-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Rate Cut Pricing Rekindled

- Treasuries rallied after this morning's soft PPI and higher weekly jobless data, extending highs after strong 30Y sale.

- Well off Wednesday's moderate post-FOMC lows, Treasury futures are back to early April levels.

- Short end support sees rate cut projections near pre-FOMC levels, near 50bp by December.

US TSYS Soft PPI, Higher Wkly Claims and Strong 30Y Sale Rekindle Rate Cut Hope

- Treasuries and the US$ has recovered from the post-FOMC reversal as today's softer PPI and higher weekly claims rekindled 50bp in rate cut pricing by year end.

- Treasury futures added to pre-release gains after lower than expected PPI final demand at -0.2% vs. 0.1% MoM (2.2% YoY vs. 2.5% est), Ex Food and Energy MoM 0.0% vs. 0.3% est, (YoY 2.3% vs. 2.5%). Meanwhile, weekly jobless claims higher than expected at 242k vs. 225k est, continuing claims 1.82m vs. 1.795M.

- Rates extended highs (TYU4 110-27, +17) after a strong $22B 30Y auction reopen (912810AU4) stopped 1.6bp through: 4.403% high yield vs. 4.419% WI; 2.49x bid-to-cover vs. 2.41x in the prior month.

- Treasury futures are now back to early April levels: Sep'24 10Y marks session high of 110-27 (+17) -- looking to test technical resistance at 110-27.5 (1.00 proj of the Apr 25 - May 16 - 29 price swing). Next resistance at 111-09 (High Apr 1).

- Cash yields extend lows: 5s -.0930 at 4.2230, 10s -.0815 at 4.2345%, 30s -.0715 at 4.4037%, while curves look mixed: 2s10s -0.327 at -44.327, 5s30s +2.063 at 17.803.

- Short end support sees rate cut projections near pre-FOMC levels (*): July'24 at -12% (-14%) w/ cumulative at -3bp (-3.8bp) at 5.298%, Sep'24 cumulative -20bp (-20.9bp), Nov'24 cumulative -29.3bp (-31.7bp), Dec'24 -50.4bp (-50.7bp).

- Friday data focus: Fed Out of Blackout, Import/Exp Prices and UofM inflation expectations.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00162 to 5.32884 (+0.00120/wk)

- 3M -0.00739 to 5.33922 (+0.00523/wk)

- 6M -0.03753 to 5.26988 (-0.00141/wk)

- 12M -0.09295 to 5.05249 (-0.01961/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.957T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $755B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $737B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $268B

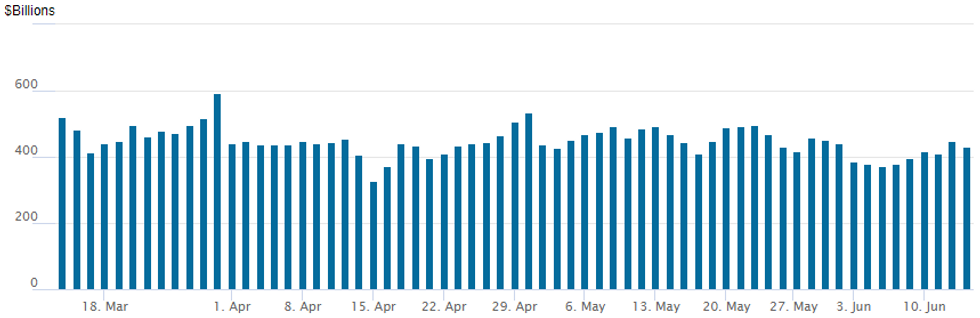

FED Reverse Repo Operation

NY Federal Reserve/MNI

- Still above $400M, RRP usage reds to $429.864B from $447.574B prior; number of counterparties steady at 77. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Volumes on two-way SOFR/Treasury option trade picked up Thursday, leaning bullish as underlying futures climbed back to early April levels after PPI miss, weekly claims gain and strong 30Y bond auction reopen. In-turn, rate cut projections climbed back near pre-FOMC levels (*): July'24 at -12% (-14%) w/ cumulative at -3bp (-3.8bp) at 5.298%, Sep'24 cumulative -20bp (-20.9bp), Nov'24 cumulative -29.3bp (-31.7bp), Dec'24 -50.4bp (-50.7bp).

- SOFR Options:

- -5,000 SFRZ4 94.37/94.43/94.62/94.68 put condor, 0.25 ref 95.215

- -5,000 SFRZ4 95.31/95.56 call spds 4.5 over 94.37/94.62 put spds

- +5,000 SFRN4 94.68/94.75/94.93/95.00 Iron Condor 1.25 ref 94.865

- +5,000 SFRZ4 95.43/95.68/95.25/95.50 Iron condor 7.0 ref 95.17

- -12,000 SFRM4 94.62/94.68/94.75/94.81 call condors 3.0 ref 94.655

- -5,000 SFRV4/SFRZ4 95.37/95.50 call spds strip 4.75-5.0 ref 95.16

- 20,000 SFRZ4 95.50 puts, 43 vs. 95.185/0.72, total +30k/day

- Block, 12,000 SFRU4 95.00/95.50 call spds 2.0 ref 94.84

- 45,700 SFRU4 95.12/95.18 call spds ref 94.84

- 3,500 SFRU4 94.68/94.75/94.81/94.87 put condors ref 94.845

- 6,500 SFRU4/SFRZ4 94.62/94.75 put spd spd

- 2,000 0QN4 95.75/95.87 call spds ref 95.88

- Treasury Options:

- -10,600 TYU4 112 calls, 43

- +15,000 FVU4 108 calls, 29

- 5,000 TYQ4 112 calls, 21 ref 110-14

- 3,000 FVQ4 107 calls

- 1,300 USQ4 115/123 strangles, 56

- 2,00 TYQ4 105.5/108.5 put spds ref 110-17

- -4,000 TYN4 109 puts, 1 ref 110-16

- +32,000 TYN4 111 calls (expire next week Fri) 8.5-9.0 over the wk2 TY 111 calls (expiring tomorrow), ref 110-17.5

- 4,000 TYU4 111/112.5 1x2 call spds vs. TYU 107/108/109 put trees

- over 7,100 FVN4 106.25 puts, 5 last

- over 6,400 FVQ4 106.25 puts, 22 last

- 3,200 FVN4 106.75/FVQ4 107.25 call spds

- 2,200 FVN4 107/FVQ4 107.25 call spds

- 7,400 TYN4 109 puts, 3 last ref 110-06

- 4,000 TYN4 111/112.5 call spds ref 110-08

- 4,000 TYU4 107.5/108.5/109.5 put trees

FOREX: EURJPY Posts Sharp 1% Reversal Lower as Political Risks Linger

- The Euro has been under pressure in late trade on Thursday, following the broader risk-off tone, with particular sensitivity in French assets (CAC-40 underperforming, French/German spreads widening, and French banking names trading particularly softly; Credit Agricole, Societe Generale lower by 2-3%) being noted.

- EUR/JPY has reversed well off highs, with the cross now over 1% below the prior session highs and the cross now pressing on the week’s lows at 168.30.

- No fresh news catalyst, but the pessimistic theme and uncertainty surrounding French politics clearly pervades - while not new news, Macron's approval rating falling to a fresh six-year low (24% according to the latest poll published in Les Echos) adds to the weight.

- Broad based single currency weakness is evident with the likes of EURUSD and EURCHF both registering 0.65% declines on the day.

- Lower-than-expected US PPI appeared to bolster the softer US price data this week, however, this was offset by the slight to quality in G10 FX. As such, the USD index stands 0.55% in the green as we approach the APAC crossover.

- In emerging markets, there was a notable weakening for the Colombian peso with USDCOP rallying around 2.5% and taking the week’s advance close to 5%. A mixture of domestic fiscal concerns, the recent global unwinding of carry trades and softer oil prices have all been weighing on the peso.

- Focus Friday turns to the Bank of Japan decision and then the preliminary read of UMich sentiment and inflation expectations data.

FX OPTIONS: Expiries for Jun14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0660-65(E1.0bln), $1.0700(E625mln), $1.0795-10(E2.0bln), $1.0900(E1.4bln)

- USD/JPY: Y154.00($1.1bln)

- EUR/GBP: Gbp0.8440(E1.1bln)

- AUD/USD: $0.6615-20(A$1.2bln), $0.6640-50(A$739mln)

- USD/CAD: C$1.3740-60($2.8bln)

Late Equities Roundup: Late Support

- Stocks have bounced late Thursday, DJIA still in the red are well off midday lows, Nasdaq still outperforming after rising to new all-time high of 17,737.94 in the first half. Currently, the Nasdaq is up 66.6 points (0.4%) at 17675.84, DJIA down 39.27 points (-0.1%) at 38676.02, S&P E-Minis up 13.25 points (0.24%) at 5441.25.

- Information Technology continues to lead gainers for the third consecutive session, hardware and semiconductor makers outperforming: Broadcom is currently up 12.71% after beating 2Q earnings late Wednesday while announcing a whopping $5.25/share quarterly dividend. Other gainers included Super Micro +12.33%, Arista Networks +4.96%. Side note: Adobe Inc reports Q2 earnings after the close.

- Real Estate sector shares lagged IT but outperformed peers as office and specialized investment trusts gained in the first half: Extra Space Storage +2.56%, Boston Properties +2.15% while Public Storage gained 2.12%.

- Industrials and Energy sectors continued to underperform in late trade, air and ground transportation shares weighing on the former: Uber -3.13%, United Airlines -1.78%, UPS -1.27%. Oil refiners and servicer shares weighed on the Energy sector: APA Corp -2.45%, Coterra Energy -2.39%, Halliburton -2.05%.

E-MINI S&P TECHS: (M4) Bull Cycle Remains In Play

- RES 4: 5500.00 Round number resistance

- RES 3: 5490.62 2.382 proj of the Apr 19 - 29 - May 2 price swing

- RES 2: 5462.77 2.236 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5454.50 High Jun 12

- PRICE: 5439.00 @ 1524 ET Jun 13

- SUP 1: 5311.70/5205.50 20-day EMA / Low May 31 and key support

- SUP 2: 5155.75 Low May 6

- SUP 3: 5099.25 Low May 3

- SUP 4: 5036.25 Low May 2

The uptrend in S&P E-Minis remains intact and the contract traded higher yesterday. Price has recently cleared 5368.25, the May 23 high and bull trigger. The move confirmed a resumption of the uptrend. The continuation higher has resulted in a break of the 5400.00 handle. This opens 5462.77 next, a Fibonacci projection. Key short-term support has been defined at 5205.50, the May 31 low. Initial support lies at 5322.72, the 20-day EMA.

COMMODITIES Crude Struggles for Direction, Precious Metals Fall Back

- Crude has struggled for direction today, oscillating between $77.67/b and $78.86/b. Lower-than expected US PPI inflation data have been offset by expectations of a delayed start to Fed rate cuts, which could limit demand.

- WTI Jul 24 is broadly unchanged at $78.5/bbl.

- Key short-term resistance lies at $80.62, the May 1 high. On the downside, a resumption of weakness would open $71.33, the Feb 5 low.

- Meanwhile, spot gold has fallen by 1.0% to $2,302/oz.

- The yellow metal has traded below the 50-day EMA, at $2,313.6. The break confirms a resumption of the reversal that started May 20 and opens $2,277.4, the May 3 low.

- Initial firm resistance to watch is $2387.8, the Jun 7 high.

- Meanwhile, silver is underperforming and is down by 2.5% at $29.0/oz

- Support to watch lies at the 50-day EMA, at $28.787. A clear break would strengthen a bearish theme. For bulls, a reversal higher would refocus attention on key resistance at $32.518, the May 20 high.

- Copper is also down by 1.7% today at $448/lb, leaving the red metal more than 12.5% below its May 20 record high.

- An increase in global inventories, profit-taking by investment funds and weak Chinese demand have all weighed on prices in recent sessions.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/06/2024 | 0200/1100 | *** |  | JP | BOJ Policy Rate Announcement |

| 14/06/2024 | 0430/1330 | ** |  | JP | Industrial Production |

| 14/06/2024 | 0600/0800 | *** |  | SE | Inflation Report |

| 14/06/2024 | 0645/0845 | *** |  | FR | HICP (f) |

| 14/06/2024 | 0830/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 14/06/2024 | 0900/1100 | * |  | EU | Trade Balance |

| 14/06/2024 | 0900/1100 |  | EU | ECB's Lane participates at Dubrovnik Economic Conference | |

| 14/06/2024 | 0900/1100 |  | EU | ECB's De Guindos at Carlos V European Prize Ceremony | |

| 14/06/2024 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/06/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/06/2024 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 14/06/2024 | 1330/1530 |  | EU | ECB's Schnabel in European Fiscal Board Meeting | |

| 14/06/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 14/06/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 14/06/2024 | 1730/1930 |  | EU | ECB's Lagarde Speech at Dubrovnik Economic Conference | |

| 14/06/2024 | 1800/1400 |  | US | Chicago Fed's Austan Goolsbee | |

| 14/06/2024 | 2300/1900 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.