-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI ASIA MARKETS ANALYSIS: Rate Hike Projections Firmer

- MNI US-CHINA: Commerce Sec Raimondo Plans To Visit China This Year

- MNI WHEAT: Russia "Ready To Explore" All Grain Export Options

- PUTIN WARNS POLAND OVER AGGRESSION AGAINST BELARUS, Bbg

- RUSSIAN CENTRAL BANK RAISES KEY RATE TO 8.50%; EST. 8.00%, Bbg

Key Links:MNI POLICY: Market Inflation Signals Mainly Noise, BOE Finds / MNI INTERVIEW: ECB Should Be Cautious In Reducing Liquidity / MNI US EARNINGS SCHEDULE - Busiest Week of the Quarter / MNI TV: Key Exclusive Highlights For Week 29 / MNI GLOBAL WEEK AHEAD: FOMC, ECB, BoJ Decisions

US TSYS Markets Roundup

- Scant data to wrap up the week, Bbg US economic survey for July this morning: showed the US economy will expand 1.5% in 2023, 0.6% in 2024 and 1.9% in 2025, according to a survey conducted by Bloomberg News.

- Data picks up slightly with S&P Global PMIs. Fed speakers remain in blackout ahead next Wednesday's policy announcement.

- Friday's focus was largely on headline risk: sources pointed to Russia grain deal headline "RUSSIA FLOATS PLAN TO SUPPLY AFRICA GRAIN WITHOUT UKRAINE" FT. Treasury futures extended gains after the open, amid surge of buying in front month 10Y futures, TYU3 marks 112-13.5 high (+9) before retracing/finishing the day at 112-06.5 on modest overall volume under 900k. Curves held flatter profiles 2s10s -1.665 at -100.927, off session low of -104.021.

- Projected rate hike expectations gained slightly: July 26 FOMC is 96% w/ implied rate of +24bp to 5.318%. September cumulative of +28.2bp at 5.36%, November cumulative of 33.2bp at 5.409%, and December cumulative of 28.8bp at 5.365%. Fed terminal holding at 5.405% in Nov'23.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00665 to 5.29799 (+.06805/wk)

- 3M +0.00564 to 5.35121 (+.04132/wk)

- 6M +0.01583 to 5.42843 (+.05289/wk)

- 12M +0.05230 to 5.36150 (+.10749/wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $111B

- Daily Overnight Bank Funding Rate: 5.07% volume: $272B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.460T

- Broad General Collateral Rate (BGCR): 5.03%, $589B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $579B

- (rate, volume levels reflect prior session)

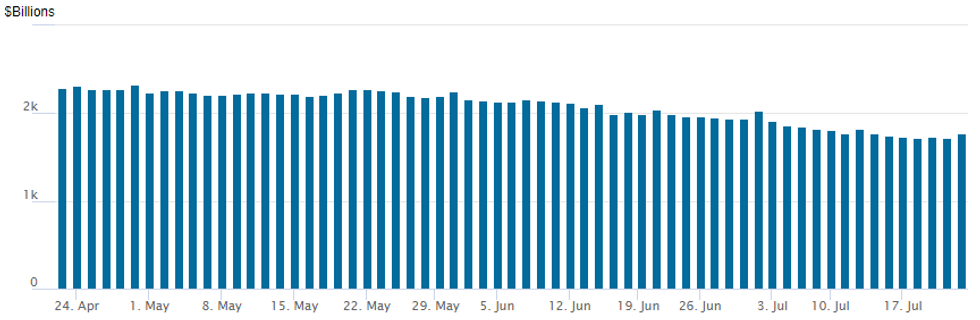

FED Reverse Repo Operation

NY Federal Reserve/MNI

The latest operation rebounds to $1,770.752B, w/99 counterparties, compared to $1,721.001B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Decent 5- and 10Y call trade was reported late Friday, compared to more consistent downside put structures in SOFR options, underlying futures weaker in the short end as rate hike projections through year end gain slightly.

- SOFR Options:

- Block/screen 6,000 OQV3 95.00/95.37/95.75/96.00 put condors, 6.5 net

- 4,000 OQQ3 95.50/2QQ3 96.31 put spds

- 6,000 OQU3 95.25/95.62 put spds vs. 2QU3 96.00/96.37 put spds (similar conditional bear curve flatteners in Oct and Dec expiries traded Wednesday)

- Treasury Options:

- Block: 54,441 wk2 10Y 114.5 calls, 8 vs. 36,961 wk2 112.75 calls, 36 vs. 7,951 TYU3 112-09

- Screen trade:

- 34,670 wk2 10Y 112.75/114.5 call spds ref 112-09.5

- 9,000 FVU3 107.75/109 call spds ref 107-10

- 4,000 TYU3 111.5/114.5 strangles, 55 ref 112-08.5

- 1,000 TYU3 112 straddles, 1-56

- 1,000 TYU3 112/113/114/115 call condors, 20 net ref 112-08.5

- over 4,500 FVU3 109 calls, 10.5 ref 107-09.75

- 1,000 TYQ3 112.25 straddles, 18 ref 112-06.5

- 1,200 TYU3 112/113 call spds ref 112-04.5

- 1,500 TYU3 109.5/110.5/111.5 put flys ref 112-07.5

- 4,000 TYU3 110.5/111.5 2x1 put spds

- Block: 54,441 wk2 10Y 114.5 calls, 8 vs. 36,961 wk2 112.75 calls, 36 vs. 7,951 TYU3 112-09

EGBs-GILTS CASH CLOSE: Bull Steeper Ahead Of Next Week's Data / ECB Hike

Core European FI ended a volatile week on a stronger note, with bull steepening in both the UK and German curves.

- German and UK 2Y yields fell 3+bp each as central bank hike prospects faded slightly (ECB terminal dipped 1bp, BoE 3bp).

- Any hawkish impact from stronger-than-expected UK retail sales faded quickly, with more global focus on potential dovishness from the BoJ at its meeting next week after multiple sources pieces suggested unchanged policy.

- Periphery bonds closed mixed, with Spanish yields seemingly unaffected by upcoming elections Sunday (MNI's preview is here).

- Beyond that, attention will swiftly be on Monday's flash PMI readings, then on the ECB decision Thursday and flash French/Spanish/German inflation Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3bps at 3.093%, 5-Yr is down 1.7bps at 2.554%, 10-Yr is down 2.1bps at 2.469%, and 30-Yr is down 1.6bps at 2.488%.

- UK: The 2-Yr yield is down 3.9bps at 4.955%, 5-Yr is down 1.4bps at 4.371%, 10-Yr is up 0.3bps at 4.28%, and 30-Yr is up 1.7bps at 4.429%.

- Italian BTP spread down 1bps at 160.9bps / Spanish up 1.2bps at 100.9bps

EGB Options: Mixed Vol Perspectives To End The Week

Friday's Europe rates / bond options flow included:

- ERZ3 96.25/37/50 call fly paper paid 1 on 3K (vs. 96.065)

- ERZ3 96.00^ v 95.625 put, pays 29.5 for the straddle in 6k (vs 96.035)

- ERU4 99.00/99.25 call spread bought for 1 in 5k

- SFIQ3 94.35/94.45/94.55/94.65 call condor bought for 3.25 in 2k

FOREX: Focus On USDJPY Recovery Ahead of Fed & BOJ Next Week

- Broad JPY weakness was the key theme across major currency markets on Friday. Concurrent BoJ sources reports raising expectations that the BoJ's yield curve control programme will be unchanged at next Friday's decision substantially weighed on the Yen. Both Bloomberg and Reuters cited sources in reporting that the board were leaning toward no change in approach, countering recent building speculation that a policy switch would be imminent.

- USDJPY (+1.12%) rallied solidly on the headlines, rising well through the recent highs to trade at the best levels since July 10th, briefly peaking at 141.96. JPY implied vols are well bid, with the one-week contract now capturing the BoJ decision and crossing 16 points to trade at the best levels since March.

- Weakness for Antipodean FX was also notable with both NZD and AUD rivalling the Yen as the weakest performers across G10. NZDUSD looks set to extend its losing streak to six trading sessions as the greenback continues to recover. Notably, the pair has now erased the entirety of the post US CPI inspired rally and now sits back below the 50 day exponential moving average, which intersected today around the 0.6200 handle.

- The main focus next week will be on the Fed meeting/decision. The FOMC is firmly expected to hike by 25 basis points and maintain its tightening bias at the July meeting. Chair Powell is likely to suggest that a follow-up hike is possible at the next meeting in September, but will emphasize that no decision has yet been made, and will depend on the substantial inflation and jobs data in the interim. Both the ECB and BOJ decisions will follow the FOMC.

- Over the weekend, attention will be on the Spanish parliamentary election before Monday’s release of European and US flash PMIs kick off the data docket.

FX: Expiries for Jul24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0995-00(E764mln), $1.1015-25(E658mln), $1.1130(E512mln)

- USD/JPY: Y140.00($1.7bln), Y140.25($500mln), Y142.00-15($810mln)

- GBP/USD: $1.2945(Gbp782mln)

- EUR/GBP: Gbp0.8474-75(E1.0bln), Gbp0.8600(E600mln)

- AUD/USD: $0.6780-00(A$1.5bln)

- USD/CNY: Cny7.0500($1.2bln), Cny7.2500($982mln)

Late Equity Roundup: Paring Earlier Gains

- Stocks trading mostly higher, holding to narrow channel in late trade. Currently, DJIA shares are up 32.79 points (0.09%) at 35262.73, S&P E-Mini Futures up 0.75 points (0.02%) at 4567.25, Nasdaq down 38.1 points (-0.3%) at 14027.87.

- Leading gainers: Utilities, Health Care and Energy sectors continued to outperform in late trade: independent/renewable power provider AES +3.0% buoyed Utilities in late trade. Pharmaceuticals and biotech shares trade higher for the second consecutive session: Pfizer subsidiary Zoetis (world's largest producer of medicine and vaccinations for pets and livestock) is up 7.3%, Danaher Corp gains 5.4% followed by Thermo-Fisher Scientific +4.9. Oil and Gas refiners, meanwhile, continued to backstop Energy sector shares: Baker Hughes +2.4%, Devon Energy and APA both +1.95%.

- Laggers: Communication Services, Information Technology and Industrials underperformed. Media and entertainment shares lagged telecom Friday, advertiser conglomerate Interpublic Group -12.6% after revenue dropped 2.1% YoY to $2.33B, lagging estimates by $60 million, while EPS at $0.74 actually outperformed expectations by 0.14. Software and services shares weighed on IT after better performance from chip makers buoyed the sector for most of the week. Ground transportation share weighed on Industrials with CSX -3.6, Norfolk Southern -1.5%.

US DATA: he coming week is the busiest of the quarter for earnings, with 35% of the S&P500's market cap set to report

- Highlights include Alphabet, Microsoft, Visa, Coca-Cola, Meta Platforms, Mastercard, Procter & Gamble, ExxonMobil among others

- Season so far has generally been better-than-expected, with the average EPS beating consensus by 6.7%, and revenues beating by 1.1%

Full schedule including timings, EPS and revenue expectations here: https://roar-assets-auto.rbl.ms/files/54818/MNIUSE...

E-MINI S&P TECHS: (U3) Bull Channel Top Cleared

- RES 4: 4739.50 High 13 Jan’22

- RES 3: 4661.90 3.0% 10-dma envelope

- RES 2: 4631.00 High 29 Mar’22

- RES 1: 4609.25 High Jul 20

- PRICE: 4572.75 @ 10:41 BST Jul 21

- SUP 1: 4498.88 / 4397.62 20- / 50-day EMA

- SUP 2: 4368.50 Low Jun 26 and a key support

- SUP 3: 4337.83 Bull channel base drawn from the Mar 13 low

- SUP 4: 4269.50 Low Jun 2

E-mini S&P finished lower Thursday, consolidating a solid rally this week and helping to alleviate the overbought conditions present in the most recent bout of strength. Prices have topped the bull channel drawn off the March 13th low at 4608.50, marking another positive shift for S/T momentum. This clears the way for a test of the March 29th 2022 high at 4631.00 and - ultimately - all time highs. Any corrective pullback would initially target the 20-day EMA at 4492.63 for support, however the Tuesday low of 4544.50 could also slow any decline.

COMMODITIES: WTI Closes At Its Highest Since Apr 25 On Tightening Supply

- Crude oil has again been supported today by signs of tightening supplies from key exporting nations like Saudi and Russia. Saudi crude exports slipped 0.6mbd in the first half of July vs June according to Vortexa. Kuwait, Nigeria and Algeria down by the same combined, whilst UAE and Iraq meanwhile rise 0.5mbd.

- Further, in latest headlines, the US oil rig count fell for the sixth straight week and the eleventh time in the past twelve, most recently down 6 to 669 for the lowest since Mar’22.

- WTI is +1.8% at $77.04, nudging Wednesday’s high and moving closer to but not yet testing resistance at $78.03 (76.4% retracement of Apr 12 – May 4 bear leg). Supporting the more bullish sentiment, the day’s most active strikes in the CLU3 have been $80/bbl and $85/bbl calls.

- Brent is +1.8% at $81.05, taking a step nearer resistance at $82.06 (76.4% retracement of Apr 12 – May 4 downleg)

- Gold is -0.3% at $1963.39 with a second consecutive decline on another step higher in the USD index. It doesn’t trouble support at $1934.4 (20-day EMA) whilst resistance remains at the early Thursday high of $1987.5.

- Weekly moves: WTI +2.2%, Brent +1.5%, Gold +0.4%, US nat gas +6.7%, EU TTF nat gas +8.5%

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/07/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 24/07/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/07/2023 | 0700/0900 | ** |  | ES | PPI |

| 24/07/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/07/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/07/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/07/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/07/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/07/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/07/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/07/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/07/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/07/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/07/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/07/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/07/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.