5.32404 (-0.00470/wk)

- 3M +0.00601 to 5.30812 (+0.00989/wk)

- 6M +0.01970 to 5.25134 (+0.03353/wk)

- 12M +0.04545 to 5.07241 (+0.07259/wk)

- Secured Overnight Financing Rate (SOFR): 5.35% (+0.01), volume: $2.023T

- Broad General Collateral Rate (BGCR): 5.33% (+0.01), volume: $674B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.01), volume: $656B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 5.32% (-0.01), volume: $226B

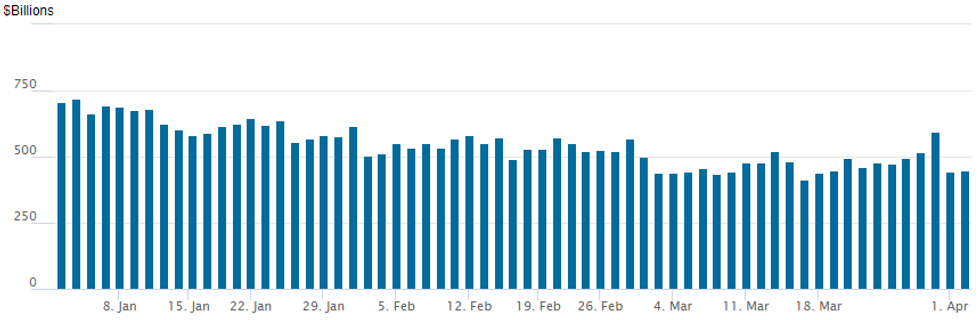

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs up to $448.424B vs $441.903B Monday. Compares to mid-March low of $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties slips to 73 vs. 74 last Thursday (compares to 65 on January 16, the lowest since July 7, 2021)

SOFR/TEASURY OPTION SUMMARY

Better upside hedging in SOFR and Treasury options on the day (some large put unwinds in the latter as well), carry-over from Monday's session as accts look for a rebound in underlying futures. Projected rate cut pricing rebounded from morning lows: May 2024 steady at -6.7% w/ cumulative -1.7bp at 5.312%; June 2024 -59.7% vs -53.3% earlier w/ cumulative rate cut -16.6bp at 5.163%. July'24 cumulative at -24.6bp vs -23.6bp earlier, Sep'24 cumulative -41.9 vs. -40.0bp.

- SOFR Options:

- +2,000 SFRU4 95.06 straddles, 33.0 ref 95.08

- +10,000 SFRZ4 96.50 calls, 8.5 vs. 95.39/0.10%

- +30,000 SFRU4 94.93/95.06/95.18 call flys, 1.75-2

- Block, 15,000 SFRU4 95.00/95.25/95.50 call flys, 5.0 ref 95.07

- +6,000 SRU4 95.00/95.25/95.50 call flys 4.75 ref 9507.5

- +4,000 SRZ4 95.50/95.75 call spds 6.25 9536

- +8,000 SRN4 94.62 put vs SRM4 94.50 put 0.75

- +5,000 SRN4 94.87/94.93/95.06 put tree 1.25)

- -5,000 SRU4 94.87/95.12/95.37/95.62 call condors 6.5over 94.50/94.75 put spds vs. 9506/0.30%

- -5,000 SRZ4 94.37/94.75 put spds, 4 ref 9532

- +5,000 SRM4 94.68/94.75/94.2281 put flys, 0.75 ref 9483

- +5,000 SFRK4 95.00/95.68 call spds, 0.75 ref 94.84

- -4,000 SFRZ4 94.75/94.87 put spds, 2.75 vs. 95.34/0.05%

- +5,000 SFRN4 94.87/94.93/95.06 put trees, 1.25

- +3,000 0QU4 96.37 calls, 18.0 vs 95.36/0.30%

- +5,000 SFRM4 94.68/94.75/94.81 put flys, 0.75

- Block, 10,000 SFRZ4 96.62 calls, 7.0 ref 95.335

- 11,500 SFRM4 94.93/95.06/95.18 call flys ref 94.835

- Block, 3,750 SFRZ4 96.50/97.25/98.50 broken 2x3x1 call flys, 5.0 vs. 95.36/0.10

- 2,000 SFRJ4 94.81/94.87/94.93 call flys ref 94.835

- 5,800 SFRN4 95.00/95.06 put spds ref 95.07

- 7,200 SFRU4 95.00/95.12 put spds ref 95.07

- Treasury Options:

- 10,000 TYK4 108.75/109.75 2x1 put spds, 3 ref 109-24

- 10,000 TYM4 112/113 1x2 call spds, 0.0 ref 109-24

- -21,500 TYK4 109/110.5 put spds, 47-46 ref 109-23.5 to -24 (expires Apr 26)

- 6,200 TYK4 109/110.5 put spds, 49 ref 109-23.5

- 2,000 TYK4 108/109.5 3x1 put spds, 9.0

- 1,500 TUK4 101.62/101.75 2x1 put spds

- -4,000 FVK4 105/107.75 put over risk reversals, 0.5

- Block, 7,500 TYM4 109.5 puts, 101 vs. 109-17/0.50%

- 2,000 TYM4 110 outs, 116 ref 109-18

- 5,000 TYK4 108/109 put spds, 16

- 8,000 USK4 116/117 put spds ref 117-13

- BLOCK, +50,000 FVK4 109 calls, 1.5 ref 106-10.5 (open interest 7,605)

- +25,000 FVK4 108.75 calls, 2 ref 106-11.25, still offered (open interest 9,583)

- 6,000 USK4 112/114 put spds, 12 ref 117-26

- 5,300 TYK4 109.5 puts, 34 last ref 109-26.5

- 2,900 FVM4 108.5 calls ref 106-16.5

- 2,500 TYK4 114 calls, 1 ref 109-31.5

- 10,000 TYK4 108.75/109.75 2x1 put spds, 3 ref 109-24

EGBs-GILTS CASH CLOSE: US-Led Rout Overshadows Softer Euro Inflation

The German and UK curves steepened sharply as long-end bonds sold off Tuesday following a 4-day weekend for European markets.

- The overriding bearish dynamic emanated from Treasuries which had sold off Monday on solid US data and a patient stance on rate cutting from Fed Chair Powell.

- European data was mixed: solid final PMIs were offset by softer-than-expected Italian and French inflation prints on Friday and German HICP a touch softer than expected today.

- That sets Eurozone-wide HICP up to come in below consensus tomorrow on the headline measure, which probably kept the short-end from selling off in line with US counterparts (2024 Fed rate cut expectations have pulled back 4bp since Mar 28, with the ECB equivalent increasing 2bp).

- The German curve twist steepened, with the UK's bear steepening.

- BTPs easily underperformed, with 10Y spreads to Bunds more than 5bp wider, versus counterparts on the periphery which closed slightly tighter.

- Dutch inflation data early Wednesday provides the final signal for the Eurozone-wide read later in the morning, which is the session focus.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1bps at 2.839%, 5-Yr is up 6.1bps at 2.382%, 10-Yr is up 10.2bps at 2.4%, and 30-Yr is up 12.5bps at 2.58%.

- UK: The 2-Yr yield is up 6.8bps at 4.24%, 5-Yr is up 11.5bps at 3.938%, 10-Yr is up 15.2bps at 4.085%, and 30-Yr is up 15.3bps at 4.576%.

- Italian BTP spread up 5.7bps at 144bps / Spanish bond spread down 0.2bps at 86.2bps

EGB Options: Rate Upside In Favour Tuesday

Tuesday's Europe rates/bond options flow included:

- RXK4 135.50/136.50/137.50c fly, bought for 3 in 1.25k

- ERU4 96.87/97.00/97.12/97.25c condor bought for 1.5 in 5k

- ERU4 96.75/96.87/97.00/97.12c condor bought for 2.75 in 7k

- 2RM4 97.87/98.25cs vs 0RM4 97.75c, traded 0.25 for the 1yr in 5k

- SFIM4 95.20/95.25/95.40/95.45c condor, bought for half in 10k

- SFIH5 95.50/95.25ps vs 97.00/98.00cs, bought the ps for 1.5 in 5k

FOREX Greenback Turns Lower Across US Hours, EURCHF Extending Bounce

- After touching the best levels of the year at 105.10 overnight, the USD index has turned lower over the course of the Tuesday session, currently down around 0.25%. Moves have been eating into the greenback’s post ISM advance on Monday and have been underpinned by weaker durable goods data and poor revisions offsetting the slightly better February JOLTS job openings.

- The dollar’s turnaround comes amid CFTC data, covering positioning as of the Tuesday close, indicating markets swung their net USD position short for the first time since 2021, potentially exposing the currency to corrective recoveries on weaker-than-expected US economic data releases.

- Weakness for major equity benchmarks has done little to impact the G10 currency space Tuesday, evidenced by AUD being one of the best performers and rising 0.35%. Despite this, the reversal lower on Mar 21 reinstated a bearish threat and has exposed 0.6478, the Mar 5 low. Clearance of this level would open the key support and bear trigger at 0.6443, the Feb 13 low.

- CHF is the poorest performer in G10 Tuesday, prompting EUR/CHF to recover well off pullback lows printed late last week. This keeps the cycle high and bull trigger well within range at 0.9820, a level that could come into play should ECB rate cut pricing follow the lead of the Fed gyrations so far this week. OIS markets currently price ~93bps of rate cuts from the ECB for this year.

- The JPY remains notably quiet as markets continue to grapple with the still wide yield differentials compared to G10 counterparts and the potential for the BOJ to intervene in the currency. USDJPY trades within 40 pips of 152.00, a key multi-decade resistance zone that continues to cap the pairs topside momentum.

- Eurozone inflation readings take centre-stage on Wednesday, before US ADP and ISM Services data. Fed Chair Powell is due to speak at Stanford's Business, Government, and Society Forum, although the focus for global markets remains firmly on Friday’s US employment report.

Expiries for Apr03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750(E554mln), $1.0780-81(E580mln), $1.0815-25(E1.7bln)

- USD/JPY: Y150.00($626mln), Y151.50-54($600mln), Y152.40($608mln)

- GBP/USD: $1.2400(Gbp542mln)

- AUD/USD: $0.6510-20(A$1.0bln), $0.6350(A$1.1bln)

Late Equities Roundup: Hugging Lows, Insurers Punished

- Stocks remain weaker, holding narrow range near session lows marked at midmorning. The sell-off curbed as short end rates recovered with projected midyear rate cuts gaining momentum. Currently, DJIA is down 443.62 points (-1.12%) at 39122.01, S&P E-Minis down 46.5 points (-0.88%) at 5249, Nasdaq down 197.2 points (-1.2%) at 16199.87.

- Laggers: Health Care and Consumer Discretionary sectors continued to underperform in late trade, insurers and services names weighed on the former as US regulators opted against raising rates for private Medicare plans: Humana -13.95%, CVS -7.70%, UnitedHealth Group -7.35%. Meanwhile, auto maker Tesla weighed on the Consumer Discretionary, -5.25% amid lower than estimated car deliveries of 387k vs. 433k produced, -8.5% YoY. Parts makers Aptiv -1.95%, BorgWarner -0.93%.

- Leading Gainers: Energy and Utility sectors outperformed in the first half, partially tied to rise in crude prices (WTI +1.44 at 85.13). Oil and gas shares buoyed the Energy sector: Phillips66 +2.96%, Marathon +2.51%, Valero +1.65%. Multi-energy providers supported the Utility sector: Xcel Energy +1.21%, Exelon +0.85%, Alliant +0.77%.

E-MINI S&P TECHS: (M4) Clears Bull Channel Support

- RES 4: 5434.54 Bull channel top drawn from the Jan 17 low

- RES 3: 5428.25 1.00 proj of the Oct 27 - Dec 28 - May 1 price swing

- RES 2: 5400.00 Round number resistance

- RES 1: 5333.50 High Apr 1

- PRICE: 5250.25 @ 1450 ET Apr 2

- SUP 1: 5240.19 20-day EMA

- SUP 2: 5157.00 Low Mar 11

- SUP 3: 5127.42 50-day EMA

- SUP 4: 5018.00 Low Feb 21

The trend condition in S&P E-Minis is unchanged and remains bullish, however, the move lower today highlights a corrective cycle that suggests potential for a bearish extension. The contract has breached bull channel support - at 5272.92 - drawn from the Jan 17 low. This signals scope for a move towards the 20-day EMA, at 5240.19. Clearance of this average would open 5127.42, the 50-day EMA. Key resistance is 5333.50, Monday’s high.

COMMODITIES Crude Rises Strongly, Spot Gold Reaches Another Record High

- WTI traded through its first resistance band amid strong gains on the day. Support has been driven by improved China demand expectations, supply cuts during Q2 and with geopolitical tensions rising.

- WTI MAY 24 is up 1.6% at $85.1/bbl.

- An OPEC+ ministerial panel is unlikely to recommend any oil output policy at its meeting April 3, five OPEC+ sources told Reuters.

- A bull theme in WTI futures remains intact and yesterday’s move higher, plus today’s follow through, reinforces current conditions and confirms a resumption of the uptrend. This signals scope for an extension towards the $90.00 handle further out. The next objective is $85.73, a Fibonacci projection.

- Spot gold is up a further 0.9% on Tuesday at $2,272/oz, having hit another all-time high of $2,277/oz earlier in the session amidst the rise in geopolitical tensions in the middle-east.

- The trend condition in gold remains bullish and the move to fresh all-time highs once again this week signals scope for a climb towards $2282.6, a Fibonacci projection. Key trend support has been defined at $2146.2, the Mar 18 low.

- Meanwhile, silver is outperforming today, rising by 3.5% to $25.97/oz, closing in on its two-year high at $26.22. This extends silver’s winning streak to four sessions, the most since early December.

WEDNESDAY DATA CALENDAR

| 03/04/2024 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/04/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 03/04/2024 | 0900/1100 | ** |  | EU | Unemployment |

| 03/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/04/2024 | 1215/0815 | *** |  | US | ADP Employment Report |

| 03/04/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 03/04/2024 | 1600/1200 |  | US | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.